Sales Taxes

National Sausage Month isn’t until October, but now is the time of year when state lawmakers are really diving into their sausage-making processes, as separate legislative houses and oftentimes political parties send competing bills, budgets, and visions back and forth to grind out their differences.

State Rundown 2/19: Necktie (NCTI) Offers a Way Out of a Knotty Situation

February 19, 2026 • By ITEP Staff

State lawmakers are grappling with a range of challenges as their fiscal outlooks deteriorate, federal tax enforcement wanes (after the Trump administration cut the IRS workforce by 25 percent), and a rewritten federal tax code sends states scrambling to decide what changes they might want to make in their own codes.

State Rundown 2/11: This Valentine’s Day, Conscious Decoupling Is Our Love Language

February 11, 2026 • By ITEP Staff

While some may be excited for a romantic Valentine’s Day this weekend, many state lawmakers are breaking up and decoupling from recent federal tax changes that are poised to leave states with revenue shortfalls – much like a bad date who forgets their wallet and asks you to pick up the tab.

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

An Anti-Affordability Agenda: Trump’s Advisors Call on States to Raise Taxes on the Working Class and Drastically Cut Taxes for the Rich

January 29, 2026 • By Carl Davis

The Trump administration’s Council of Economic Advisors suggests that states consider drastically raising sales taxes and using those new revenues to pay for repealing taxes on corporate and personal income. Working-class families would face dramatic tax increases while the nation’s wealthiest families would see their state tax bills plummet.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

Local Governments Are Increasingly Strapped: 2026 Will Bring New Challenges and New Opportunities

January 21, 2026 • By Kamolika Das

2025 saw an intensification of state and local tax fights across the country, as well as growing experimentation with local-option taxes, levies, fees, and tourism taxes aimed at keeping budgets afloat while also navigating political constraints imposed by state legislatures.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

Not-So-Free Kick: How the 2026 FIFA World Cup Will Cost Cities Millions

December 5, 2025 • By Page Gray

FIFA demanded sales tax breaks on World Cup Tickets. That means millions in lost revenue for host cities already shouldering the costs on providing infrastructure, security and logistics.

In 2025, Voters Said Yes to Public Resources and Community Investments

November 6, 2025 • By Rita Jefferson

Important tax measures were on the ballot this week, and the outcomes are clear: many voters support new state and local spending to support critical services in their communities.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

July 17, 2025 • By Miles Trinidad

Sales tax holidays are often marketed as relief for everyday families, but they do little to address the deeper inequities of regressive sales taxes. In 2025, 18 states offer these holidays at a collective cost of $1.3 billion.

Equitable (and Less Equitable) Washington State Revenue Raisers

April 24, 2025 • By Dylan Grundman O'Neill

Washington state came into the year with strong tax justice momentum. Lawmakers’ innovative Capital Gains Excise Tax on the state’s highest-income households was upheld by the state and federal Supreme Courts and was overwhelmingly affirmed by voters despite a well-funded repeal effort. The new tax is bringing in much-needed revenue for schools, child care, and […]

Mississippi Considers Deep Tax Cuts Amidst Budget and Economic Uncertainty

February 26, 2025 • By Neva Butkus

At a time when states across the country are forecasting deficits or anticipating slowing revenue growth, Mississippi lawmakers are debating deeply regressive and expensive tax cuts that would overwhelmingly benefit their state’s richest residents.

Policymakers Unwisely Propose Cutting Property Taxes in Favor of Sales Taxes

January 14, 2025 • By Rita Jefferson

Lawmakers across the country are taking aim at property taxes with a new strategy: raising sales taxes instead. Doing so would create a regressive tax shift that puts unfair burdens on renters and reduces the strength of local government revenues.

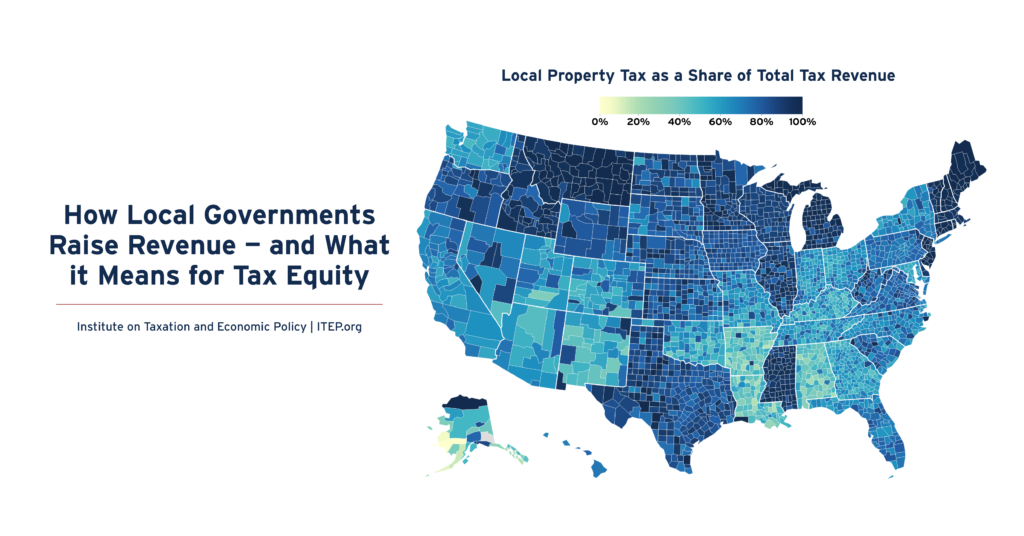

How Local Governments Raise Revenue — and What it Means for Tax Equity

December 5, 2024 • By Galen Hendricks, Rita Jefferson

Local taxes are key to thriving communities. One in seven tax dollars in the U.S.—about $886 billion annually—is levied by local governments in support of education, infrastructure, public health, and other priorities. Three fourths of this funding comes from property taxes, 18 percent comes from sales and excise taxes, and six percent comes from income taxes.

2024 Local Tax Ballot Measures: Voters in Dozens of Communities Will Shape Local Policy

October 17, 2024 • By Rita Jefferson

Next month, voters across the country will weigh in on many local ballot measures that will have a profound effect on the adequacy of our local tax systems and whether cities and communities can fund public needs. These are in addition to statewide ballot questions, many of which have local implications this year.

ITEP’s Carl Davis: Pyramids, Cascades, and the Taxation of Business Inputs

August 26, 2024

ITEP Research Director Carl Davis gave this presentation to the New Mexico Revenue Stabilization and Tax Policy Committee on August 23, 2024. View the slides here.

Many cities, counties, and townships across the country are in a difficult, or at least unstable, budgetary position. Localities are responding to these financial pressures in a variety of ways with some charging ahead with enacting innovative reforms like short-term rental and vacancy taxes, and others setting up local tax commissions to study the problem.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

August 6, 2024 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2024. These suspensions combined will cost states and localities over $1.3 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

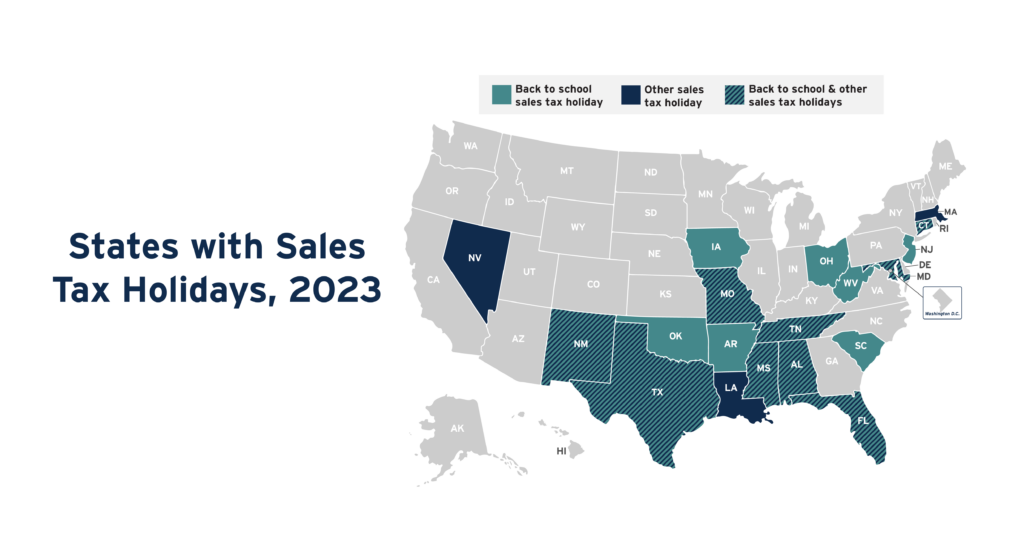

The number of states with sales tax holidays on the books fell to 19 in 2023 from 20 in 2022. Yet even as slightly fewer states have them, they are estimated to cost much more. In 2023, sales tax holidays will cost states and localities nearly $1.6 billion in lost revenue, up from an estimated $1 billion just a year ago.

A Lot for A Little: Gimmicky Sales Tax Holidays Are an Ineffective Substitute for Real Sales Tax Reform

August 3, 2023 • By Marco Guzman

This year, 19 states will forgo a combined $1.6 billion in tax revenue on sales tax holidays—politically popular, yet ultimately ineffective gimmicks with minimal benefits and significant downsides.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.