Illinois

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

State Rundown 9/13: The Year of Unprecedented State Budget Impasses Continues

September 13, 2017 • By ITEP Staff

This week, Pennsylvania lawmakers risk defaulting on payments due to their extremely overdue budget and Illinois legislators will borrow billions to start paying their backlog of unpaid bills. Governing delves into why there were more such budget impasses this year than in any year in recent memory. And Oklahoma got closure from its Supreme Court on whether closing special tax exemptions counts as "raising taxes" (it doesn't).

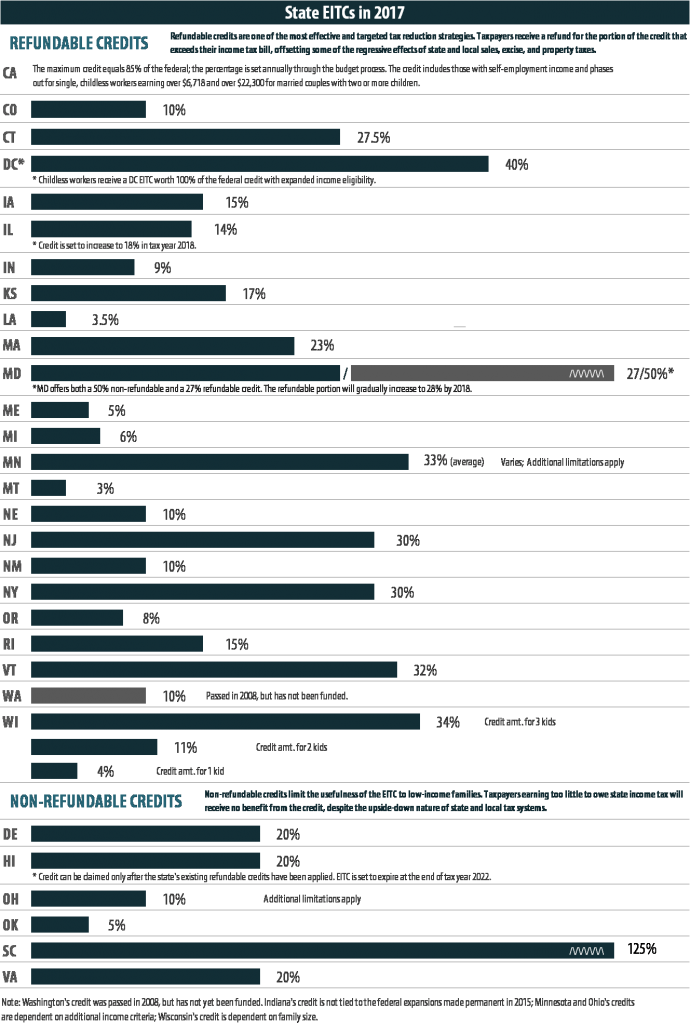

Rewarding Work Through State Earned Income Tax Credits in 2017

September 11, 2017 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

State Rundown 9/6: Most Statehouses Quiet, Many Pondering Harvey’s Impacts

September 7, 2017 • By ITEP Staff

It's been a quiet week for tax policy in most states, though lawmakers are still making noise in Pennsylvania, where a budget agreement is still needed, and in Wisconsin, where legislators are searching for the will to raise revenue for the state's ailing transportation infrastructure. In our "What We're Reading" section you'll find interesting reading on the fiscal fallout of Hurricane Harvey, as well as an in-depth series on how states' disaster response needs are likely to continue to increase.

State Rundown 8/31: Modernizing Taxes is Sometimes a Sprint, Sometimes a Marathon

August 31, 2017 • By ITEP Staff

Tax and budget debates are progressing at different paces in different parts of the country this week. In Connecticut and Wisconsin, lawmakers hope to finally settle their budget and tax differences soon. In South Dakota, a court case that could finally enable states to enforce their sales taxes on online retailers inches slowly closer to the U.S. Supreme Court.

The Chicago Tribune: After the Rush Job to Use Public Money on Private Schools, Now We Wait

August 30, 2017

Third, the Illinois program specifies that donations to scholarship funds — up to $1,000 a year for an individual — are not eligible for the 75 percent state tax credit if the taxpayer also claims that donation as a charitable contribution for federal tax purposes. This provision eliminates the ability of donors in higher tax […]

Illinois Public Radio: Flat Vs. Graduated Income Tax

August 24, 2017

Obviously to be fair to taxpayers, Illinois needs the flexibility to tax lower levels of income at lower rates and higher levels of income at higher rates. The constitutional prohibition against that makes Illinois a national outlier. Of the 41 states in America with an income tax, 33 have graduated rate structures. Illinois is one […]

Chicago Tribune: Put the Brakes on GOP’s Backdoor Voucher Idea

August 24, 2017

Donors to the scholarship funds are also allowed to count that donation as a standard charitable donation for federal income tax purposes, meaning, as one Georgia agency that distributes to schools enthuses on its website, “You will end with more money than when you started.” And the higher your tax bracket, the higher your risk-free […]

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

In Illinois 54.9 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Illinois population (0.8 percent) earns more than $1 million annually. But this elite group would receive 54.9 percent of the tax cuts that go to Illinois residents under the tax proposals from the Trump administration. A much larger group, 41.0 percent of the state, earns less than $45,000, but would receive just 3.9 percent of the tax cuts.

State Rundown 7/27: State Legislative Debates Winding Down but Tax Talk Continues

July 27, 2017 • By ITEP Staff

While only a few states still remain mired in overtime budget debates, there is plenty of budget and tax news from around the country this week. Efforts are underway to repeal gas tax increases in California and challenge a local income tax in Seattle, Washington. And New Jersey legislators' law to modernize its tax code to tax Airbnb rentals has been vetoed for now.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

Trump Tax Proposals Would Provide Richest One Percent in Illinois with 56.1 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Illinois would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,726,200 in 2018. They would receive 56.1 percent of the tax cuts that go to Illinois’s residents and would enjoy an average cut of $134,270 in 2018 alone.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2017 • By ITEP Staff

Sales taxes are an important revenue source, composing close to half of all state tax revenues. But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 16 states will hold them in 2017), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief…

State Rundown 7/11: Some Legislatures Get Long Holiday Weekends, Others Work Overtime

July 11, 2017 • By ITEP Staff

Illinois and New Jersey made national news earlier this month after resolving their contentious budget stalemates. But they weren’t the only states working through (and in some cases after) the holiday weekend to resolve budget issues.

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

Chicago Magazine: What Can Illinois Learn from Other States’ Budget Disasters

June 1, 2017

In 2012, Kansas would go on to enact tax cuts that the Institute on Taxation and Economic Policy called ”among the largest” enacted by any state. Under the leadership of recently elected Governor Sam Brownback, the state dropped the top income tax rate by one-fourth, nixed taxes on “pass through” business profits (business profits passed directly to the […]

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

Crain’s Chicago Business: How Much Do Illinois Companies Pay in Taxes?

April 28, 2017

Illinois’ Fortune 500 companies are paying less and less in state corporate taxes—and sometimes, almost nothing at all. A new report by the Institute on Taxation and Economic Policy found certain corporations are finding ways to shelter much of their profit from state taxes. The eight-year study looked at 240 Fortune 500 companies from 2008 […]

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

The Register-Mail: Change ‘tax avoidance’ laws

March 22, 2017

However, the practice isn’t unusual. About $2.5 trillion has been held offshore in about 10,000 tax-haven subsidiaries by more than 350 of Fortune-500 companies, according to another report, “Offshore Shell Games 2016,” from the Public Interest Research Group, the Institute on Taxation and Economic Policy, and Citizens for Tax Justice. Companies such as Apple and […]

Quad City-Times: Embrace immigrant past, be welcoming community

March 13, 2017

Immigrants are more likely to start a business than native-born Americans and are particularly over-represented in Main Street business — retail, restaurants and neighborhood services — that are crucial to local economies. They also contribute to local tax bases. Even unauthorized immigrants paid $11.74 billion in state and local taxes in 2014 ($758 million just […]