Blog

141 posts

Why Proponents of the Trump-GOP Tax Law Can’t Get their Story Straight

May 16, 2018 • By Steve Wamhoff

If you listened closely to today’s House Ways and Means Committee hearing on the Tax Cuts and Jobs Act (TCJA), you could sense that the witnesses speaking in favor of the new tax law were not 100 percent on the same page. This has been apparent ever since the law was enacted at the end of last year. The economists who speak in favor of the law (including Douglas Holtz-Eakin at today’s hearing) tend to focus on other indicators of its success. They know that the talk of bonuses and raises is nothing more than a desperate corporate PR campaign…

Apple’s Three-Month Tax Savings under President Trump’s New Tax Law: $1.68 Billion

May 2, 2018 • By Matthew Gardner

By now, it should come as no shock that profitable Fortune 500 corporations are reaping huge benefits from the corporate tax cuts enacted last December. But as first quarter earnings reports are released, we’re learning just how big.

15 Companies Report Tax Savings of $6.2 Billion in First Three Months of 2018

April 26, 2018 • By Matthew Gardner

In reports released over the past week, covering the first three months of 2018, a few of the biggest and most profitable Fortune 500 corporations acknowledge receiving billions in tax cuts in the first quarter of 2018 alone. Fifteen of these companies collectively disclosed reducing their effective tax rates by $6.2 billion compared to the rates they faced in the first quarter of last year.

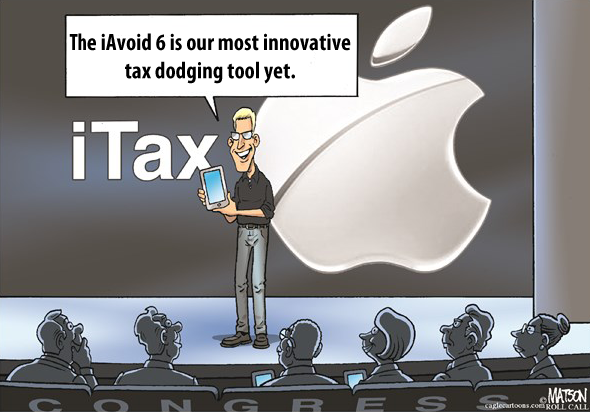

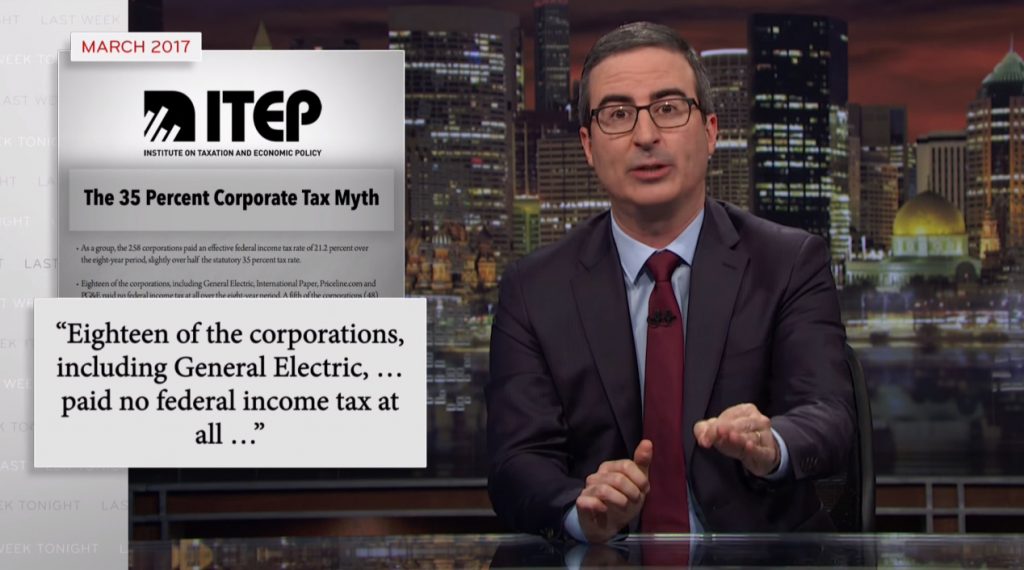

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

Is the Trump Organization’s Sales Tax Avoidance More Aggressive Than Amazon’s?

April 6, 2018 • By Carl Davis

In recent weeks, President Trump has been raking Amazon over the coals for failing to collect state and local sales taxes on many of the company’s sales—a criticism that has some merit. But a new story first reported by James Kosur at RedStateDisaster, and then picked up today by the Wall Street Journal, provides fascinating insight into the sales tax collection habits of the Trump Organization’s “official retail website,” TrumpStore.com.

Cities Fail to Disclose Tax Incentives in Bids for Amazon’s HQ2

April 3, 2018 • By Guest Blogger

The Amazon HQ2 project would be the biggest in U.S. history as measured in projected jobs, yet little is known about the incentives cities have offered Amazon to lure its second headquarters. This lack of disclosure prevents public participation in the deal, including raising important questions about whether tax incentives that cities are offering are in the best short- and long-term interest of their residents. This is the main finding of Public Auction, Private Dealings: Will Amazon’s HQ2 Veer to Secrecy Create A Missed Opportunity for Inclusive, Accountable Development?, a Good Jobs First study released today.

President Trump’s latest Twitter target, the Amazon Corporation, is now under the microscope for its state and local tax avoidance. In a Thursday tweet, the President claimed that “[u]nlike others, they pay little or no taxes to state & local governments.” Such a statement is a startling reversal for a president who previously said his own ability to avoid paying income taxes “makes me smart.”

Boeing Paid Tax Rate of 8.4% in Previous Decade, But Trump to Speak About Why It Needed His Corporate Tax Cut

March 14, 2018 • By Matthew Gardner

For the second time in seven months, President Trump will visit a Boeing factory to hype corporate tax cuts. He’s chosen the wrong poster child. If there was something preventing the aerospace giant from expanding its business before the Trump-GOP tax law, it certainly wasn’t taxes. Boeing made headlines in 2016 only because after years of paying zero in federal taxes, it finally paid something. Over 10 years (2008 to 2017), the company paid an effective federal tax rate of 8.4 percent on $54.7 billion of U.S. profits.

The tobacco company Reynolds American announced this week that its full-time employees will receive a one-time bonus of $1,000 in the wake of a sharp reduction in its British parent company’s tax bill.

Five Ways States Can Recoup Corporations’ Massive Federal Tax Giveaway

March 2, 2018 • By Aidan Davis

Corporate America is doing alright. Corporate profits soared last year, and 2018 has already brought a major windfall in the form of the Trump-GOP tax law, which dramatically cut the federal corporate tax rate from 35 percent to 21 percent and shifted to a territorial tax system, giving income earned offshore by U.S. companies a free pass by no longer making it subject to U.S. taxes.

Amazon Inc. Paid Zero in Federal Taxes in 2017, Gets $789 Million Windfall from New Tax Law

February 13, 2018 • By Matthew Gardner

The online retail giant has built its business model on tax avoidance, and its latest financial filing makes it clear that Amazon continues to be insulated from the nation’s tax system. In 2017, Amazon reported $5.6 billion of U.S. profits and didn’t pay a dime of federal income taxes on it. The company’s financial statement suggests that various tax credits and tax breaks for executive stock options are responsible for zeroing out the company’s tax this year.

The More Things Change: PG&E Records a Tenth Straight Year of No Federal Income Taxes

February 9, 2018 • By Matthew Gardner

In the runup to last fall’s tax debate, it was commonly observed that corporate tax reform is both easy and hard: the easy part is cutting the rate, and the hard part is paying for it by closing loopholes. The real test of Congress’ determination to achieve tax reform would be whether they would stand up to corporate lobbyists and shut down loopholes like accelerated depreciation that allow profitable companies to pay little or no income tax. As is now widely known, Congress was not especially determined: lawmakers aggressively cut the corporate rate from 35 to 21 percent, but then…

How Exxon’s Empty $50 Billion Promise Made Its Way into Trump’s SOTU

January 31, 2018 • By Matthew Gardner

Never one to let the truth get in the way of a good story, House Speaker Paul Ryan immediately published a press release with the headline, “ExxonMobil to Invest an Additional $50 Billion in the U.S. Due to Tax Reform.” The statement was completely faithful to ExxonMobil’s statement, except for the words “additional” and “due to tax reform.” Not to be outdone, President Trump implied during his State of the Union address that the company was investing $50 billion in response to the new tax law. But a closer examination of ExxonMobil’s recent history of domestic spending finds that the…

Moody’s and Conservative Economists Agree: The Trump Corporate Tax Cut Is Not Helping Workers

January 26, 2018 • By Steve Wamhoff

Moody’s does not believe that corporate tax cuts are trickling down to working people as bonuses and pay raises. The real problem with the corporate PR campaign is that even those economists who supported Trump’s corporate tax cut and claimed it would help workers do not believe that it works this way.

The Walt Disney Corporation announced this week that in the wake of the new tax bill’s passage, it will spend $125 million on one-time bonuses and $50 million on an education program for some employees, all in 2018. This $175 million spending commitment is notable for two reasons: it’s temporary, and it’s a drop in the bucket for a company that’s likely to see annual tax savings of $1.2 billion a year and has already committed to a $50 billion-plus corporate acquisition of 21st Century Fox’s assets.

Olympics-like Bidding for Amazon’s HQ2 Is a PR Stunt Meant to Extract Tax Subsidies

January 19, 2018 • By Guest Blogger

By Greg LeRoy Amazon.com’s announcement of a 20-site “short list” for its second headquarters, or “HQ2” location, is provoking a public backlash that could reshape how economic development is done in the United States. In one sense, Amazon is continuing to behave as predicted, staging a public-relations stunt apparently to extract the largest possible subsidies […]

Apple Gambled on Congressional Spinelessness on Tax Policy— and Won

January 18, 2018 • By Matthew Gardner

Now, Apple Inc. would like the American public to know that it has “a deep sense of responsibility to give back to our country” a small fraction of its multi-billion-dollar tax cut haul. However, the company’s splashy press release is devoid of any specifics on the jobs it will create as a result of the tax bill. Like other corporate announcements, the company’s recent proclamation of newfound patriotism should be viewed as a public relations ploy designed to convince a skeptical public that working families will see some trickle-down benefit from this historic corporate giveaway.

Walmart’s Minimum Wage Hike: Did the Tax System Make Them Do It?

January 12, 2018 • By Matthew Gardner

The Walmart corporation announced this week that it will increase its minimum wage to $11 an hour, in a move that the company attributed to the major corporate tax cut signed into law by President Trump last month. The $300 million the company will spend on the wage boost is just a fraction of the more than $2 billion a year ITEP estimates Walmart could net from the corporate tax rate cuts that took effect January 1—but even so, the company felt the need to make the wage boost more affordable by simultaneously closing 63 Sam’s Club stores and laying…

Corporate America, You Just Got a $650 Billion Tax Cut! What Are You Going to Do Next?

December 22, 2017 • By Matthew Gardner

While many Fortune 500 CEO’s likely had to restrain themselves from preemptively shouting “we’re going to Disneyland” in an homage to the Disney Corporation’s trademark ad spot involving the winner of each year’s Super Bowl, it’s pretty understandable that several of them—including known tax avoiders AT&T, Boeing, Comcast and Wells Fargo—would preemptively make grandiose promises that they will reserve part of their tax cuts for the little people who made it all possible.

The Manufacturing Deduction Is a Case Study in Tax Policy Gone Wrong

October 30, 2017 • By Richard Phillips

When you think of manufacturing, what comes to mind? According to the U.S. Congress, manufacturing may include things like the production of wrestling-rated films, assembling bouquets of flowers and even slicing cheesecake. These unusual definitions of manufacturing come from the domestic production activities deduction (better known as the manufacturing deduction), a tax break Congress created to encourage manufacturing in the United States.

The Corporate Tax Code is in Dire Shape, But Trump-GOP Plan Would Make It Worse

October 18, 2017 • By Richard Phillips

Just how bad has the corporate tax code gotten? The newest edition of Offshore Shell Games, a joint report by the Institute on Taxation and Economic Policy (ITEP) and U.S. PIRG, outlines the massive scale of the offshore tax avoidance undertaken by U.S. multinationals. It’s well known that Fortune 500 companies have accumulated a stash of $2.6 trillion in earnings offshore, which has allowed them to avoid an estimated $752 billion in taxes.

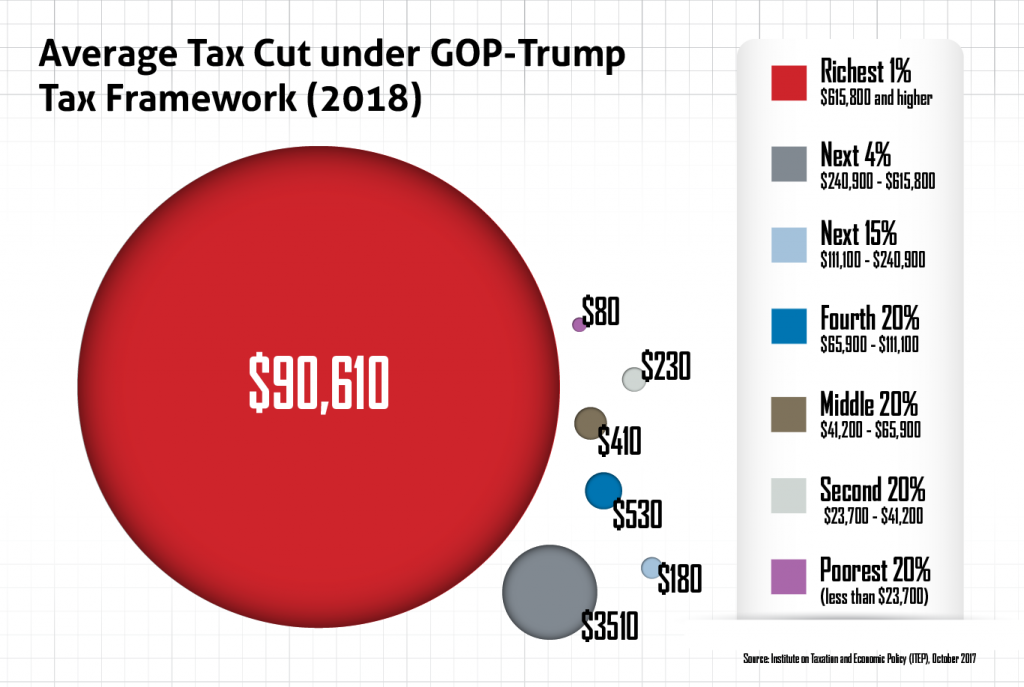

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]

The Trump-GOP tax plan is touted as plan for the middle-class but delivers a boon to the wealthy, throws a comparative pittance to everyone else and even includes a dose of tax increases for some middle- and upper-middle-income taxpayers. The data belie the rhetoric.

GOP Leaders Tout Corporate Tax Cuts at Boeing and AT&T, Companies that Already Have Single-Digit Tax Rates

August 23, 2017 • By Matthew Gardner

House Speaker Paul Ryan plans to visit a Boeing factory in Washington State tomorrow to promote the GOP’s ideas for tax reform, which include a deep cut in the corporate tax rate, while House Ways and Means Chairman Kevin Brady is bringing the same message today to employees of AT&T in Dallas. What is unclear is how much lower taxes for these companies can possibly go.