New Mexico

State Rundown 2/16: Spending Priorities Emerge as the Votes Are Counted

February 16, 2022 • By ITEP Staff

State lawmakers have been busy working out deals and negotiating how best to use excess revenues, and as the votes are beginning to come in, spending priorities are becoming clearer...

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

Federal EITC Enhancements Help More Than One in Three Young Workers

February 8, 2022 • By Aidan Davis

More than one in three young adults would benefit from workers without children being eligible to receive the federal EITC. This policy change would bolster young adults’ economic security.

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

State Rundown 1/20: Governors Eyeing Tax Cuts in Yearly Addresses

January 20, 2022 • By ITEP Staff

A common theme is emerging out of states, as governors around the U.S. begin the year with their annual state speeches, and the news does not bode well for long-term growth and sustainable budgets...

Rather than resorting to tax cuts, which can eventually create revenue shortfalls, lawmakers should determine whether they have adequately invested in people and communities. There are better ways to leverage tax systems to help those who need it most.

Here at ITEP we want to give thanks and say we’re grateful for all of the hard work that advocates in states across the country are doing to secure progressive tax policy victories...

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2021

October 21, 2021 • By Aidan Davis

The EITC benefits low-income people of all races and ethnicities. But it is particularly impactful in historically excluded Black and Hispanic communities where discrimination in the labor market, inequitable educational systems, and countless other inequities have relegated a disproportionate share of people to low-wage jobs.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

Though we can’t fault anyone for being distracted by the major stories of the day, we at ITEP remain committed to keeping you up to date on what’s happening in the tax world around you...

Extending Federal EITC Enhancements Would Bolster the Effects of State-Level Credits

September 13, 2021 • By Aidan Davis

The EITC expansion targets workers without children in the home. In 2022 it would provide a $12.4 billion boost, benefiting 19.5 million workers who on average would receive an income boost of $730 dollars.

Frequently Asked Questions about Proposals to Repeal the Cap on Federal Tax Deductions for State and Local Taxes (SALT)

September 3, 2021 • By Carl Davis, ITEP Staff, Steve Wamhoff

Even though Democrats in Congress uniformly opposed the TCJA because its benefits went predominately to the rich, many Democratic lawmakers now want to give a tax cut to the rich by repealing the cap on SALT deductions.

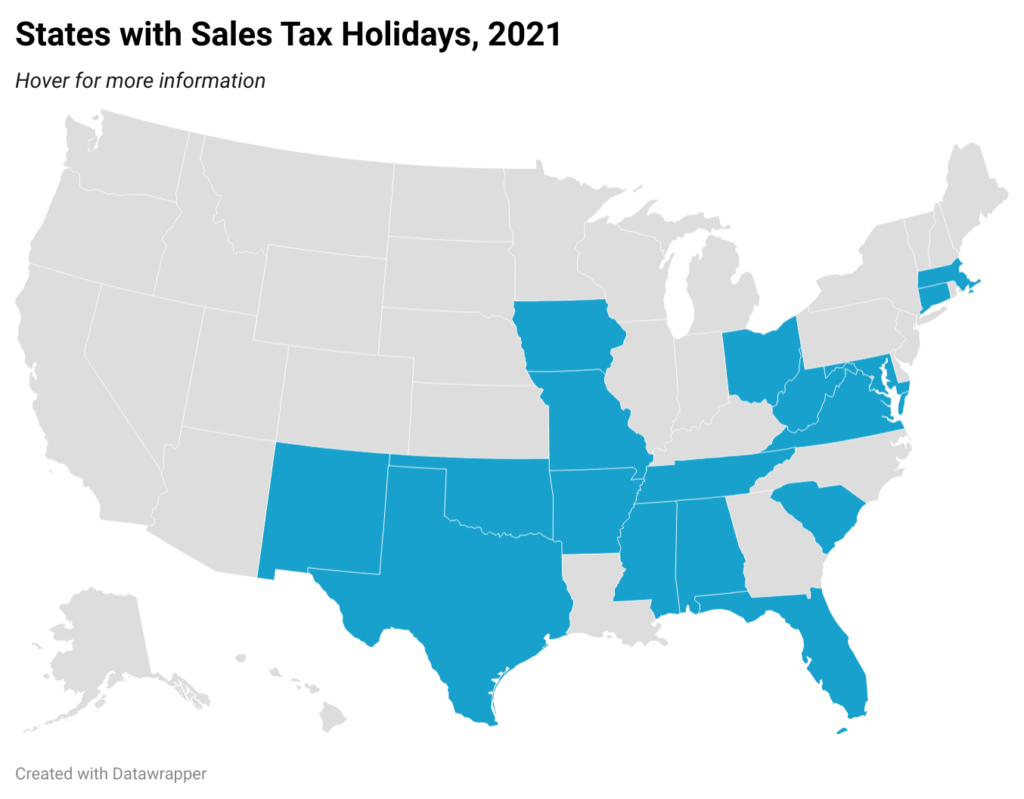

State Experimentation with Sales Tax Holidays Magnifies Their Flaws

August 6, 2021 • By Dylan Grundman O'Neill

It’s back-to-school shopping season, so…everyone who buys a cell phone in Arkansas this weekend will do so sales-tax-free. For this whole week in Connecticut, and for the entire spring in New Mexico, the corporate owners of highly profitable multinational restaurant chains had the option to pocket their customers’ taxes rather than remit them to the state to fund vital public services, pass along those savings to their customers, or give a much-needed boost to their employees. And all told, about $550 million of state and local revenue will be forgone in 17 states this year through wasteful and poorly targeted…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...

President Joe Biden's American Families and Jobs plans intend to “build back better” and create a more inclusive economy. To fully live up to this ideal, the final plan must include undocumented people and their families.

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.

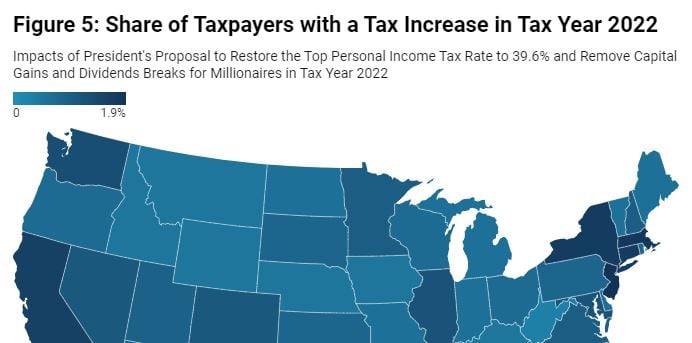

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

Bloomberg: N.Y., New Jersey, California Hit Hardest by Biden Tax Changes

April 29, 2021

President Joe Biden’s plan to ramp up the income tax rate and capital gains tax rate as part of a $1.8 trillion stimulus plan would hit high-tax states like New York and California the hardest, while New Mexico and Mississippi would be least affected, according to research from the Institute on Taxation and Economic Policy. […]

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Young workers are confronting a harsh economic reality filled with student loan debt and far too few good-paying jobs. The pandemic reinforced this group’s long history of not receiving proper benefits, such as health insurance, from their employers. They also are often overlooked when it comes to policies that promote economic wellbeing. The federal Earned Income Tax Credit (EITC), for example, is a glowing success story. It lifted 5.8 million people out of poverty in 2018, including 3 million children. But a key shortcoming of the federal EITC: working adults without children in the home receive little to no benefit.

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…