Tax Reform Options and Challenges

Which States Benefit from the Tax Cuts in the GOP Health Plan?

June 15, 2017 • By Steve Wamhoff

Congressional Republicans’ plans to repeal the two largest tax increases on individuals that were enacted as part of the Affordable Care Act (ACA) would disproportionately benefit residents of Connecticut, New York, the District of Columbia and 10 other states. The remaining states would receive a share of the tax cuts that is less than their share of the total U.S. population.

One of the supposed selling points of the House GOP’s “Better Way” tax plan is that it will make the tax system so simple that you could do your taxes on a postcard. The reality, however, is that their promised postcard is a deception that would require numerous additional pages of worksheets to fill out. A better solution to making tax preparation simpler is called “return-free filing.” It does not just reduce your work to filling out a postcard, it could eliminate it altogether.

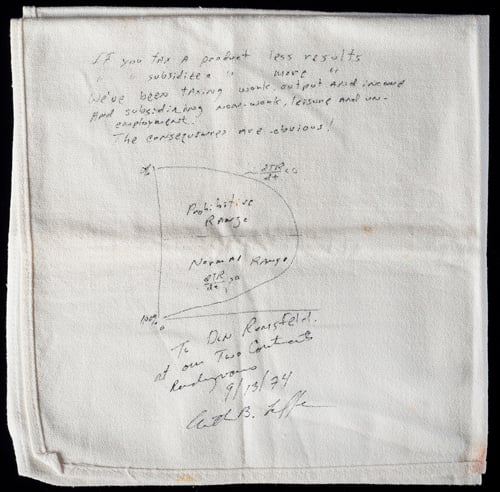

Sitting in the National Museum of American History in Washington, DC, hidden in the jumble of Americana like Thomas Jefferson’s desk, Michelle Obama’s inaugural gown and the ruby slippers worn in the Wizard of Oz, is a napkin with a drawing on it. Probably one of the least known exhibits in the museum, this napkin, quietly hiding behind glass lest some child wandering from a school group wipe his nose on it, has on several occasions destroyed the finances of the federal government and several state governments, most recently in Kansas.

Congressional Hearing Highlights Problems with the Border Adjustment Tax

May 25, 2017 • By Richard Phillips

The debate over the so-called border adjustment tax (or BAT) took center stage this week when the House Ways and Means Committee held its first hearing on the topic. Despite strong support by the House Republican leadership and the Chairman of the Ways and Means Committee, Rep. Kevin Brady, the proposal faced an onslaught of criticism during the hearing from invited witnesses and members of both parties.

ITEP’s Commitment to Being a Voice for Low-, Moderate- and Middle-Income People in Tax Policy Debates

May 22, 2017 • By Alan Essig

A strong voice for working people in federal and state tax policy debates is absolutely critical. Sound, progressive tax policies make all the difference between high-quality educational systems or crowded classrooms with limited resources. They account for the difference between structurally sound roads and bridges or potholes and other crumbling infrastructure. At the federal level, good tax policy means raising enough revenue so the nation can adequately fund child care and early education, health care, food inspection, national parks, and a clean, safe environment among other things.

President Donald Trump’s tax sketch released in late April is the starting point for federal tax reform discussions. For now, the sketch includes too few details to properly analyze its revenue and distributional impacts, but based on limited information, corporations and the wealthy stand to benefit most. Below are resources ITEP has produced on tax […]

If lawmakers truly want to create an environment in which economic mobility is possible for more working people, budget-busting tax cuts are the wrong way to achieve this goal. Dramatic tax giveaways would force cuts to programs that provide early education, health care, job training, affordable housing, nutrition assistance, and other vital services that promote economic mobility. Further, current tax proposals from Congress and the Trump Administration defy what most Americans would consider true reform and, instead, embrace supply-side economic theories. This policy brief outlines two sensible, broad objectives for meaningful federal tax reform and discusses six tax policies that…

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding the tax plan released today by the Trump Administration. The administration has said that this plan will be the “largest tax cut in history.” “The Trump tax plan is not tax reform but a massive tax cut […]

GOP Obamacare Repeal Would Slash Taxes on the Wealthy At the Expense of Middle- and Low-Income Families

March 7, 2017 • By Richard Phillips

On Monday, House Republicans released legislation that would repeal or modify many of the most significant portions of the Affordable Care Act (ACA). A central theme of the GOP plan is that it would significantly cut funding for low- and middle-income families’ health care, while eliminating the ACA’s expansion of Medicare taxes on the wealthiest […]

Fact-Checking Tax Policy Points in President Trump’s Address to Congress

March 1, 2017 • By Richard Phillips

Despite some expectations that President Donald Trump would use his address to a joint session of Congress to lay out more details of his plan for tax legislation, the speech was extremely light on details. The few details mentioned were largely misleading or outright erroneous. Below we break down four tax-related statements from President Trump’s […]

Congress Shouldn’t Defy Public Opinion and Good Policy by Cutting Taxes for Corporations and the Wealthy

January 17, 2017 • By Richard Phillips

Members of Congress have floated fundamental changes to the tax code for years, but last week marked a ramping up of these efforts as Republican Speaker of the House Paul Ryan met with President-elect Donald Trump and his advisors to discuss how to move forward with tax reform in 2017. Plans floated by the incoming […]

State of Play: The Coming Debate Over the Ryan and Trump Tax Plans

January 17, 2017 • By Richard Phillips

If the incoming Trump Administration and Republican-lead Congress have their way, fundamental changes to the tax code are afoot. The most important similarity between the Ryan and Trump tax plans are dramatic reductions in the corporate tax rate and across-the-board tax cuts whose benefits primarily flow to the richest Americans. Because of their potentially catastrophic […]

Fact Sheet: Comparison of House GOP Tax Plan, Trump’s Initial Tax Proposal and Trump’s Revised Tax Proposal

November 15, 2016 • By ITEP Staff

Chart comparing House GOP Tax Plan, Trump's Initial Tax Proposal and Trump's Revised Tax Proposal.

The Camp Tax Plan Is a Regressive $1.7 Trillion Tax Cut

April 7, 2014 • By ITEP Staff

The Chairman of the House Ways and Means Committee, Dave Camp (R-Mich.), has a tax overhaul plan that would cut the top personal income tax rate down from about 40 percent to 35 percent and slash the corporate tax rate from 35 percent to 25 percent. Camp claims his plan would still break even revenue-wise […]

In short, while not all “tax expenditures” are evil, many of them undermine tax fairness, impede economic growth and divert scarce tax dollars away from better uses. If we hope to “reinvent government” to make it more effective and less burdensome—in short, a better deal for ordinary American families—then scaling back wasteful and pernicious tax […]

In addition to distributional analyses of existing and proposed tax law, ITEP provides policy recommendations for lawmakers to build a more equitable tax code, from progressive revenue-raising options to corporate tax reform to establishing a model for a wealth tax.