Georgia

Atlanta Journal Constitution: IRS Proposal Could Hurt Georgia Rural Hospital, School Tax Credits

August 25, 2018

The change will have no impact on many Georgians because they don’t itemize their deductions when they file their tax returns. “For about 90 percent of people who are just claiming the standard deduction, this (rule) isn’t going to have any impact at all,” said Carl Davis, the research director with the Institute on Taxation […]

Bloomberg: New Yorkers Have Four Days to Try to Beat SALT Cap

August 24, 2018

Residents of states that have had charitable tax break programs in effect for some time, such as Georgia and South Carolina, that benefit hospitals or schools, will probably have an easier time writing checks before the new rules go into effect, said Steve Rosenthal, a senior fellow at the Urban-Brookings Tax Policy Center. “The reality […]

The Oregonian: Trump Administration Moves to Stop Oregon, Other States from Circumventing New Tax Law

August 23, 2018

Treasury said it expects that only about 1 percent of all U.S. taxpayers would see a reduction of their tax credits for donations to a private-school voucher fund. Several states — Alabama, Arizona, Georgia, Montana and South Carolina — allow taxpayers who donate to private-school funds to get a 100 percent credit against their state […]

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

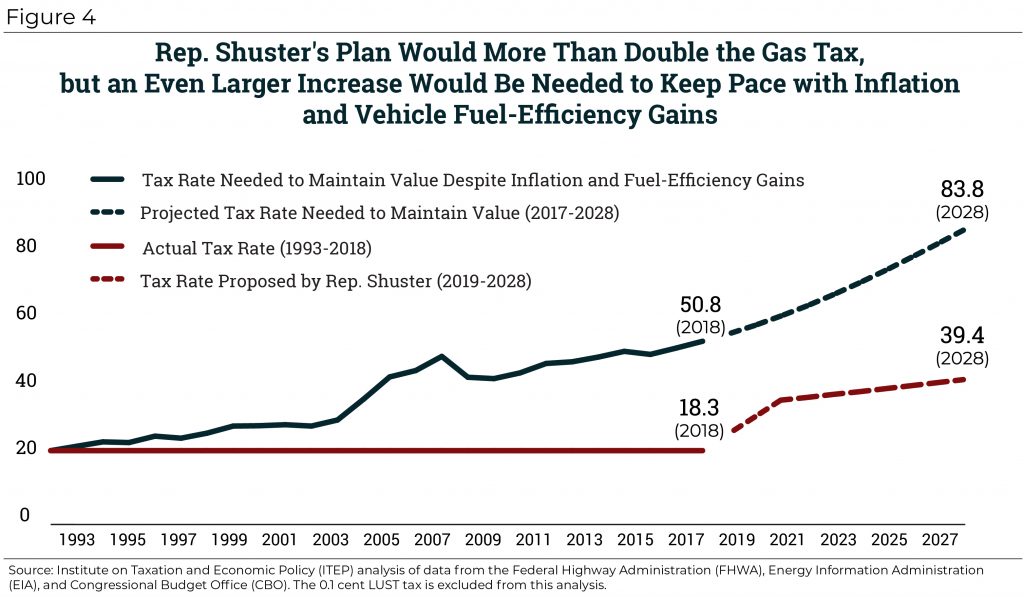

Rep. Shuster’s Mixed Bag: Doubling the Gas Tax before Repealing It Entirely

July 24, 2018 • By Carl Davis

This article examines the good aspects of Rep. Shuster’s infrastructure funding plan (a higher gas tax that is indexed to inflation), the bad (a flawed indexing formula and eventual gas tax repeal), and the downright ugly (tying the hands of a funding commission before their work even begins and refusing to ask more of high-income households).

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

The Bond Buyer: Where SALT Workarounds Are Being Promoted

July 5, 2018

he $10,000 federal cap on the deductibility of state and local taxes has led to a flurry of activity in red states to promote tax credits for taxpayers’ efforts to make charitable donations to get around that cap. That’s the finding of a survey by the Institute for Taxation and Economic Policy that highlights the […]

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, so it is now time for an update on how well state policymakers have kept to, or veered from, the path we charted out earlier this year. Most states that have enacted laws in response to the federal changes have adhered to some but not all of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of…

Bloomberg BNA: Fix’ for Federal Cap on State Tax Deduction? K-12 Tax Credits

June 27, 2018

But the very same charge can be made against the tax credit programs for private K-12 schools, the Institute on Taxation and Economic Policy said in its report. These programs are now being openly promoted by tax advisers and accountants as a way to sidestep or circumvent the SALT deduction cap, according to ITEP. “In […]

Wall Street Journal: As Treasury Targets Workarounds to Tax Law, Impact May Extend Beyond High-Tax States

June 27, 2018

Tax experts say the federal government will find it difficult if not impossible to write rules to stop the workarounds in New York, New Jersey and Connecticut without also limiting existing tax credits in Georgia, Alabama, South Carolina and elsewhere. According to a recent paper from law professors, 33 states currently have more than 100 […]

The Other SALT Cap Workaround: Accountants Steer Clients Toward Private K-12 Voucher Tax Credits

June 27, 2018 • By Carl Davis

On May 23, 2018, the IRS and Treasury Department announced that they “intend to propose regulations addressing the federal income tax treatment of certain payments made by taxpayers for which taxpayers receive a credit against their state and local taxes.” They made the announcement in response to new “workaround tax credits” enacted in New York […]

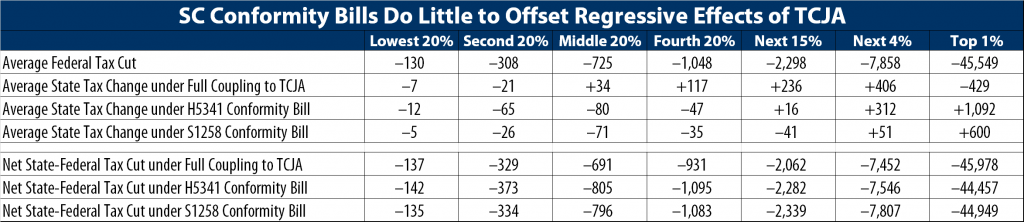

What’s at Stake in South Carolina’s Upcoming Tax Conformity Debate

June 22, 2018 • By Dylan Grundman O'Neill

South Carolina legislators will return next week to try to finalize a few issues before the end of their session and fiscal year on June 30th, including the question of how to respond to the federal Tax Cuts and Jobs Act (TCJA). That's a short timeframe with some important questions at stake, and some misinformation has been spread, so here's a quick guide to the facts, issues, and options.

SALT/Charitable Workaround Credits Require a Broad Fix, Not a Narrow One

May 23, 2018 • By Carl Davis

The federal Tax Cuts and Jobs Act (TCJA) enacted last year temporarily capped deductions for state and local tax (SALT) payments at $10,000 per year. The cap, which expires at the end of 2025, disproportionately impacts taxpayers in higher-income states and in states and localities more reliant on income or property taxes, as opposed to sales taxes. Increasingly, lawmakers in those states who feel their residents were unfairly targeted by the federal law are debating and enacting tax credits that can help some of their residents circumvent this cap.

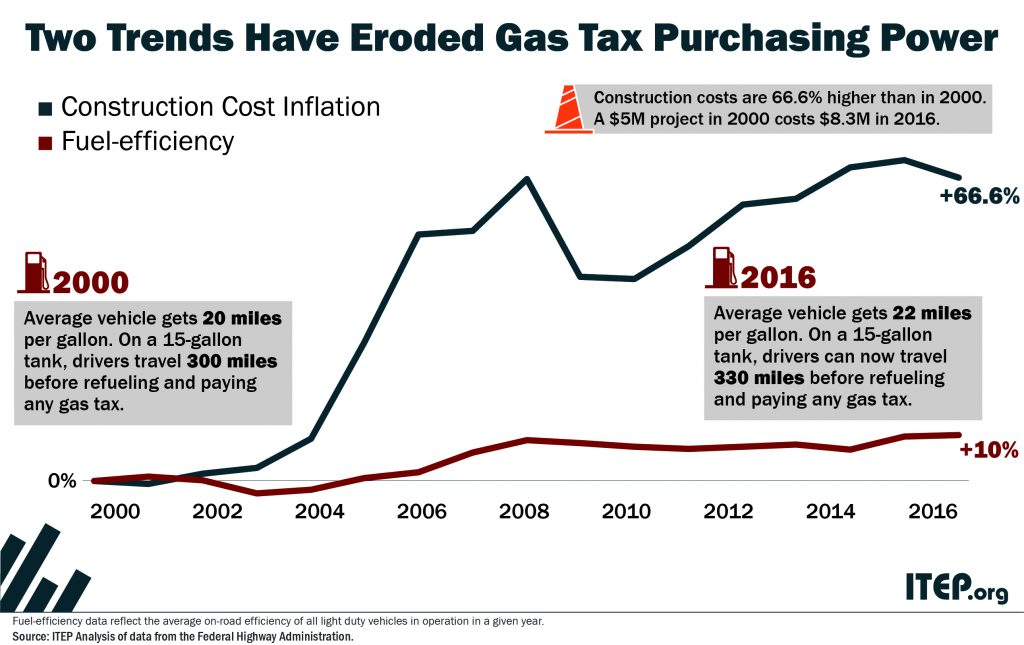

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

State Rundown 5/17: Don’t Bet on Legal Sports Betting Solving State Budget Woes

May 17, 2018 • By ITEP Staff

This week the U.S. Supreme Court opened the door to legal sports gambling in the states (see our What We're Reading section), which will surely be a hot topic in state legislative chambers, but most states currently have more pressing matters before them. The teacher pay crisis made news in North Carolina, Alabama, and nationally. Louisiana, Oregon, and Vermont lawmakers are headed for special sessions over tax and budget issues. And several other states have recently reached or are very near the end of their legislative sessions.

Valdosta Daily Times: T-SPLOST: Good for our community

May 12, 2018

According to the Institute on Taxation and Economic Policy, the fuel tax in Georgia actually increased .3 cents on gasoline and .4 cents on diesel in 2017. The fuel tax is indexed to the consumer price index and is adjusted annually. So basically there was no real increase in revenue to fund additional projects with […]

State Rundown 5/9: Iowa Digs a New Hole as Other States Try to Avoid or Climb Out of Theirs

May 9, 2018 • By ITEP Staff

This week we have news of a destructive tax cut plan finally approved in Iowa just as one was narrowly avoided in Kansas. Tax debates in Minnesota and Missouri will go down to the wire. And residents of Arizona and Colorado are considering progressive revenue solutions to their states' education funding crises.

Teachers’ Strikes Are Emblematic of Larger Tax Challenges for States

March 30, 2018 • By Meg Wiehe

As other researchers as well as journalists have noted, teachers striking or threatening to strike over low wages and overall lack of investment isn’t simply a narrative about schools and public workers’ pay. It is illustrative of a broader conflict over tax laws and how states and local jurisdictions fund critical public services that range from K-12 education, public safety, roads and bridges, health care, parks, to higher education.

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

State Rundown 3/22: Some Spring State Tax Debates in Full Bloom, Others Just Now Surfacing

March 22, 2018 • By ITEP Staff

The onset of spring this week proved to be fertile ground for state fiscal policy debates. A teacher strike came to an end in West Virginia as another seems ready to begin in Oklahoma. Budgets were finalized in Florida, West Virginia, and Wyoming, are set to awaken from hibernation in Missouri and Virginia, and are being hotly debated in several other states. Meanwhile Idaho, Iowa, Maryland, and Minnesota continued to grapple with implications of the federal tax-cut bill. And our What We're Reading section includes coverage of how states are attempting to further public priorities by taxing carbon, online gambling,…

Georgia Budget & Policy Institute: Lawmakers Approve Major Tax Plan, Still Reviewing Several Tax Breaks

March 15, 2018

A range of tax bills are still in the pipeline at the General Assembly after lawmakers already approved a sweeping package of income tax cuts. Georgia’s 2018 General Assembly advanced 11 pieces of tax legislation by the Feb. 28 Crossover Day milestone that affect state revenues if approved by the House, Senate and the governor. […]

Trends We’re Watching in 2018, Part 2: State Revenue Shortfalls and the Impact on Education and Other Services

March 12, 2018 • By Aidan Davis

Many states struggle with a need for revenue, yet their lawmakers show little will to raise taxes to fund public services. Revenue shortfalls can prove to be a moving target. Some states with expected shortfalls are now seeing rosier forecasts. But as estimates come in above or below projections, states continue to grapple with how and whether to raise the revenue necessary to adequately fund key programs. Here are a few trends that are leading to less than cushy state coffers this year.

Georgia Budget and Policy Institute: All Georgians Stand to Lose from Immigrant Crackdown Measure

March 9, 2018

And Georgia immigrants contribute significant state and local tax revenue, including $352 million a year by undocumented immigrants as a whole and $66 million by Dreamers in particular. Read more here

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.