Maine

Rather than resorting to tax cuts, which can eventually create revenue shortfalls, lawmakers should determine whether they have adequately invested in people and communities. There are better ways to leverage tax systems to help those who need it most.

The new year often brings with it a reinvigorated commitment to new goals and a fresh perspective on how to accomplish them, but it seems like lawmakers in states around the country are giving up already...

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

Maine Beacon: Analysis: Dems’ budget plan would raise taxes on rich, cut rates for 80% of Mainers

September 25, 2021

A report released this week by a national policy group found that proposed changes to the tax code advanced by the House Ways and Means Committee to pay for the sweeping expansion of the social safety net within Democrats’ $3.5 trillion budget bill could result in a tax cut for 80% of Mainers while only […]

Extending Federal EITC Enhancements Would Bolster the Effects of State-Level Credits

September 13, 2021 • By Aidan Davis

The EITC expansion targets workers without children in the home. In 2022 it would provide a $12.4 billion boost, benefiting 19.5 million workers who on average would receive an income boost of $730 dollars.

State Rundown 7/7: The New Fiscal Year Starts off With a Bang, And Not Just Fireworks

July 7, 2021 • By ITEP Staff

States were busy over the past week despite the Fourth of July holiday. Many are gearing up for upcoming tax and budget clashes that could shape their futures for some time...

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

This week’s state fiscal news brings a reminder that even though advocates for great economic and racial justice have won some major progressive victories recently, anti-tax zealots have been hard at work too. Lawmakers advanced or enacted troubling regressive tax cuts or shifts in Idaho, Kansas, and Montana, and are actively debating them in Iowa, […]

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

Young workers are confronting a harsh economic reality filled with student loan debt and far too few good-paying jobs. The pandemic reinforced this group’s long history of not receiving proper benefits, such as health insurance, from their employers. They also are often overlooked when it comes to policies that promote economic wellbeing. The federal Earned Income Tax Credit (EITC), for example, is a glowing success story. It lifted 5.8 million people out of poverty in 2018, including 3 million children. But a key shortcoming of the federal EITC: working adults without children in the home receive little to no benefit.

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

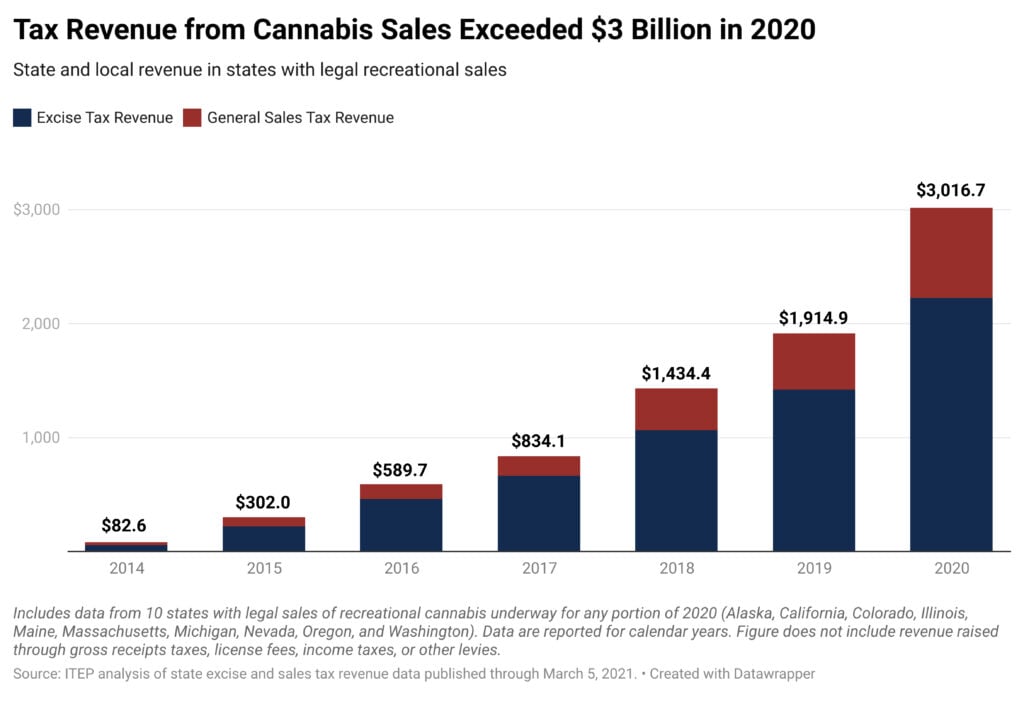

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

State Rundown 3/10: Federal Pandemic Aid Means States Can Focus on the Big Picture

March 10, 2021 • By ITEP Staff

State and local policymakers will be preoccupied for a short time with celebrating and deciphering the federal pandemic relief package approved today, but ultimately the federal aid should free them to focus on even bigger concerns such as tax codes that often fail to adequately fund core priorities even in good years and exacerbate the economic and racial inequities that this pandemic has laid bare.

Although lawmakers in some states continue to push for expensive and regressive tax cuts that would primarily benefit wealthy households, worsen economic and racial injustices, and undermine funding for key public services, this week’s state fiscal news is dominated by efforts to do the opposite. Leaders in the District of Columbia, Maine, Nebraska, New York, Washington, and Wyoming made recent headlines by advocating for policies that improve on upside-down tax codes and generate needed funding for shared priorities like schools and health care.

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

Maine Center for Economic Policy: Tax Policy Options: Maine Needs Progressive Revenue Solutions to Build a Stronger, Fairer Future

January 27, 2021

Generally, the sales tax is regressive. The poorest one-fifth of families pay a share of their income in Maine sales taxes that is nearly nine times larger than the top 1 percent. Poorer households pay larger shares of their income in sales taxes than wealthy households in part because wealthier households save a larger percent […]

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.