Utah

SALT/Charitable Workaround Credits Require a Broad Fix, Not a Narrow One

May 23, 2018 • By Carl Davis

The federal Tax Cuts and Jobs Act (TCJA) enacted last year temporarily capped deductions for state and local tax (SALT) payments at $10,000 per year. The cap, which expires at the end of 2025, disproportionately impacts taxpayers in higher-income states and in states and localities more reliant on income or property taxes, as opposed to sales taxes. Increasingly, lawmakers in those states who feel their residents were unfairly targeted by the federal law are debating and enacting tax credits that can help some of their residents circumvent this cap.

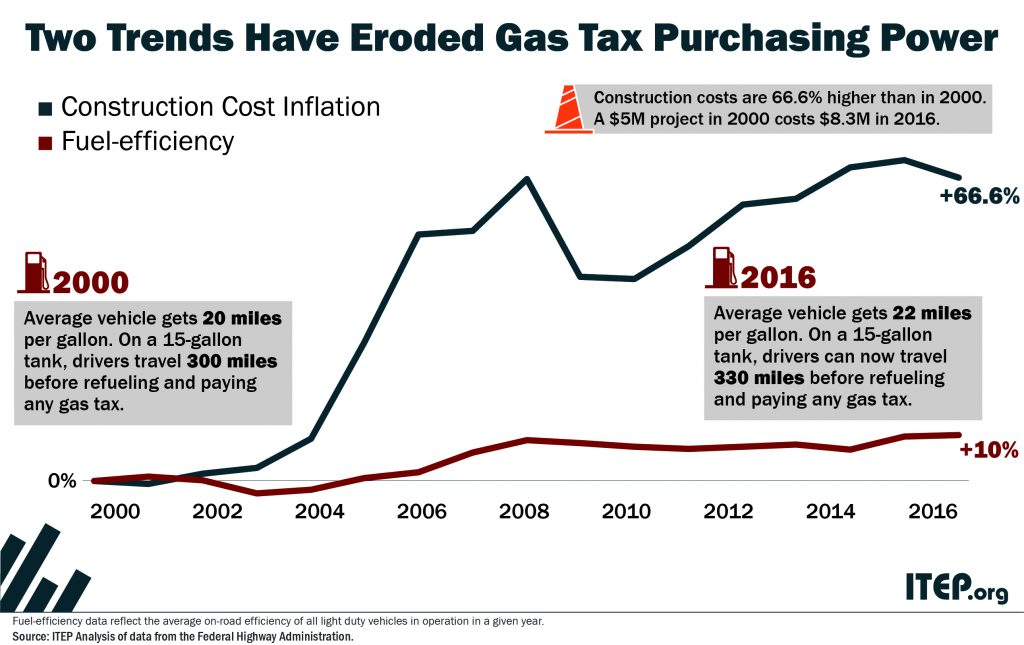

An updated version of this blog was published in April 2019. State tax policy can be a contentious topic, but in recent years there has been a remarkable level of agreement on one tax in particular: the gasoline tax. Increasingly, state lawmakers are deciding that outdated gas taxes need to be raised and reformed to fund infrastructure projects that are vital to their economies.

Bloomberg BNA: Higher Gas Prices May Mean Paying States More in Taxes

May 1, 2018

As a result, a few states will see revenue gains from higher prices because their tax rates are tied to the price of fuel, rather than its volume, Carl Davis, research director for the left-leaning Institute on Taxation and Economic Policy, told Bloomberg Tax. Those states include California, Connecticut, Kentucky, Maryland, Nebraska, New Jersey, New […]

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

Trends We’re Watching in 2018, Part 3: Improvements to Tax Credits for Workers and Families

March 26, 2018 • By Aidan Davis

This has been a big year for state action on tax credits that support low-and moderate-income workers and families. And this makes sense given the bad hand low- and middle-income families were dealt under the recent Trump-GOP tax law, which provides most of its benefits to high-income households and wealthy investors. Many proposed changes are part of states’ broader reaction to the impact of the new federal law on state tax systems. Unfortunately, some of those proposals left much to be desired.

With many state legislative sessions about halfway through, the ripple effects of the federal tax-cut bill took a back seat this week as states focused their energies on their own tax and budget issues. Major proposals were released in Nebraska and New Jersey, one advanced in Missouri, and debates wrapped up in Florida, Utah, and Washington. Oklahoma and Vermont are considering ways to improve education funding, while California, New York, and Vermont look to require more of their most fortunate residents. And check in on "what we're reading" for resources on the online sales tax debate, the role of property…

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

Trends We’re Watching in 2018, Part 1: State Responses to Federal Tax Cut Bill

March 5, 2018 • By Dylan Grundman O'Neill

Over the next few weeks we will be blogging about what we’re watching in state tax policy during 2018 legislative sessions. And there is no trend more pervasive in states this year than the need to sort through and react to the state-level impact of federal tax changes enacted late last year.

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

Preventing State Tax Subsidies for Private K-12 Education in the Wake of the New Federal 529 Law

February 23, 2018 • By Ronald Mak

This policy brief explains the federal and various state-level breaks for 529 plans and explores the potential impact that the change in federal treatment of 529 plans will have on state revenues.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

State Rundown 1/31: Low-Income Families’ Taxes Getting Some Much-Needed Attention

January 31, 2018 • By ITEP Staff

This week was promising for advocates of Earned Income Tax Credits (EITCs) and other tax breaks for workers and their families, which are making headway in Alabama, Maine, Massachusetts, Missouri, Utah, and Wisconsin. The week also saw the unveiling of a tax cut plan in Missouri, a budget-balancing tax increase package in Oklahoma, the end of an unproductive film tax credit in West Virginia, and a very busy week for tax policy in Utah.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

State Rundown 1/25: States Begin Tax Debates while Still Racing to Understand Federal Bill

January 25, 2018 • By ITEP Staff

State legislative sessions are in full swing this week as states grapple with revenue shortfalls and the ramifications of the federal tax cut bill. Lawmakers in Alaska and Louisiana, for example, are debating how to handle their revenue shortfalls, and a tax cut proposal in Idaho has been received tepidly. And be sure to peruse our "What We're Reading" section for helpful perspectives on how states are affected by the federal tax cut bill.

These have been dark days for those who care about tax justice and public investments, but with the Winter Solstice this week and many states diving into their legislative sessions in January, longer days (and long work days) are soon to come! Governors and legislators are already proposing or hinting at their 2018 tax and budget plans in Alaska, California, Iowa, Maryland, and Washington. And transportation investments are getting strong support in Missouri, Oregon, and Virginia.

How the Final GOP-Trump Tax Bill Would Affect Utah Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

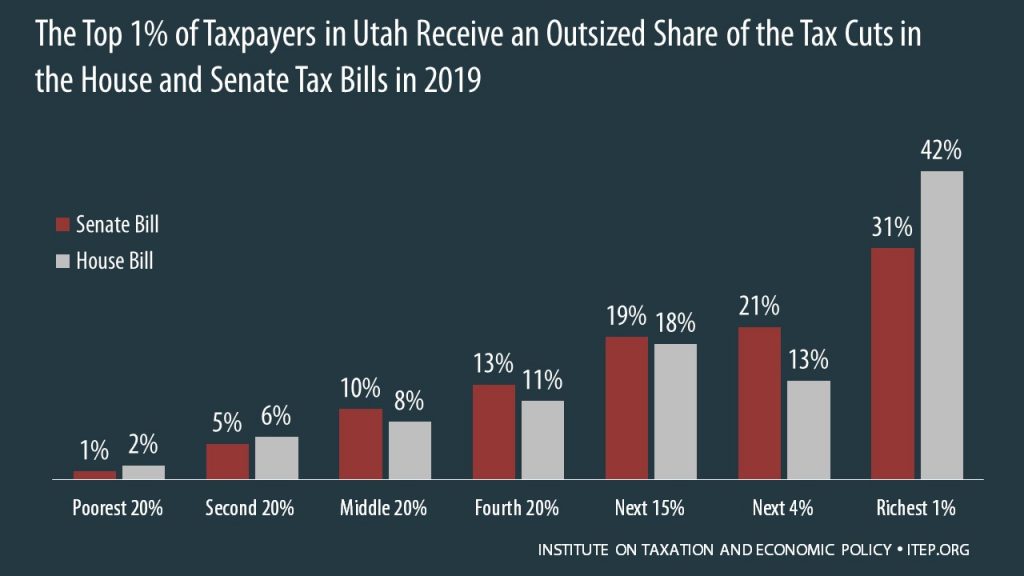

How the House and Senate Tax Bills Would Affect Utah Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Utah residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

ITEP has analyzed each of the tax proposals advanced by the House and Senate in recent weeks. While some details have changed, the bottom line is the same: The plans would disproportionately benefit corporations and the wealthy. The Senate tax plan ITEP’s latest analysis examined the proposal that passed the Senate Finance Committee on Nov. […]

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect Utah Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Utah, 58 percent of the federal tax cuts would go to the richest 5 percent of residents, and 18 percent of households would face a tax increase, once the bill is fully implemented.

Senate Tax Plan Reserves Greatest Benefit for Richest Americans, Millions Face an Increase

November 13, 2017 • By ITEP Staff

A 50-state analysis of the Senate tax proposal finds that not only would greatest share of benefits go to the richest Americans, but also more than one in 10 taxpayers would face a tax hike, with a large number of those taxpayers residing in states where residents pay higher state and local taxes.