Illinois

Voters Have the Chance in 2020 to Increase Tax Equity in Arizona, Illinois, and California, And They Should

October 22, 2020 • By Marco Guzman

There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects brought on by the coronavirus pandemic and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

WGLT: What To Know About Illinois’ Graduated Tax Amendment

October 14, 2020

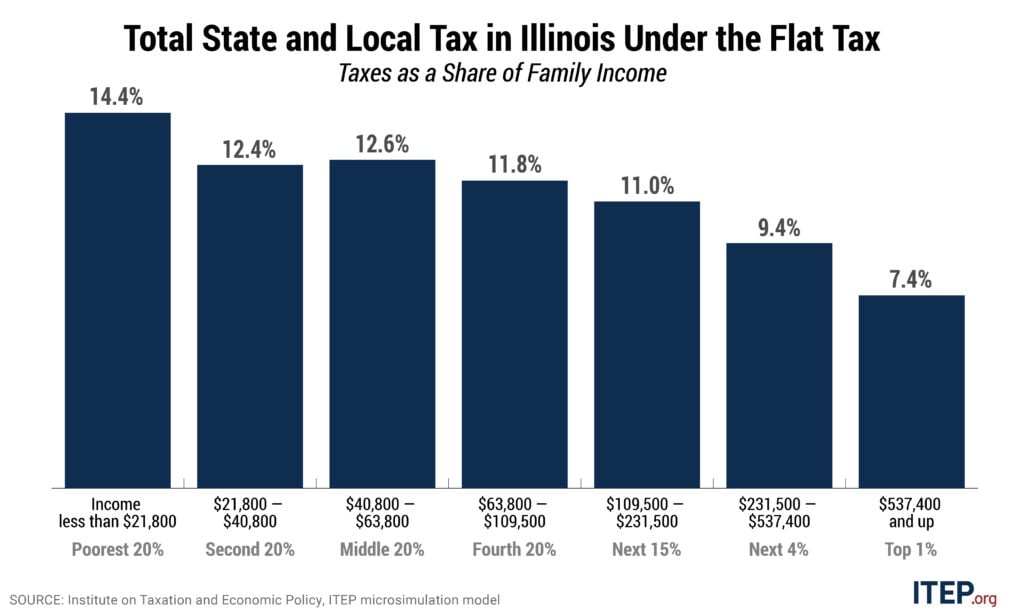

Proponents of the amendment, including Pritzker, cite a breakdown which shows the bottom 20 percent of Illinois earners pay 14.4 percent of their total income to state and local taxes, while the top 1 percent of earners pay 7.4 percent of their income in taxes. That’s according to a report by the left-leaning Washington D.C.-based […]

Chicago Sun-Times: Illinois needs the Fair Tax for racial equity

October 2, 2020

An analysis by the non-partisan Institute on Taxation and Economic Policy shows that, between 1999 and 2019, the state’s current flat rate income tax dramatically increased the racial wealth gap, transferring billions of dollars in tax liability from wealthy, mostly white taxpayers to African American and Latino families. The details reveal a stunning portrait of […]

Jacobin Magazine: Abraham Lincoln Taxed the Rich. This Election Day, Illinois Can, Too.

October 2, 2020

Illinois now boasts one of the most unfair tax systems in the country. According to a new report from the Institute on Taxation and Economic Policy, the state’s flat tax “amounts to a tax subsidy for the wealthiest Illinoisans that compounds income inequality and racial wealth gaps.” Read more

State Rundown 9/23: Tax Justice Advanced in New Jersey, On the Ballot in Illinois

September 23, 2020 • By ITEP Staff

New Jersey leaders grabbed the biggest headlines of the week by finally agreeing to implement a much-needed and long-discussed millionaires tax to shore up the budget and improve tax fairness. And Illinois residents can begin voting tomorrow to enact a graduated income tax there. Relatedly, ITEP Research Director Carl Davis updated our research debunking the myth that progressive taxes interfere with economic growth. Cannabis legalization and taxation was a hot topic as well, as lawmakers in Vermont reached an agreement to move forward on the matter and others in Connecticut, Kansas, and New Hampshire worked toward the same.

Another Reason to Tax the Rich? States with High Top Tax Rates Doing as Well, if Not Better, than States Without Income Taxes

September 23, 2020 • By Carl Davis

ITEP updated a 2017 study that examined the economic performance of the nine states with the highest top marginal tax rates compared to the nine states with no state income tax. Economies in states with the highest top marginal rates grew faster. States facing budget shortfalls should first look at raising taxes on those most able to pay (incomes at the top have grown during this economic crisis) before considering harmful budget cuts.

New York Times: Morning Newsletter

September 18, 2020

Many states have tax systems that are regressive: They take a greater share of income from the poor than the rich. And because a disproportionate share of the richest taxpayers are white, these state tax systems also widen racial wealth gaps. In Illinois, for example, the lowest-earning fifth of the population pays 14.4 percent of […]

Black Enterprise: Study Shows Illinois Tax System Harder on Black, LatinX Taxpayers

September 18, 2020

A study released Thursday by the Institute on Taxation and Economic Policy (ITEP) showed Illinois’ flat tax system disproportionately affects Black and Hispanic taxpayers. According to the study, the state’s flat tax system has resulted in Black and Latinx taxpayers paying $4 billion more in income taxes than they would have under a fair tax […]

Bloomberg: Stimulus Strategizing as Election Nears

September 18, 2020

Flat Tax Pitfalls: Illinois’ flat income tax perpetuates inequities that force minority communities to pay a large chunk of their earnings to the state, while permitting upper-income taxpayers to retain their wealth, according to a study by the Institute on Taxation and Economic Policy. Yesterday’s analysis comes two months before voters will decide whether the […]

Webinar: What’s Tax Got to Do With It?

September 17, 2020 • By ITEP Staff

Tax justice is necessary to achieve racial, social and economic justice. We need race-forward tax policies that create opportunity for everyone, demand corporations and the wealthy pay their fair share and raise enough revenue to respond to compounding climate, health and economic crises. Tax justice is justice. Sen. Sherrod Brown, joined by Dorian Warren (Community […]

Illinois’s Flat Income Tax Amounts to a Tax Subsidy for the Wealthiest Illinoisans that Compounds Income and Wealth Inequalities

September 17, 2020 • By Lisa Christensen Gee

This November, Illinoisans will decide whether to amend the state constitution to allow a graduated income tax. A “yes” vote on the Illinois Fair Tax constitutional amendment will make effective legislation that will replace the current flat tax rate of 4.95 percent with graduated rates that cut taxes for those with taxable income less than $250,000 and institute higher marginal rates on taxable incomes greater than $250,000.

New 20-Year Study Provides Insight on How State Tax Systems Worsen Inequality and the Racial Wealth Gap

September 17, 2020 • By ITEP Staff, Lisa Christensen Gee

A new study finds that over the last 20 years, Illinois’s tax system has effectively sapped $4 billion more from Black and Hispanic communities than it would have under a graduated income tax while also allowing the state’s highest-income (mostly white) households to pay $27 billion less in taxes, the Institute on Taxation and Economic Policy (ITEP) said today.

Illinois’s Flat Tax Exacerbates Income Inequality and Racial Wealth Gaps

September 17, 2020 • By Lisa Christensen Gee

Flat or graduated personal income taxes have varying effects on the annual individual tax liabilities of taxpayers at different income levels. Less examined is how tax structures affect income inequality and racial wealth gaps. This brief illustrates how Illinois’s historic flat income tax structure compares to the proposed Fair Tax through a multi-year retrospective analysis. It shows that Illinois’s flat income tax in lieu of a graduated rate tax used by most states amounts to a tax subsidy for the wealthiest Illinoisans that compounds income inequality and racial wealth gaps.

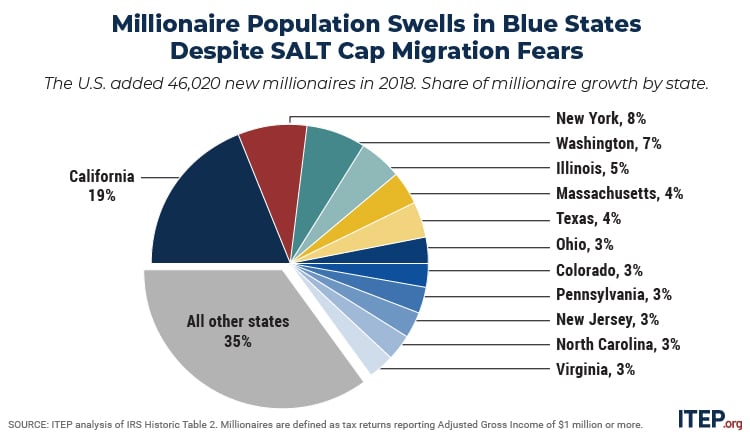

Yahoo! Finance: Salt Cap Isn’t Scaring Away Blue State Millionaires

September 15, 2020

The $10,000 cap on state and local tax deductions imposed as part of the 2017 Republican tax law is not causing high-income taxpayers to flee high-tax blue states, according to Carl Davis, research director at the progressive Institute on Taxation and Economic Policy. In a blog post last week, Davis said that new IRS data […]

Millionaire Population Swells in Blue States Despite Migration Fearmongering

September 3, 2020 • By Carl Davis

Although the 2017 Tax Cuts and Jobs Act has created a slew of problems, it is now clear that a mass migration of top earners out of higher-tax blue states is not one of them.

The Rich Are Weathering the Pandemic Just Fine: Tax Them

September 3, 2020 • By Carl Davis, ITEP Staff, Meg Wiehe

Reductions in critical state and local investments, including health care and education, would only exacerbate the economic crisis brought on by COVID-19 and worsen racial and income inequality for years to come. Higher taxes on top earners are among the best options for addressing pandemic-related state revenue shortfalls in the coming months.

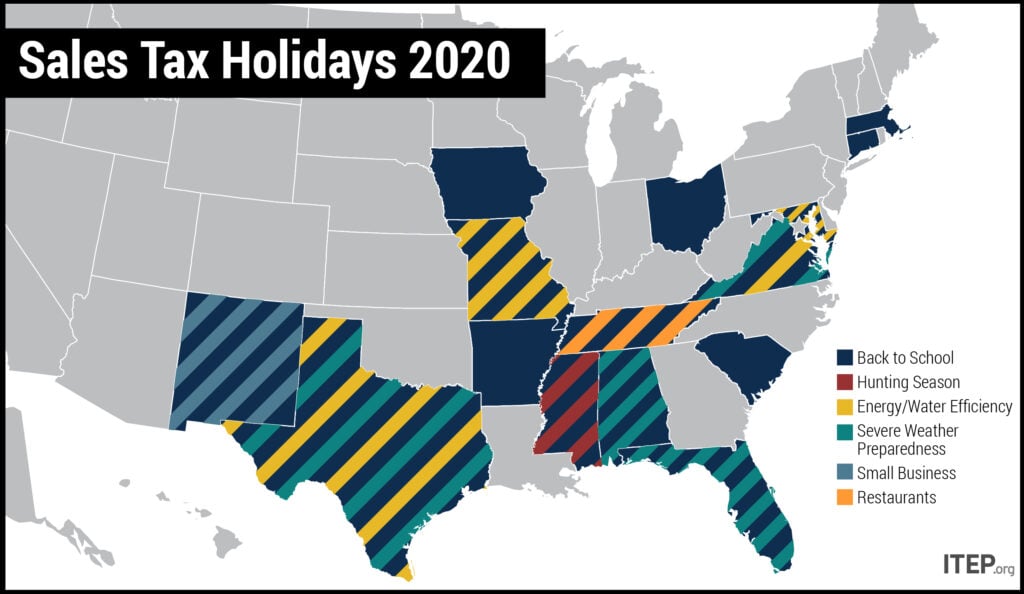

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 29, 2020 • By Dylan Grundman O'Neill

Lawmakers in many states have enacted “sales tax holidays” (16 states will hold them in 2020) to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—and amplified in the context of the COVID-19 pandemic. This policy brief looks at sales tax holidays as a tax reduction device.

New Fiscal Year Brings New Challenges and Opportunities in the States

July 1, 2020 • By Kamolika Das

July 1—the start of the new fiscal year in most states—typically marks a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions. 2020 is markedly different. Nationwide business closures and stay-at-home orders in response to COVID-19 have led to unprecedented spikes in unemployment, decreased demand for consumer spending, and increased demand for vital public services. As a result, states face incredibly uncertain financial futures with little clarity regarding how their tax collections will fare over the next year.

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

State Rundown 5/27: Some States Finally Talking Revenue Solutions to Revenue Crisis

May 27, 2020 • By ITEP Staff

This week the immense scale and uneven distribution of economic and health damage from the COVID-19 pandemic continued to come into focus, hand in hand with greater clarity around pandemic-related revenue losses threatening state and local revenues and the priorities—such as health care, education, and public safety—they fund. Officials in many states, including Ohio and Tennessee, nonetheless rushed to declare their unwillingness to be part of any solution that includes raising the tax contributions of their highest-income residents. On the brighter side, some leaders are willing to do just that, for example through progressive tax increases proposed in New York…

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

Sales Tax Policy in a Pandemic: Exemptions for Digital Goods and Services Are More Outdated Than Ever

April 29, 2020 • By Estefan Hernandez Escoto

Many states are making the decline in sales tax collection worse by failing to apply their sales taxes to digital goods (such as downloads of music, movies, or software) and services (such as digital streaming). A state that taxes movie theater tickets but not digital streaming, for instance, is needlessly hastening the decline of its own sales tax.

The full effect of the coronavirus pandemic on state revenue streams remains largely unknown. One key policy option is to reevaluate recent misguided tax cuts—particularly those that have not yet taken full effect and will add to growing revenue shortfalls in the coming years.

Chicago Tribune: Agencies scramble to help Lake County undocumented immigrants impacted by coronavirus crisis

April 18, 2020

According to the Institute on Taxation and Economic Policy, Illinois is one of six states that derive the most revenue from taxes paid by undocumented immigrants. California, Florida, New York, Texas and New Jersey, are also on the list. Read more

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.