Recent Work

2162 items

House Tax Plan Offers an Exceptionally Bad Deal for California, New York, New Jersey, and Maryland

November 14, 2017 • By Carl Davis

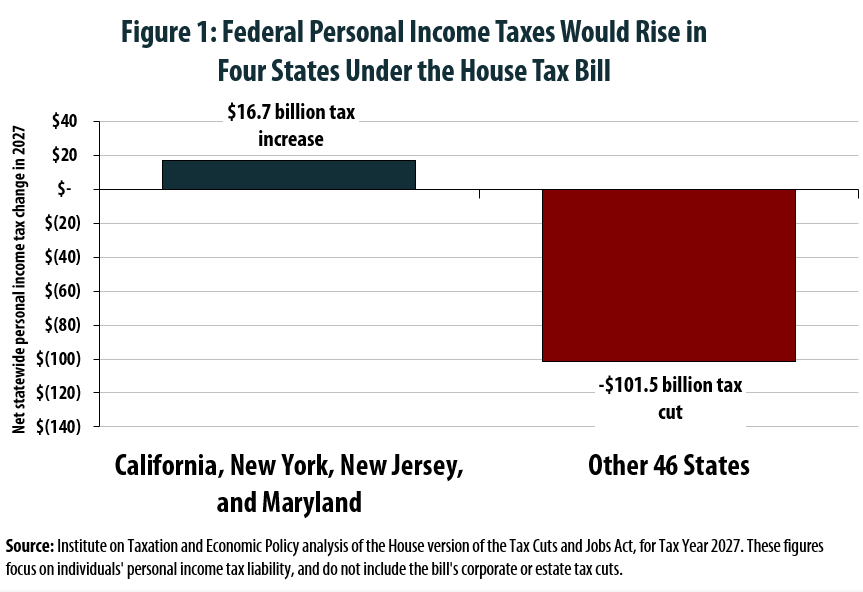

An ITEP analysis reveals that four states would see their residents pay more in aggregate federal personal income taxes under the House’s Tax Cuts and Jobs Act. While some individual taxpayers in every state would face a tax increase, only California, New York, Maryland, and New Jersey would see such large increases that their residents’ overall personal income tax payments rise when compared to current law.

House Tax Bill Would Put Property Tax Deduction Out of Reach for Most Households

November 13, 2017 • By ITEP Staff

The House of Representatives is expected to vote this week on a bill that would reduce federal revenues by roughly $1.5 trillion over the next decade. Despite the bill’s high price tag, many households would pay more in federal tax if the bill is enacted, in large part because it slashes the deduction for state […]

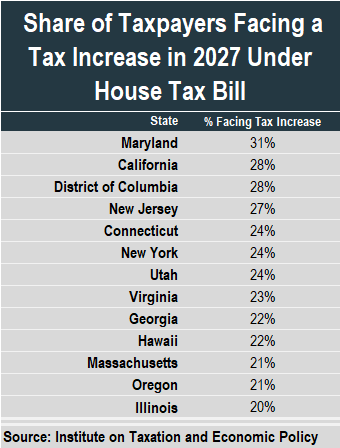

Flawed Data from House Leadership Attempts to Hide Tax Hikes Under Proposal

November 9, 2017 • By Carl Davis

In a story published yesterday evening, Politico reported that House leaders have been “working to create customized data models” to show lawmakers that their constituents will not face a tax increase under the tax bill being debated in the House. On this point, House leaders have taken on an impossible task.

State Rundown 11/8: Online Sales Tax Fight and Tax Subsidy Absurdity Go National

November 8, 2017 • By ITEP Staff

Internet sales tax fairness efforts gained momentum this week as most states joined together to encourage the US Supreme Court to allow them to collect taxes on online sales. Meanwhile, Montana lawmakers will enter special session next week to plug their revenue shortfall, Mississippi's (self-inflicted) revenue crunch is reaching unprecedented severity, and misguided corporate tax subsidies got mainstream attention from HBO's John Oliver and Rolling Stone.

House Tax Plan Would Make Offshore Tax Avoidance Substantially Worse

November 8, 2017 • By Richard Phillips

The Sunday release of the Paradise Papers has once again brought the issue of offshore tax avoidance to the forefront of public discussion. The papers expose the complex structures that companies such as Apple and Nike have pursued in recent years to pay little to nothing in taxes on their offshore earnings. Yet even as these revelations make headlines, House Republicans are moving forward with major tax legislation, the Tax Cuts and Jobs Act, that would reward the worst tax avoiders and make it even easier for multinational companies to avoid taxes.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

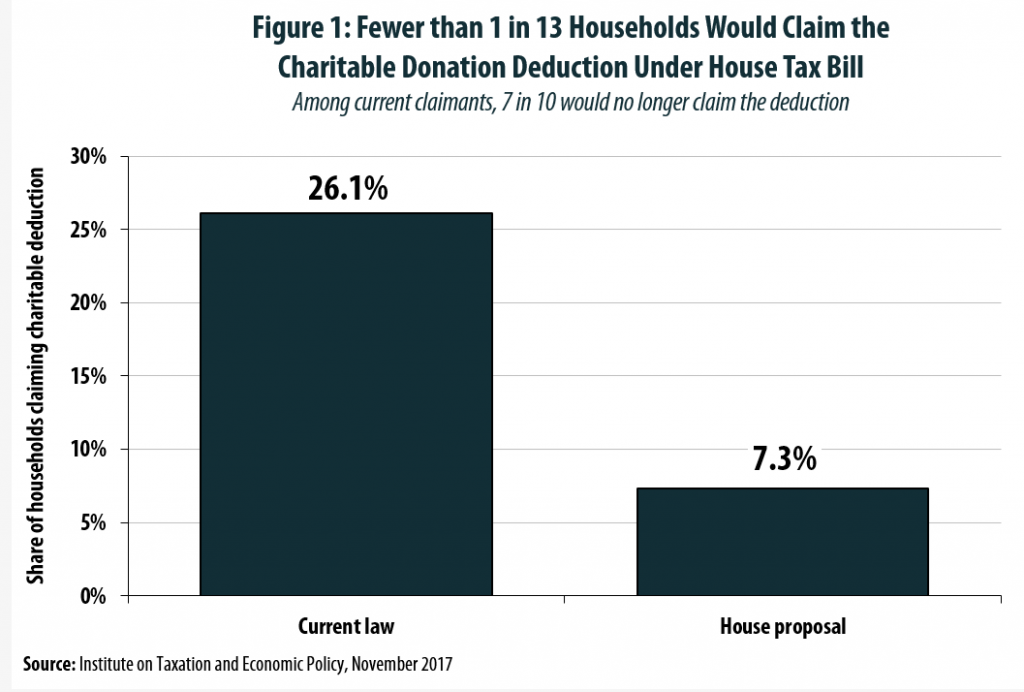

House Tax Bill Would Reserve Charitable Giving Subsidies for a Small Subset of Wealthier Households

November 6, 2017 • By Carl Davis, Steve Wamhoff

In the tax policy framework released in September, President Trump and Congressional leadership insisted that their proposal would retain the tax incentive for donating to charity because doing so helps “accomplish important goals that strengthen civil society, as opposed to dependence on government.” Now that the House has released a more detailed proposal, it is finally possible to evaluate exactly how their plans would impact the incentive to donate to charity.

American Corporations Tell IRS that 61 Percent of Their Offshore Profits Are in 10 Tax Havens

November 5, 2017 • By Richard Phillips

Recent revelations that a Bermuda law firm helped facilitate offshore tax avoidance has heightened awareness of the vast amount of income and wealth flowing into tax and secrecy havens worldwide. The countries through which this firm helped funnel global elites’ assets also act as tax havens for multinational corporations. Recently released data from the Internal Revenue Service show that U.S. corporations claim that 61 percent of their foreign subsidiaries’ pretax worldwide income is being earned in 10 tiny tax haven countries.

Paradise Papers Underscore Why Lawmakers Should Focus on Offshore Tax Avoidance

November 5, 2017 • By ITEP Staff

Following is a statement by Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, regarding the release of the “Paradise Papers,” a series of documents from Appleby, a leading offshore law firm. The International Consortium of Investigative Journalists released the investigative report today.

Nike earned more than $10 billion in U.S. profits from 2008 to 2015 but only paid 18.6 percent in U.S. federal taxes during this time. This is just over half of the official U.S. corporate tax rate of 35 percent.

Since Facebook became a public company, its annual revenues have increased by 250 percent from around $8 billion in 2013 to nearly $28 billion last year. In the same time period, the company’s before-tax profits shot up four-and-a-half fold to $12.5 billion. But in this time it has also managed to avoid billions of dollars in U.S. taxes.

Apple is the most valuable public company of all time with a market value of more than $800 billion. Last year, it cleared $45.7 billion[iii] in profits after taxes, making it the most profitable company in the Fortune 500 for the third straight year.

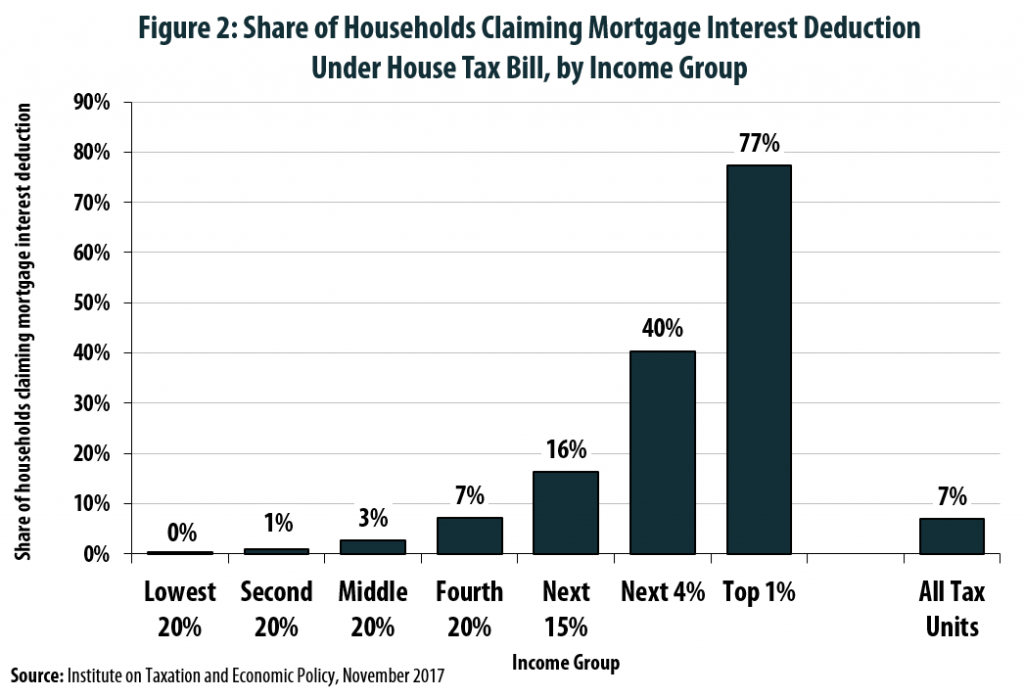

Mortgage Interest Deduction Wiped Out for 7 in 10 Current Claimants Under House Tax Plan

November 5, 2017 • By Carl Davis, Steve Wamhoff

Throughout the ongoing federal tax debate, President Trump and Congressional leadership have insisted that while many tax deductions and credits would be wiped out, the mortgage interest deduction would be spared from the chopping block. But while the proposal recently unveiled by House leaders retains the mortgage interest deduction on paper, the actual substance of this policy would be nearly unrecognizable to today’s homeowners.

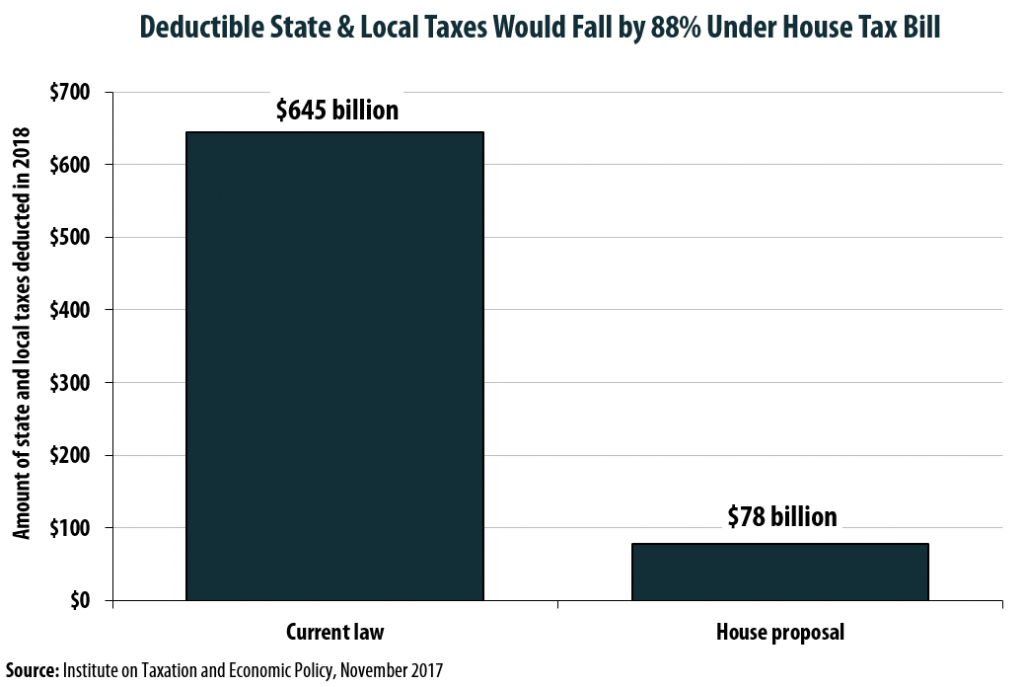

House Plan Slashes SALT Deductions by 88%, Even with $10,000 Property Tax Deduction

November 3, 2017 • By Carl Davis, Steve Wamhoff

One of the most contentious issues in the current federal tax debate is over what to do with the deduction for state and local taxes paid (the SALT deduction). Since the deduction’s benefits vary by state, the House proposal to drastically scale it back has led to an outcry among lawmakers from states such as New York, New Jersey, and California whose constituents would be impacted most dramatically by the change. In an attempt to address those concerns, House leadership agreed to partially retain the deduction for real estate property taxes paid (up to $10,000 per year) while still repealing…

A Chart Book on the U.S. Tax System