Gas Taxes

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

State Rundown 1/7: New Year, New Opportunities for Progressive Revenue

January 7, 2026 • By ITEP Staff

As we kick off a new year, several states are facing revenue shortfalls. Some lawmakers are approaching the challenge with sustainable and equitable solutions.

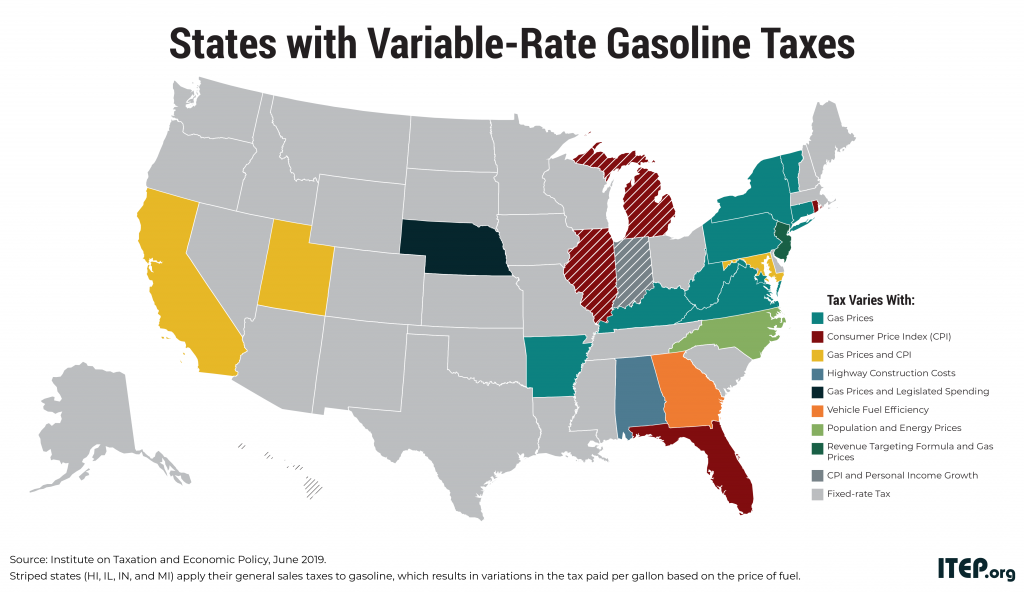

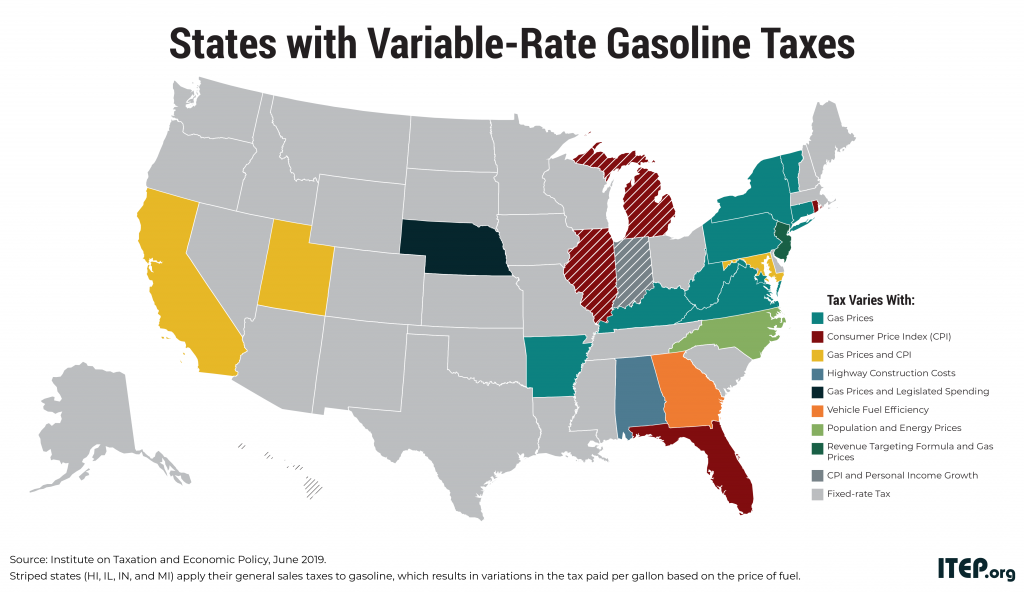

Two in Three Americans Live in States with Variable-Rate Gas Taxes

July 16, 2025 • By Carl Davis

As inflation and fuel efficiency undercut traditional gas tax revenue, many states are rethinking how they fund transportation. Lawmakers across the country are beginning to modernize outdated gas tax systems to keep pace with rising infrastructure costs and changing driving habits.

Taxing Transportation Is One Great Way to Reduce Carbon Emissions

November 12, 2024 • By Amy Hanauer

Federal, state, and local tax codes are important but underused tools that can create a more climate-resilient, less carbon-emitting America. A modernized tax code would stop subsidizing emissions and instead encourage lower-carbon design. Because cars and trucks produce roughly one-fourth of US greenhouse gas emissions, transportation taxation is a great starting point.

It’s unlikely that state gas tax holidays will meaningfully benefit consumers, and they come with risks for states’ infrastructure quality.

The Federal Gas Tax Holiday is Not a New Idea, Just a Bad One

February 17, 2022 • By Steve Wamhoff

The argument for suspending the gas tax, which would cost $20 billion, is weaker than ever.

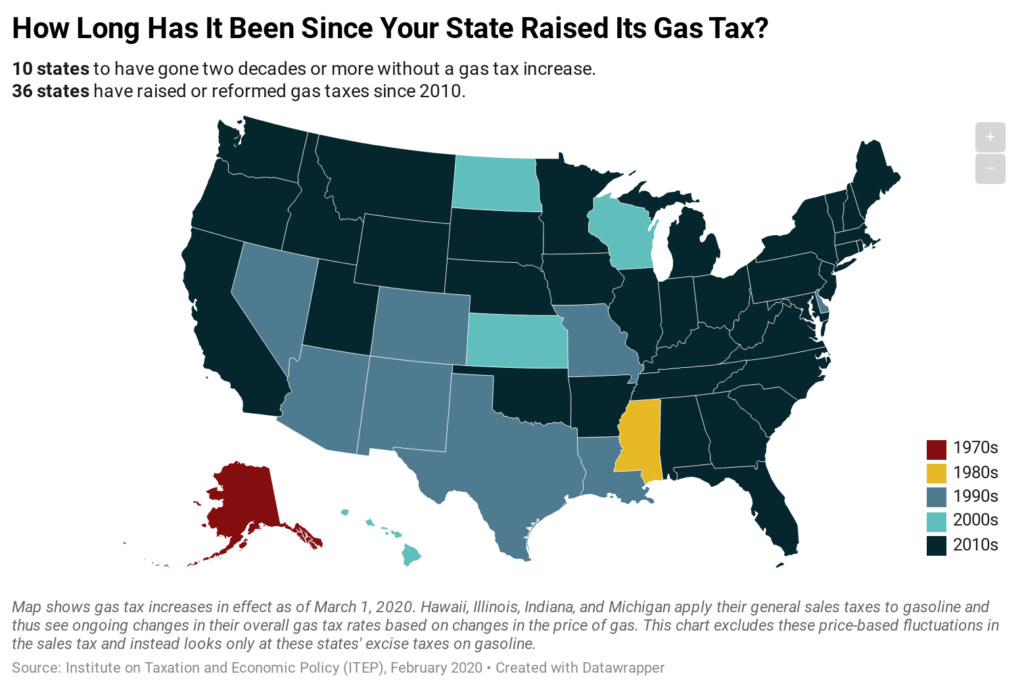

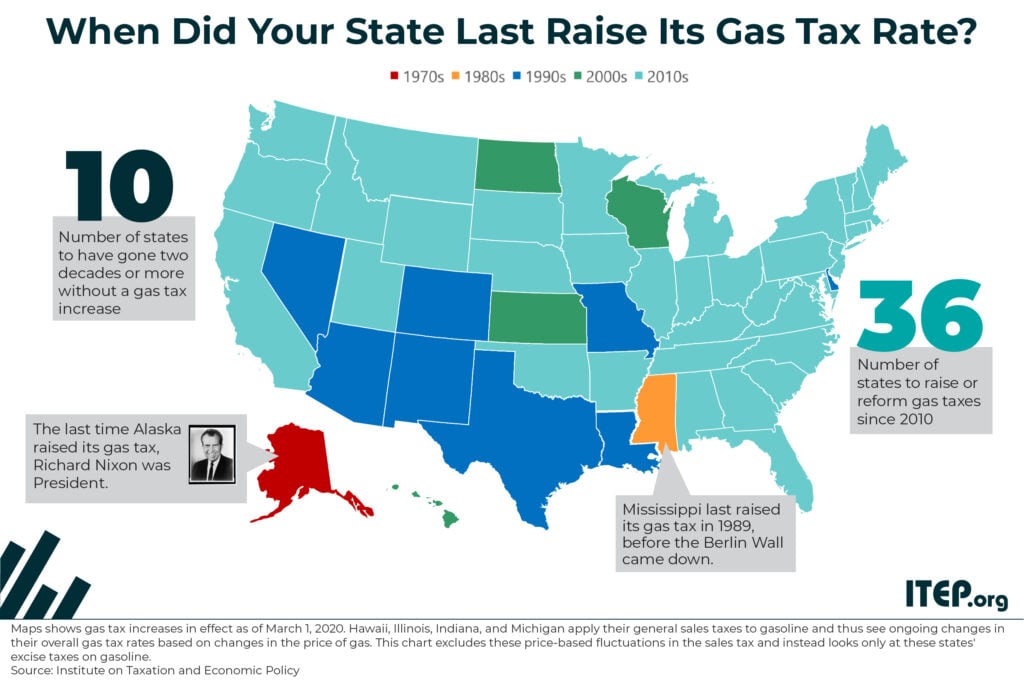

10 states to have gone two decades or more without a gas tax increase.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

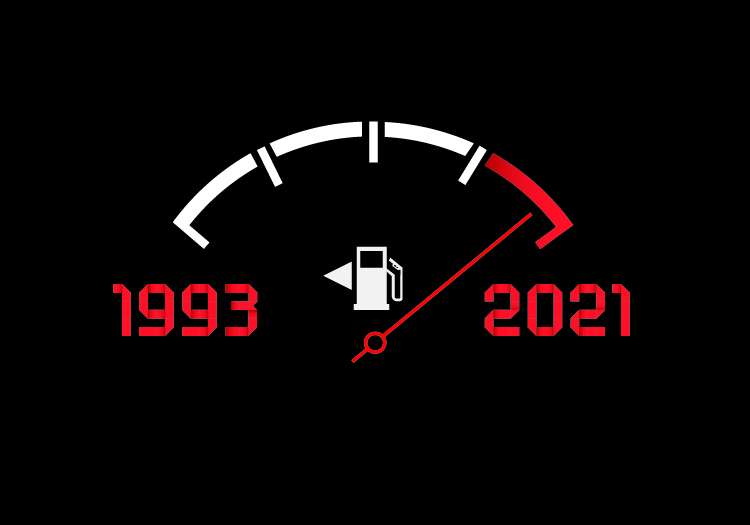

It’s Been 10,000 Days Since the Federal Government Raised the Gas Tax

February 12, 2021 • By Carl Davis

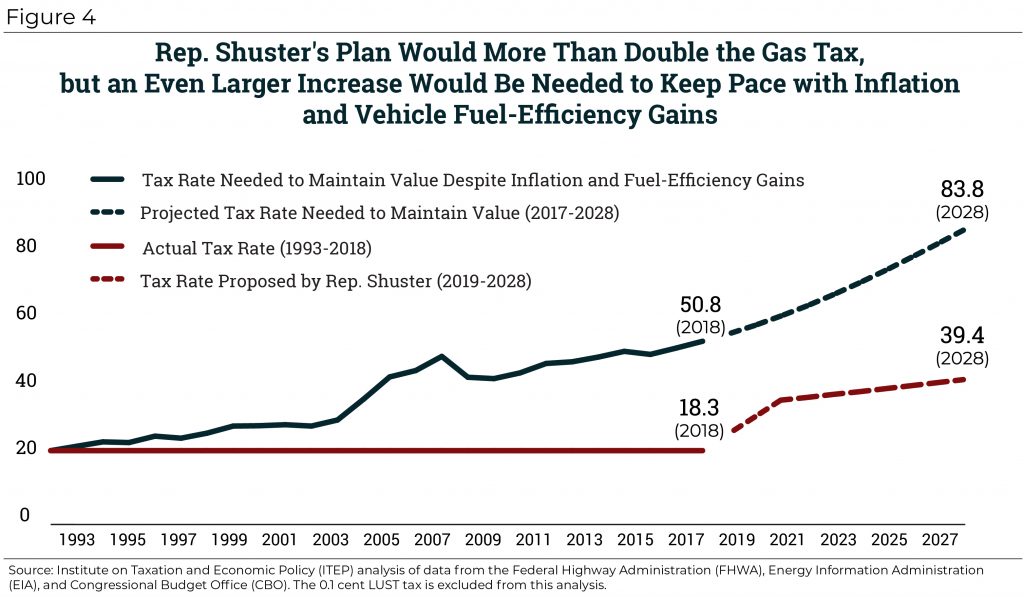

10,000 days. More than 27 years. By next Tuesday that’s how long it will have been since the federal government last raised the gas tax. Over that time, vehicle fuel efficiency has improved by 25 percent and construction costs have grown 185 percent. And yet the federal gas tax has remained frozen at 18.3 cents per gallon, with its purchasing power shrinking by the day. The federal government has never gone this long without updating the nation’s gas tax rate.

Lawmakers should keep in mind that transportation funding woes can be traced to the federal government’s extremely outdated gas tax rate, which has not been raised in more than 26 years—not even to keep up with inflation.

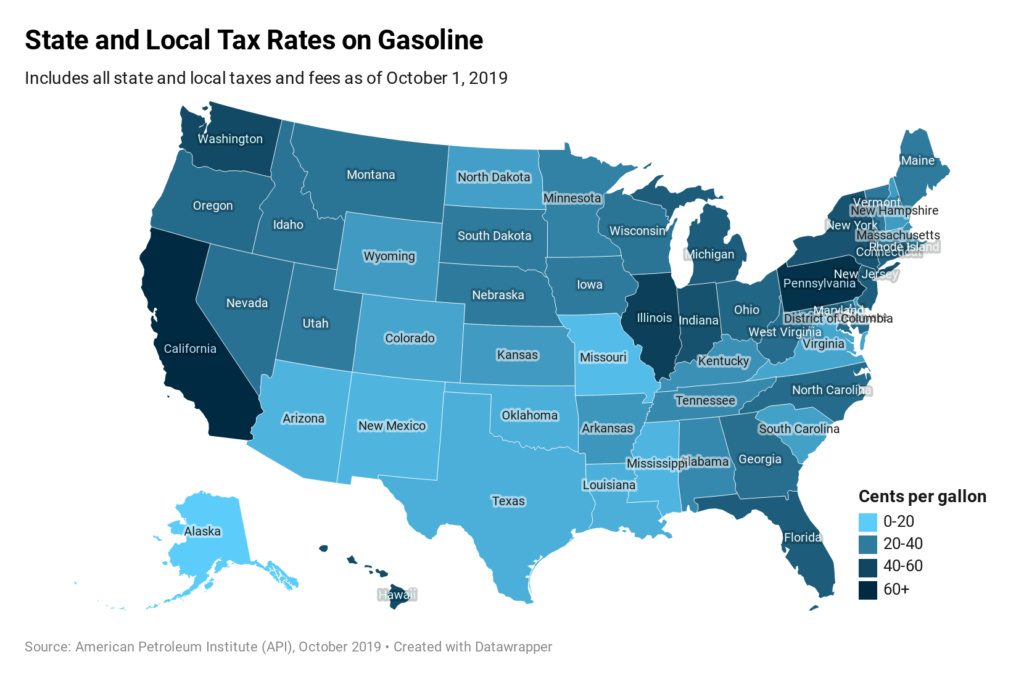

Every state levies excise taxes on motor fuel, including gasoline, to pay for transportation infrastructure. People who drive far distances or heavy vehicles tend to pay more tax, which helps offset the wear-and-tear they inflict on the roads.

The Heartland Institute: Utah Studies New Method for Transportation Funding

October 11, 2019

The Institute on Taxation and Economic Policy has also found that gas taxes are not a sufficient funding source to repair and rebuild the nation’s crumbling infrastructure. This is mainly due to more fuel-efficient vehicles on the road coupled with skyrocketing transportation construction costs. Read more

Gas Taxes Rise in a Dozen States, Including an Historic Increase in Illinois

June 27, 2019 • By Carl Davis

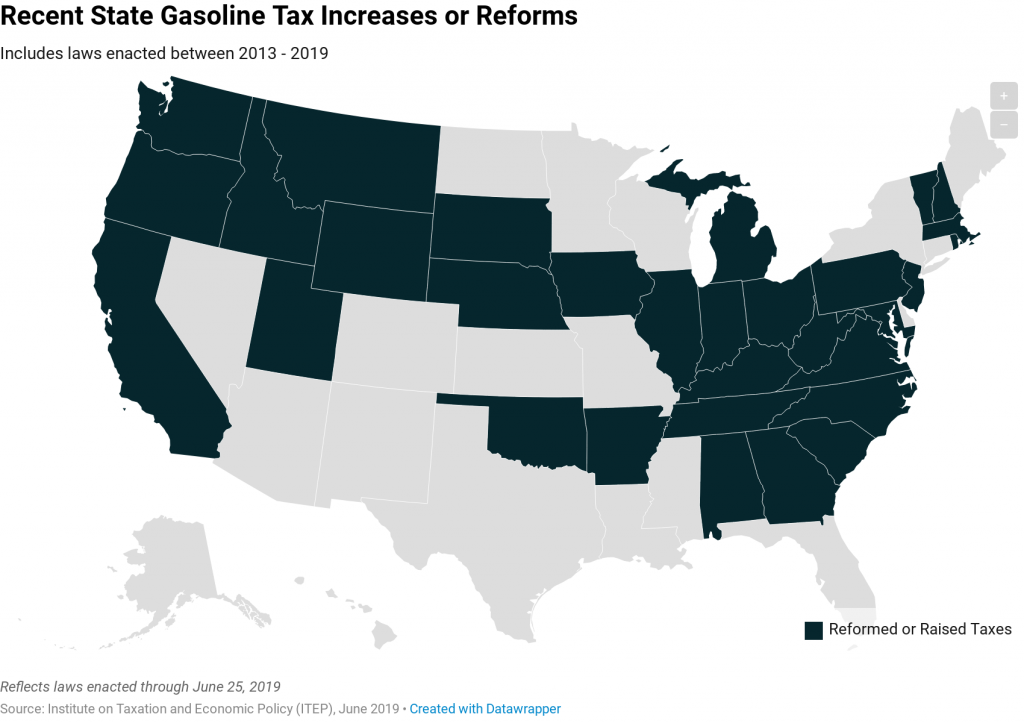

On July 1, 12 states will boost their gasoline taxes and 11 will boost their diesel taxes. The reasons for these increases vary, but they’re generally intended to fund maintenance and improvement of our nation’s transportation infrastructure–a job at which Congress has not excelled in recent years.

Gas taxes are the most important revenue source that states have available to pay for transportation infrastructure. In recent years, state lawmakers across the country have increasingly agreed that gas taxes must be increased to fund the maintenance and improvement of their infrastructure networks.

Ohio now enjoys the distinction of being the 30th state to raise or reform its gas tax this decade, and the third state to do so this year, under a bill signed into law by Gov. Mike DeWine. While state tax policy can be a contentious topic, there has been a remarkable level of agreement on the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies. These actions are helping reverse losses in gas tax purchasing power caused by rising construction costs…

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Twenty-eight states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers purchase more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4-cent gas tax, for example, has not increased in over 25 years. Many states have waited a decade or more since last raising their own gas tax rates.

Gas Taxes Have Gone Up in Most States, but Decades-Long Procrastinators Remain

May 21, 2019 • By Carl Davis

The upcoming Memorial Day weekend marks the start of the traditional summer driving season. In most states, summer road-trippers are paying more gas tax than they did a few years ago and are benefiting from smoother and safer roads as a result. In total, 30 states have raised or reformed their gas taxes in the last six years.

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

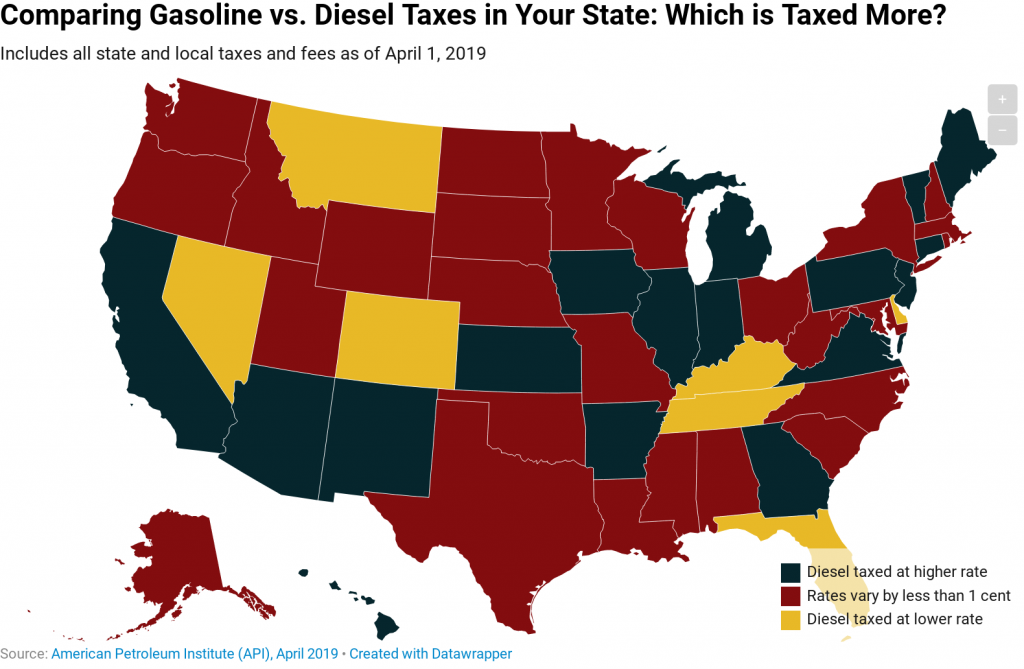

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

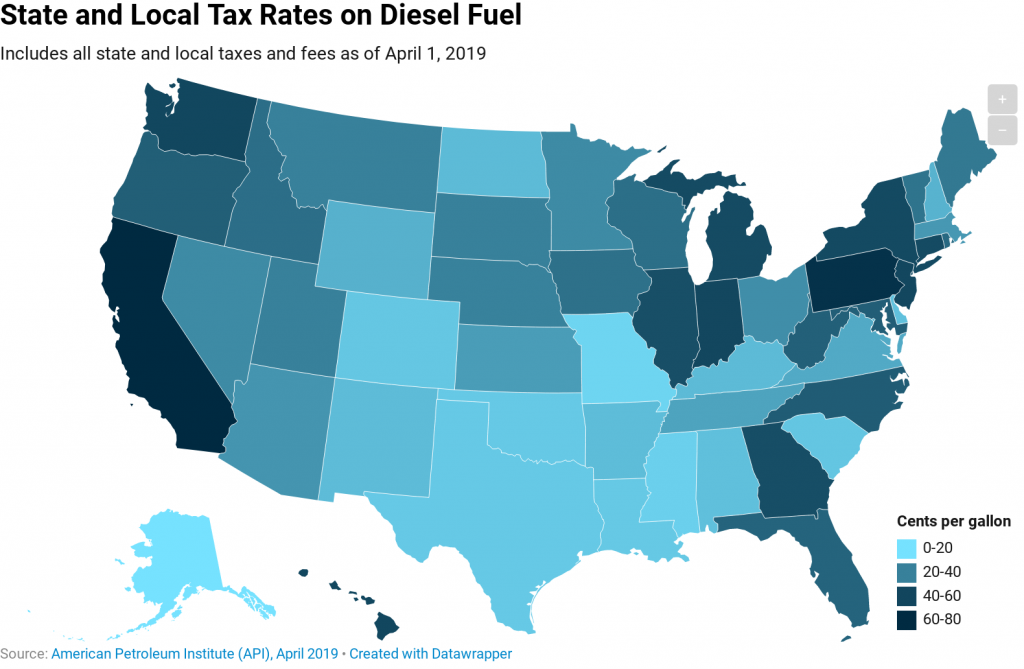

The tax rates identified in this map include state and local excise and sales taxes on diesel fuel, as well as various fees, as calculated by the American Petroleum Institute (API). These taxes are levied in addition to the federal government’s 24.4-cent-per-gallon diesel tax.

Rep. Shuster’s Mixed Bag: Doubling the Gas Tax before Repealing It Entirely

July 24, 2018 • By Carl Davis

This article examines the good aspects of Rep. Shuster’s infrastructure funding plan (a higher gas tax that is indexed to inflation), the bad (a flawed indexing formula and eventual gas tax repeal), and the downright ugly (tying the hands of a funding commission before their work even begins and refusing to ask more of high-income households).

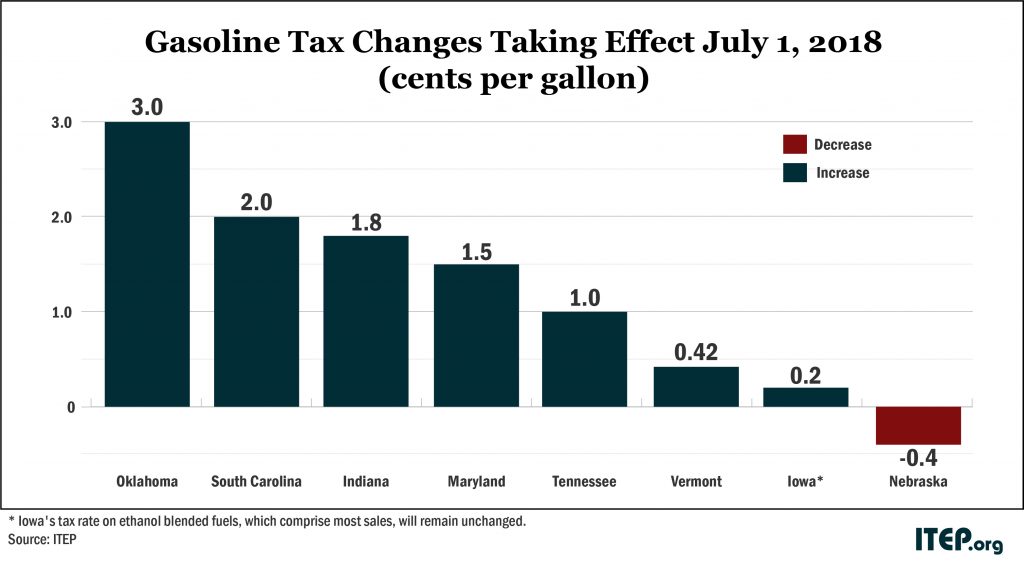

Gas Taxes Rise in Seven States, Including an Historic Increase in Oklahoma

June 26, 2018 • By Carl Davis

A rare sight is coming to Oklahoma. The last time the Sooner State raised its gas tax rate, the Berlin Wall was still standing, and Congress was debating whether to ban smoking on flights shorter than two hours. Fast forward 31 years, and Oklahoma is finally at it again. On Sunday, the state’s gas tax rate will rise by 3 cents and its diesel tax rate by 6 cents. Both taxes will now stand at 19 cents per gallon—still among the lowest in the country. But Oklahoma isn’t the only state where gas taxes will soon rise.

A Gas Tax Hike Is the Obvious Answer to Infrastructure Funding

February 14, 2018 • By Steve Wamhoff

As part of his budget plan released Monday, President Trump offered an infrastructure proposal that he describes as a $1.5 trillion 10-year surge in infrastructure investments. The details of the proposal explain that the federal government would put up only $200 billion of this total, which the administration claims will be offset with cuts in other spending. Even this relatively meager funding amount is illusory because it would clearly be financed by cutting other federal spending — including infrastructure investments.