Nevada

How the House Tax Proposal Would Affect Nevada Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

State Rundown 10/25: Marijuana Taxes a Bright Spot amid Underperforming State Revenues

October 25, 2017 • By ITEP Staff

This week in state tax news saw Alaska begin yet another special session, Louisiana lawmakers holding meetings to begin preparing for the state’s looming (self-imposed) fiscal cliff, and Alabama policymakers beginning a study of school finance (in)adequacy and (in)equity. Meanwhile, state revenue performance is poor well into 2017 in many states, though Montana, Nevada, and Oregon are all enjoying modest but welcome revenue bumps from legalized marijuana.

State Rundown 10/4: Wildfires in Montana and Tax Cuts in Kansas Wreak Budget Havoc

October 4, 2017 • By ITEP Staff

This week, Kansas's school funding was again ruled unconstitutionally low and unfair, while Montana lawmakers indicated they'd rather let historic wildfires burn a hole through their budget than raise revenues to meet their funding needs. Meanwhile, a struggling agricultural sector continues to cause problems for Iowa and Nebraska, but legalized recreational marijuana is bringing good economic news to both California and Nevada.

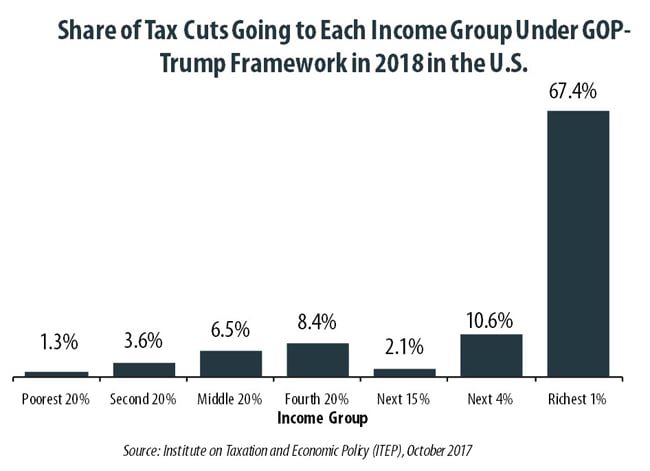

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

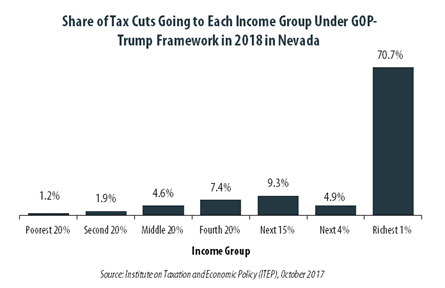

GOP-Trump Tax Framework Would Provide Richest One Percent in Nevada with 70.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Nevada equally. The richest one percent of Nevada residents would receive 70.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $538,200 next year. The framework would provide them an average tax cut of $113,840 in 2018, which would increase their income by an average of 4.5 percent.

In Nevada 51.7 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Nevada population (0.3 percent) earns more than $1 million annually. But this elite group would receive 51.7 percent of the tax cuts that go to Nevada residents under the tax proposals from the Trump administration. A much larger group, 47.5 percent of the state, earns less than $45,000, but would receive just 5.4 percent of the tax cuts.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

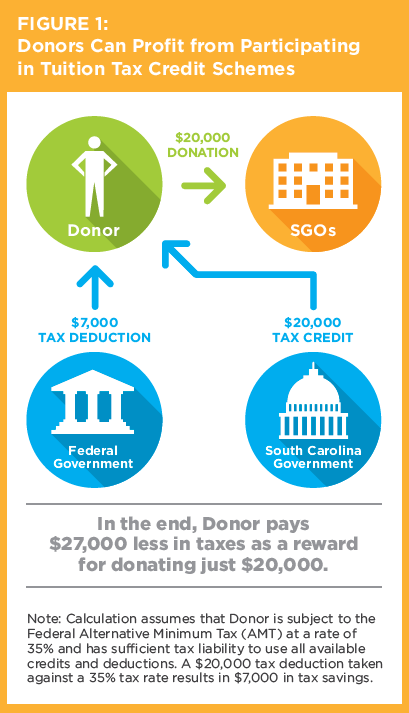

AP: School Voucher Programs Raise Questions about Transparency and Accountability

August 11, 2017

The AAA Scholarship Foundation Inc. which runs programs in Nevada and five other states, says it doesn’t give tax advice but has, when asked, shared an IRS memo on the matter. The Institute on Taxation and Economic Policy say loopholes in the tax code would allow contributors to both eliminate their state tax bill and […]

Trump Tax Proposals Would Provide Richest One Percent in Nevada with 62.7 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Nevada would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $2,498,000 in 2018. They would receive 62.7 percent of the tax cuts that go to Nevada’s residents and would enjoy an average cut of $170,150 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

Reno News and Review: Workers Stuck with the Check

July 5, 2017

According to the Institute on Taxation and Economic Policy, Nevada’s poorest 20 percent of families pay 6.1 percent of their income in sales tax. The wealthiest one percent of Nevada families pay six-tenths of 1 percent. Given the fact that low income people bear a heavier portion of taxation in Nevada than the affluent, the […]

State Rundown 6/21: Crunch Time for Many States with New Fiscal Year on Horizon

June 21, 2017 • By Meg Wiehe

This week several states rush to finalize their budget and tax debates before the start of most state fiscal years on July 1. West Virginia lawmakers considered tax increases as part of a balanced approach to closing the state’s budget gap but took a funding-cuts-only approach in the end. Delaware legislators face a similar choice, […]

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

This week saw tax debates heat up in many states. Late-session discovered revenue shortfalls, for example, are creating friction in Delaware, New Jersey, and Oklahoma, while special sessions featuring tax debates continue in Louisiana, New Mexico, and West Virginia. Meanwhile the effort to revive Alaska's personal income tax has cooled off.

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

State Rundown 5/10: Spring Tax Debates at Different Stages in Different States

May 10, 2017 • By Meg Wiehe

This week saw a springtime mix of state tax debates in all stages of life. In West Virginia and Louisiana, debates over income tax reductions and comprehensive tax reform are full of vigor. Other debates that bloomed earlier are now settled, such as Florida‘s now-complete budget debate and the more florid debates over gas taxes […]

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

State Rundown 4/12: Season in Transition as Some States Close, Others Open Tax Debates

April 12, 2017 • By ITEP Staff

This week in state tax news we see Louisiana‘s session getting started, budgets passed in New York and West Virginia, Kansas lawmakers taking a rest after defeating a harmful flat tax proposal, and Nebraska legislators preparing for full debate on major tax cuts. Nevada lawmakers may make tax decisions related to tampons, diapers, marijuana, and […]

Charleston Gazette-Mail: Cutting WV Income Tax Likely to Backfire

April 11, 2017

There are nine states with no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire and Tennessee. Only Texas has seen job growth — as a result of being the center of the oil industry. The others have not; job growth has trailed population growth in the other eight. This is based […]

Testimony before the Alaska House Labor & Commerce Committee On House Bill 36

April 4, 2017 • By Matthew Gardner

Thank you for the opportunity to testify on the changes House Bill 36 would make to Alaska's tax treatment of pass-through income. The taxation of pass-through business entities has been a focal point of state and federal tax reform debates for over a quarter century, with a dual focus on minimizing the role of tax laws in determining the choice of business entity and on ensuring that the income of all business entities is subject to at least a minimal tax. My testimony makes two main points: 1. Alaska is one of a small number of states that do not…

What to Watch in the States: State Earned Income Tax Credits (EITC) on the Move

March 24, 2017 • By Misha Hill

While every state’s tax system is regressive, meaning lower income people pay a higher tax rate than the rich, some states aim to improve tax fairness through a state Earned Income Tax Credit (EITC). Federal lawmakers established the in 1975 to bolster the earnings of low-wage workers, especially workers with children and offset some of […]

Tax Justice Digest: 50-State Analysis of GOP Health Care Plan, Ensuring State Sales Taxes Keep Pace with Our Changing Economy

March 23, 2017 • By ITEP Staff

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. State-by-State Analysis of GOP Health Care Plan By now, it’s widely known that the GOP health care plan […]

This week in state tax news saw major changes debated in Hawaii and West Virginia and proposed in North Carolina, a harmful flat tax proposal in Georgia, new ideas for ignoring revenue shortfalls in Mississippi and Nebraska, an unexpected corporate tax proposal from the governor of Louisiana, gas tax bills advance in South Carolina and […]