Tax Reform

The no tax on tips idea isn't a new one, but it's always been abandoned because it's practically impossible to do without creating new avenues for tax avoidance. Despite its embrace by the candidates from both major parties, this policy idea would do little to help the roughly 4 million people who work in tipped occupations while creating a host of problems.

Tax the Wealthy and Reject Austerity for a More Just and Thriving Democracy

July 1, 2024 • By Amy Hanauer

Two of the last five presidents won office over the objection of the majority of the people; California, with 65 times more people, has the same voting power in the U.S Senate as Wyoming; and the U.S. Supreme Court just permitted South Carolina lawmakers to dilute Black votes in drawing districts. These obvious flaws undermine our claim to be a strong democracy. One less appreciated but similarly undemocratic trend is our extreme inequality that supercharges the power and wealth of corporations and the uber-rich, weakens what the public sector can deliver, and often feeds on itself.

Everything! Taxing wealthy people and corporations and using the revenue for paid leave, child care, education, health care and college would transform America for girls and women of every race and family type, in every corner of this country.

“Fair Tax” Plan Would Abolish the IRS and Shift Federal Taxes from the Wealthy to the Rest of Us

January 11, 2023 • By Steve Wamhoff

The "Fair Tax" bill would impose a 30 percent federal sales tax on everything we buy – groceries, cars, homes, health care - and lead to a giant tax shift from the well-off to everyone else.

Congress should unite around a basic principle that Republican, Democratic, and independent voters support: the wealthiest, whether they are presidents, CEOs, or just rich heirs, should pay their fair share. Using Trump's tax maneuvering as a guidebook could make the tax code much fairer for all of us.

ITEP: Inflation Reduction Act is Biggest Corporate Tax Reform in Decades

August 12, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act (IRA) of 2022,” the reconciliation bill passed today by the House of Representatives. “Today Congress signed off on the biggest corporate tax reform in decades as part of a bill that will provide a […]

What Tax Provisions are in the Senate-Passed Inflation Reduction Act?

August 9, 2022 • By Steve Wamhoff

The Inflation Reduction Act approved by the Senate on Aug. 7 would raise more than $700 billion in new revenue over a decade by closing corporate tax loopholes, empowering the IRS to enforce the tax laws on the books, taxing stock buybacks, and extending a limitation on deductions for business losses. The IRA – if […]

They Might Really Do It: The Senate Is About to Reform Our Tax Code

August 5, 2022 • By Steve Wamhoff

For now, the Senate is poised to reverse cuts to the IRS enforcement against wealthy tax evaders for the first time in a decade, crack down on tax-dodging by huge corporations for the first time since 1986, and finally address the method increasingly used by corporations to transfer income to shareholders to avoid federal taxes. The multi-decade winning streak of corporate lobbyists and special interests who have practically written many of our tax laws in recent years is about to come to an end.

Corporate Minimum Tax Examples: Apple Would Likely Pay More, 3M Would Not

August 5, 2022 • By Matthew Gardner

Apple, one of the largest corporations in the United States despite manufacturing most of its physical products offshore, would likely pay the corporate minimum tax that is included in the Inflation Reduction Act that the Senate is debating this week. 3M, a manufacturer that has about 40 percent of its workforce in the United States, likely would not pay the corporate minimum tax if current trends in the company’s profits and taxes continue, because it is already paying above 15 percent of its profits in taxes.

Top Republican Tax-Writer Falsely Claims that Minimum Tax for Huge Corporations Is a Tax Hike on Middle-Class

August 2, 2022 • By Steve Wamhoff

Opponents of requiring corporations to pay even a minimum amount of taxes hold an unpopular position. But Sen. Mike Crapo, the top Republican on the Senate Finance Committee and a leader of that opposition, is using a one-sided and incomplete analysis to claim that the corporate minimum tax would raise taxes on low- and middle-income people.

ITEP: Reconciliation Deal Represents “Transformational Change” for U.S. Tax Policy

July 28, 2022 • By Amy Hanauer

Amy Hanauer, Executive Director of the Institute on Taxation and Economic Policy, issued the following statement on “The Inflation Reduction Act of 2022,” the reconciliation bill announced yesterday by Senate Democrats. “This is a transformational change for U.S. tax and energy policy. The bill restores sorely needed and long-overdue accountability to our tax code. By […]

No Reason to Water Down the Tax Reforms in the Build Back Better Act

June 30, 2022 • By Steve Wamhoff

There is no justification for recently reported efforts to scale back the tax reforms in the Build Back Better Act, a bill passed by the House of Representatives in November that would raise significant revenue and make our tax code more progressive by enacting widely popular proposals. (See ITEP’s report on the BBBA.) Of course, […]

Long-term troubles for this country and this planet now demand our attention. Progressive tax policy would transform our ability to tackle them.

New ITEP Report Explains How the Biden Administration Can Act on Its Own to Fix Our Tax Code

March 25, 2022 • By Steve Wamhoff

The Biden administration should revise regulations from the TCJA to enforce the law as it was written and passed by Congress, not as big banks and multinational corporations have lobbied for it to be enforced.

What the Biden Administration Can Do on Its Own, Without Congress, to Fix the Tax Code

March 25, 2022 • By Steve Wamhoff

The Biden administration has several options to address tax reform even when Congress is unable or unwilling to help.

Women’s History Month is a Reminder that Sensible Tax Policy is Central to Women’s Economic Security

March 24, 2022 • By Brakeyshia Samms

Women’s History Month is a chance to remember what happens for women when tax policy becomes more progressive, boosts income, and helps make raising a family more affordable.

A Better Alternative: New Mexico Prioritizes Targeted, Temporary Tax Cuts

March 9, 2022 • By Marco Guzman

New Mexico stands in stark contrast to the many examples of poorly targeted tax-cut proposals currently being considered around the country.

Sen. Scott and others who favor shifting taxes away from the rich and down the income distribution often focus solely on the federal personal income tax and ignore all the other taxes that Americans pay.

In this country, wealthier than any other and wealthier than we’ve ever been, we can create a smarter, more equitable tax code that better taxes those most able to pay.

Tax Provisions in the White House Build Back Better Framework: The Good and Bad

October 28, 2021 • By Amy Hanauer

The tax provisions in the Build Back Better framework released by the White House today include enormously helpful reforms but also some disappointments. The good news is that the plan would raise nearly $2 trillion over a decade from those who can afford to pay–the richest Americans and large, profitable corporations. The bad news is that some fundamental problems with our tax code would remain unaddressed.

President Reagan is lionized by many for cutting taxes and government. But the story is more complicated. Reagan knee-capped regulation and much domestic spending, and early in his administration he slashed taxes in ways that drastically reduced revenue. Yet he vastly expanded military spending, so his cuts were only to things he disliked. Less known […]

When Tax Breaks for Retirement Savings Enrich the Already Rich

June 25, 2021 • By Steve Wamhoff

Members of Congress frequently claim they want to make it easier for working people to scrape together enough savings to have some financial security in retirement. But lawmakers’ preferred method to (ostensibly) achieve this goal is through tax breaks that have allowed the tech mogul Peter Thiel to avoid taxes on $5 billion. This is just one of the eye-popping revelations in the latest expose from ProPublica.

Take a minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.

Taxes not only provide revenue so we can have a functioning government, they also shape broader society. Currently economic inequality is one of the most pressing challenges of our time. ITEP has produced research over the years that shows the nation’s overall tax system (local, state and federal combined) is barely progressive. With real tax reform that centers ordinary people, tax policy can help create a more equitable society.

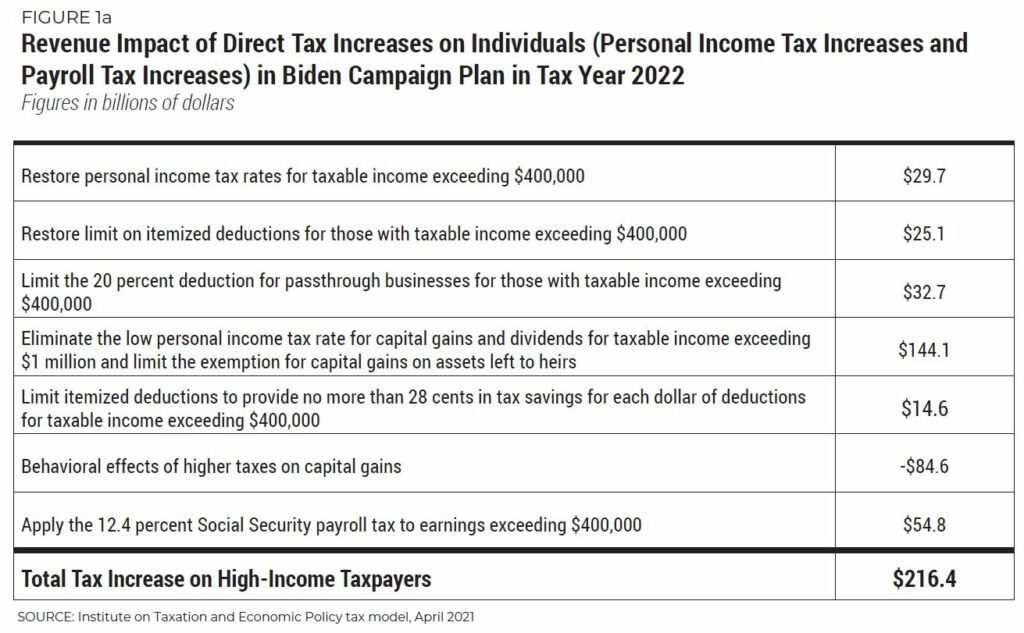

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…