Kansas

The new year often brings with it new goals and a desire to take on complex problems with a fresh perspective. Unfortunately, that doesn’t always apply to state lawmakers when considering tax policy...

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Missouri Budget Project: Special Session Tax Proposal Leaves Out 1/3 of Missouri Taxpayers, Weighted to Benefit Wealthiest

August 28, 2022

Governor Parson’s recently released tax proposal would leave out about one-third of Missourians, including many of those who pay the highest proportion of their income in state & local taxes, and set the state up for a Kansas-like budget bomb that would require significant cuts to schools, public safety, healthcare, and other critical needs. Read […]

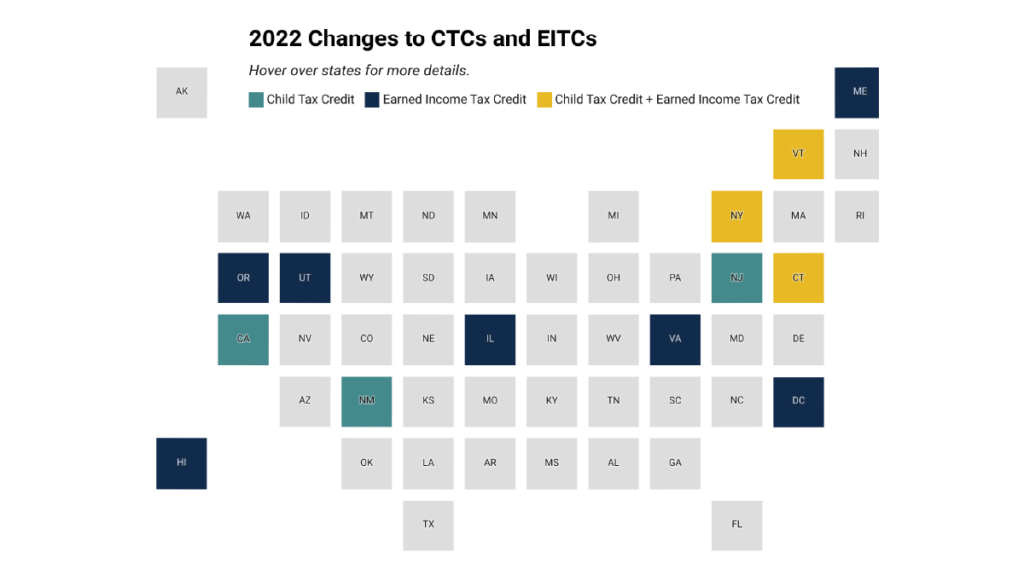

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

Several states have dropped a few late-session surprises, and from the looks of it, they’re not the good kind...

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

President Biden should elevate his tax and revenue proposals which remain essential if we are to pay for environmental restoration, health priorities and peacekeeping, the front-burner items that may dominate the speech.

State Rundown 1/13: The Tax Cuts Cometh, But There Is a Better Way

January 13, 2022 • By ITEP Staff

As expected, with the start of many new legislative sessions around the country, lawmakers have introduced a slew of tax cut plans following better-than-expected budget outlooks that have, so far, weathered the impact of the pandemic...

Rather than resorting to tax cuts, which can eventually create revenue shortfalls, lawmakers should determine whether they have adequately invested in people and communities. There are better ways to leverage tax systems to help those who need it most.

The new year often brings with it a reinvigorated commitment to new goals and a fresh perspective on how to accomplish them, but it seems like lawmakers in states around the country are giving up already...

State Rundown 11/10: It’s Beginning to Look a Lot Like…Election Season?!

November 10, 2021 • By ITEP Staff

If the leaves are turning colors and you find yourself walking out of the office into pitch-black darkness, it only means that time of the year is upon us—and no, I'm not talking about the holiday season. Before that, it’s the equally important election season...

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

This week’s state fiscal news brings a reminder that even though advocates for great economic and racial justice have won some major progressive victories recently, anti-tax zealots have been hard at work too. Lawmakers advanced or enacted troubling regressive tax cuts or shifts in Idaho, Kansas, and Montana, and are actively debating them in Iowa, […]

North Carolina lawmakers may have approved a massive tax subsidy giveaway to Apple, but we won’t let that news spoil our barrel this week. Nor will we be discouraged by Connecticut Gov. Ned Lamont’s threats to upset the apple cart full of positive progressive tax reforms state lawmakers recently came together to approve...Why all the optimism? Because the apple of our eye this week is Washington State, where advocates and lawmakers succeeded in a decade-long fight...

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

State Rundown 4/1: Most States Resisting Foolish Tax Cut Games That Tear Revenues Apart

April 1, 2021 • By ITEP Staff

Supporters of tax fairness and adequate funding for public needs are hoping West Virginia’s income tax elimination effort turns out to be a prank, but most states are not fooling around with such harmful policies this year. For example...

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

Trickle-Down Myths Swamp Tax Policy Debates in Mississippi and West Virginia

March 15, 2021 • By Aidan Davis

Recent proposals in both Mississippi and West Virginia seek to pare back, and ultimately eliminate, each state’s income tax while shifting the responsibility of funding services even more onto low- and middle-income taxpayers through increased consumption taxes. The states are moving forward with this tax experiment even though a similar experiment notoriously and immediately sent Kansas into a financial tailspin.

Kansas Action for Children: Working Kansas Families Bear Brunt of Skewed Policies

February 26, 2021

In the midst of a global pandemic and recession, the Kansas Legislature shockingly continues to consider bills that will further lower the already low tax responsibilities of corporations and high-income Kansans. Lawmakers should reject legislation like Senate Bill 22 and instead work to enhance economic and racial equity through Kansas’s tax code. Our state’s leaders […]

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…