Blog

1298 posts

State Rundown 7/11: Some Legislatures Get Long Holiday Weekends, Others Work Overtime

July 11, 2017 • By ITEP Staff

Illinois and New Jersey made national news earlier this month after resolving their contentious budget stalemates. But they weren’t the only states working through (and in some cases after) the holiday weekend to resolve budget issues.

What do terrorists, opioid and human traffickers, corrupt government officials and tax evaders have in common? They all depend on the secrecy provided by anonymous shell corporations to allow them to finance and profit from their crimes. Momentum is building in the House and Senate to pass legislation that would strike against illicit finance in the United States and around the world by bringing an end to the anonymity provided by U.S. incorporation.

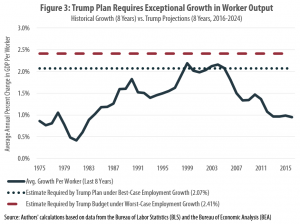

Last month, the Trump Administration released a budget proposal that relies on unrealistic projections of economic growth to create the illusion that it will balance the budget by 2027. By making the federal budget outlook appear more favorable than it actually is, the administration is seeking to bolster its case for enacting a multi-trillion-dollar tax cut. Fortunately, Congress has its own independent forecaster that just chimed in with a more rational assessment of the economy.

State Rundown 6/28: States Scramble to Finish Budgets Before July Deadlines

June 28, 2017 • By ITEP Staff

This week, several states attempt to wrap up their budget debates before new fiscal years (and holiday vacations) begin in July. Lawmakers reached at least short-term agreement on budgets in Alaska, New Hampshire, Rhode Island, and Vermont, but such resolution remains elusive in Connecticut, Delaware, Illinois, Maine, Pennsylvania, Washington, and Wisconsin.

Gas Taxes Will Rise in 7 States to Fund Transportation Improvements

June 28, 2017 • By Carl Davis

Summer gas prices are at their lowest level in twelve years, which makes right now a sensible time to ask drivers to pay a little more toward improving the transportation infrastructure they use every day. Seven states will be doing this on Saturday, July 1 when they raise their gasoline tax rates. At the same time, two states will be implementing small gas tax rate cuts.

Senate Health Care Reform Bill Just as “Mean” as the House Version

June 26, 2017 • By Alan Essig

The Congressional Budget Office today released its score of the Senate Health Care proposal and the news is not good. It’s no wonder a narrow group of 13 lawmakers cobbled together the bill behind closed doors. Now that the measure has seen the light of day, we know that it epitomizes Robin Hood in reverse policies by snatching health coverage from 22 million people by 2026 (15 million in 2018) while showering tax cuts on the already wealthy.

Rather than being known for its pioneering pharmaceuticals, Mylan is increasingly becoming infamous for its pioneering tax avoidance strategies. In 2015, Mylan used an inversion to claim that it is now based in the Netherlands for tax purposes. It is a Dutch company only on paper because ownership of the company was mostly unchanged and it continues to operate largely out of the United States. This maneuver has allowed the company to avoid millions in taxes on its earnings in the U.S. and abroad. But that’s not the end of Mylan’s innovation when it comes to tax planning. A new…

Explaining our Analysis of Washington State’s Highly Regressive Tax Code

June 22, 2017 • By Carl Davis

Supporters of creating a local personal income tax in Seattle are rightly concerned about the lopsided nature of their state’s tax code. In a 50-state study titled Who Pays?, produced using our microsimulation tax model, we found that Washington State’s tax system is the most regressive in the nation.

West Virginia Lawmakers Settle on Imperfect Budget, Delay Tax Debate for Next Session

June 21, 2017 • By Aidan Davis

West Virginia’s roller coaster ride of a session is nearing its tumultuous end. In a press conference this morning, Gov. Jim Justice announced that he will let the legislature’s most recent budget bill become law without his signature.

State Rundown 6/21: Crunch Time for Many States with New Fiscal Year on Horizon

June 21, 2017 • By Meg Wiehe

This week several states rush to finalize their budget and tax debates before the start of most state fiscal years on July 1. West Virginia lawmakers considered tax increases as part of a balanced approach to closing the state’s budget gap but took a funding-cuts-only approach in the end. Delaware legislators face a similar choice, […]

The GOP Health Plan Cuts Medicaid to Lower Taxes for the Richest 3 Percent

June 16, 2017 • By Alan Essig

The bill passed by the House of Representatives last month to repeal the Affordable Care Act (ACA) is the most unpopular legislation in decades. Lawmakers should reverse course and take the necessary time to put together legislation that would preserve or, better yet, improve access to health care. But this isn’t likely to happen because at its core, the American Health Care Act isn’t truly health care reform. It is tax cuts that disproportionately benefit the rich shrouded in legislative provisions that would weaken the existing health care law.

Which States Benefit from the Tax Cuts in the GOP Health Plan?

June 15, 2017 • By Steve Wamhoff

Congressional Republicans’ plans to repeal the two largest tax increases on individuals that were enacted as part of the Affordable Care Act (ACA) would disproportionately benefit residents of Connecticut, New York, the District of Columbia and 10 other states. The remaining states would receive a share of the tax cuts that is less than their share of the total U.S. population.

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

Gov. Sam Brownback’s tax experiment in Kansas was a failure. His radical tax cuts for the rich eventually had to be partly paid for through tax hikes on low- and middle-income families and also failed to deliver on promises of economic growth. Meanwhile, the tax cuts decimated the state’s budget, diminished its credit rating, and compromised its ability to meet the state’s constitutional standard of adequacy for public education.

One of the supposed selling points of the House GOP’s “Better Way” tax plan is that it will make the tax system so simple that you could do your taxes on a postcard. The reality, however, is that their promised postcard is a deception that would require numerous additional pages of worksheets to fill out. A better solution to making tax preparation simpler is called “return-free filing.” It does not just reduce your work to filling out a postcard, it could eliminate it altogether.

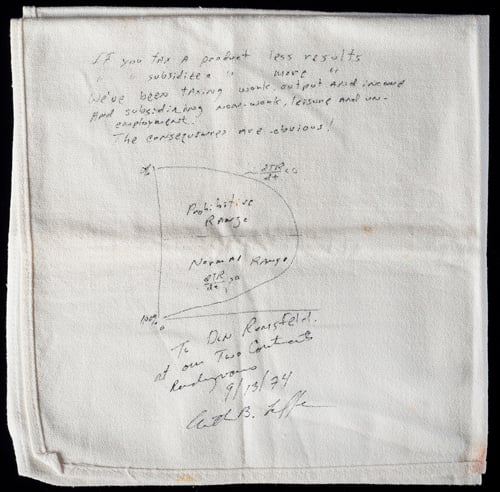

Sitting in the National Museum of American History in Washington, DC, hidden in the jumble of Americana like Thomas Jefferson’s desk, Michelle Obama’s inaugural gown and the ruby slippers worn in the Wizard of Oz, is a napkin with a drawing on it. Probably one of the least known exhibits in the museum, this napkin, quietly hiding behind glass lest some child wandering from a school group wipe his nose on it, has on several occasions destroyed the finances of the federal government and several state governments, most recently in Kansas.

This week, we celebrate a victory in Kansas where lawmakers rolled back Brownback's tax cuts for the richest taxpayers. Governors in West Virginia and Alaska promote compromise tax plans. Texas heads into special session and Vermont faces another budget veto, while Louisiana and New Mexico are on the verge of wrapping up. Voters in Massachusetts may soon be able to weigh in on a millionaire's tax, the California Senate passed single-payer health care, and more!

Oklahoma’s Budget Signed by Governor, but Long-Run Challenges Remain

June 2, 2017 • By Aidan Davis

On the last day of their legislative session, Oklahoma lawmakers finalized a $6.8 billion budget bill that was later signed by Gov. Mary Fallin. In the governor's statement on the bill, she noted that state agencies will be hard hit by the agreement--"it leaves many agencies facing cuts for the sixth year in a row"--and that while it does include some recurring revenue, it does not address the state's long-run structural budget challenges.

A truly populist budget would seek to ensure that middle- and low-income families have the resources that they need to get ahead, that the wealthy and corporations are paying their fair share in taxes, and that our country is making the public investments we need to ensure full employment and improve productivity over the long term. The Congressional Progressive Caucus’s (CPC) 2018 budget proposal would make real progress on all of these fronts.

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

Avocado Toast, iPhones, Billionairesplaining and the Trump Budget

May 30, 2017 • By Jenice Robinson

A couple weeks ago, a billionaire set the Internet ablaze when on 60 Minutes Australia he chided millennials to stop buying avocado toast and fancy coffee if they wanted to buy a home. The backlash was swift and deserved. Twenty- and early thirty-something people rightly took offense to the suggestion that they haven’t purchased homes […]

Besides Eviscerating the Safety Net, Trump Budget Would Put States in a Fiscal Bind

May 26, 2017 • By Misha Hill

There has been considerable discussion about the human impact of the Trump budget’s draconian cuts to what remains of the social safety net. A long-standing conservative talking point in response to such criticism is that states can pick up the tab when federal dollars disappear. But at a time when many states are facing budget shortfalls and the effect of federal tax reform is yet to be determined, it is outlandish to suggest that states are flush with cash to make up for federal spending reductions.

Congressional Hearing Highlights Problems with the Border Adjustment Tax

May 25, 2017 • By Richard Phillips

The debate over the so-called border adjustment tax (or BAT) took center stage this week when the House Ways and Means Committee held its first hearing on the topic. Despite strong support by the House Republican leadership and the Chairman of the Ways and Means Committee, Rep. Kevin Brady, the proposal faced an onslaught of criticism during the hearing from invited witnesses and members of both parties.

23 Million Uninsured Americans Is Too Great a Cost to Finance Tax Cuts for the Rich

May 24, 2017 • By Richard Phillips

The cost to give $1 trillion in tax cuts to the wealthy and corporations is 23 million uninsured Americans by 2026. This is the bottom-line take away from the much-awaited Congressional Budget Office (CBO) score of the American Health Care Act, which House Republicans rushed through the chamber and narrowly passed (217-213) in early May.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.