Oregon

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

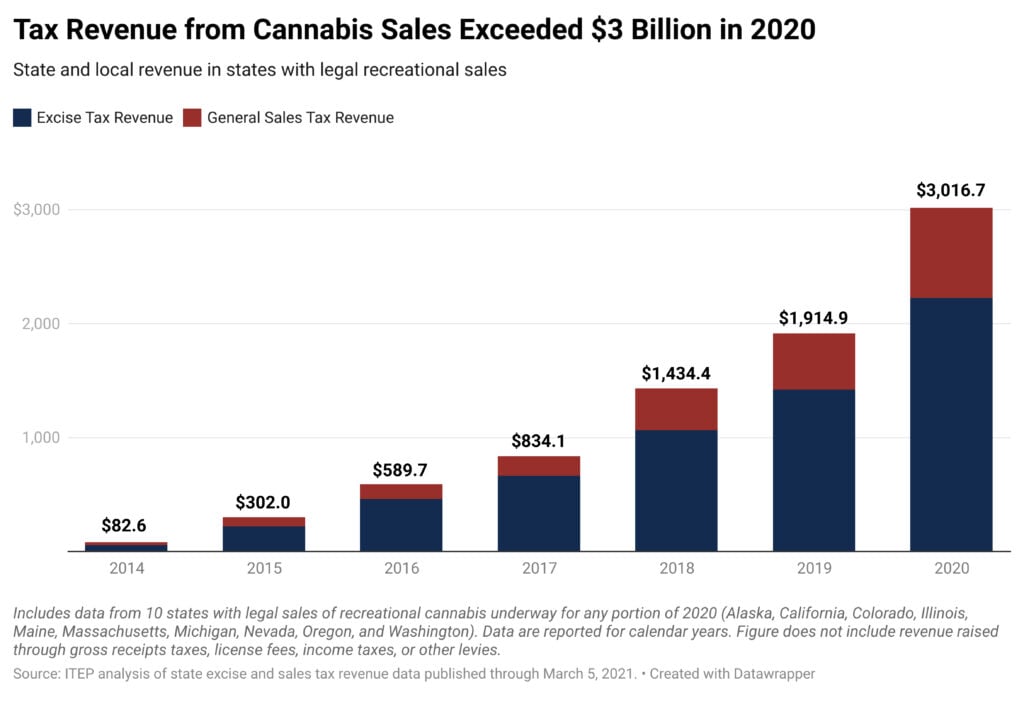

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

Although lawmakers in some states continue to push for expensive and regressive tax cuts that would primarily benefit wealthy households, worsen economic and racial injustices, and undermine funding for key public services, this week’s state fiscal news is dominated by efforts to do the opposite. Leaders in the District of Columbia, Maine, Nebraska, New York, Washington, and Wyoming made recent headlines by advocating for policies that improve on upside-down tax codes and generate needed funding for shared priorities like schools and health care.

Marketplace: High-income taxpayers help some states stay above water

March 1, 2021

However, in 22 states, tax revenue actually increased, with revenue in four states — Idaho, Utah, South Dakota and Colorado — up more than 5%. Revenue fell in the remaining states, with seven down more than 10% —Texas, Oregon, Florida, Nevada, North Dakota, Hawaii and Alaska. This disparity has a lot to do with the […]

State Rundown 2/24: State Tax Debates Quickly Thaw Out with Warmer Weather

February 24, 2021 • By ITEP Staff

Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas…

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

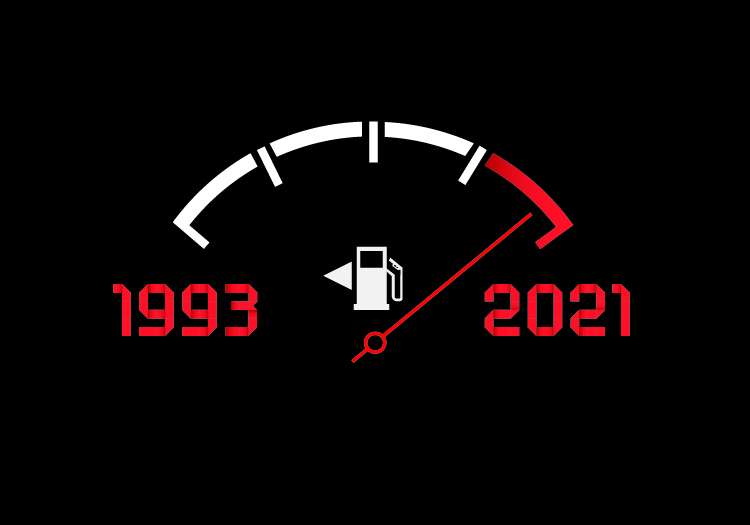

It’s Been 10,000 Days Since the Federal Government Raised the Gas Tax

February 12, 2021 • By Carl Davis

10,000 days. More than 27 years. By next Tuesday that’s how long it will have been since the federal government last raised the gas tax. Over that time, vehicle fuel efficiency has improved by 25 percent and construction costs have grown 185 percent. And yet the federal gas tax has remained frozen at 18.3 cents per gallon, with its purchasing power shrinking by the day. The federal government has never gone this long without updating the nation’s gas tax rate.

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

State Rundown 12/17: New and Old State Tax Debates Await in 2021

December 17, 2020 • By ITEP Staff

Our last Rundown of 2020 includes news of yet another misguided proposal to eliminate a state income tax, this time in Arkansas. Florida and Missouri, on the other hand, are looking to modernize their tax codes by becoming the last two states to enforce their own sales taxes on online retailers. Leaders in Maryland and Oregon, meanwhile, are working to decouple the state from unnecessary and regressive tax cuts included in the federal CARES Act. And Missouri and Nevada lawmakers both got updated estimates of the revenue shortfalls they will need to resolve when they convene in 2021. The Rundown…

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

Better tax policies will help communities emerge from the current staggering fiscal crisis with tax structures that reduce inequality at a time when rich people are thriving and public services are under siege. Preserving public spending will boost the economy and improve lives–and cutting these essentials will not only hurt people but also deepen the downturn, a lesson we learned in the Great Recession’s slow recovery. Other states should take note.

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2020

September 15, 2020 • By Aidan Davis

The Earned Income Tax Credit (EITC) is a policy designed to bolster the incomes of low-wage workers and offset some of the taxes they pay, providing the opportunity for families struggling to afford the high cost of living to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been amplified as many states have enacted and expanded their own credits.

State Rundown 8/12: States Find Themselves in New Unemployment Pickle

August 12, 2020 • By ITEP Staff

Even in statehouses, many eyes remained on Congress and President Trump this week as state lawmakers advocated for needed federal fiscal relief and debated whether they can afford to join in on the president’s executive order requiring states to partially fund a new version of enhanced unemployment benefits that have otherwise expired.

This week, voters in Missouri approved Medicaid expansion, Nevada lawmakers moved to amend their Constitution to raise taxes on the state’s mining industry, and leaders in California and New York continued to push for needed revenues through tax increases on their richest households.

As many of the country’s major professional sports leagues attempt to return to action amid concerns that the pandemic will find a way to ruin even the best-laid plans, state legislatures find themselves in a similar boat. Lawmakers would normally be enjoying their summer breaks at this time of year, but instead are returning to work in special sessions surrounded by plexiglass and uncertainty. Read on for information on ongoing sessions in states including California, Massachusetts, and Nebraska, as well as upcoming sessions in Missouri and Oregon.

Beyond SCOTUS: States Recognize Need for More Inclusive Immigrant Policy

June 26, 2020 • By Marco Guzman

The U.S. Supreme Court last week halted an effort by the Trump administration that would have stripped DACA (Deferred Action for Childhood Arrivals) recipients of their lawful status in the country. The 5-4 ruling is a significant victory for immigrant rights advocates and over 643,000 Dreamers—as they’re known—who were brought here as children and have […]

Crain’s New York Business: Legalizing Marijuana Can’t Cure Inequality, But It Will Ease Budget Crisis

June 14, 2020

My methodology is informed by the work of Carl Davis, research director at the Institute on Taxation and Economic Policy, who recently published a thoughtful blog post on per-capita cannabis excise tax collections. Davis found that last year more than $1.9 billion of tax revenue was collected across seven adult-use states (Alaska, California, Colorado, Massachusetts, Nevada, Oregon, […]

State Rundown 5/27: Some States Finally Talking Revenue Solutions to Revenue Crisis

May 27, 2020 • By ITEP Staff

This week the immense scale and uneven distribution of economic and health damage from the COVID-19 pandemic continued to come into focus, hand in hand with greater clarity around pandemic-related revenue losses threatening state and local revenues and the priorities—such as health care, education, and public safety—they fund. Officials in many states, including Ohio and Tennessee, nonetheless rushed to declare their unwillingness to be part of any solution that includes raising the tax contributions of their highest-income residents. On the brighter side, some leaders are willing to do just that, for example through progressive tax increases proposed in New York…

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

State Rundown 5/7: State Fiscal Responses to Pandemic Starting to Get Real

May 7, 2020 • By ITEP Staff

State lawmakers are starting to use fiscal policy levers to address the COVID-19 pandemic, but the actions vary greatly and are just a start. Mississippi, for example, is one state still clarifying who has authority to determine how federal aid dollars are spent. Colorado, Georgia, Missouri, and Ohio are among the many states identifying painful funding cuts they will likely make to shared priorities like health care. The Louisiana House and the Minnesota Senate each advanced tax cuts and credits that could dig their budget holes even deeper. Connecticut leaders are looking at one of the more comprehensive packages, which…

State Rundown 4/29: State Responses and Federal Aid Could Be Among “May Flowers” to Come

April 29, 2020 • By ITEP Staff

April has brought relentless showers of troublesome tax and budget news as the COVID-19 pandemic wreaked havoc on communities and the public services and institutions that both support and depend on them. There is hope, however, that these troubles have opened the eyes of policymakers and that May will bring more clarity and strong action in the form of federal fiscal relief as well as home-grown state and local responses.

Bloomberg: Pot, Liquor ‘Essential’ to Keep Up Spirits, Revenue During Virus

April 10, 2020

The state of Washington raised the most cannabis tax revenue last year—$67.31 per person, according to the Institute on Taxation and Economic Policy. That compares with $60.11 per person raised in Colorado, $53.50 in Nevada, $38.83 in Alaska, $31.75 in Oregon, $15.93 in California, and $12.92 in Massachusetts, the institute said. Read more

State Rundown 4/3: States Welcome Federal Aid, Seek Further Solutions

April 3, 2020 • By ITEP Staff

States and families got good news this week as Congress came together to pass major aid to help during the COVID-19 coronavirus pandemic. But that bright spot came amid an onslaught of very difficult news about the public health crisis and the economic and fiscal fallout accompanying it. This week’s Rundown brings you the latest on these developments and state and local responses to them.

ITEP Testimony on the Illinois Earned Income Credit

March 11, 2020 • By Lisa Christensen Gee

Read as PDF Testimony of Lisa Christensen Gee, Director of Special Initiatives, Institute on Taxation and Economic Policy Submitted to: Illinois House Revenue Committee Chairman Zalewski, committee members—thank you for holding this subject matter hearing this morning on the Earned Income Credit (EIC) and its importance for hard working Illinoisans and their families. My name […]