South Carolina

State Rundown 1/12: Tax Cut Tunnel Vision Threatens to Bore State Budget Holes Even Deeper

January 12, 2018 • By ITEP Staff

As states continue to sift through wreckage of the federal tax cut bill to try to determine how they will be affected, two things should be clear to everyone: the richest people in every state just got a massive federal tax cut, and federal funding for shared priorities like education and health care is certain to continue to decline. State leaders who care about those priorities should consider asking those wealthy beneficiaries of the federal cuts to pay more to the state in order to minimize the damage of the looming federal funding cuts, but so far policymakers in Idaho,…

State Rundown 1/4: Will States Show Resolve in a Challenging Year?

January 4, 2018 • By ITEP Staff

This week marks the beginning of what is bound to be a wild year for state tax and budget debates. Essentially every state is already working to sort through the complicated ramifications of the federal tax cuts passed in December, including Kansas, Michigan, Montana, and New Jersey highlighted below. These and other states will have important decisions to make about how to incorporate, reject, or mitigate various aspects of the new federal law, and will need considerable resolve to improve state tax policy to be more fair and more adequate – even as federal taxes become less so.

NPR: This Tax Loophole for Wealthy Donors Just Got Bigger

December 29, 2017

One of the changes, according to the Institute on Taxation & Economic Policy, which advocates for a “fair and sustainable” tax system, allows far more wealthy donors in 10 states to turn a profit through “donations” to private school scholarships. Yes, you read that right. If your income is high enough, you can actually make […]

How the Final GOP-Trump Tax Bill Would Affect South Carolina Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

Private Schools Donors Likely to Win Big from Expanded Loophole in Tax Bill

December 14, 2017 • By Carl Davis

For years, private schools around the country have been making an unusual pitch to prospective donors: give us your money, and you’ll get so many state and federal tax breaks in return that you may end up turning a profit. Under tax legislation being considered in Congress right now, that pitch is about to become even more persuasive.

Tax Bill Would Increase Abuse of Charitable Giving Deduction, with Private K-12 Schools as the Biggest Winners

December 14, 2017 • By Carl Davis

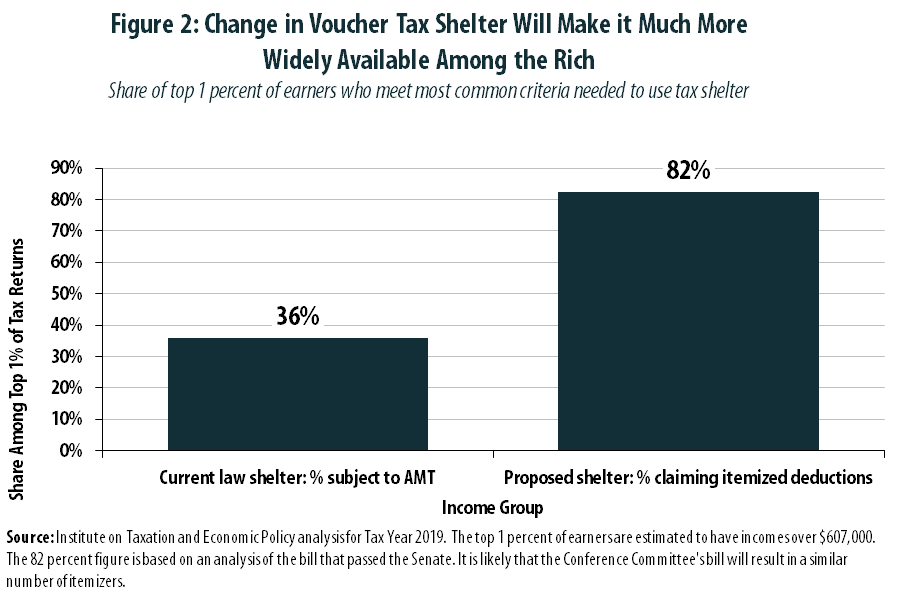

In its rush to pass a major rewrite of the tax code before year’s end, Congress appears likely to enact a “tax reform” that creates, or expands, a significant number of tax loopholes.[1] One such loophole would reward some of the nation’s wealthiest individuals with a strategy for padding their own bank accounts by “donating” to support private K-12 schools. While a similar loophole exists under current law, its size and scope would be dramatically expanded by the legislation working its way through Congress.[2]

State Rundown 12/7: States Try to Plan While Awaiting Federal Tax Decisions

December 7, 2017 • By ITEP Staff

Though most eyes were on Congress rather than states this week, several states have been taking stock of their fiscal situations. Wyoming lawmakers considered ways to resolve budget shortfalls, Kansas and New Mexico legislators got some minor good news about their states' revenues, their counterparts in Minnesota and Vermont grappled with less encouraging revenue news, and those in West Virginia were just happy to hear their revenues had at least met expectations for once.

How the House and Senate Tax Bills Would Affect South Carolina Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

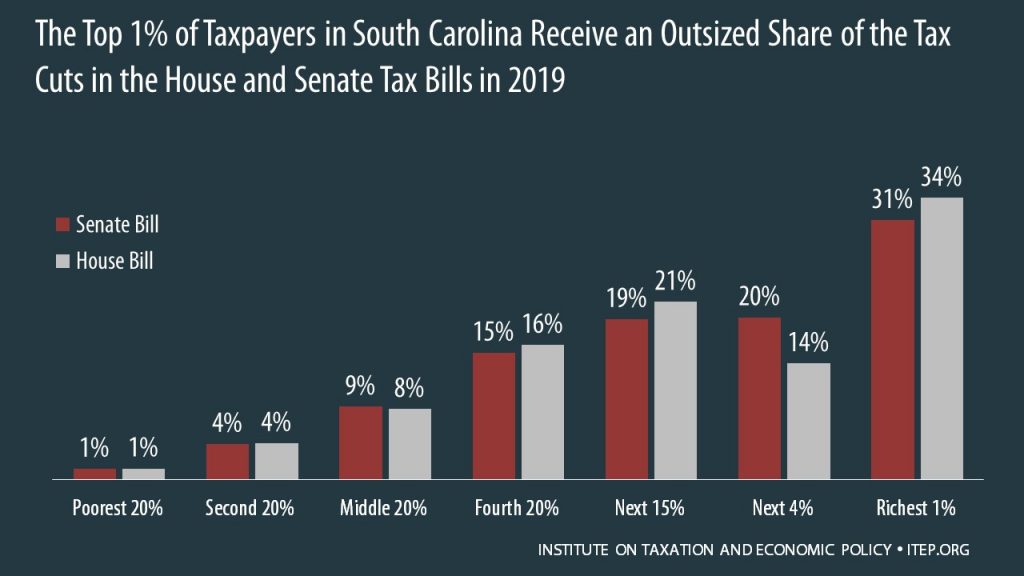

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of South Carolina residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

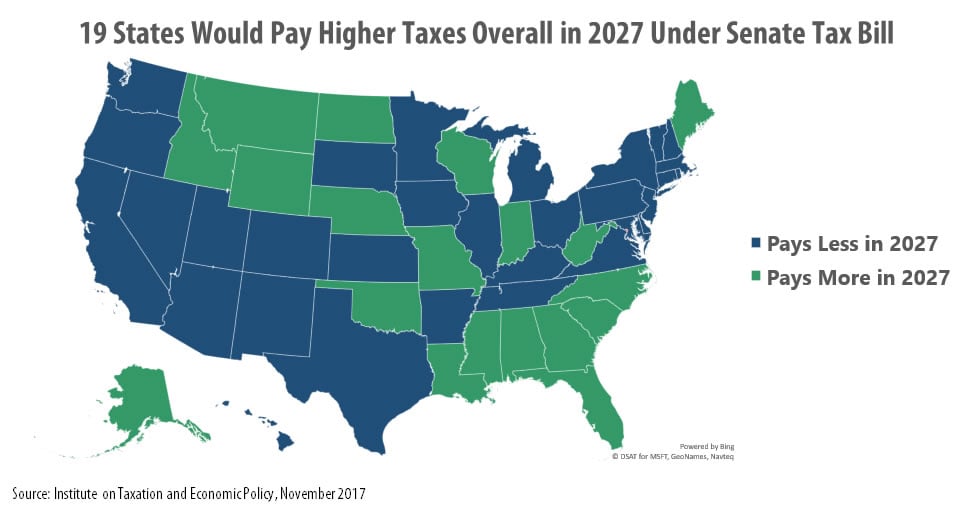

Mick Mulvaney and the 19 States Paying Higher Taxes Under the Senate Tax Bill

November 22, 2017 • By Steve Wamhoff

One of the more surprising findings of ITEP’s recent estimates on the Senate tax bill is that 19 states would pay more overall in federal taxes if the bill becomes law. This is not just an increase in the personal income taxes paid (which would happen in some states under the House bill). This is an increase in their net federal taxes overall, even including the assumed benefits of corporate tax cuts and estate tax cuts.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect South Carolina Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In South Carolina, 51 percent of the federal tax cuts would go to the richest 5 percent of residents, and 11 percent of households would face a tax increase, once the bill is fully implemented.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

How the House Tax Proposal Would Affect South Carolina Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

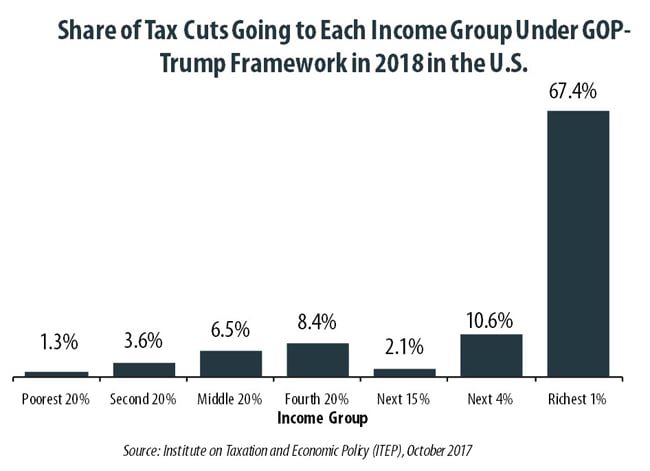

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

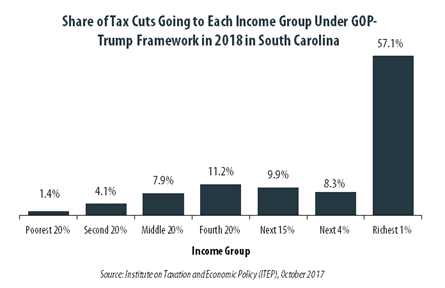

GOP-Trump Tax Framework Would Provide Richest One Percent in South Carolina with 57.1 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in South Carolina equally. The richest one percent of South Carolina residents would receive 57.1 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $478,100 next year. The framework would provide them an average tax cut of $52,250 in 2018, which would increase their income by an average of 4.6 percent.

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

Rewarding Work Through State Earned Income Tax Credits in 2017

September 11, 2017 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Private School Voucher Credits Offer a Windfall to Wealthy Investors in Some States

August 30, 2017 • By Carl Davis

State lawmakers who want to send public dollars to private schools have devised a shrewd tactic for getting around political and constitutional obstacles that make it difficult to do so. These lawmakers found a way to pay high-income taxpayers to fund those schools on states’ behalf, sometimes even offering those taxpayers a tidy profit in […]

State Rundown 8/23: Few Lingering Budget Debates Cannot Linger Much Longer

August 23, 2017 • By ITEP Staff

This week, Oklahoma lawmakers learned they'll need to enter a special session to balance their budget and that they'll likely face a lawsuit over their low funding of public education. Pennsylvania's budget stalemate is also coming to a head as the state literally runs out of funds to pay its bills. And Amazon's tax practices are in the news again as the company has been sued in South Carolina.

The Epoch Times: Trump Targets Amazon Over Sales Tax and Retail Jobs

August 23, 2017

More than half of items sold on Amazon are coming through third-party retailers, according to a CNBC report. These retailers can benefit from Amazon’s facilities or payment system, but they are not required to collect sales tax. It is still a pending issue and a meaningful revenue loss for states, said Carl Davis, research director […]

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.