Reports

Revenue-Raising Proposals in the Evolving Build Back Better Debate

January 25, 2022 • By Steve Wamhoff

The United States needs to raise more tax revenue to fund investments in the American people. This revenue can be obtained with reforms that would require the richest and wealthiest Americans to pay their fair share to support the society that makes their fortunes possible.

Analysis of the House of Representatives’ Build Back Better Legislation

November 18, 2021 • By Carl Davis, Steve Wamhoff

If the bill becomes law, in 2022 federal taxes would go up for the average taxpayer among the richest one percent and down for the average taxpayer in other income groups.

The Impact of Work From Home on Commercial Property Values and the Property Tax in U.S. Cities

November 4, 2021 • By ITEP Staff

The fiscal implications of a decline in commercial property values are important because the property tax is the dominant local source of taxes, and commercial property makes up a significant portion of the property base in cities.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

Repealing the SALT Cap Would Wipe Out Revenue Raised by the House Ways and Means Bill’s Income Tax Provisions

September 23, 2021 • By Steve Wamhoff

There are several ways that the House leadership could avoid this problem. One approach is for lawmakers to replace the SALT cap with a different kind of limit on tax breaks for the rich that actually raises revenue and avoids disfavoring some states compared to others as the SALT cap does. ITEP has suggested a way to do this.

Tax Changes in the House Ways and Means Committee Build Back Better Bill

September 21, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

This report finds that the vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts -- expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) -- would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

Why Congress Should Reform the Federal Corporate Income Tax

September 17, 2021 • By Joe Hughes, Steve Wamhoff

It is reasonable for corporations (and, indirectly, their shareholders) to pay taxes to support the government investments that make their profits possible, such as the highways that facilitate the movement of goods and people, the education and health care systems that provide a productive workforce, the legal system and the protection of property, all of which are vital to commerce. Corporate tax avoidance allows wealthy and powerful individuals to reap enormous benefits from these investments without contributing their fair share to support them.

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

Corporate Tax Avoidance Under the Tax Cuts and Jobs Act

July 29, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

Thirty-nine profitable corporations in the S&P 500 or Fortune 500 paid no federal income tax from 2018 through 2020, the first three years that the Tax Cuts and Jobs Act (TCJA) was in effect. Besides the 39 companies that paid nothing over three years, an additional 73 profitable corporations paid less than half the statutory corporate income tax rate of 21 percent established under TCJA. As a group, these 73 corporations paid an effective federal income tax rate of just 5.3 percent during these three years.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

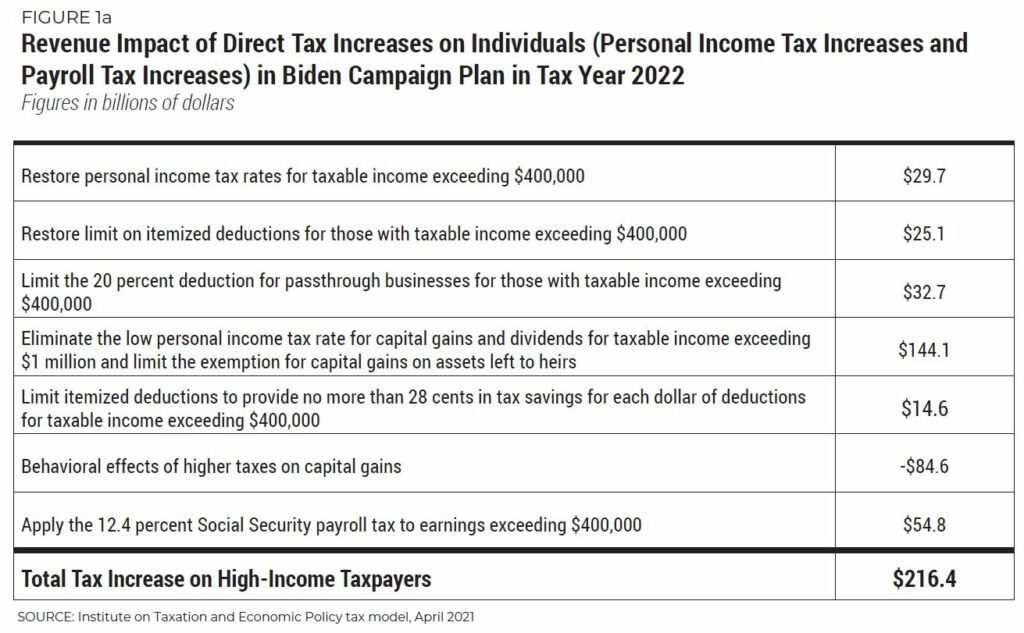

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

A Proposal to Simplify President Biden’s Campaign Plan for Personal Income Taxes and Replace the Cap on SALT Deductions

April 8, 2021 • By Steve Wamhoff

In this paper, we describe a tax policy idea that would simplify the proposals President Biden presented during his campaign to raise personal income taxes for those with annual incomes greater than $400,000. Our proposal would replace the cap on state and local tax (SALT) deductions with a broader limit on tax breaks for the rich that would raise more revenue than the personal income tax hikes that Biden proposed during his campaign. Our proposal would also achieve Biden’s goals of setting the top rate at 39.6 percent and raising taxes only on those with income exceeding $400,000.

55 Corporations Paid $0 in Federal Taxes on 2020 Profits

April 2, 2021 • By Matthew Gardner, Steve Wamhoff

At least 55 of the largest corporations in America paid no federal corporate income taxes in their most recent fiscal year despite enjoying substantial pretax profits in the United States. This continues a decades-long trend of corporate tax avoidance by the biggest U.S. corporations, and it appears to be the product of long-standing tax breaks preserved or expanded by the 2017 tax law as well as the CARES Act tax breaks enacted in the spring of 2020.

Read as PDF Note: This report is adapted from written testimony submitted by Amy Hanauer before testifying in person to the Senate Budget Committee on March 25, 2021. In 2020, the pandemic killed hundreds of thousands of Americans and unemployment soared to levels not seen since the Bureau of Labor Statistics started collecting data in […]

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

Estimates of Cash Payment and Tax Credit Provisions in American Rescue Plan

March 7, 2021 • By Steve Wamhoff

Update: On March 10, the House passed the Senate version of the COVID relief bill, called the American Rescue Plan Act, and sent it to President Biden for his signature. This means that the Senate version of the bill described herein is the final legislation enacted into law.

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

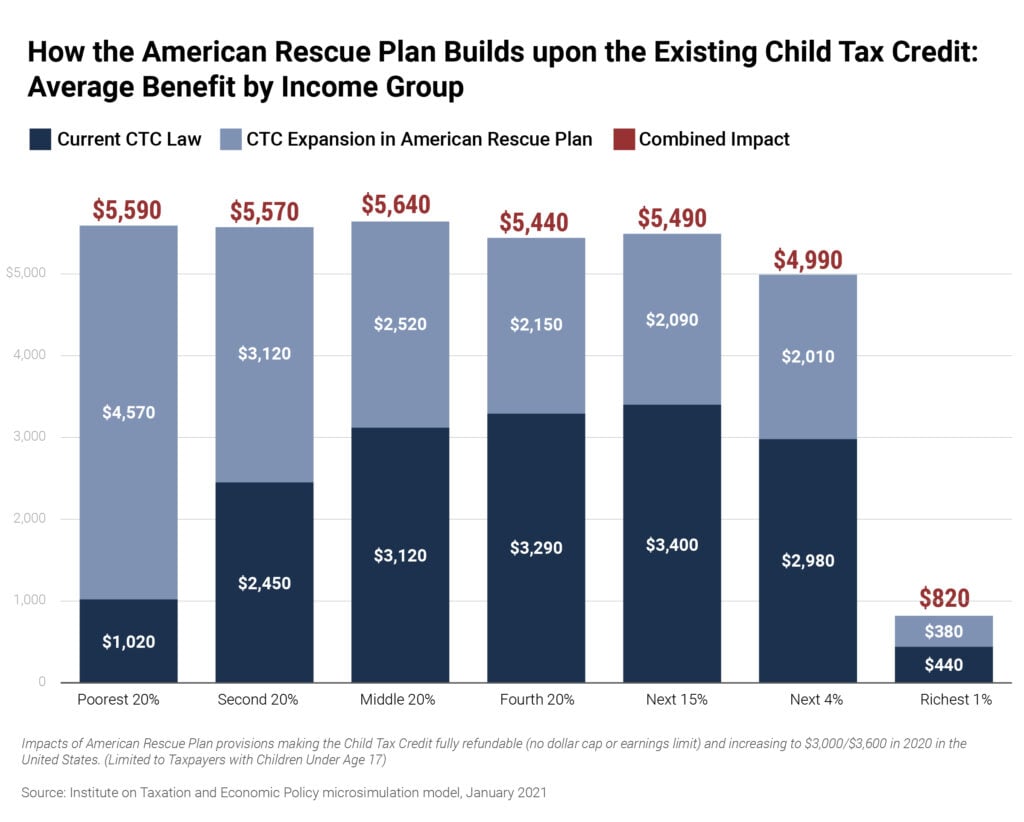

Child Tax Credit Enhancements Under the American Rescue Plan

January 26, 2021 • By Aidan Davis, Jessica Schieder

President Joe Biden’s coronavirus relief package, the American Rescue Plan, includes a significant expansion of the Child Tax Credit (CTC). The president’s proposal provides a $125 billion boost in funding for the program, which would essentially double the size of the existing federal credit for households with children. Combined with existing law, the CTC provisions in Biden's plan would provide a 37.4 percent income boost to the poorest 20 percent of families with children who make $21,300 or less a year.

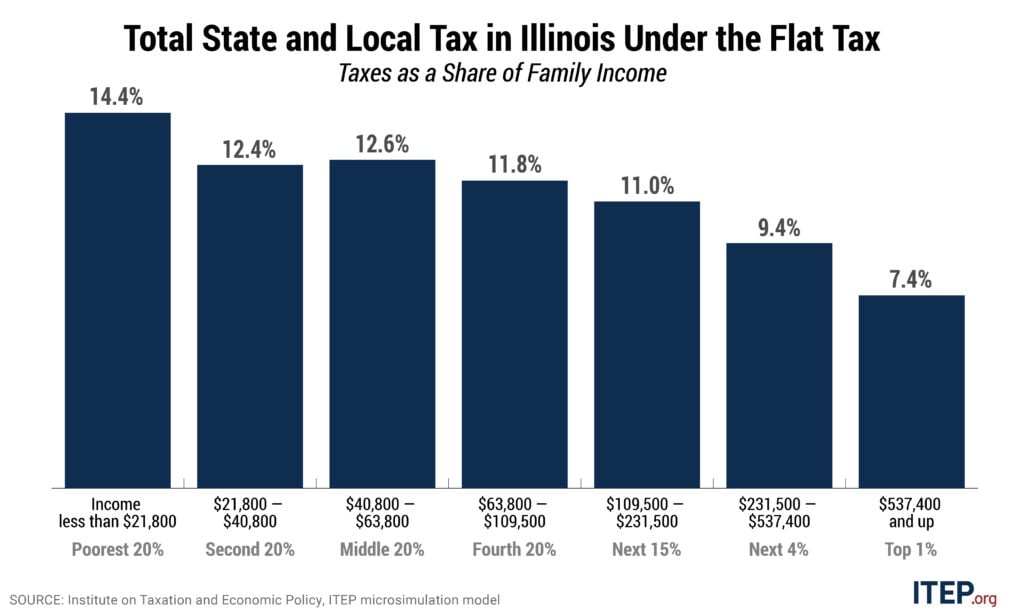

Illinois’s Flat Tax Exacerbates Income Inequality and Racial Wealth Gaps

September 17, 2020 • By Lisa Christensen Gee

Flat or graduated personal income taxes have varying effects on the annual individual tax liabilities of taxpayers at different income levels. Less examined is how tax structures affect income inequality and racial wealth gaps. This brief illustrates how Illinois’s historic flat income tax structure compares to the proposed Fair Tax through a multi-year retrospective analysis. It shows that Illinois’s flat income tax in lieu of a graduated rate tax used by most states amounts to a tax subsidy for the wealthiest Illinoisans that compounds income inequality and racial wealth gaps.

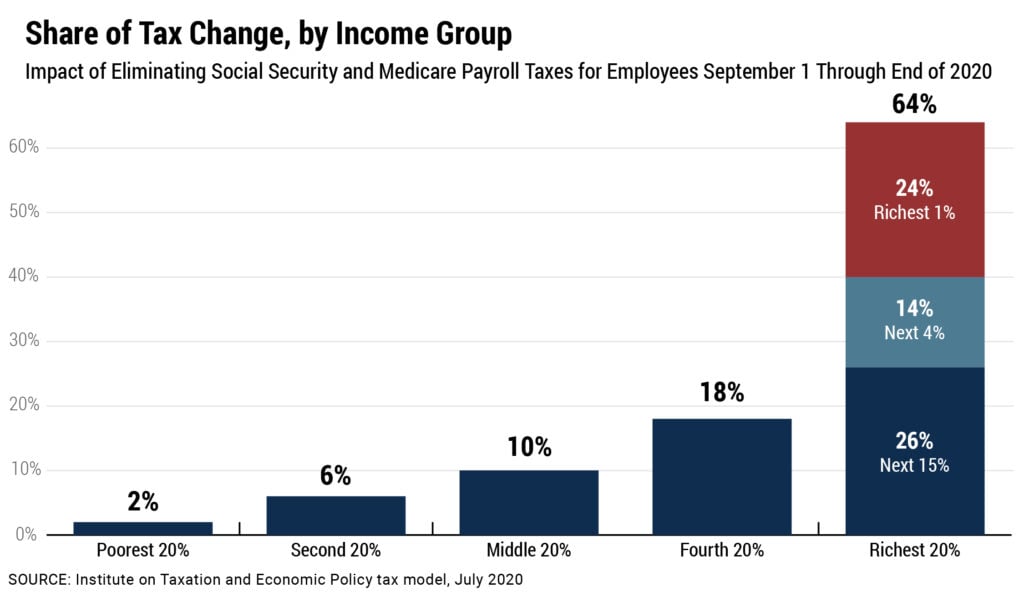

An Updated Analysis of a Potential Payroll Tax Holiday

July 21, 2020 • By Jessica Schieder, Matthew Gardner, Steve Wamhoff

ITEP estimates that if Congress and the president eliminated all Social Security and Medicare payroll taxes paid by employers and employees from Sept. 1 through the end of the year, 64 percent of the benefits would go the richest 20 percent of taxpayers and 24 percent of the benefits would go to the richest 1 percent of taxpayers, as illustrated in the table below. The total cost of this hypothetical proposal would be $336 billion.

Trade Deals Aren’t Enough: Fixing the Tax Code to Bring American Jobs Back

July 16, 2020 • By Amy Hanauer

We all need the public sector to protect public health, keep us safe, educate our children, and much more. Companies, particularly multinational corporations, could not function without the legal, infrastructure, financial, regulatory, health, and transportation resources that the government provides.

Who Pays Taxes in America in 2020?

July 14, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

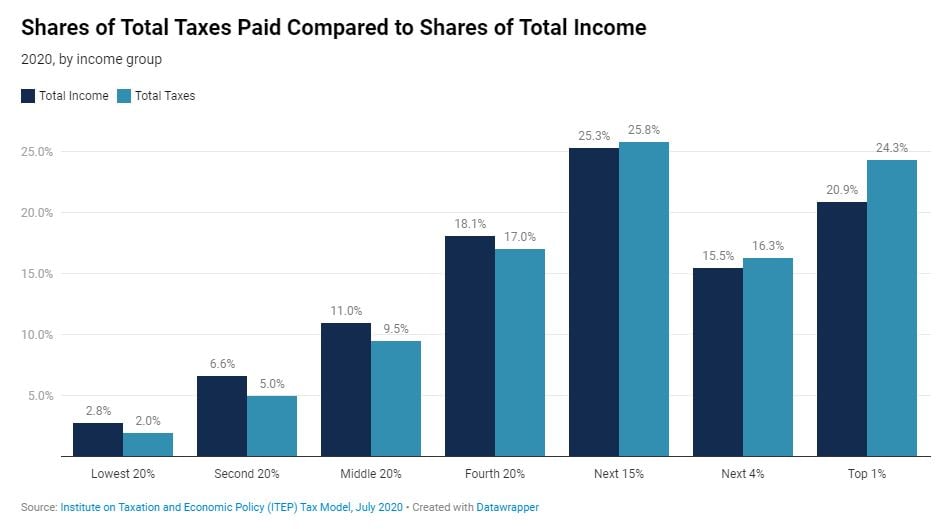

Having a sound understanding of who pays taxes and how much is a particularly relevant question now as the nation grapples with a health and economic crisis that is devastating lower-income families and requiring all levels of government to invest more in keeping individuals, families and communities afloat. This year, the share of all taxes paid by the richest 1 percent of Americans (24.3 percent) will be just a bit higher than the share of all income going to this group (20.9 percent). The share of all taxes paid by the poorest fifth of Americans (2 percent) will be just…

Republican Tax Credit Proposal Would Provide New Breaks to Tax Avoiders Like Amazon and Netflix

June 30, 2020 • By Matthew Gardner, Steve Wamhoff

While lawmakers of both parties and policy experts discuss various ways to respond to the continuing COVID-19 crisis and resulting economic downturn, Republicans in Congress are offering a new solution. Their idea, which is still being discussed, is to waive existing limits on business tax credits. This could benefit corporations that are profitable but that nonetheless pay no taxes or very little in taxes because of the many tax breaks and legal loopholes they already enjoy.

Depreciation Breaks Have Saved 20 Major Corporations $26.5 Billion Over Past Two Years

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

The Trump administration and its congressional allies have proposed making permanent the expensing provision in the Trump-GOP tax law. Expensing is the most extreme form of accelerated depreciation, which allows businesses to deduct the cost of purchasing equipment more quickly than it wears out. But expensing and other types of accelerated depreciation already account for a very large share of corporate tax breaks and allows many companies to pay nothing at all.

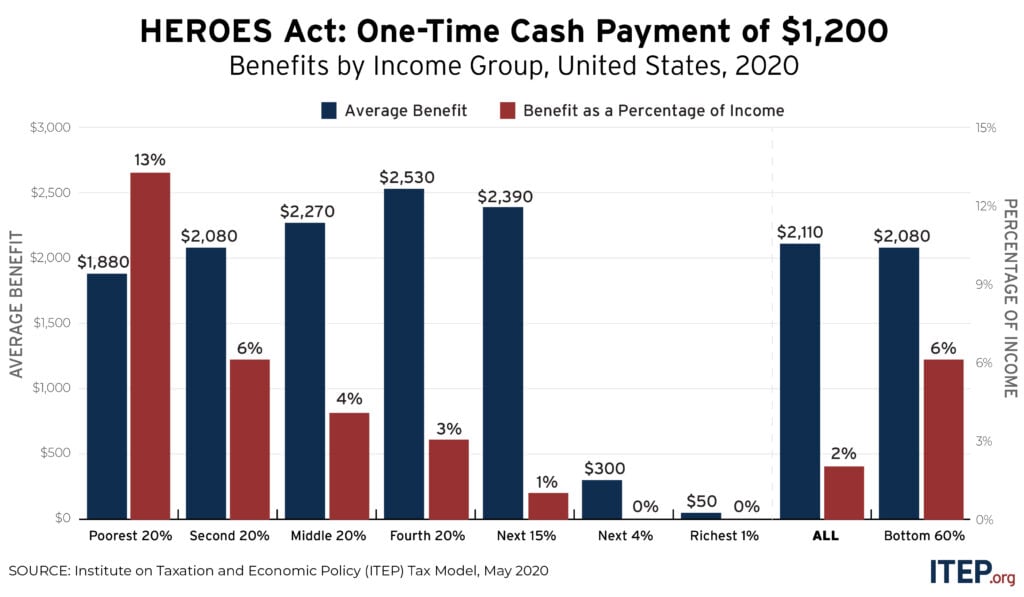

Major Cash Payment and Tax Provisions in the HEROES Act

May 15, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The major provisions for cash payments and tax changes in the House Democrats’ Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act would provide nearly $600 billion to individuals and households and average benefits of more than $3,000 to families in all but the highest income levels.