Recent Work

2146 items

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

Gentrification and the Property Tax: How Circuit Breakers Can Help

April 27, 2021 • By David Crawford

Property tax circuit breakers are effective because they provide property tax relief to families whose property taxes surpass a certain percentage of their income. If a family in a gentrifying area sees their property tax bill (or their rent) surge to an unaffordable level, a circuit breaker credit kicks in to offer relief. This targeted approach assists low- and middle-income families without significantly reducing overall tax revenue.

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Inclusive Child Tax Credit Reform Would Restore Benefit to 1 Million Young ‘Dreamers’

April 27, 2021 • By Marco Guzman

As the Biden administration maps out the next steps in America’s response to the coronavirus pandemic—through what is now being called the American Families Plan—it should make sure a proposed expansion of the Child Tax Credit (CTC) includes undocumented children who have largely been left out of federal relief packages this past year. Prior to 2017 Tax Cut and Jobs Act, all children regardless of their immigration status received the credit as long as their parents met the income eligibility requirements. This change essentially excluded around 1 million children and their families.

Sometimes a good idea takes a while. Alvin Schorr, who would have turned 100 this month, helped draft a 1972 bill “to provide for a system of children’s allowances.” He continued to push (in a 1977 congressional testimony and in a 1983 New York Times op-ed) for a refundable tax credit for all families and a children’s allowance, among other laudable ideas. A half-century later, these ideas—which many others have championed—are becoming reality.

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

Young workers are confronting a harsh economic reality filled with student loan debt and far too few good-paying jobs. The pandemic reinforced this group’s long history of not receiving proper benefits, such as health insurance, from their employers. They also are often overlooked when it comes to policies that promote economic wellbeing. The federal Earned Income Tax Credit (EITC), for example, is a glowing success story. It lifted 5.8 million people out of poverty in 2018, including 3 million children. But a key shortcoming of the federal EITC: working adults without children in the home receive little to no benefit.

SALT Cap Repeal Would Worsen Racial Income and Wealth Divides

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A bipartisan group of 32 House lawmakers banded together to form the “SALT Caucus,” demanding elimination of the SALT cap. None of their arguments in favor of repeal change the fact that it would primarily benefit the rich and, according to new research, exacerbate racial income and wealth disparities.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

Nike’s Tax Avoidance Response Does not Dispute It Paid $0 in Federal Income Tax

April 19, 2021 • By Matthew Gardner

It was (allegedly) P.T. Barnum who first said “there’s no such thing as bad publicity.” But the public relations professionals at the Nike Corporation clearly disagree with this maxim. Last week, after multiple media outlets, including the New York Times, wrote about ITEP’s conclusion that Nike avoided federal corporate income taxes under the Trump tax law, the company contacted these news organizations to… change the subject.

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

What to Expect from Biden and Congressional Democrats on Tax Increases for Individuals

April 8, 2021 • By Steve Wamhoff

The Biden administration has already provided details on its corporate tax proposals and in the next couple of weeks is expected to propose tax changes for individuals. Meanwhile, congressional Democrats have some ideas of their own. What should we expect?

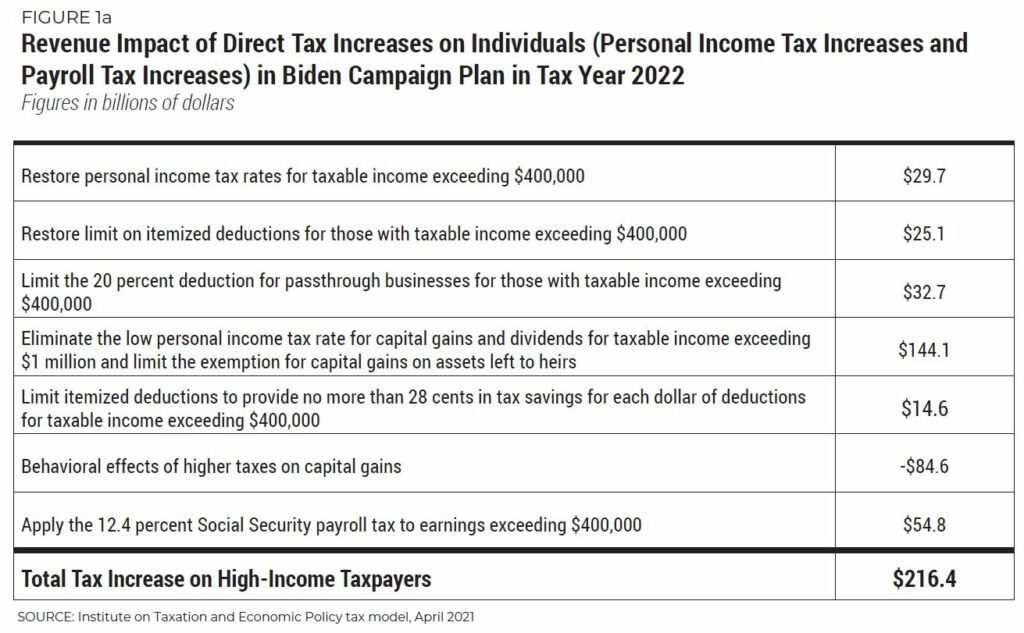

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

A Proposal to Simplify President Biden’s Campaign Plan for Personal Income Taxes and Replace the Cap on SALT Deductions

April 8, 2021 • By Steve Wamhoff

In this paper, we describe a tax policy idea that would simplify the proposals President Biden presented during his campaign to raise personal income taxes for those with annual incomes greater than $400,000. Our proposal would replace the cap on state and local tax (SALT) deductions with a broader limit on tax breaks for the rich that would raise more revenue than the personal income tax hikes that Biden proposed during his campaign. Our proposal would also achieve Biden’s goals of setting the top rate at 39.6 percent and raising taxes only on those with income exceeding $400,000.

The High Cost of Corporate Tax Avoidance (Webinar)

April 8, 2021 • By Amy Hanauer, ITEP Staff, Matthew Gardner

When communities thrive, so do corporations. But when profitable corporations build their empires by exploiting the tax code, it is workers, the environment and our communities—not CEOs or shareholders—that are harmed. Amazon posted its highest U.S. profit ever for 2020, an unprecedented year defined by a pandemic. Yet the company sheltered more than half its profits from corporate taxes—legally. While the company may be one of the most recognizable tax avoiders, it's not an outlier.