Recent Work

2146 items

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

2021 Trump Budget Continues 40-Year Trickle-Down Economic Agenda

February 12, 2020 • By Jenice Robinson

The 2017 Tax Cuts and Jobs Act may as well have been called the Promise for Austerity Later Act.

ITEP Testimony In Support of H.B. 222 Income Tax Rates – Capital Gains Income & H.B. 256 Maryland Estate Tax – Unified Credit

February 12, 2020 • By Kamolika Das

Read as PDF Testimony of Kamolika Das, State Policy Analyst, Institute on Taxation and Economic Policy Submitted to: Ways and Means Committee, Maryland General Assembly Thank you for this opportunity to submit testimony. My name is Kamolika Das, and I represent the Institute on Taxation and Economic Policy (ITEP), a non-profit, non-partisan research organization that […]

Hearing Witness: Trump Administration Giving Tax Breaks Not Allowed by Law

February 12, 2020 • By Steve Wamhoff

The Treasury Department, tasked with issuing regulations to implement the hastily drafted Trump-GOP tax law, is concocting new tax breaks that are not provided in the law. This is the short version of what we learned while watching Tuesday’s House Ways and Means Committee hearing on “The Disappearing Corporate Income Tax.”

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

Why Today’s Congressional Hearing on “The Disappearing Corporate Income Tax” Is Imperative

February 11, 2020 • By Steve Wamhoff

The United States is collecting a historically low level of tax revenue from corporations. In 2018, corporate tax revenue as a share of gross domestic product (the nation’s economic output) dipped to 1 percent and reached just 1.1 percent in 2019. The only other times in the last 40 years that tax collections were this […]

President Trump’s 2021 Budget: Promises Made, Promises Broken

February 10, 2020 • By Steve Wamhoff

President Trump has kept only one of his promises--his pledge to lower taxes for corporations and their investors. The budget plan he released today again breaks his promise to reject cuts in Medicaid that would affect millions of people. His budget once again fails to eliminate the deficit, much the less the national debt, during his presidency as he promised. It cuts trillions from safety net programs and student aid programs despite his pledge to stand for forgotten Americans.

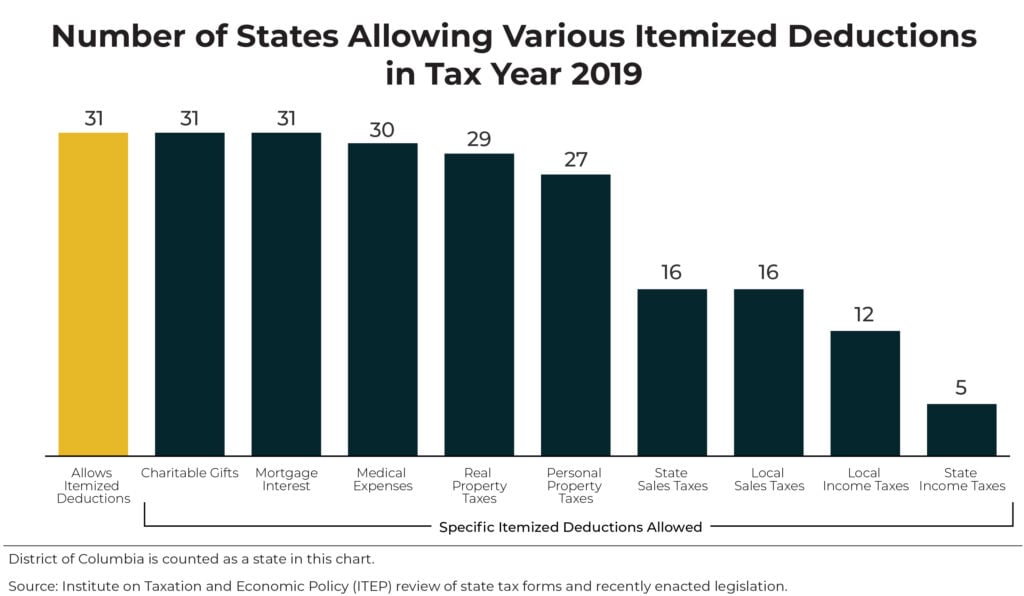

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

If President Trump puts forth another tax proposal this year, as he is hinting, it will be his third. The second round, already costing the U.S. Treasury billions, was implemented largely out of the public’s view.

Washington Is Finally Having the Right Conversation about Taxes

February 4, 2020 • By Amy Hanauer

Presidential candidates and some elected officials are finally talking about bold tax policy ideas that would increase taxes and raise revenue. This is a dramatic shift from when a radical, right-wing narrative dominated the public debate. Republicans redefined “fiscal responsibility” as fewer taxes and less government, peddled supply-side economic theories, and denied the clear evidence that tax cuts were adding to our nation’s deficits.

From 0% to 1.2%: Amazon Lauds Its Minuscule Effective Federal Income Tax Rate

January 31, 2020 • By Matthew Gardner

If we focus on the taxes the company paid in 2019, we see an effective federal income tax rate of just 1.2 percent. And since the company enjoyed federal income tax rebates in 2017 and 2018, this means that over the last three years Amazon has paid zero on $29 billion of U.S. pretax income.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

A new IRS proposal could once again allow wealthy business owners to use state charitable tax credits–including tax credits for donating to support private and religious K-12 schools–to dodge the federal government’s $10,000 cap on state and local tax (SALT) deductions.

ITEP Comments and Recommendations on REG-107431-19

January 29, 2020 • By Carl Davis

Comments regarding the possibility that owners of passthrough businesses may be able to circumvent the $10,000 SALT deduction cap of section 164(b)(6) by recharacterizing the nondeductible portion of their state and local income tax payments as deductible expenses associated with carrying on a trade or business.