New York

State Income Tax Reform Can Bring Us Closer to Racial Equity

October 4, 2021 • By Carl Davis, ITEP Staff, Marco Guzman

To pave the way for a more racially equitable future, states must move away from poorly designed, regressive policies that solidify the vast inequalities that exist today.

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

Tax Changes in the House Ways and Means Committee Build Back Better Bill

September 21, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

This report finds that the vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts -- expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) -- would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

Frequently Asked Questions about Proposals to Repeal the Cap on Federal Tax Deductions for State and Local Taxes (SALT)

September 3, 2021 • By Carl Davis, ITEP Staff, Steve Wamhoff

Even though Democrats in Congress uniformly opposed the TCJA because its benefits went predominately to the rich, many Democratic lawmakers now want to give a tax cut to the rich by repealing the cap on SALT deductions.

We asked New York state resident Morris Pearl, former Blackrock executive and current chair of the Patriotic Millionaires, a few questions to hear straight from the mouth of a millionaire how the SALT cap and its proposed repeal would affect his life.

New Report from ITEP Describes Options for Changing the SALT Cap without Repealing It

August 26, 2021 • By Steve Wamhoff

A new report from ITEP provides policy recommendations to modify the $10,000 cap on federal tax deductions for state and local taxes (SALT), which was signed into law by President Trump as part of the Tax Cuts and Jobs Act. Because the SALT cap mostly restricts tax deductions for the richest 5 percent of Americans, the best options are to leave the cap as is or replace […]

Options to Reduce the Revenue Loss from Adjusting the SALT Cap

August 26, 2021 • By Carl Davis, ITEP Staff, Matthew Gardner, Steve Wamhoff

If lawmakers are unwilling to replace the SALT cap with a new limit on tax breaks that raises revenue, then any modification they make to the cap in the current environment will lose revenue and make the federal tax code less progressive. Given this, lawmakers should choose a policy option that loses as little revenue as possible and that does the smallest amount of damage possible to the progressivity of the federal tax code.

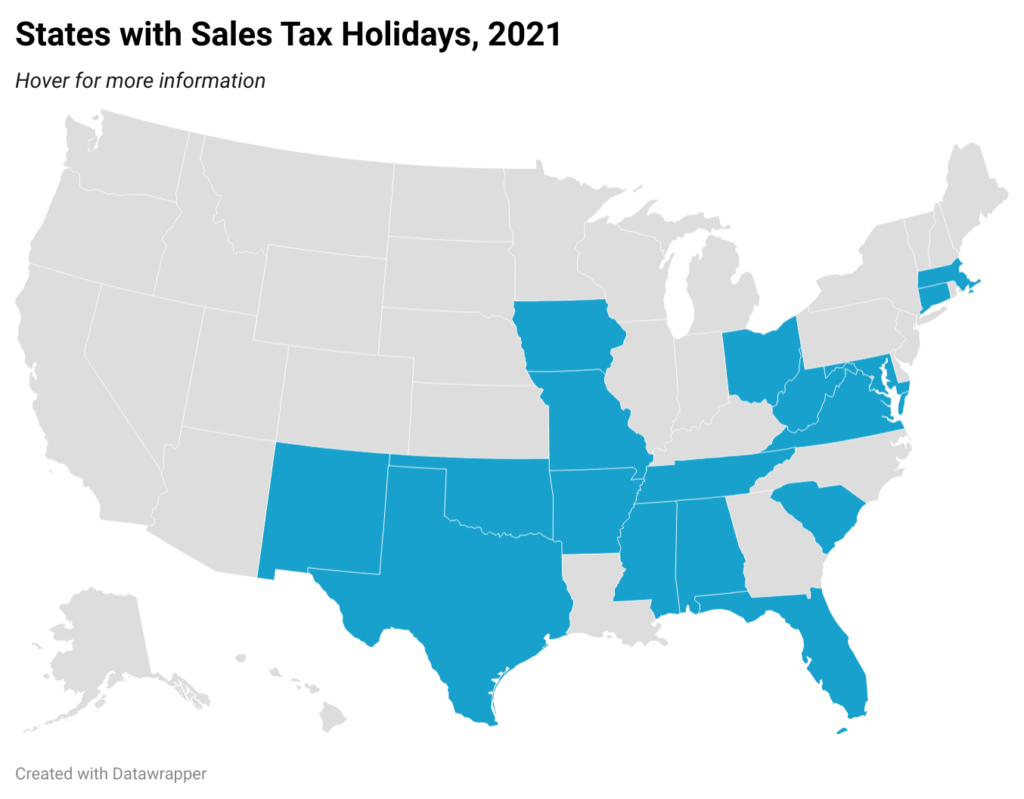

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

Congress is proving that there does not need to be a trade-off between good climate policy and good economic policy. Direct hires aside, an even bolder government-backed effort to secure the future of our planet could create as many as 25 million net new jobs at its peak, as well as 5 million permanent jobs, many of which deal directly with domestic infrastructure and cannot be outsourced. With the U.S. economy still down 5.7 million jobs from pre-pandemic levels, climate legislation can be a critical investment for jumpstarting our economic recovery.

State Rundown 7/21: States Go for Tax Policy Gold This Olympics Season

July 21, 2021 • By ITEP Staff

It’s Olympics season! As countries around the globe battle for first place in a plethora of sports and contests it’s as good a time as any to look around America to see which states deserve a gold medal in the ‘Equitable Tax Policy’ event...

Child Tax Credit Expansion Acknowledges There Is More We Can Do for Children

July 20, 2021 • By Aidan Davis

For the next six months, low-, middle- and upper-middle-income families with children are eligible to receive part of their 2021 Child Tax Credit (CTC) in advanced monthly payments. More than putting money in people’s pockets, this policy recognizes “the dignity of working-class families and middle-class families,” as President Biden said last week.

New York Post: Jeff Bezos openly embraces tax hikes, but Amazon lobbied against them

July 8, 2021

Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, who’s studied the tax habits of Amazon and other big companies, told Politico that Amazon is likely “getting hundreds of millions of dollars a year in R&D tax credits.” Read more

President Joe Biden's American Families and Jobs plans intend to “build back better” and create a more inclusive economy. To fully live up to this ideal, the final plan must include undocumented people and their families.

New York Times: Investors Fret as Biden Takes Aim at a 100-Year-Old Tax Loophole

June 8, 2021

In this congressional session, Democrats appear to be placing enormous emphasis on creating a fairer tax code along with investing in infrastructure and social programs, said Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy, a nonprofit group in Washington that advocates equitable revenue-raising measures. Read more

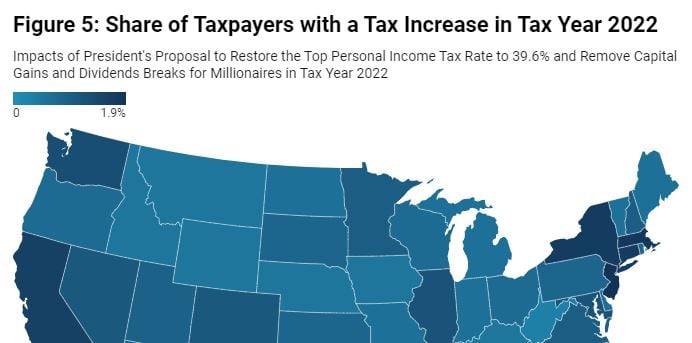

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

The New York Times: How to collect a trillion dollars

May 11, 2021

It’s difficult to quantify just how much money goes uncollected each year, officials say. Corporate tax collections in the U.S. are “at historic lows and well below what other countries collect,” according to a recent Treasury report. U.S. multinational companies can be taxed at a 50 percent discount compared with their domestic peers, an incentive […]

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

New York Times: Amazon Had a Big Year, but Paid No Tax to Luxembourg

May 4, 2021

Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, a left-leaning research group in Washington, said Amazon’s Luxembourg filing showed why there was such urgency, not only in the European Union but also in the United States, to require a global minimum tax. “This is a stark reminder of the high […]

New York Times: Why a $10,000 Tax Deduction Could Hold Up Trillions in Stimulus Funds

May 1, 2021

There’s no debate that the SALT deduction goes mostly to wealthier taxpayers. About 85% of its benefits accrue to the richest 5% of households, according to an analysis by the Institute on Taxation and Economic Policy in Washington. Were the cap to be repealed, about two-thirds of the benefits — about $67 billion — would […]

Bloomberg: N.Y., New Jersey, California Hit Hardest by Biden Tax Changes

April 29, 2021

President Joe Biden’s plan to ramp up the income tax rate and capital gains tax rate as part of a $1.8 trillion stimulus plan would hit high-tax states like New York and California the hardest, while New Mexico and Mississippi would be least affected, according to research from the Institute on Taxation and Economic Policy. […]

Salon: Key Democrats want to keep most of Trump’s corporate tax cut — and slash more taxes for the rich

April 28, 2021

Of course, many corporations pay no federal income taxes at all. The Trump tax cut doubled the number of companies that had an effective 0% tax rate, according to the Institute on Taxation and Economic Policy (ITEP), while giving the vast majority of Fortune 500 companies an average federal tax rate of 11.3% the year […]

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

Sometimes a good idea takes a while. Alvin Schorr, who would have turned 100 this month, helped draft a 1972 bill “to provide for a system of children’s allowances.” He continued to push (in a 1977 congressional testimony and in a 1983 New York Times op-ed) for a refundable tax credit for all families and a children’s allowance, among other laudable ideas. A half-century later, these ideas—which many others have championed—are becoming reality.