ITEP's Research Priorities

Joe Hughes

August 27, 2021 • By ITEP Staff

Joe supports ITEP in monitoring federal tax policies. His research focuses on progressive tax priorities to ensure corporations and the ultra wealthy pay their fair share. Prior to joining ITEP in 2021, Joe worked at the Congressional Research Service and the Bureau of Labor Statistics. He completed a master’s in applied economics at George Washington University and undergraduate studies at the University of Tennessee.

We asked New York state resident Morris Pearl, former Blackrock executive and current chair of the Patriotic Millionaires, a few questions to hear straight from the mouth of a millionaire how the SALT cap and its proposed repeal would affect his life.

New Report Outlines Less Costly Alternatives to SALT Repeal

August 26, 2021 • By ITEP Staff

Media contact Ever since former President Trump and the GOP-led Congress enacted a $10,000 cap on state and local tax (SALT) deductions in December 2017, federal and state lawmakers in the mostly “blue”, higher-income states that have more residents affected by the provision have been weighing measures to repeal the cap or provide state-level workarounds. Repealing the cap has made […]

New Report from ITEP Describes Options for Changing the SALT Cap without Repealing It

August 26, 2021 • By Steve Wamhoff

A new report from ITEP provides policy recommendations to modify the $10,000 cap on federal tax deductions for state and local taxes (SALT), which was signed into law by President Trump as part of the Tax Cuts and Jobs Act. Because the SALT cap mostly restricts tax deductions for the richest 5 percent of Americans, the best options are to leave the cap as is or replace […]

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

The One Thing Missing From the Qualified Business Income Deduction Conversation: Racial Equity

August 25, 2021 • By Marco Guzman

When crafting tax policy, lawmakers and bill authors often work backward, using a patchwork of changes to help achieve their stated goal. One important consideration that is routinely left out is what impact the change will have on racial equity. Such is the case with the qualified business income deduction, which is helping to further enrich wealthy business owners, the overwhelming majority of whom are white. At present, white Americans own 88 percent of private business wealth despite making up only 60 percent of the population. Meanwhile, Black and Hispanic families confronting much higher barriers to entrepreneurship each own less…

Bloomberg Law: Wyden Plan Retains Tax Boost But Mulls Foreign Tax Credit Perk

August 25, 2021

But public opinion supports the idea of companies paying higher taxes on their offshore profits, said Steve Wamhoff, director of federal tax policy for the Institute on Taxation and Economic Policy, and he sees Congress approving a significant package of changes. “At the end of the day, the need for revenue to pay for investments, […]

Eliminating the State Income Tax Would Wreak Havoc on Mississippi

August 25, 2021 • By Kamolika Das

History has repeatedly shown that such policies harm state economies, dismantle basic public services, and exacerbate tax inequities.

Newark Star-Ledger: U.S. House paves way to increase property tax breaks after delay spurred by N.J. Democrat

August 24, 2021

The Institute on Taxation and Economic Policy, a progressive research group, said 80% of the 1.9 million New Jerseyans who would benefit from removing the cap had an average income of $216,000 or less, even though 72% of the benefits would go to the richest 5%. The House’s August recess had been temporarily short-circuited and […]

The Motley Fool: Low-Income Americans Will Get an Average of $3,590 in Stimulus Money in 2021

August 20, 2021

According to the Institute on Taxation and Economic Policy, the lowest-earning Americans will receive more financial relief this year than some of their higher-earning counterparts. Specifically, those who have a household income of $21,300 or less will get an average of $3,590 in stimulus money and tax credits this year. On average, this includes: $2,210 […]

Mississippi Today: Mississippi tax laws place higher burden on people of color

August 19, 2021

“Black households pay an average of 8.7% of their income in state and local tax while Hispanic families pay 9.1%,” according to a recently released study by non-profit One Voice, based on data compiled by the Institute on Taxation and Economic Policy. “Those rates are significantly above the statewide average tax rate of 8.4% and […]

Neva Butkus

August 18, 2021 • By ITEP Staff

Neva supports researchers and advocates in their fight for equitable and adequate state tax systems through policy analysis, research and collaboration. Prior to ITEP, Neva was a Senior Policy Analyst at the Louisiana Budget Project where her research and advocacy included issues of corporate tax policy, working family tax credits, unemployment insurance, and K-12 finance policy.

Brakeyshia Samms

August 18, 2021 • By ITEP Staff

Brakeyshia researches and writes about tax policies to inform the public and supports advocates and policymakers with analyses to help secure equitable tax policies, sound fiscal practices, and policy solutions that remedy historical injustices.

Summer is quickly (and sadly) coming to an end and if you’ve been away enjoying the great outdoors or off the grid, we’re here to help keep you up to date on what’s been happening on the tax front around the country...

CNBC: States boost earned income tax credits for pandemic relief

August 17, 2021

President Joe Biden proposed making these changes permanent in the American Families Plan, which could provide $12.4 billion to families in 2022, affecting 19.5 million workers, according to research from the Institute on Taxation and Economic Policy. Read more

One Voice: Who Pays, Mississippi? An Overview of State Tax Policy and Racial Equity Impacts

August 17, 2021

Historic and current injustices, both in public policy and in society more broadly, have resulted in vast disparities in income across race and ethnicity in Mississippi. State and local tax codes are not the sole contributors to, nor will they be the sole solution to, racial economic inequities. However, the state’s tax system is playing […]

Motley Fool: Middle-Class Americans Will Get an Average of $2,910 in Stimulus Money in 2021

August 13, 2021

Although there’s no specific data detailing exactly how much stimulus money people within this income range will receive on average, the Institute on Taxation and Economic Policy found that those with household incomes between $65,000 and $111,300 will receive an average of $3,540. This range is a pretty close overlap with families who are considered […]

Yahoo! Finance: Silence from congressional liberals as Democrats move toward SALT tax cut for wealthy

August 13, 2021

The issue has made odd bedfellows of Republicans and some Democrats, with the liberal-leaning Institute on Taxation and Economic Policy blasting a repeal as “inequitable.” ITEP found that if the cap were repealed, two-thirds, or some $67 billion, would flow to white taxpayers who make over $200,000 per year. The report said that a clean […]

CNBC: Biden’s boost to the earned income tax credit may trigger a ‘marriage penalty’

August 13, 2021

A worker without children may receive up to $1,502 in 2021, nearly triple the former benefit, and President Joe Biden proposed making the changes permanent in the American Families Plan. If that happens the enhanced EITC would provide $12.4 billion to families in 2022, benefiting 19.5 million workers, according to research from the Institute on Taxation and Economic Policy. […]

North Carolina Policy Watch: NC House Tax Plan Isn’t Good for Our State (And These Graphs Explain Why This Is the Case)

August 10, 2021

The House tax plan would deliver the greatest share of the net tax cut to the richest North Carolinians. Fifty-six percent of the net tax cut would go to the richest 20 percent in North Carolina. During the House Finance debate, proponents of the tax plan suggested that North Carolinians with poverty-level incomes would see […]

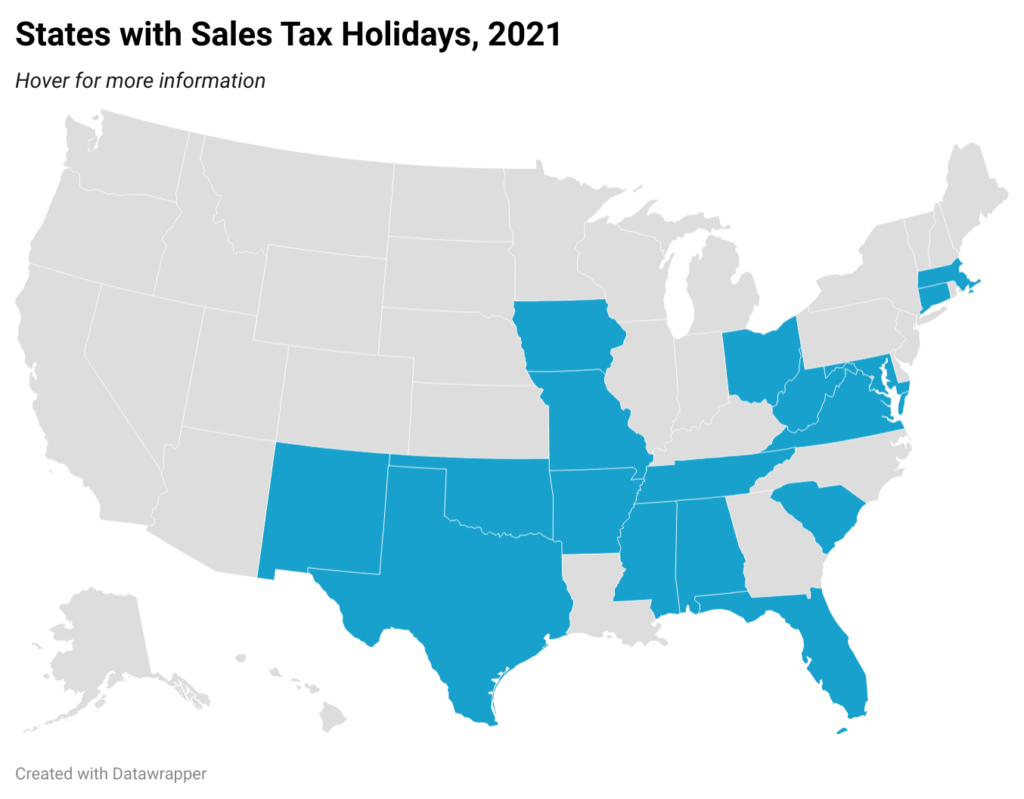

State Experimentation with Sales Tax Holidays Magnifies Their Flaws

August 6, 2021 • By Dylan Grundman O'Neill

It’s back-to-school shopping season, so…everyone who buys a cell phone in Arkansas this weekend will do so sales-tax-free. For this whole week in Connecticut, and for the entire spring in New Mexico, the corporate owners of highly profitable multinational restaurant chains had the option to pocket their customers’ taxes rather than remit them to the state to fund vital public services, pass along those savings to their customers, or give a much-needed boost to their employees. And all told, about $550 million of state and local revenue will be forgone in 17 states this year through wasteful and poorly targeted…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

Congress is proving that there does not need to be a trade-off between good climate policy and good economic policy. Direct hires aside, an even bolder government-backed effort to secure the future of our planet could create as many as 25 million net new jobs at its peak, as well as 5 million permanent jobs, many of which deal directly with domestic infrastructure and cannot be outsourced. With the U.S. economy still down 5.7 million jobs from pre-pandemic levels, climate legislation can be a critical investment for jumpstarting our economic recovery.

ITEP Statement on AFL-CIO President Richard Trumka’s Death

August 5, 2021 • By Amy Hanauer

Following is a statement from Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the death of AFL-CIO President Richard Trumka: “The board and staff of the Institute on Taxation and Economic Policy and Citizens for Tax Justice mourn the sad news of the loss of AFL-CIO President Richard Trumka. Mr. […]

Why Local Governments Need an Anti-Racist Approach to Property Assessments

August 5, 2021 • By Ambika Sinha

Property taxes are among the oldest and most relied upon form of local taxes. Revenue raised from these taxes funds education, firefighting, law enforcement, street and infrastructure maintenance, and other essential services. Though all members of the community enjoy these public goods, homeowners of color, especially Black families, pay more as a share of home value in property taxes than their white counterparts.