Recent Work

2162 items

State Rundown 7/8: Many State Legislatures Reconvene for Special or Resumed Sessions

July 8, 2020 • By ITEP Staff

Local leaders in the District of Columbia and Seattle, Washington, approved progressive tax changes to raise needed funding this week for priorities such as coronavirus relief, affordable housing, and mental health. Arizona advocates submitted signatures to place a high-income surcharge on the ballot for November. And as a number of states made decisions on how to use federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funds, North Carolina decoupled from costly business tax cuts contained in the act and Nebraska started discussing doing the same.

As ITEP analyst Kamolika Das wrote today, July 1 is typically the beginning of state fiscal years and “a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions.” Not so in 2020, she writes, as uncertainty surrounding the virus, state revenues, and potential federal action give state lawmakers no such time to relax and reflect. Although most recent state actions, such as those covered below in California, Mississippi, and West Virginia, have focused on funding cuts and temporary measures to bring budgets into short-term balance, the need for…

New Fiscal Year Brings New Challenges and Opportunities in the States

July 1, 2020 • By Kamolika Das

July 1—the start of the new fiscal year in most states—typically marks a point when one can take a step back and reflect on the wins and disappointments of the past state legislative sessions. 2020 is markedly different. Nationwide business closures and stay-at-home orders in response to COVID-19 have led to unprecedented spikes in unemployment, decreased demand for consumer spending, and increased demand for vital public services. As a result, states face incredibly uncertain financial futures with little clarity regarding how their tax collections will fare over the next year.

Republican Tax Credit Proposal Would Provide New Breaks to Tax Avoiders Like Amazon and Netflix

June 30, 2020 • By Matthew Gardner, Steve Wamhoff

While lawmakers of both parties and policy experts discuss various ways to respond to the continuing COVID-19 crisis and resulting economic downturn, Republicans in Congress are offering a new solution. Their idea, which is still being discussed, is to waive existing limits on business tax credits. This could benefit corporations that are profitable but that nonetheless pay no taxes or very little in taxes because of the many tax breaks and legal loopholes they already enjoy.

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

McSally “Travel Tax Credit” Is an Invitation for Tax Avoidance

June 23, 2020 • By Matthew Gardner

Earlier this week, U.S. Sen. Martha McSally (R-AZ) introduced the “American TRIP Act,” a bill ostensibly designed to encourage Americans to boost the economy by traveling within the United States. The bill is certainly a trip in the colloquial sense of the word.

The Institute on Taxation and Economic Policy stands with activists who are guiding the movement to transform America, dismantle systemic racism in policing, and envision a better justice system. Committed protestors in big cities, small towns, and suburban enclaves have spurred a sea change in public opinion and policy possibility on policing and incarceration. Their work and activism builds on years of action by Black Lives Matter and other leaders.

State Rundown 6/18: States Work to “Finalize” Budgets in Uncertain Times

June 18, 2020 • By ITEP Staff

Despite uncertainty all around the nation, a few states passed budgets this week and many more are negotiating to enact theirs before fiscal years close at the end of June. Colorado notably pared back some of its own tax breaks and limited the potential damage on its budget from new federal breaks. California also passed a budget but few in the state actually think the dealing is done. Iowa quietly enacted its budget too, though advocates in the state are making noise about non-fiscal bills that were added late in the game.

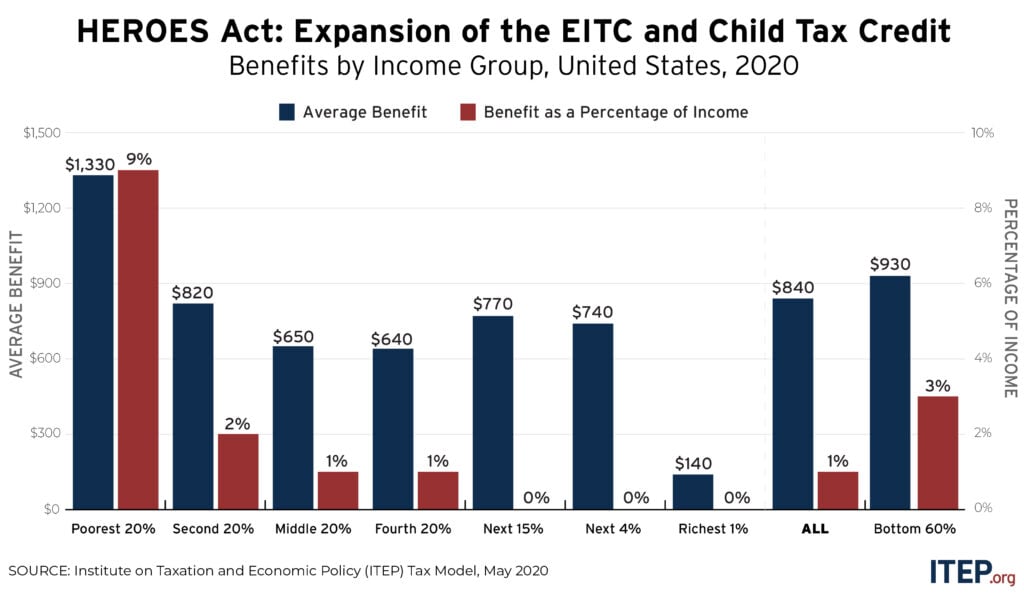

National and State-by-State Estimates of House-Passed Improvements in Tax Credits for Workers and Children

June 18, 2020 • By Steve Wamhoff

Among other important provisions, the HEROES Act includes reforms to the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) to make these tax credits more effective in helping working people and helping parents afford the costs of raising children.

Tax Justice and Racial Justice: Transformative Change Is Overdue

June 16, 2020 • By Amy Hanauer, ITEP Staff

Progressive tax policy can spur deep investments in communities, help families afford childcare and college, provide healthcare for everyone, re-imagine energy consumption to stop heating the planet, expand parks and bike lanes and public transit. Economic justice can give workers a greater voice than corporations in our democracy. People are protesting because the moment for transformative change in policing and our economy is long overdue.

As calls to defund the police demonstrate, state and local decisions about funding priorities and how those funds are raised are deeply embedded in racial justice issues. Tax justice is also a key component in advancing racial justice. Racial wealth disparities are the result of countless historic inequities and tax policy choices are certainly among […]

Most people assume that the federal government is the main—if not only—agent for ensuring economic stability and recovery in response to COVID. Yet, the fight for tax fairness at the state level will have a dramatic impact on economic recovery.

White House Incredibly Still Believes Tax Cuts Are the Answer to America’s Problems

June 2, 2020 • By Steve Wamhoff

White House officials continue to discuss tax cuts in response to the COVID-19 pandemic. Steve Wamhoff provides a roundup of these terrible ideas that would do little to boost investment or reach those who need it most.

Depreciation Breaks Have Saved 20 Major Corporations $26.5 Billion Over Past Two Years

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

The Trump administration and its congressional allies have proposed making permanent the expensing provision in the Trump-GOP tax law. Expensing is the most extreme form of accelerated depreciation, which allows businesses to deduct the cost of purchasing equipment more quickly than it wears out. But expensing and other types of accelerated depreciation already account for a very large share of corporate tax breaks and allows many companies to pay nothing at all.