Blog - State Policy

651 posts

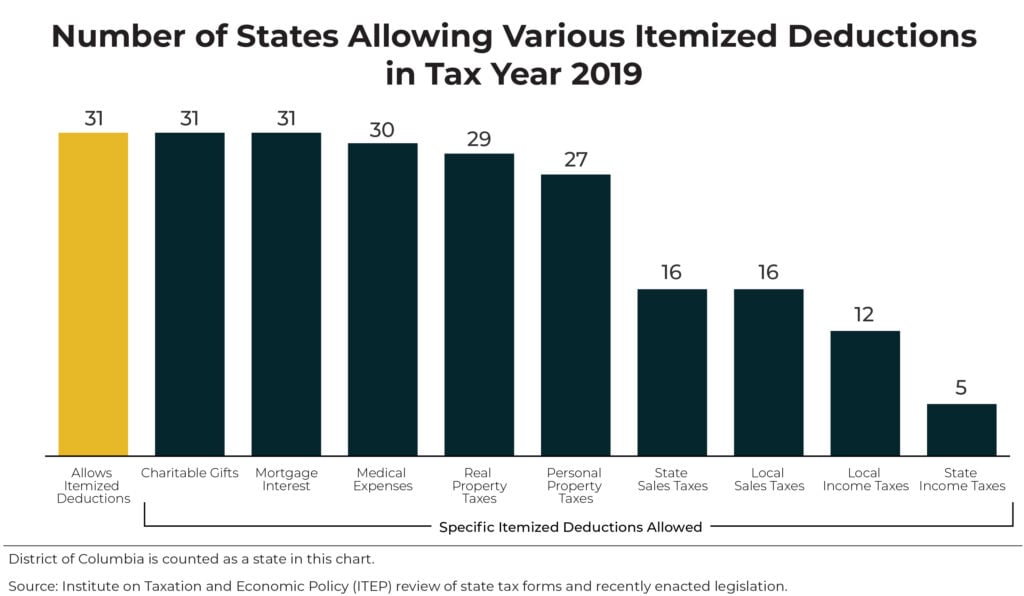

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

A new IRS proposal could once again allow wealthy business owners to use state charitable tax credits–including tax credits for donating to support private and religious K-12 schools–to dodge the federal government’s $10,000 cap on state and local tax (SALT) deductions.

This week as Americans celebrate Martin Luther King Jr.’s messages of resisting oppression and fighting for progress, state policymakers can look to some bright spots where tax and budget debates are bending toward justice. Among those highlights, Hawaii leaders are considering improvements to minimum wage policy, early childhood education, and affordable housing; Kansas Gov. Laura Kelly is seeking to reduce sales taxes applied to food and restore the state’s grocery tax credit; and advocates in Connecticut and Maryland are pushing for meaningful progressive tax reforms.

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…

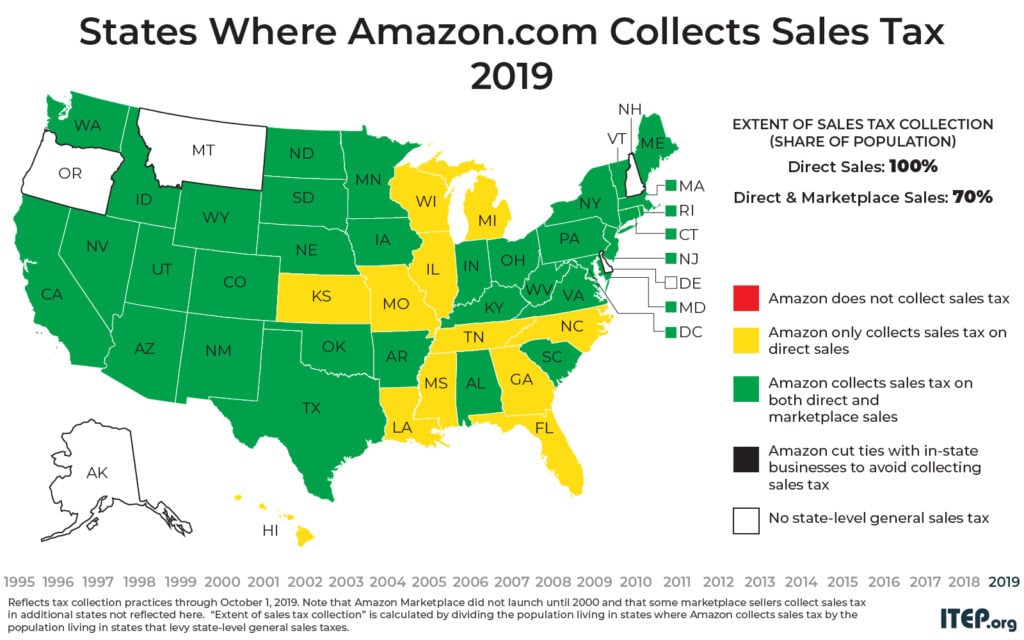

A Lump of Coal for 12 States Not Collecting Marketplace Sales Taxes this Holiday Season

November 25, 2019 • By Carl Davis

The last few years have brought major improvements in how states enforce their sales tax laws on purchases made over the Internet. Less than a decade ago, e-retailers almost never collected the sales taxes owed by their customers. The result was a multi-billion dollar drain on state coffers and a competitive disadvantage for local businesses. But this holiday season looks a bit different.

State Rundown 11/6: State Voters Show Readiness to Fix Broken Tax Codes

November 6, 2019 • By ITEP Staff

Many of yesterday’s Election Day votes came down to questions of whether or not to improve on upside-down and often inadequate state and local tax systems. The status quo was maintained in Colorado, where voters failed to approve a proposition to allow the state to invest tax revenue in education and other needs, and in Texas, where a constitutional amendment was approved to prohibit the state from creating an income tax. But voters supported important reforms in other states by approving needed funding for schools in Idaho, opting to legalize and tax recreational cannabis in California. And for more on…

State Rundown 10/24: State Tax Talk Makes Like a Tree and Gets Colorful

October 24, 2019 • By ITEP Staff

As autumn brings a colorful display of foliage to many states, so too are tax proposals taking on interesting hues as states move from the summer off-season toward 2020 legislative sessions. Ohio lawmakers are blue in the face from debating and re-debating tax and budget issues there. Maryland residents again showed they can’t be called yellow-bellied when it comes to footing the bill for needed education improvements, showing their broad support for higher taxes to fund those needs even despite a hefty price tag. Alaska, Michigan, and other states are giving the green light to laws implementing their new ability…

State Rundown 10/10: Always Something Old, Something New in State Tax Debates

October 10, 2019 • By ITEP Staff

Creative thinking from Pennsylvania lawmakers has helped them discover that the Wayfair ruling allowing states to collect sales tax from online retailers can also help them identify and tax corporate profits earned in their borders. Similarly, New York leaders had the vision to put bold environmental goals in place and identify a carbon price as a potential pay-for. Gubernatorial candidates in Mississippi and Kentucky showed less ingenuity, proposing tax cuts even though Mississippi is still phasing in a massive tax cut from a few years ago and Kentucky’s next election isn’t until 2020. Meanwhile, the old idea of eliminating income…

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

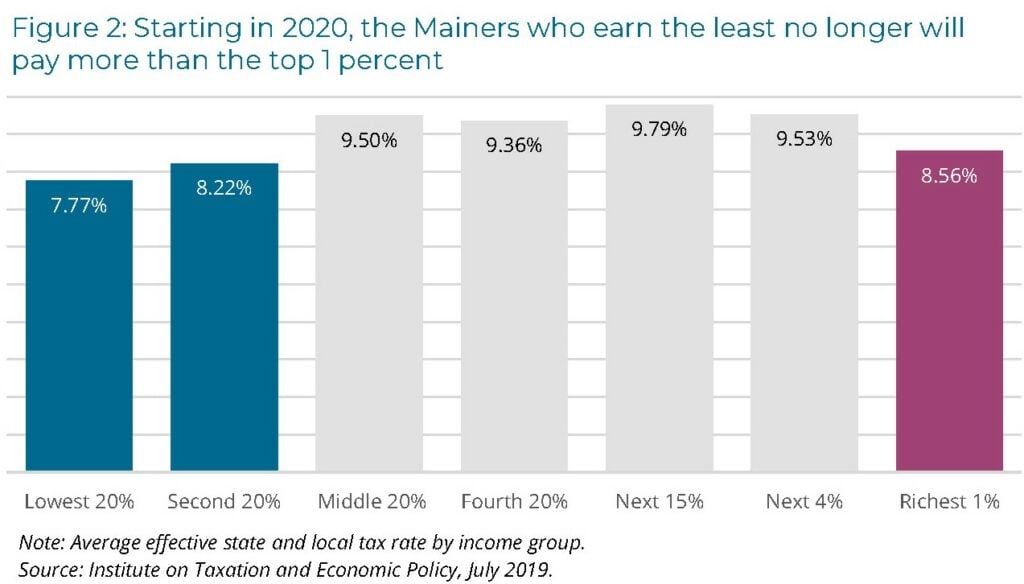

Lawmakers in Maine this year took bold steps toward making the state’s tax system fairer. Their actions demonstrate that political will can dramatically alter state tax policy landscape to improve economic well-being for low-income families while also ensuring the wealthy pay a fairer share.

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

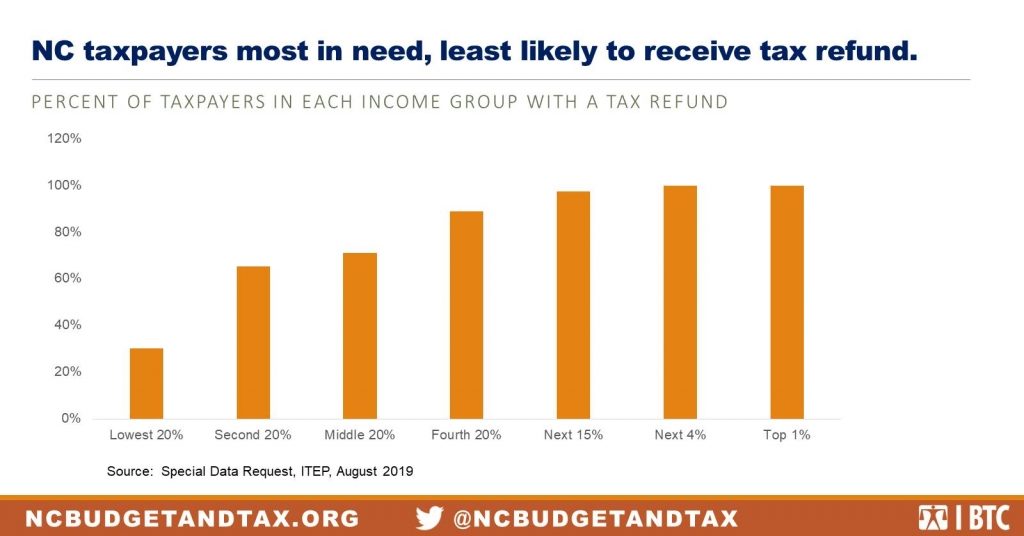

New Analysis: A Third of NC Taxpayers Won’t Benefit from Proposed Tax Refund Plan

August 29, 2019 • By Guest Blogger

North Carolina Senate and House leaders are moving forward with a flawed proposal to spend the majority of the state’s revenue over collections, more than $600 million, to issue tax refund checks of $125 per taxpayer ($250 for married couples).

The hottest, stickiest month of the year has left a grimy feeling on several state tax debates, as Idaho lawmakers find themselves unable to fund the state’s priorities after years of cutting taxes, Alaskans express their support for public investments to their governor’s polling office and then watch the governor slash them anyway, New Jersey lawmakers go to bat for ineffective and corrupt business tax subsidies, and residents of North Carolina watch their representatives pursue cheap political points over sound investments and thoughtful policy. Nonetheless, residents and advocates on the other side of these and other debates have fought long…

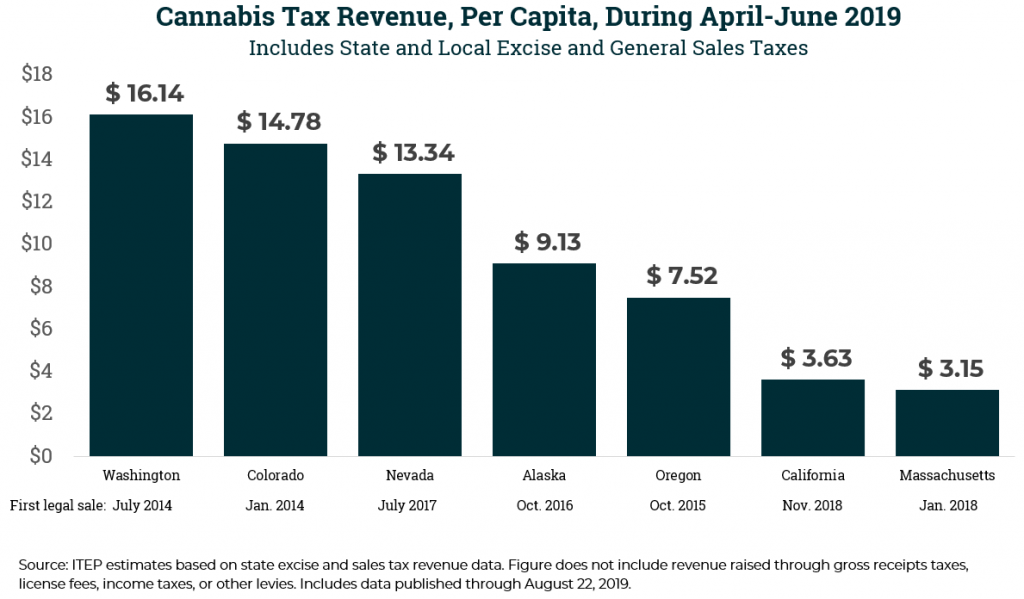

Why California’s Cannabis Market May Not Tell You Much about Legalization in Your State

August 22, 2019 • By Carl Davis

New tax data out of California, the world’s largest market for legal cannabis, tell a complicated story about the cannabis industry and its tax revenue potential. Legal cannabis markets take time to establish, and depending on local market conditions, the revenue states raise can vary significantly.

One Tax System for Most Americans, and a Second System for the Wealthiest

August 16, 2019 • By Matthew Gardner

Last year, the Walton family's fortune grew by $100 million a day. This level of wealth is particularly obscene in the context of the Walmart Corporation’s dark store strategy. The company works nationwide to reduce its property tax assessments, which, when successful, deprives local communities of revenue necessary to fund education, libraries, parks, public health and other services.

State Rundown 8/15: A Tax-Subsidy Cease-Fire in Kansas and Missouri

August 15, 2019 • By ITEP Staff

Over the last couple of weeks, leaders in Kansas and Missouri reached a historic agreement to stop giving away tax subsidies just to entice companies a couple of miles across their shared state line. Meanwhile, policymakers in Alaska resolved a stand-off over education funding...by cutting education funding slightly less. And California voters may be voting in 2020 on a stronger reform to the notoriously inequitable property tax effects of “Proposition 13.”

IRS’s SALT Workaround Regulations Should be Strengthened, Not Rejected

August 13, 2019 • By Carl Davis

Lawmakers are seeking to achieve a backdoor repeal of the $10,000 cap on deductions for state and local taxes paid (SALT) by invalidating recent IRS regulations that cracked down on schemes that let taxpayers dodge the cap. If successful, their efforts would drain tens of billions of dollars from federal coffers each year, with the vast majority of the benefits going to the nation’s wealthiest families.

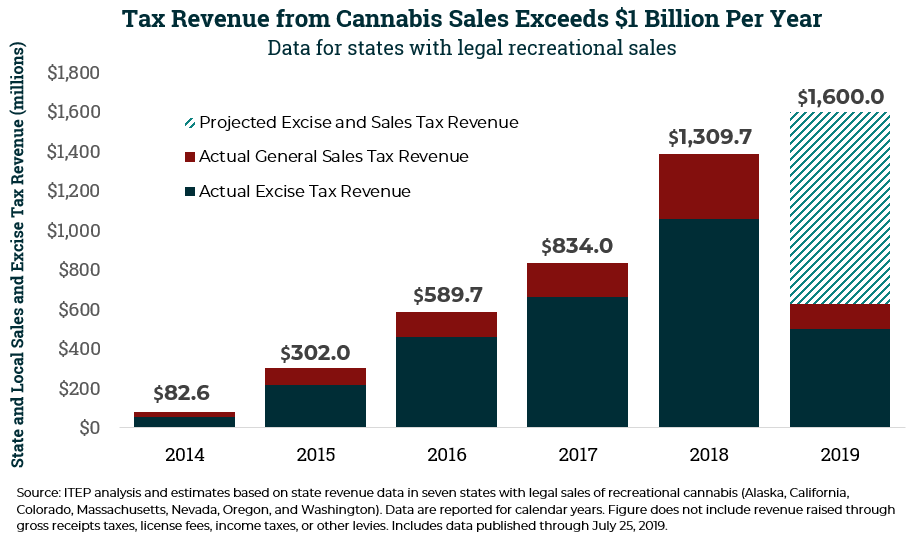

State and Local Cannabis Tax Revenue on Pace for $1.6 Billion in 2019

August 7, 2019 • By Carl Davis

Cannabis tax revenue is becoming more significant as legal sales grow. The tax is far from a budgetary panacea, but an ITEP analysis of revenue data reported by the seven states with legal cannabis sales underway suggests that excise and sales tax revenues from the sale of the drug could reach $1.6 billion this year.

Many States Move Toward Higher Taxes on the Rich; Lower Taxes on Poor People

July 18, 2019 • By Meg Wiehe

Several states this year proposed or enacted tax policies that would require high-income households and/or businesses to pay more in taxes. After years of policymaking that slashed taxes for wealthy households and deprived states of revenue to adequately fund public services, this is a necessary and welcome reversal.

Follow the Money to See How Sales Tax Holidays Are Poor Policy

July 17, 2019 • By Dylan Grundman O'Neill

Sales tax holidays are wasteful, misguided policies that will drain more than $300 million of funding away from shared priorities like schools, roads, and health care this year in 16 states, while delivering little benefit to the families that could most use the help. Our newly updated brief reviews recent developments in sales tax holiday policy—including how online sales taxes are changing the picture—and explains why they are a misguided policy option for states. And the story below “follows the money” to show how sales tax holidays are a bad deal for families and communities alike.