Refundable Tax Credits

Trump Megabill’s Deduction for Car Loan Interest Would Not Offset Tariff-Related Auto Price Increases for Most Buyers

June 12, 2025 • By Carl Davis, Sarah Austin

The auto loan interest deduction that recently passed the House is designed, at least in part, to mitigate the impact of tariff-induced price increases on vehicles assembled in America. But the deduction is incapable of offsetting even small-scale price increases, especially for working-class families and others with moderate incomes.

Millions of Citizen Children Would be Harmed by Proposal Billed as Targeting Immigrant Tax Filers

April 24, 2025 • By Emma Sifre, Joe Hughes

Congressional Republicans have floated a proposal to strip the Child Tax Credit from millions of children who are U.S. citizens and legal residents in situations where their parents do not have Social Security numbers. Approximately 4.5 million citizen children with Social Security numbers would lose access to the credit under this proposal.

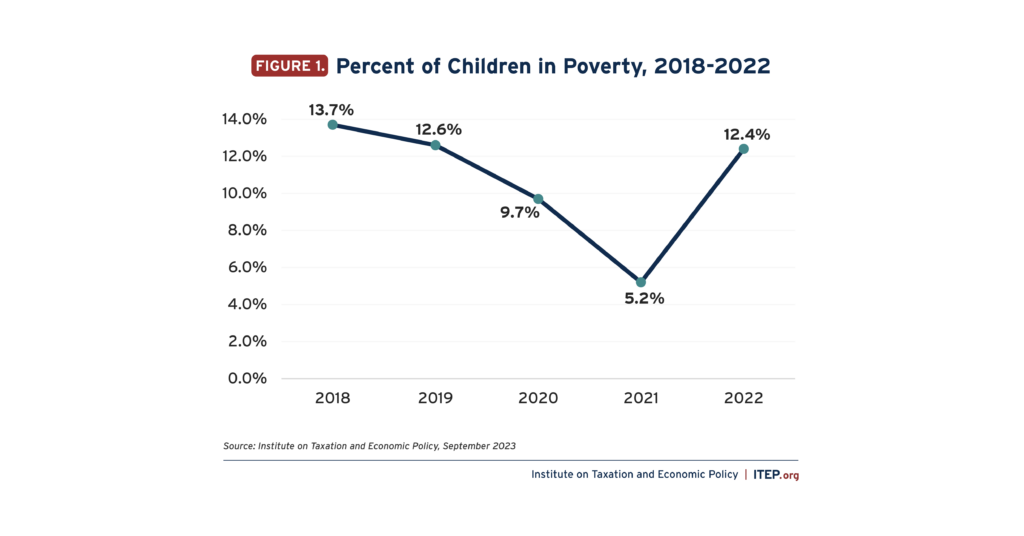

Expanded Child Tax Credit is Key to Reducing Child Poverty, New Census Data Illustrate

September 10, 2024 • By Jon Whiten

From 2021-2023, child poverty has more than doubled from 5.2 to 13.7 percent. The latest Census data make clear that lawmakers have the tools to help millions of children and their families – and it’s beyond time they take action.

The no tax on tips idea isn't a new one, but it's always been abandoned because it's practically impossible to do without creating new avenues for tax avoidance. Despite its embrace by the candidates from both major parties, this policy idea would do little to help the roughly 4 million people who work in tipped occupations while creating a host of problems.

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

Every child deserves the opportunity to succeed in society – and tax policy has a huge role to play in making that happen. Better tax policy can help prepare our young children with skills to become successful and thriving adults.

Impacts of the Tax Relief for American Families and Workers Act

February 2, 2024 • By Joe Hughes, Steve Wamhoff

The Tax Relief for American Families and Workers Act passed by the House of Representatives on January 31 is a compromise between lawmakers who want to address child poverty and lawmakers who want to expand the Trump tax cuts for corporations and therefore includes provisions that do both. It also offsets the costs of those […]

Proposed Tax Deal Would Help Millions of Kids with Child Tax Credit Expansion While Extending Damaging Corporate Tax Breaks

January 16, 2024 • By Joe Hughes

On January 16, Congressional tax writers officially announced the details of a tax policy agreement. The deal includes expansions of the Child Tax Credit (CTC) to improve access for low- and middle-income families as well as expansions of the 2017 Trump tax cuts for businesses. The agreement also includes bipartisan tax priorities tax provisions for […]

Lapse of Expanded Child Tax Credit Led to Unprecedented Rise in Child Poverty

September 12, 2023 • By Joe Hughes

The new Census data should provide both concern and optimism for lawmakers. The steep rise in child poverty is an inexcusable tragedy. But it shows that child poverty is avoidable when Congress makes the decision to make tax policy for those who need the hand up rather than for the rich and powerful.

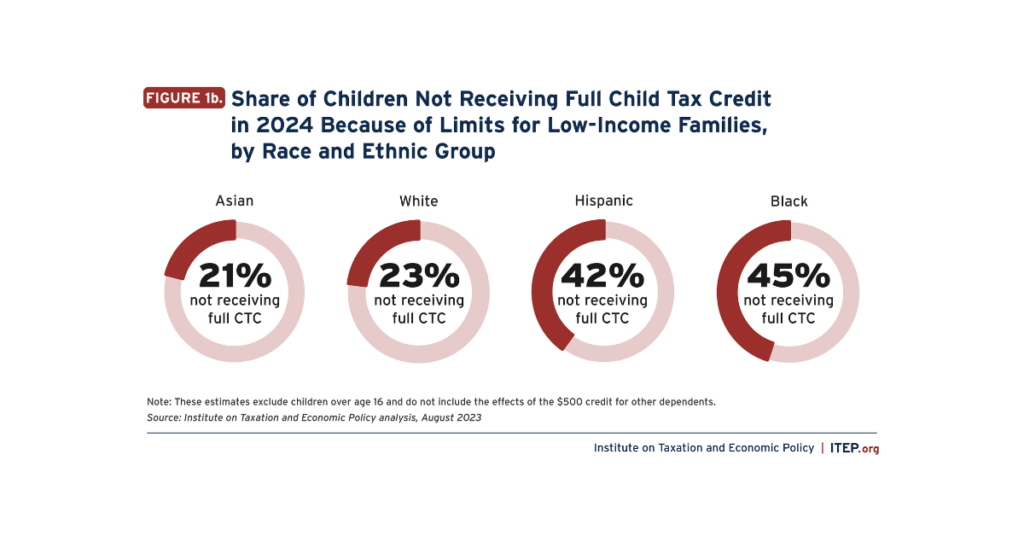

Expanding the Child Tax Credit Would Advance Racial Equity in the Tax Code

August 29, 2023 • By Emma Sifre, Joe Hughes

Expanding the federal Child Tax Credit to 2021 levels would help nearly 60 million children next year. It would help the lowest-income children the most and would particularly help children and families of color.

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids, Especially Those in Families with Low Incomes

June 13, 2023 • By Joe Hughes

Restoring the federal Child Tax Credit to 2021 levels would benefit nearly 60 million children. Three-quarters of the benefit would go to families in the bottom three quintiles, consisting of households with less than $86,600 in income.

Why is My Refund So Much Smaller This Year? Only the Good (Tax Credits) Die Young.

April 18, 2023 • By Joe Hughes

This year millions of American families are finding that their refunds are much smaller than last year—or that they even owe taxes back to the government—because of the expiration of the expanded Child Tax Credit and Earned Income Tax Credit that were in effect in 2021. The lapse of the expanded credits affects a majority of the middle class, but lower-income households are particularly likely to feel the sting.

Effects of President Biden’s Proposal to Expand the Child Tax Credit

March 16, 2023 • By Joe Hughes

In his latest budget proposal, President Biden proposes enhancing the Child Tax Credit (CTC) based on the temporary credit that was in effect for 2021 as part of the American Rescue Plan Act. In this report we analyze how that proposal would help children and families.

The Tax Deal That Wasn’t: Congress Decides Corporate Tax Cuts Are Too Expensive if it Means Also Helping Children

December 20, 2022 • By Joe Hughes

Congressional leaders announced their long-awaited omnibus spending package which will fund the government through September 2023. The good news: the bill does not include needless corporate tax giveaways. The bad news: it also leaves out any expansion of the child tax credit.

Child Tax Credit Expansion Would Shrink the Racial Wealth Gap

November 21, 2022 • By ITEP Staff

Extending the expanded Child Tax Credit would benefit nearly every child in low- and middle-income families. Under current rules, 24% of white children, 45% of Black children, and 42% of Hispanic children will not receive the full credit in 2023 because their families make too little. These figures would drop to zero if the provisions were extended, helping families of all races and disproportionately helping families of color.

Key Republicans Say Negligible Decline in Economic Growth Outweighs Enormous Drop in Child Poverty

November 3, 2022 • By Joe Hughes

The expanded Child Tax Credit reduced child poverty dramatically and immediately. There is no debate or murkiness on this. Some lawmakers have decided that cutting child poverty in half is not worth the cost if it means an ambiguous and negligible decline in GDP growth. This view is not just cruel, it is bad economics.

Congress Should Not Leave Children Out of Possible Year-End Tax Deal

October 3, 2022 • By Steve Wamhoff

If lawmakers believe it’s worthwhile to extend corporate tax breaks, then it would be entirely unreasonable for them to not conclude the same about tax provisions that help low-income children.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

Romney Child Tax Credit Plan Would Leave Millions of Children Worse Off and Raise Taxes for the Average Black Family

September 7, 2022 • By Steve Wamhoff

Sen. Romney’s plan would expand the Child Tax Credit and offset the costs by scaling back other tax benefits. All told, it would raise taxes on a fourth of all kids in the U.S. This includes about a fourth of the children among the poorest fifth of U.S. families.

Long-term troubles for this country and this planet now demand our attention. Progressive tax policy would transform our ability to tackle them.

Women’s History Month is a Reminder that Sensible Tax Policy is Central to Women’s Economic Security

March 24, 2022 • By Brakeyshia Samms

Women’s History Month is a chance to remember what happens for women when tax policy becomes more progressive, boosts income, and helps make raising a family more affordable.

What We Can Learn Today from the American Rescue Plan – and Sen. Rick Scott’s Proposed Tax Increases

March 11, 2022 • By Steve Wamhoff

The success of the American Rescue Plan Act is worth revisiting today. Instead of pursuing Sen. Rick Scott’s agenda of making life more difficult for those already working the hardest, Congress should extend or make permanent some of the beneficial policies in ARPA.

President Biden should elevate his tax and revenue proposals which remain essential if we are to pay for environmental restoration, health priorities and peacekeeping, the front-burner items that may dominate the speech.

The Compelling Data and Moral Case for Continuing the Child Tax Credit Expansion

January 14, 2022 • By Alex Welch, ITEP Staff, Jenice Robinson

In just six short months, the enhanced Child Tax Credit (CTC), enacted as part of the American Rescue Plan (ARP), decreased the number of children living in poverty by 40 percent. ITEP estimated that the lowest-income 20 percent of households with children would receive a 35 percent income boost from this policy alone in 2021. This is a meaningful, life-changing sum.

The Problem with Returning to a $2,000 Non-Refundable Child Tax Credit

January 13, 2022 • By Joe Hughes

Prior to last year, more than one in three children lived in households with incomes too low to receive the full $2,000 credit because it is not fully refundable. This means earnings requirements and other limits reduce the amount tax filers can receive as a refund. In fact, the maximum refundable portion is reduced to $1,400 (less than half of the maximum refundable credit available in 2021).

Refundable credits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) boost the economic security of working families. ITEP examines how such tax credits affect working people’s incomes and how this would change under proposals to modify the credits or create new ones.