COVID-19

Lawmakers continue to examine how to respond to the continually evolving economic crisis, precipitated by COVID-19. ITEP’s unique contribution to the policy debate is its rapid analyses of economic stimulus and relief plans. Decisions made now will have short- and long-term implications for families, communities and state and local governments. We are committed to providing distributional analyses of how all proposals affect people across the income spectrum. When possible, we also will provide analyses for all 50 states.

Depreciation Breaks Have Saved 20 Major Corporations $26.5 Billion Over Past Two Years

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

The Trump administration and its congressional allies have proposed making permanent the expensing provision in the Trump-GOP tax law. Expensing is the most extreme form of accelerated depreciation, which allows businesses to deduct the cost of purchasing equipment more quickly than it wears out. But expensing and other types of accelerated depreciation already account for a very large share of corporate tax breaks and allows many companies to pay nothing at all.

Trump Administration Stops Pretending to Care About the Economy with Its Capital Gains Tax Proposal

May 28, 2020 • By Steve Wamhoff

Proponents of capital gains tax breaks have always offered a weak argument that they encourage investment and thereby grow the economy. But the Trump administration is now floating a temporary capital gains tax break, which is supported by no argument at all. It would only reward investments made in the past while doing nothing to encourage new investment.

The Health Economic Recovery and Omnibus Emergency Solutions (HEROES) Act includes important changes to business tax provisions in the CARES Act, the most recent COVID-19 legislation enacted by Congress and the president. The House-passed plan would undo CARES Act changes that make it easy for businesses to claim losses to reduce or avoid all taxes. […]

Major Cash Payment and Tax Provisions in the HEROES Act

May 15, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

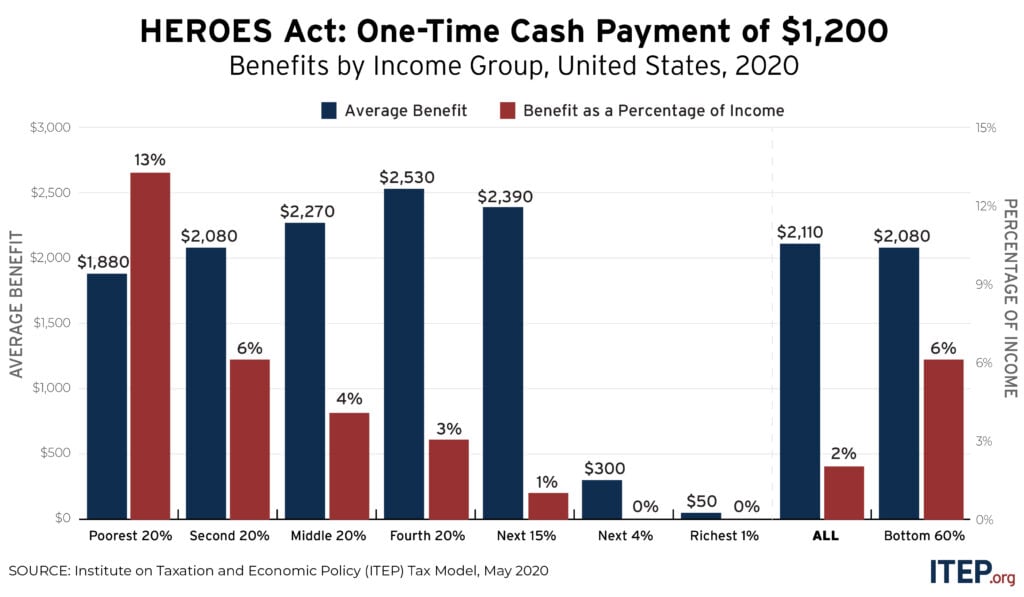

The major provisions for cash payments and tax changes in the House Democrats’ Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act would provide nearly $600 billion to individuals and households and average benefits of more than $3,000 to families in all but the highest income levels.

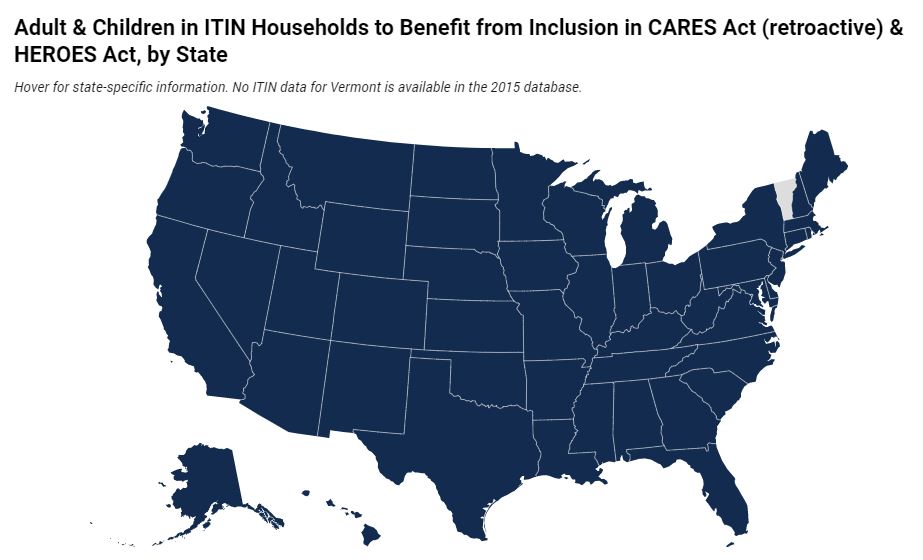

The HEROES Act, filed by the House Democrats this week, includes a new one-time payment of $1,200 per adult and child and extends the payment to ITIN filers and their families. The bill also includes a retroactive change to the CARES Act ensuring ITIN filers will also receive the initial payment under the CARES Act. ITEP estimates more than 4.3 million adults and 3.5 million children would benefit from this change.

Fiscal Policy Institute: Unemployment Insurance Taxes Paid for Undocumented Workers in NYS

May 14, 2020

In the midst of a pandemic, there has been a growing call for undocumented immigrants, who make up five percent of the New York State labor force, to be covered by some form of unemployment insurance. What is often overlooked in discussions of unemployment insurance is the extent to which undocumented immigrants are already part […]

House Democrats today introduced a proposal that responds to our staggering economic crisis with the right policies at the necessary scale. It’s a refreshing change from some of the misdirected ideas that have passed or been floated in these alarming economic times.

Which Workers Wouldn’t Be Helped by a Payroll Tax Cut?

May 8, 2020 • By Jessica Schieder, Lorena Roque

New data released today estimates 20.5 million jobs were lost in the month of April alone. Workers not currently receiving paychecks would be left out of any benefits provided by a payroll tax cut.

ITEP: White House Seeks to Exploit COVID-19 Crisis to Enact Unpopular Tax Cuts

May 6, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the Trump administration’s musings to respond to the COVID-19 health and economic crisis with tax cuts.

Trump’s Latest Tax Break Proposals Include Everything—Except Helping Regular People

May 6, 2020 • By Steve Wamhoff

None of the tax proposals considered by the administration would provide help to those who need it or do much, if anything, to boost investment.

Trump’s Payroll Tax Cut Makes Even Less Sense as Job Losses Mount

May 5, 2020 • By Steve Wamhoff

Last August, long before COVID-19 ravaged the U.S. economy, the Trump Administration began touting a payroll tax cut as a stimulus. Now, with more than 30 million official unemployment claims and projections that the jobless rate could grow to Depression-era levels, the White House is claiming that a payroll tax cut is the best way […]

Intended Consequences: Deliberate Disinvestment Caused Florida’s Unemployment Disaster

May 4, 2020 • By Stephanie Clegg

Florida politicians deliberately rigged the unemployment system after the Great Recession to avoid raising taxes on businesses. Now, in a pandemic, some out-of-work residents are left waiting more than six weeks for unemployment benefits while more than 280,000 others have been inexplicably denied. What’s happening in Florida underscores deeper challenges with systems that should help those in need, but instead are designed to fail them.

COVID-19 has revealed a policy apparatus that reflexively prioritizes those who need it least, a wholly inadequate safety net, an underfunded public health infrastructure, and an inefficient national health stockpile. If the nation stays this course, it will make only cosmetic restorations to a shoddily built house.

A bipartisan group of governors and senators from Louisiana to Maryland to Ohio have called for at least $500 billion in state and local fiscal relief. They also need specific help with testing, protective equipment, unemployment costs, Medicaid costs, social services, education and infrastructure. States can’t be on their own as they address the double whammy of plunging revenue and skyrocketing needs.

Pandemic Profits: Netflix’s Record Profit Haul, Past Tax Avoidance Raise Questions about Tax Law’s Weaknesses

April 29, 2020 • By Matthew Gardner

At a time when many companies are facing existential threats due to the COVID-19 pandemic and associated economic shutdown, it is vital to ensure that our corporate tax laws apply fairly to companies that are still turning a profit in these turbulent times.

The CARES Act Provision for High-Income Business Owners Looks Worse and Worse

April 24, 2020 • By Steve Wamhoff

A select group of millionaires will receive an average tax break of $1.6 million thanks to a CARES Act provision that is receiving delayed but well-deserved scrutiny. Wealthy business owners are receiving this windfall because the CARES Act provides tax breaks to people with losses from a business they own. This approach may seem sensible because businesses small and large are taking a hit from the economic recession, but on close inspection, these provisions benefit those least in need and can be easily abused.

Partying Like It’s 2017: How Congress Went Overboard on Helping Businesses with Losses

April 24, 2020 • By Steve Wamhoff

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides some needed relief for individuals and families, but two arcane tax provisions related to business losses will further enrich the wealthy and fail to boost our economy more broadly.

ITEP: Making Decisions on Federal Relief Based on Blue v. Red States is Morally Bankrupt

April 24, 2020 • By Meg Wiehe

Following is a statement by Meg Wiehe, deputy executive director of the Institute on Taxation and Economic Policy, regarding Senate Majority Leader Mitch McConnell’s press release on “blue state bailouts” and suggestion that states facing budgetary shortfalls should seek bankruptcy protection.

To Avoid the CARES Act’s Flaws, Invest in Automatic Relief

April 23, 2020 • By Jessica Schieder

With adequate automatic stabilizers, the United States might not end up with economic relief bills that have provisions tucked in them mostly helping millionaires, as we learned was the case with a CARES Act provision suspending limits on business losses. And regular people could get help more quickly, blunting the economic downturn.

Media contact Following is a statement by Amy Hanauer, executive director of the Institute on Taxation and Economic Policy, regarding the Senate bill on small business relief. “State budgets have already taken an enormous hit due to the necessary halting of economic activity to curb the COVID-19 public health crisis. The initial $150 billion in […]

The full effect of the coronavirus pandemic on state revenue streams remains largely unknown. One key policy option is to reevaluate recent misguided tax cuts—particularly those that have not yet taken full effect and will add to growing revenue shortfalls in the coming years.

State Options to Shore up Revenues and Improve Tax Codes amid Pandemic

April 15, 2020 • By Dylan Grundman O'Neill, Meg Wiehe

The COVID-19 pandemic is an extraordinarily challenging time, as we see harm and struggle affecting the vast majority of our families, businesses, public services, and economic sectors. No one will be unaffected by the crisis, and everyone has a stake in the recovery and faces tough decisions. In the world of state fiscal policy, where revenue shortfalls are likely to be far bigger than can be filled by the initial $150 billion in federal aid or absorbed through funding cuts without causing major harm, tax increases must be among those decisions. Even with more federal support, states will need home-grown…

Our elected officials have to listen to we the people and change their approach. Going forward, corporate voices cannot continue to steer. Instead, families, communities and working individuals have to lead our policymaking so it better helps people struggling now.

ITEP: Tax Cuts for Millionaires in the CARES Act Violate Public Trust

April 14, 2020 • By Amy Hanauer

“Public trust and the broad agreement that families and communities needed immediate relief from the economic crisis allowed the $2.2 trillion economic relief package to move quickly through Congress. Yet during a crisis in which thousands have lost their lives and millions are losing their jobs, their health care and their retirement security, some of our lawmakers snuck in tax benefits for the nation’s richest families."

Addressing the COVID-19 Economic Crisis: Advice for the Next Round

April 7, 2020 • By Steve Wamhoff

Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?