Nebraska

In Nebraska 38.4 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Nebraska population (0.5 percent) earns more than $1 million annually. But this elite group would receive 38.4 percent of the tax cuts that go to Nebraska residents under the tax proposals from the Trump administration. A much larger group, 41.8 percent of the state, earns less than $45,000, but would receive just 5.0 percent of the tax cuts.

Nearly Half of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million Annually

August 17, 2017 • By ITEP Staff

A tiny fraction of the U.S. population (one-half of one percent) earns more than $1 million annually. But in 2018 this elite group would receive 48.8 percent of the tax cuts proposed by the Trump administration. A much larger group, 44.6 percent of Americans, earn less than $45,000, but would receive just 4.4 percent of the tax cuts.

This week, Rhode Island lawmakers agreed on a budget, leaving only three states – Connecticut, Pennsylvania, and Wisconsin – without complete budgets. Texas, however, remains in special session and West Virginia could go back into another special session over tax issues. And in New York City, the mayor proposes a tax on the wealthy to […]

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

Trump Tax Proposals Would Provide Richest One Percent in Nebraska with 52.6 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Nebraska would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $1,572,200 in 2018. They would receive 52.6 percent of the tax cuts that go to Nebraska’s residents and would enjoy an average cut of $128,300 in 2018 alone.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

State Rundown 7/19: Handful of States Still Have Their Hands Full with Tax and Budget Debates

July 19, 2017 • By ITEP Staff

Tax and budget debates drag on in several states this week, as lawmakers continue to work in Alaska, Connecticut, Rhode Island, Pennsylvania, Texas, and Wisconsin. And a showdown is brewing in Kentucky between a regressive tax shift effort and a progressive tax reform plan. Be sure to also check out our "What We're Reading" section for a historical perspective on federal tax reform, a podcast on lessons learned from Kansas and California, and more!

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2017 • By ITEP Staff

Sales taxes are an important revenue source, composing close to half of all state tax revenues. But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and services subject to the tax. Lawmakers in many states have enacted “sales tax holidays” (at least 16 states will hold them in 2017), to provide a temporary break on paying the tax on purchases of clothing, school supplies, and other items. While these holidays may seem to lessen the regressive impacts of the sales tax, their benefits are minimal. This policy brief…

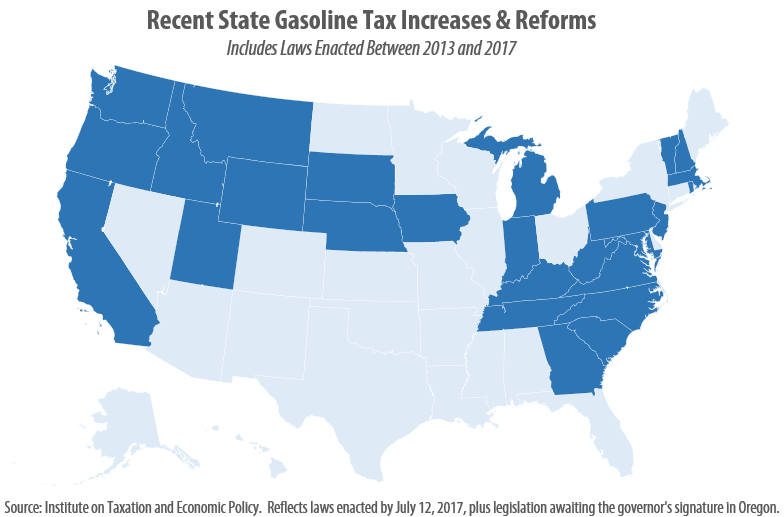

Gas Taxes Will Rise in 7 States to Fund Transportation Improvements

June 28, 2017 • By Carl Davis

Summer gas prices are at their lowest level in twelve years, which makes right now a sensible time to ask drivers to pay a little more toward improving the transportation infrastructure they use every day. Seven states will be doing this on Saturday, July 1 when they raise their gasoline tax rates. At the same time, two states will be implementing small gas tax rate cuts.

This week, Kansas lawmakers continued work on fixing the fiscal mess created by tax cuts in recent years, as legislators in Louisiana, Minnesota, Oklahoma, and West Virginia attempted to wrap up difficult budget negotiations before their sessions come to an end, and Delaware lawmakers advanced a corporate tax increase as one piece of a plan to close that state's budget shortfall. Our "what we're reading" section this week is also packed with articles about state and local effects of the Trump budget, new 50-state research on property taxes, and more.

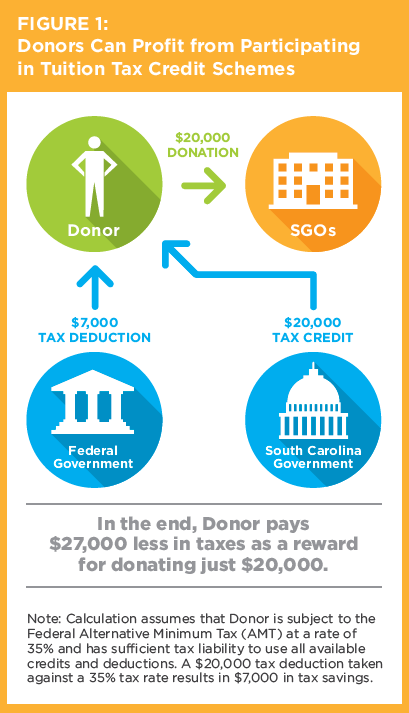

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

Nebraska Vote Is Latest Defeat for Tax-Cut “Trigger” Gimmick

May 4, 2017 • By Dylan Grundman O'Neill

Nebraska lawmakers had a long and contentious tax-cut debate this session but ultimately chose the wise path and rejected attempts to give a massive tax cut to the wealthy at the expense of the state’s schools, other public services, low- and middle-income families, and property tax payers. Tax cut efforts in Nebraska last year ended […]

State Rundown 5/3: Lawmakers See Value in State EITCs, Danger in Tax Cut Triggers

May 3, 2017 • By ITEP Staff

This week, Kansas lawmakers found that they’ll have to roll back Gov. Brownback’s tax cuts and then some to adequately fund state needs. Nebraska legislators took notice of their southern neighbors’ predicament and rejected a major tax cut. Both Hawaii and Montana‘s legislatures sent new state EITCs to their governors, and West Virginia began an […]

Associated Press: Tax Package Backed by Nebraska Gov. Ricketts Stalls

May 2, 2017

The bill would have given a larger benefit to wealthy residents who pay a larger share of their income at the top tax rate. Supporters said the income tax portion was largely aimed at small businesses that would promote job growth and diversify the economy. Critics said the package doesn’t do nearly as much for […]

State Rundown 4/27: States Finally Reaching Resolution on Gas Taxes

April 27, 2017 • By ITEP Staff

This week, transportation funding debates finally concluded with gas tax updates in Indiana, Montana, and Tennessee, and appear to be nearing an end in South Carolina. Meanwhile, Louisiana and Oregon lawmakers debated new Gross Receipts Taxes, and Texas legislators considered eliminating the state’s franchise tax. — Meg Wiehe, ITEP Deputy Director, @megwiehe Louisiana Gov. Bel Edward’s Commercial Activities Tax (CAT) was pulled from committee early this week without a vote due to opposition, […]

Dylan Grundman O’Neill

April 21, 2017 • By ITEP Staff

Dylan is the “coach on the floor” of the ITEP state policy team. He provides hands-on analysis and support on tax policy issues to advocates and lawmakers in several states. He also supports and vets the work of ITEP's other state policy analysts as they do the same in their states, and he liaises between the state team and the data and model team to ensure quality and consistency in how ITEP models policies and presents data.

State Rundown 4/19: Alaska’s Long Income Tax Freeze May Be Thawing

April 19, 2017 • By ITEP Staff

This week Alaska‘s House advanced a historic bill to reinstate an income tax in the state, Oklahoma‘s House voted to cancel a misguided tax cut “trigger,” West Virginia‘s governor colorfully vetoed his state’s budget, tax reform debate kicked off in Louisiana, and gas tax updates were considered in South Carolina and Tennessee, among other tax-related news […]

Open Sky Policy Institute: Amid budget woes, plan calls for tax cuts for the wealthy

April 17, 2017

LB 461, the tax-cut package put forth by the Revenue Committee, is first and foremost an income tax cut for wealthy Nebraskans and the proposal does little to truly address property tax relief. In fact, LB 461 is fundamentally flawed in a way that makes it more likely to exacerbate, not help, Nebraska’s reliance on […]

State Rundown 4/12: Season in Transition as Some States Close, Others Open Tax Debates

April 12, 2017 • By ITEP Staff

This week in state tax news we see Louisiana‘s session getting started, budgets passed in New York and West Virginia, Kansas lawmakers taking a rest after defeating a harmful flat tax proposal, and Nebraska legislators preparing for full debate on major tax cuts. Nevada lawmakers may make tax decisions related to tampons, diapers, marijuana, and […]

This week in state tax news we saw a destructive tax cut effort defeated in Georgia, a state shutdown avoided in New York, and lawmakers hone in on major tax debates in Massachusetts, Nebraska, South Carolina, and WestVirginia. State efforts to collect taxes owed on online purchases continue to heat up as well. — Meg […]

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. Corporations Offshore Cash Hoard Grows to $2.6 Trillion U.S. corporations now hold a record $2.6 trillion offshore, a […]

State Rundown 3/29: More States Looking to Raise or Protect Revenues Amid Fiscal and Federal Uncertainty

March 29, 2017 • By ITEP Staff

This week we see West Virginia, Georgia, Minnesota, and Nebraska continue to deliberate regressive tax cut proposals, as the District of Columbia considers cancelling tax cut triggers it put in place in prior years, and lawmakers in Hawaii, Washington, Kansas, and Delaware ponder raising revenues to shore up their budgets. Meanwhile, gas tax debates continue […]

Tax Justice Digest: 50-State Analysis of GOP Health Care Plan, Ensuring State Sales Taxes Keep Pace with Our Changing Economy

March 23, 2017 • By ITEP Staff

In the Tax Justice Digest we recap the latest reports, blog posts, and analyses from Citizens for Tax Justice and the Institute on Taxation and Economic Policy. Here’s a rundown of what we’ve been working on lately. State-by-State Analysis of GOP Health Care Plan By now, it’s widely known that the GOP health care plan […]