California

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

Eli Byerly-Duke

October 19, 2022 • By ITEP Staff

Eli is a State Analyst who monitors trends in state tax policy and conducts long-term research. His focus is principally on the border South and California. Prior to joining ITEP in 2022, Eli researched spatial economic inequality and local budgets at Brookings Metro with particular attention to local use of federal funds.

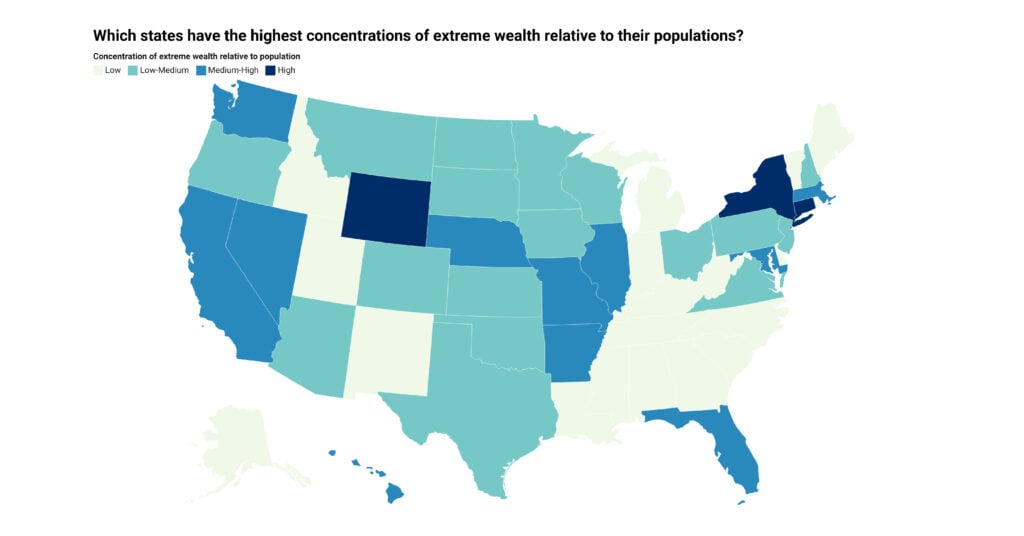

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. This extreme wealth is geographically concentrated, with the top 10 states accounting for more than 70 percent of nationwide extreme wealth and with New York and California alone accounting for nearly a third.

Report: Ten States Hold 71 Percent of America’s Extreme Wealth

October 13, 2022 • By ITEP Staff

Tackling wealth inequality through the tax code can boost economic opportunity Washington, DC: Wealth inequality is rampant in every state and particularly concentrated in a handful of states, according to a first-of-its-kind analysis released today by the Institute on Taxation and Economic Policy (ITEP). This extreme wealth hinders economic opportunities for all but the […]

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. Nationally, we estimate that wealth over $30 million per household will reach $26 trillion in 2022 with roughly one-fifth of that amount ($4.5 trillion) held by billionaires.

Houston Chronicle: Middle-Class Texans Lap Up the Low Taxes Lie

October 7, 2022

Texas is a low-tax state only if you make a lot of money. If you don’t, then you’re better off in California. The biggest lie Texas politicians have ever told — and both parties have perpetuated it — is the lack of an income tax is an absence of taxation. But Texas doesn’t collect much […]

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...

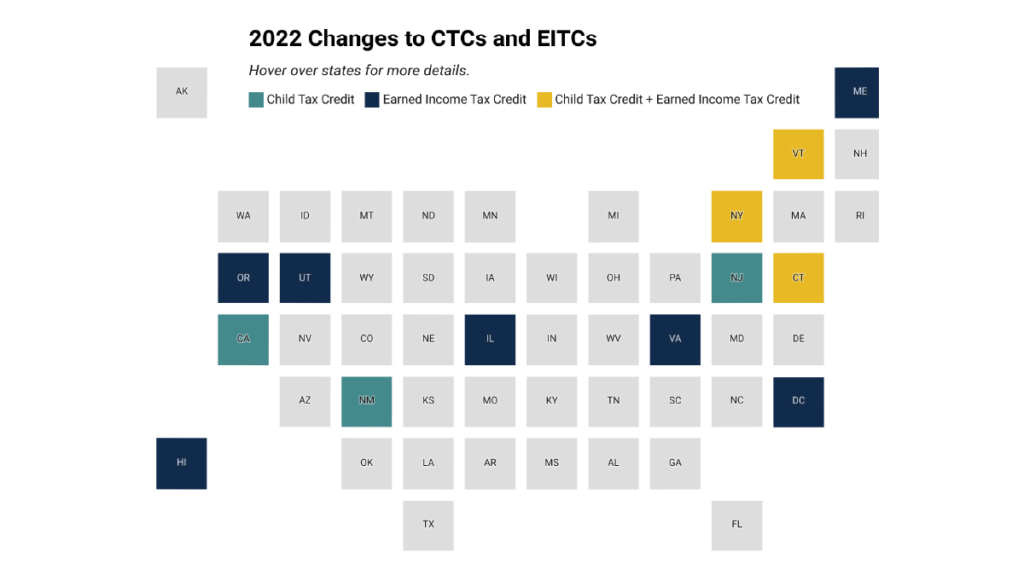

ITEP Policy Briefs: More and More States Are Helping Low-Income Families with New and Expanded Tax Credits

September 15, 2022 • By ITEP Staff

13 states plus D.C. created or expanded state CTCs or EITCs this year, helping create more equitable state tax systems WASHINGTON, D.C.: In 2022’s state legislative sessions, lawmakers across the country advanced tax policies that will bolster the economic security of millions of low- and moderate-income working families through new and enhanced Child Tax Credits […]

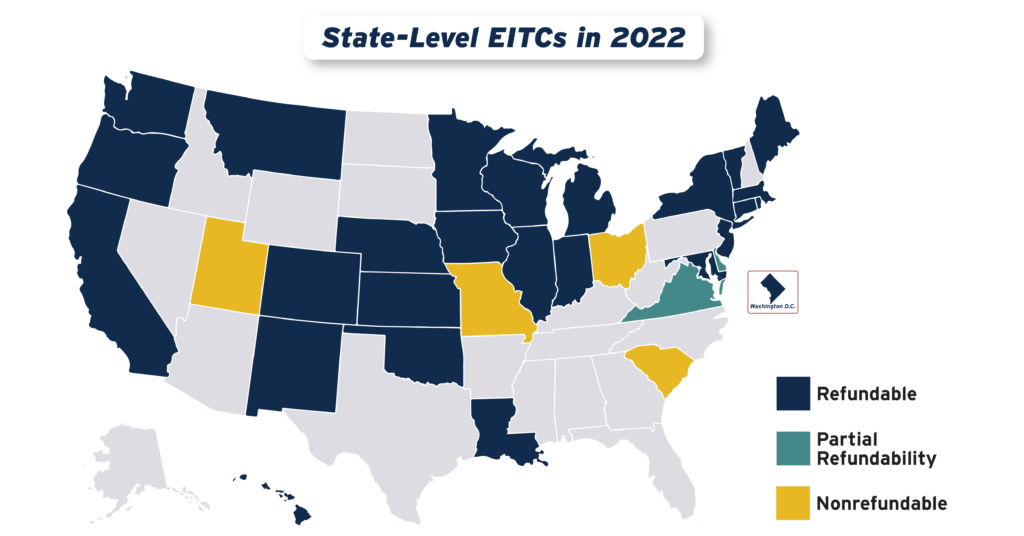

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

State Rundown 9/7: Labor Day Week Provides Sobering Reminder of Steps Forward, Back

September 7, 2022 • By ITEP Staff

Though Labor Day has passed, advocates on the ground in states across the country are continuing to uphold the spirit of the labor movement...

Everyone loves a deal, so it’s no surprise why the appeal of the state sales tax holiday continues to persist. This year, 20 states will forgo more than $1 billion in combined revenue to enact a variety of sales tax holidays that—like most things that are too good to be true—will do little to provide meaningful benefits and instead undermine funding for public services.

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...

State Rundown 7/27: It’s (Sales Tax) Holiday Season, But Who’s Really Celebrating?

July 27, 2022 • By ITEP Staff

It’s the holiday season – well, the sales tax holiday season, that is. But after taking a closer look, you may notice that there is little to celebrate...

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...

CNBC: Millions of Calif. families to get ‘inflation relief’ stimulus checks of up to $1,050

July 5, 2022

Democratic California Gov. Gavin Newsom and Democratic legislative leaders agreed on a $17 billion relief package that includes $9.5 billion in inflation relief funds. Those estimated 23 million California taxpayers will receive between $200 and $1,050 by early next year. California has more flexibility to send these kinds of payments because its budget is one of the […]

Although the sun is shining and Independence Day is right around the corner, many state lawmakers are still indoors hammering out the details of future budgets or still hard at work passing laws...

With many state legislative sessions wrapped or wrapping up, we at ITEP want to take a moment to direct your attention south, and specifically, to the American South...

Creating Racially and Economically Equitable Tax Policy in the South

June 21, 2022 • By Kamolika Das

The South's negative outcomes on measures of wellbeing are the result of a century and a half of policy choices. Lawmakers have many options available to make concrete improvements to tax policy that would raise more revenue, do so equitably, and generate resources that could improve schools, healthcare, social services, infrastructure, and other public resources.

With inflation dominating headlines both nationally and locally, state lawmakers around the U.S. are searching for ways to put their revenues to good use, and not surprisingly, some options are better than others...