Michigan

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

State Rundown 8/22: Wayfair Fallout Could Hit the Pavement Soon

August 22, 2018 • By ITEP Staff

Arizona voters learned this week that they will have an opportunity this fall to restore school funding through a progressive tax measure. The effects of the Supreme Court’s Wayfair decision could soon be seen on Michigan and Mississippi roads, as leaders in both states have proposed devoting new online sales tax revenues to infrastructure needs. And new research highlighted in our “What We’re Reading” section discredits one-size-fits-all prescriptions for state economic growth such as supply-side tax-cut orthodoxy, advocating instead for more nuanced and state-specific policymaking.

State Rundown 8/8: States Setting Rules for Upcoming Tax Decisions

August 8, 2018 • By ITEP Staff

August is often a season for states to define the parameters of tax debates to come, and that is true this week in several states: a tax task force in Arkansas is nearing its final recommendations; residents of Missouri, Montana, and North Carolina await results of court challenges that will decide whether tax measures will show up on their ballots this fall; and Michigan and South Dakota are taking different approaches to making sure they’re ready to collect online sales taxes next year.

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

State Rundown 6/13: Budget Crunch Time Sets in as State Fiscal Years Come to Close

June 13, 2018 • By ITEP Staff

With many state fiscal years ending June 30th, budget negotiations were completed recently in California, Illinois, Michigan, and North Carolina. New Jersey remains a state to watch as a government shutdown looms but leaders continue to disagree about a proposed millionaires tax, corporate taxes, and school funding. In other states looking to wealthy individuals and large corporations for needed revenues, Arizona's teacher pay crisis could be solved with a tax on its highest-income residents and a similar proposal in Massachusetts is polling well, but Seattle's new "head tax" could be on the chopping block.

State Rundown 6/1: Time Is Ripe for Closer Look at Intergovernmental Relations

June 1, 2018 • By ITEP Staff

This week, Virginia lawmakers overcame their budget impasse and approved an expansion of Medicaid, North Carolina's behind closed doors budget debate appears to be wrapping up, and Vermont's special session continues in the wake of the governor's vetoes of the state budget and accompanying tax bills. New research highlighted in our What We're Reading section shows that both corporate income tax cuts and business tax subsidies contribute to wider economic inequality. And the possible reconstitution of a federal commission on intergovernmental relations could not come soon enough, as other headlines this week include a state-to-local shift in school funding, governments…

State Rundown 5/23: Special Sessions Abound Amid Budget Vetoes, Stalemates, Federal Tax Bill

May 23, 2018 • By ITEP Staff

This week the governors of Louisiana and Minnesota both vetoed budget bills, leading to another special session in Louisiana and unanswered questions in Minnesota, and Missouri legislators managed to push through a tax shift bill just before adjourning their regular session and heading right into a special session to impeach their governor. Wisconsin and Wyoming localities are both looking at ways to raise revenues as state funding drops. And our What We're Reading section contains helpful pieces on changing demographics, the effects of wealth inequality on families with children, and the impacts of the Supreme Court sports gambling and online…

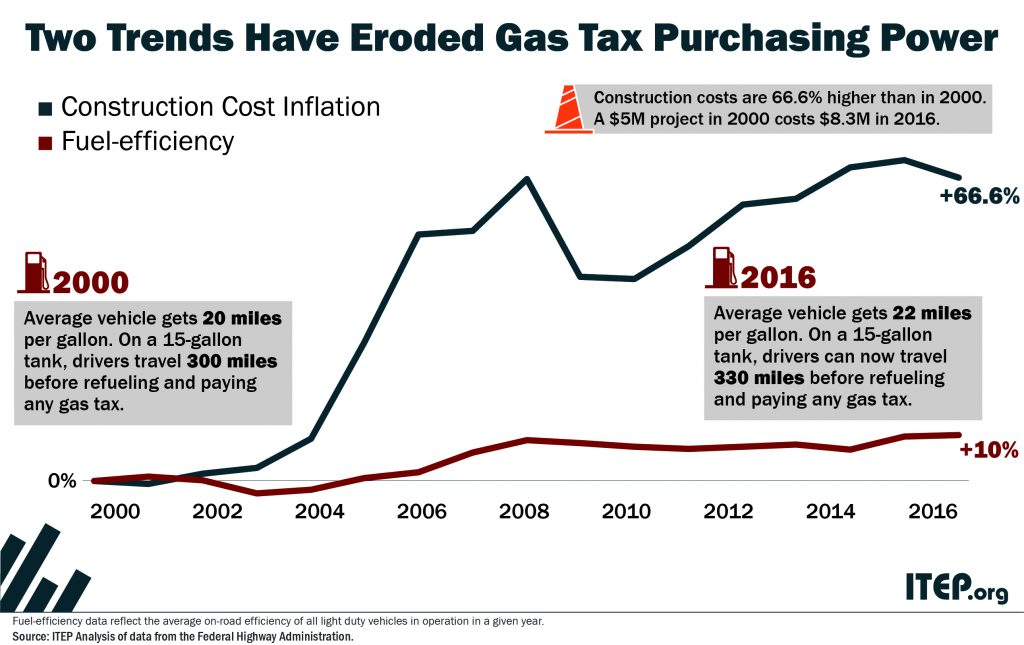

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

Michigan League for Public Policy: The Looming Danger of Tax Cut Triggers in Michigan

May 15, 2018

New analysis by the Institute on Taxation and Economic Policy (ITEP) uses current year and two-year forecasts to calculate the impact that a 0.1 or 0.25 rate reduction in the Personal Income Tax (PIT) could have on taxpayers and state revenue. The data shows that any reduction in the PIT actually shifts the tax load further to low-income Michiganders.

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

Michigan League for Public Policy: The EITC: The Good, The Great And The Unfortunate

January 26, 2018

According to modeling by the Institute on Taxation and Economic Policy, in 2019 about 1,400 fewer filers (about 0.4%) will qualify for the credit, resulting in $7 million in fewer federal credits being distributed to the state. By 2027 about 14,500 fewer filers (about 2%) will qualify for the credit, resulting in a loss of $96 million of federal credit value. The same filers who lose their federal EITC will also lose their ability to claim their state EITC, resulting in a loss of additional local economic support.

State Rundown 1/17: Budget Deficits, Online Sales Tax, and More

January 17, 2018 • By ITEP Staff

The big news this week in state tax law is that the U.S. Supreme Court has agreed to take on the issue of online sales, nexus, and sales tax collection. States have increasingly lost out on sales tax revenues as more transactions have shifted online from brick-and-mortar stores and the laws determining who is required to collect and remit sales taxes haven't kept up. This is potentially good news for states—25 of which National Association of State Budget Officers (NASBO) reports started the new year with budgetary deficits. In other news, grappling with the local impact of federal tax reform…

State Rundown 1/12: Tax Cut Tunnel Vision Threatens to Bore State Budget Holes Even Deeper

January 12, 2018 • By ITEP Staff

As states continue to sift through wreckage of the federal tax cut bill to try to determine how they will be affected, two things should be clear to everyone: the richest people in every state just got a massive federal tax cut, and federal funding for shared priorities like education and health care is certain to continue to decline. State leaders who care about those priorities should consider asking those wealthy beneficiaries of the federal cuts to pay more to the state in order to minimize the damage of the looming federal funding cuts, but so far policymakers in Idaho,…

New Tax Law Allows Affluent Taxpayers to Write off K-12 Private School Tuition

January 9, 2018 • By Matthew Gardner

Taxpayers are still learning about the intended and unintended consequences of the major tax overhaul that Republican leaders ramrodded through late last year. One little-noted provision subverts state laws that prohibit the use of public dollars for private schools by allowing taxpayers to use 529 plans to pay for K-12 tuition. Until last year, the […]

State Rundown 1/4: Will States Show Resolve in a Challenging Year?

January 4, 2018 • By ITEP Staff

This week marks the beginning of what is bound to be a wild year for state tax and budget debates. Essentially every state is already working to sort through the complicated ramifications of the federal tax cuts passed in December, including Kansas, Michigan, Montana, and New Jersey highlighted below. These and other states will have important decisions to make about how to incorporate, reject, or mitigate various aspects of the new federal law, and will need considerable resolve to improve state tax policy to be more fair and more adequate – even as federal taxes become less so.

Michigan League for Public Policy: The benefits of Deferred Action for Childhood Arrivals (DACA) on immigrants in Michigan

December 20, 2017

Researchers at the Institute on Taxation and Economic Policy (ITEP) estimate that nationwide, DACA enrollees contribute $2 billion in state and local taxes each year. In Michigan, these young adults contribute $13 million in state and local taxes annually. If federal elected officials fail to pass a replacement to DACA and beneficiaries’ work permits expire, […]

How the Final GOP-Trump Tax Bill Would Affect Michigan Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

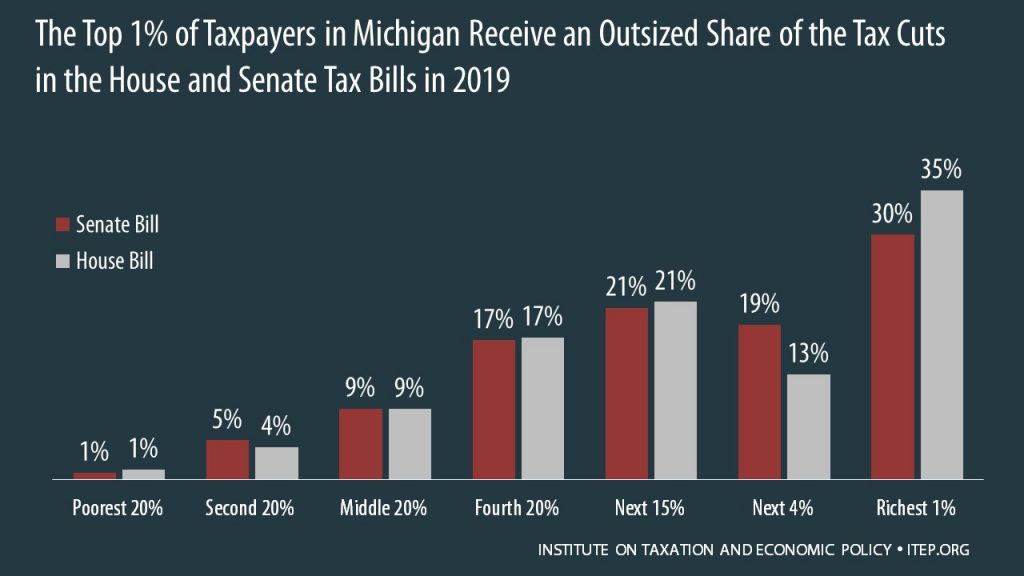

How the House and Senate Tax Bills Would Affect Michigan Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Michigan residents.