Inequality

A 2019 ITEP analysis found that Black and Latinx households are overrepresented in the lowest-income quintiles; while they represent about 22 percent of overall tax returns, they account for 30 percent of the poorest quintile of taxpayers.

Why We Should Talk about Progressive Taxes Despite Billionaires’ Objections

January 30, 2019 • By Jenice Robinson

It was the tone-deaf remark heard ‘round the world. Last week on CNBC’s Squawk Box, Commerce Secretary Wilbur Ross suggested that furloughed government employees who hadn’t been paid in a month could go to a bank and get a loan to make ends meet. This was not a gaffe. It’s hard to fathom how a […]

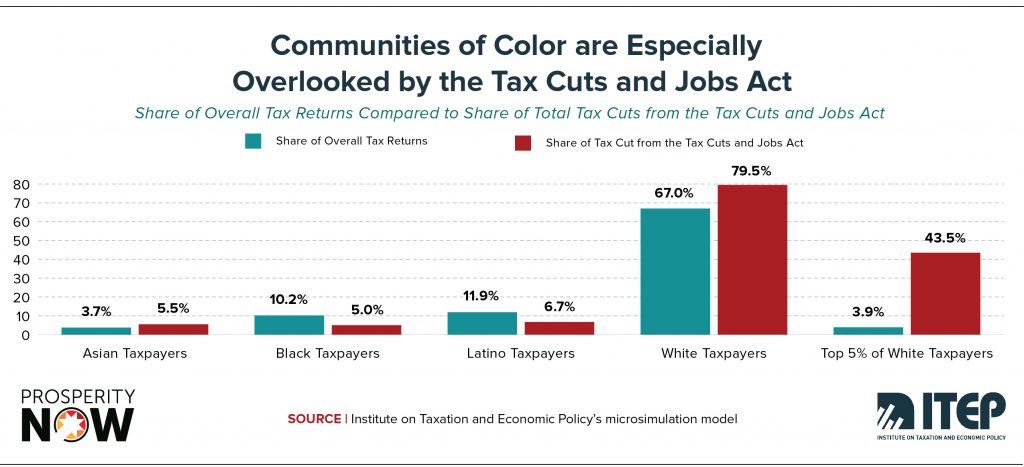

Race, Wealth and Taxes: How the Tax Cuts and Jobs Act Supercharges the Racial Wealth Divide

October 11, 2018 • By Meg Wiehe

A newly released report by Prosperity Now and the Institution on Taxation and Economic Policy, Race, Wealth and Taxes: How the Tax Cuts and Jobs Act Supercharges the Racial Wealth Divide, finds that the TCJA not only adds unnecessary fuel to the growing problem of overall economic inequality, but also supercharges an already massive racial wealth divide to an alarming extent.

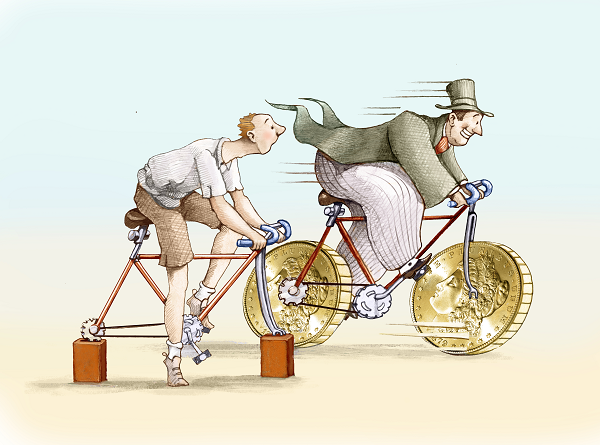

Today's poverty and income data show that income continues to concentrate at the top; in fact, the top 20 percent continue to capture 51.5 percent of income. Meanwhile, average income for the poorest 20 percent of households is less today than it was 18 years ago.

1964: Unconditional War on Poverty; 2018: Unconditional War on the Poor

August 15, 2018 • By Misha Hill

During his first State of the Union address in January 1964, Lyndon Baines Johnson declared a War on Poverty in response to a national poverty rate of more than 19 percent. The legislative result of this war was an early education program, expanded funding for secondary education, job training and work opportunity programs and the […]

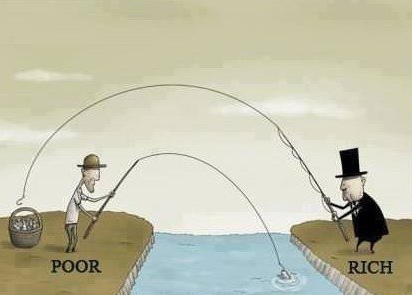

Rigging the System and Poor Shaming (Rightly) Are Incompatible Political Strategies

June 27, 2018 • By Jenice Robinson

The absurdity of blaming poor and moderate-income people for their circumstances is close to running its course as an effective political tool, particularly as some elected officials more boldly assert their intent to cater to the whims of the wealthy. Take last year’s GOP-led drive to eliminate the Affordable Care Act (ACA), for example. House […]

Two narratives that intentionally obscure who benefits from the tax law are emerging. One focuses on the personal income tax cuts that will result in an increase in net take-home pay for many employees once their employers adjust withholding. Anecdotes abound of working people getting a $100 or more increase, after taxes, per paycheck, but the reality is that most workers will receive a lot less than that. Meanwhile, the wealthiest 1 percent of households will receive an average annual tax break of $55,000, an amount that nearly eclipses the nation’s median household income.

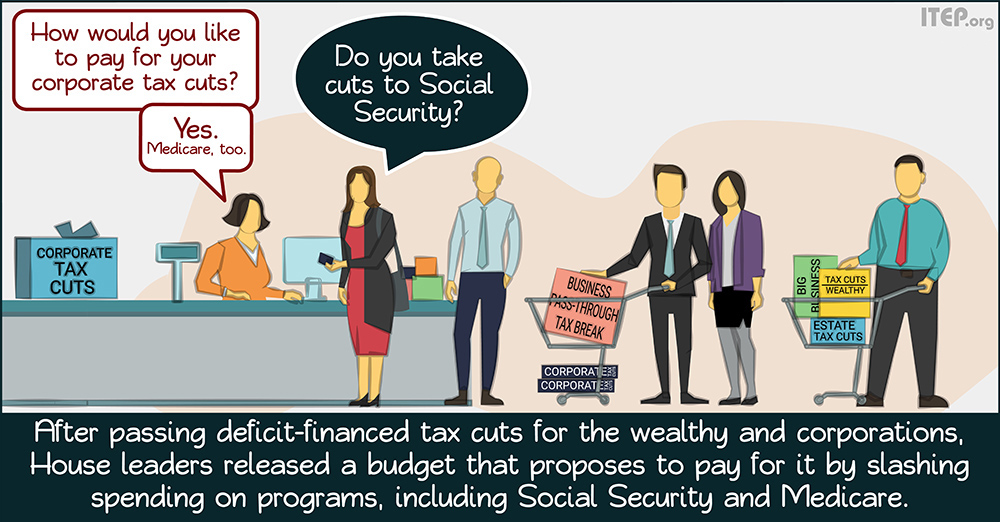

They Can’t Help Themselves: GOP Leaders Reveal True Intent Behind Tax Overhaul

December 4, 2017 • By Jenice Robinson

The hand-written scrawls in the margins of the hastily written 500-page Senate tax bill had barely dried when lawmakers began to reveal the true motivation behind their rush to fundamentally overhaul the nation’s tax code.

The Bottom 40 Percent Has Grown Poorer, So Why Are Tax Cut Plans Focused on the Rich and Corporations?

November 14, 2017 • By Jenice Robinson

The bottom line is that the rich and corporations are doing fine. We don’t need legislative solutions that fix non-existent problems. Only in a world of alternative facts does the top 0.2 percent of estates need to be exempt from the estate tax, for example.

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

Census Data Reveal Modest Gains for Working People; GOP Tax Overhaul Could Reverse These Gains

September 14, 2017 • By Jenice Robinson

On the surface, census poverty and income data released Tuesday reveal the nation’s economic conditions are improving for working families. The federal poverty rate declined for the second consecutive year and is now on par with the pre-recession rate. For the first time, median household income surpassed the peak it reached in 1999 and is […]

Avocado Toast, iPhones, Billionairesplaining and the Trump Budget

May 30, 2017 • By Jenice Robinson

A couple weeks ago, a billionaire set the Internet ablaze when on 60 Minutes Australia he chided millennials to stop buying avocado toast and fancy coffee if they wanted to buy a home. The backlash was swift and deserved. Twenty- and early thirty-something people rightly took offense to the suggestion that they haven’t purchased homes […]

Michigan’s “Customer” Service Fail Is a Cautionary Tale about Cutting Taxes and Disinvestment

January 28, 2016 • By Jenice Robinson

The Michigan legislature just approved a $28 million appropriation to provide immediate aid in response to the water crisis in Flint, Mich., where vulnerable children and families have been poisoned by toxic lead. This avoidable crisis partly has roots in the misguided movement to cut taxes so much that state and local governments have difficulty […]