Tennessee

Tennessee: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

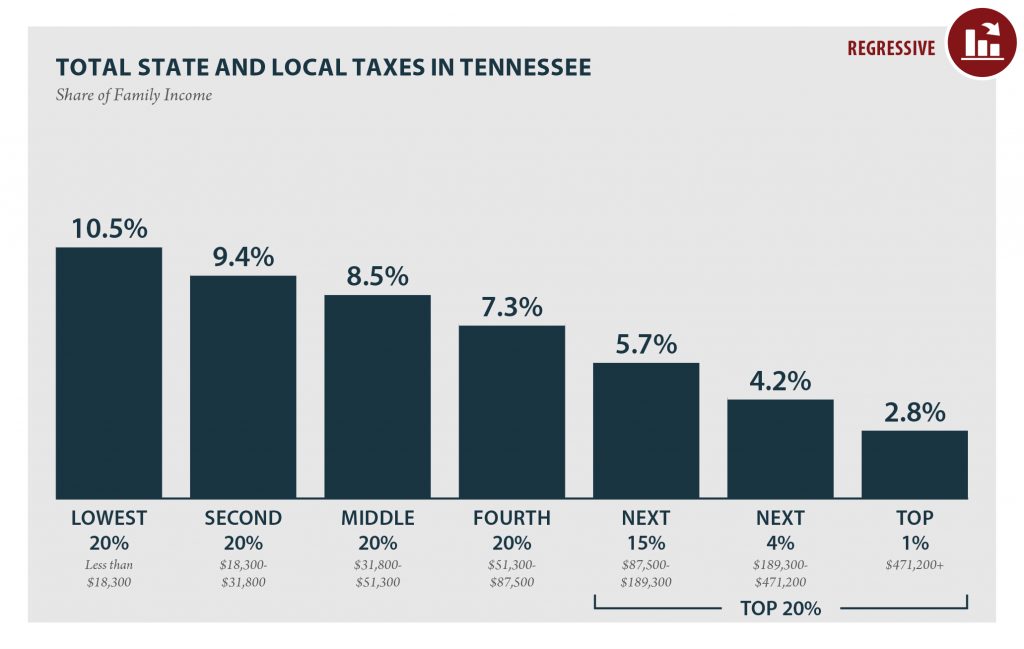

TENNESSEE Read as PDF TENNESSEE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $18,300 $18,300 to $31,800 $31,800 to $51,300 $51,300 to $87,500 $87,500 to $189,300 $189,300 to $471,200 over $471,200 […]

Tax Cuts 2.0 – Tennessee

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

The Tennessean: Where Are The Tax Cuts Going?

July 30, 2018

So where has the money gone? Many companies won’t say or are scant on specifics. Several publicly traded companies in Tennessee have issued press releases announcing bonuses or minimum wage increases, but few have offered details on the size and scope of those raises. Meanwhile, privately held companies in Tennessee have been reticent to share any of their […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

Fox Business: Higher State Taxes, Not OPEC, Boosting Gas Prices

July 5, 2018

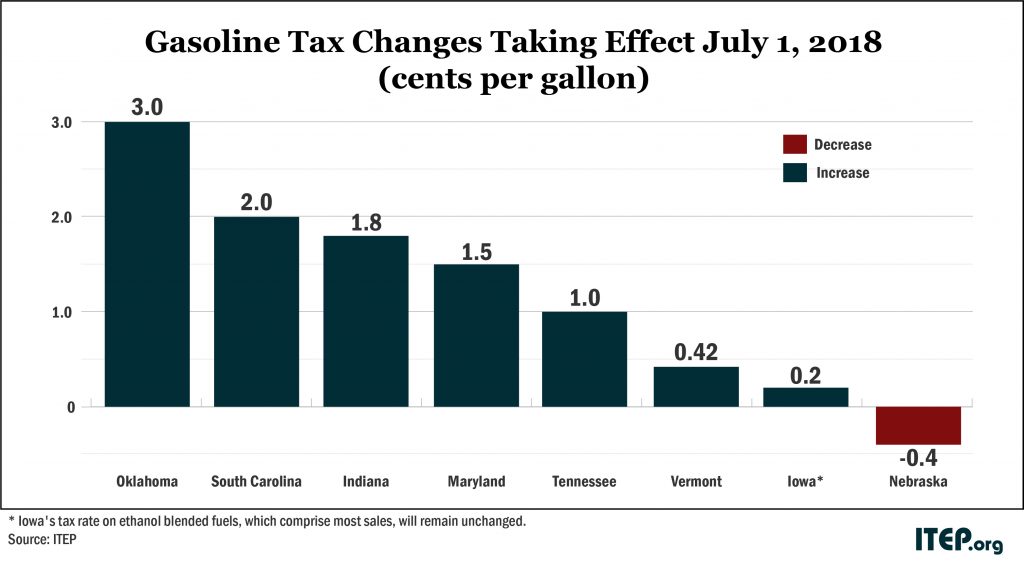

In July, Oklahoma, South Carolina and Tennessee were among seven states that raised their gas taxes Opens a New Window. . At least 27 states have raised or updated their gas taxes since 2013, according to a report from the Institute on Taxation and Economic Policy Opens a New Window. . California – where drivers pay some […]

Gas Taxes Rise in Seven States, Including an Historic Increase in Oklahoma

June 26, 2018 • By Carl Davis

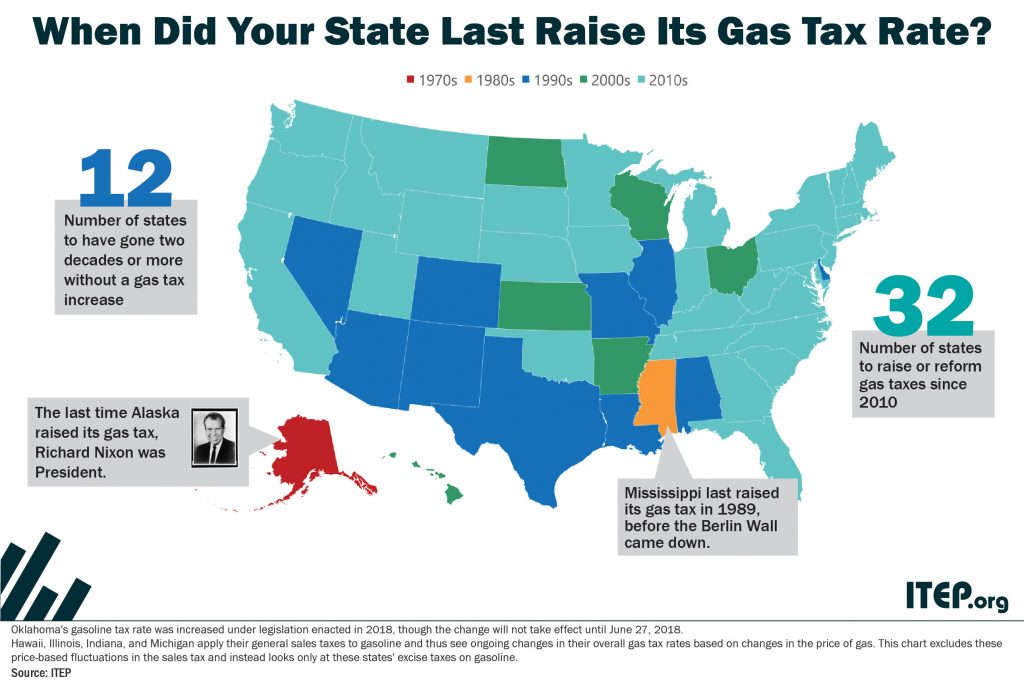

A rare sight is coming to Oklahoma. The last time the Sooner State raised its gas tax rate, the Berlin Wall was still standing, and Congress was debating whether to ban smoking on flights shorter than two hours. Fast forward 31 years, and Oklahoma is finally at it again. On Sunday, the state’s gas tax rate will rise by 3 cents and its diesel tax rate by 6 cents. Both taxes will now stand at 19 cents per gallon—still among the lowest in the country. But Oklahoma isn’t the only state where gas taxes will soon rise.

The U.S. Supreme Court made big news this morning by allowing states to collect taxes due on internet purchases, which will help put main-street and online retailers on an even playing field while also improving state and local revenues and the long-term viability of the sales tax as a revenue source. Many states remain focused on more local issues, however, as Louisiana's third special session of the year kicked off, Massachusetts won a living wage battle while losing an opportunity to put a popular millionaires tax proposal before voters, and major fiscal debates continue in Maine, New Jersey, and Vermont.

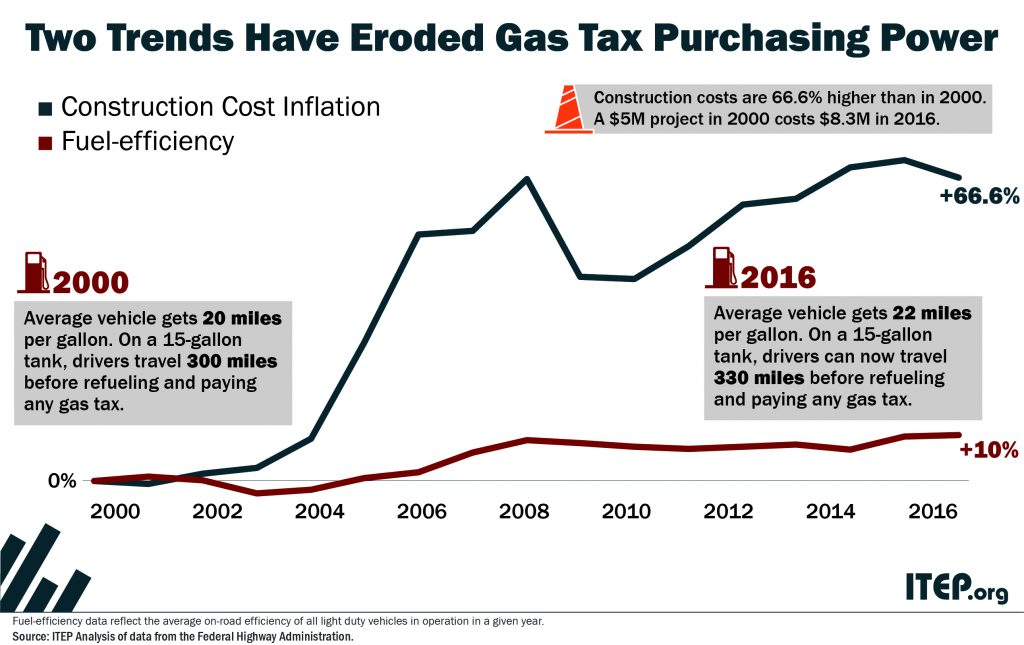

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Corker Claims Provisions Benefiting Him Could Not Have Changed His Vote Because He Never Read the Bill

December 18, 2017 • By Matthew Gardner

Many Republicans who had previously claimed to be deficit hawks have been cheerfully supportive of major tax-cutting legislation as it has moved forward this fall. But one Republican Senator, Bob Corker of Tennessee, has taken a defiant stance on the issue, insisting that “passing off increased debt to future generations” would be a deal-breaker for him. When the Senate passed its version of the tax plan last week, Corker was the only Republican to vote No.

How the Final GOP-Trump Tax Bill Would Affect Tennessee Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

ITEP researchers have produced new reports and analyses that look at various pieces of the tax bill, including: the share of tax cuts that will go to foreign investors; how the plans would affect the number of taxpayers that take the mortgage interest deduction or write off charitable contributions, and remaining problems with the bill in spite of proposed compromises on state and local tax deductions.

How the House and Senate Tax Bills Would Affect Tennessee Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

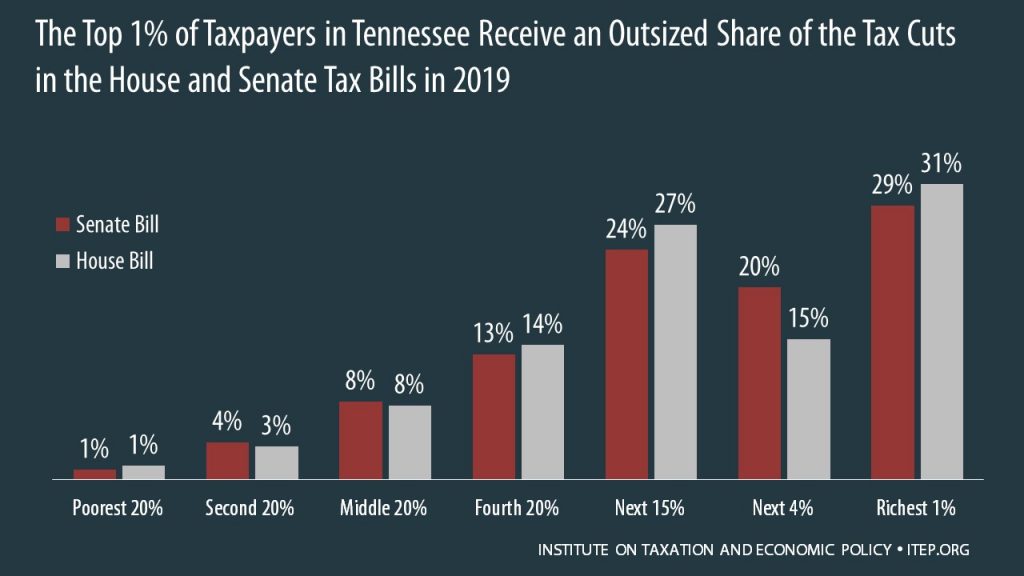

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Tennessee residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

A Corporate Tax Cut Would Benefit Coastal Investors, Not the Heartland

November 30, 2017 • By Carl Davis

The centerpiece of the House and Senate tax plans is a major tax cut for profitable corporations that the American public does not want, and that will overwhelmingly benefit a small number of wealthy investors living in traditionally “blue” states. New ITEP research shows that poorer states such as West Virginia, Oklahoma, Alabama, and Tennessee would be largely left behind by a corporate tax cut, while the lion’s share of the benefits would remain with a relatively small number of wealthy investors who tend to be concentrated in larger cities near the nation’s coasts.

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect Tennessee Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Tennessee, 46 percent of the federal tax cuts would go to the richest 5 percent of residents, and 8 percent of households would face a tax increase, once the bill is fully implemented.

State Rundown 11/8: Online Sales Tax Fight and Tax Subsidy Absurdity Go National

November 8, 2017 • By ITEP Staff

Internet sales tax fairness efforts gained momentum this week as most states joined together to encourage the US Supreme Court to allow them to collect taxes on online sales. Meanwhile, Montana lawmakers will enter special session next week to plug their revenue shortfall, Mississippi's (self-inflicted) revenue crunch is reaching unprecedented severity, and misguided corporate tax subsidies got mainstream attention from HBO's John Oliver and Rolling Stone.

Analysis of the House Tax Cuts and Jobs Act

November 6, 2017 • By Matthew Gardner, Meg Wiehe, Steve Wamhoff

The Tax Cuts and Jobs Act, which was introduced on Nov. 2 in the House of Representatives, would raise taxes on some Americans and cut taxes on others while also providing significant savings to foreign investors.

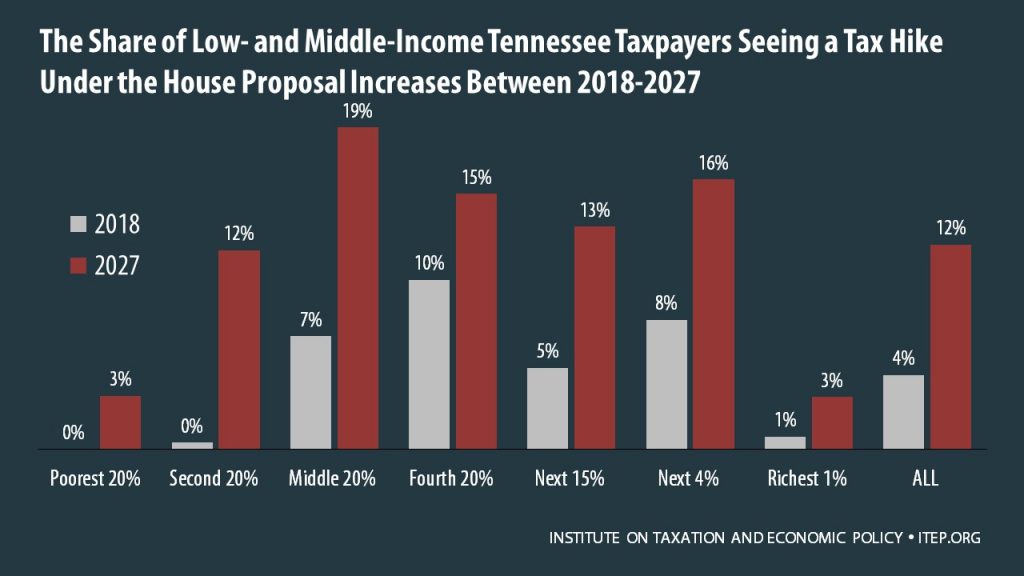

How the House Tax Proposal Would Affect Tennessee Residents’ Federal Taxes

November 6, 2017 • By ITEP Staff

The Tax Cuts and Jobs Act, which was introduced on November 2 in the House of Representatives, includes some provisions that raise taxes and some that cut taxes, so the net effect for any particular family’s federal tax bill depends on their situation. Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate…

Trickle-Down Dries Up: States without personal income taxes lag behind states with the highest top tax rates

October 26, 2017 • By Carl Davis, Nick Buffie

Lawmakers who support reducing or eliminating state personal income taxes typically claim that doing so will spur economic growth. Often, this claim is accompanied by the assertion that states without income taxes are booming, and that their success could be replicated by any state that abandons its income tax. To help evaluate these arguments, this study compares the economic performance of the nine states without broad-based personal income taxes to their mirror opposites—the nine states levying the highest top marginal personal income tax rates throughout the last decade.

Benefits of GOP-Trump Framework Tilted Toward the Richest Taxpayers in Each State

October 4, 2017 • By Steve Wamhoff

The “tax reform framework” released by the Trump administration and Congressional Republican leaders on September 27 would affect states differently, but every state would see its richest residents grow richer if it is enacted. In all but a handful of states, at least half of the tax cuts would flow to the richest one percent of residents if the framework took effect.

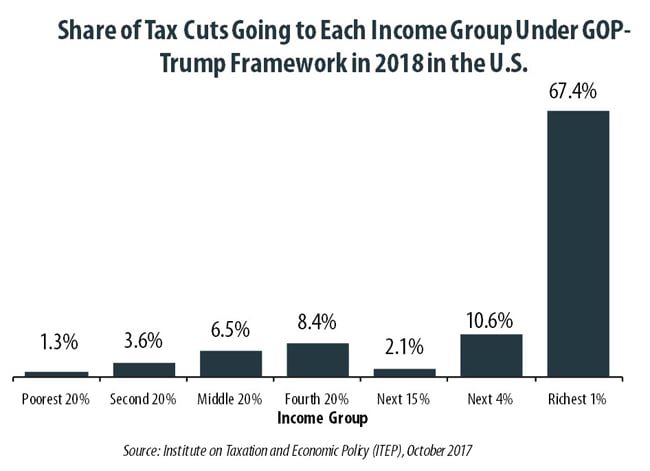

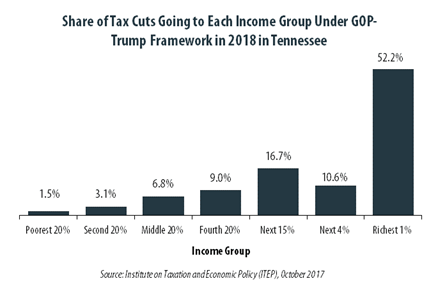

GOP-Trump Tax Framework Would Provide Richest One Percent in Tennessee with 52.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Tennessee equally. The richest one percent of Tennessee residents would receive 52.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $534,500 next year. The framework would provide them an average tax cut of $60,940 in 2018, which would increase their income by an average of 3.3 percent.

In Tennessee 40.7 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Tennessee population (0.5 percent) earns more than $1 million annually. But this elite group would receive 40.7 percent of the tax cuts that go to Tennessee residents under the tax proposals from the Trump administration. A much larger group, 48.0 percent of the state, earns less than $45,000, but would receive just 4.5 percent of the tax cuts.