New York

New York Times: Trump’s Payroll Tax Cut Would Dwarf the 2008 Bank Bailout

March 12, 2020

The largest gains in dollar figures would go to households earning more than $123,000 a year, according to an analysis by the Institute on Taxation and Economic Policy in Washington. Read more

State Rundown 3/11: Georgia Bucks Trend of Cautious Policymaking Amid Crises

March 11, 2020 • By ITEP Staff

With all eyes on the potential effects of the oil price war and COVID-19 coronavirus on lives, communities, and economies, Georgia House lawmakers this week crammed through a regressive and costly tax cut for the rich with essentially no debate, information, or transparency. Most states are proceeding much more responsibly, assessing the ramifications for their service provision needs and revenues to fund those needs.

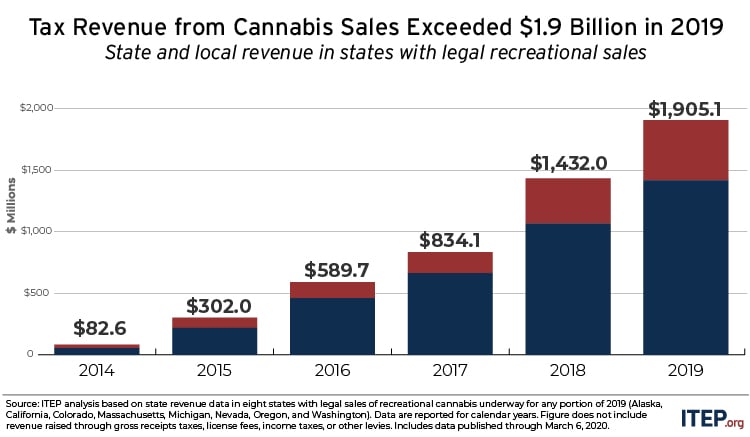

State and Local Cannabis Tax Revenue Jumps 33%, Surpassing $1.9 Billion in 2019

March 10, 2020 • By Carl Davis

Excise and sales taxes on cannabis raised more than $1.9 billion in 2019. This represents a jump of nearly half a billion dollars, or 33 percent, compared to a year earlier. These are the findings of an ITEP analysis of newly released tax revenue data from the eight states where legal sales of adult-use cannabis took place last year.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

Yahoo! Finance: In Search of the ‘Disappearing Corporate Income Tax’

February 12, 2020

Those losses, driven by generous rule-writing and interpretations of the 2017 tax law by the U.S. Treasury, are so substantial that they were deemed “tax cuts 2.0” by the liberal-leaning Institute on Taxation and Economic Policy. (You can read more about the revision in a recent blog post from CBO director Phillip Swagel, and in […]

Hearing Witness: Trump Administration Giving Tax Breaks Not Allowed by Law

February 12, 2020 • By Steve Wamhoff

The Treasury Department, tasked with issuing regulations to implement the hastily drafted Trump-GOP tax law, is concocting new tax breaks that are not provided in the law. This is the short version of what we learned while watching Tuesday’s House Ways and Means Committee hearing on “The Disappearing Corporate Income Tax.”

State lawmakers have plenty to keep them busy on the tax policy front in 2020. Encouraging trends we’re watching this year include opportunities to enact and enhance refundable tax credits and increase the tax contributions of high-income households, each of which would improve tax equity and help to reduce income inequality.

Kamolika Das

February 10, 2020 • By ITEP Staff

Kamolika monitors trends in state tax policy and supports state researchers and advocates. She primarily focuses on the South and mid-Atlantic regions. Before joining the team in 2020, Kamolika promoted progressive affordable housing and workforce development policies at the local level in the District of Columbia.

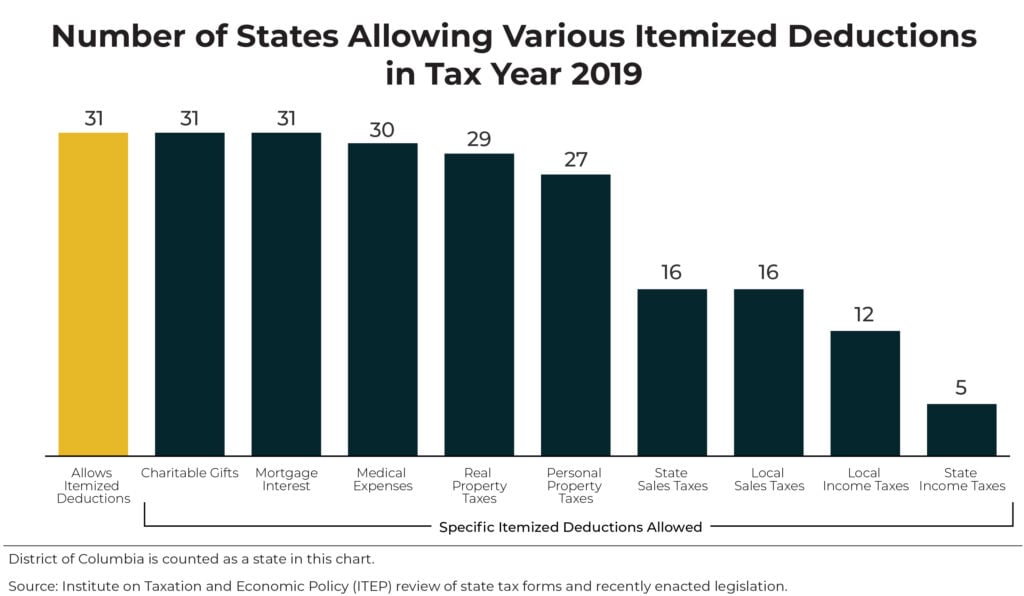

States Can Make Their Tax Systems Less Regressive by Reforming or Repealing Itemized Deductions

February 5, 2020 • By Carl Davis

Itemized deductions are problematic tax subsidies that need to close. The mortgage interest deduction, for instance, is often lauded as a way to help middle-class families afford homes and charitable deductions are touted as incentivizing gifts to charitable organizations. But the dirty little secret is that itemized deductions primarily benefit higher-income households while largely failing to achieve their purported goals.

State Itemized Deductions: Surveying the Landscape, Exploring Reforms

February 5, 2020 • By Carl Davis

State itemized deductions are generally patterned after federal law, though nearly every state makes significant changes to the menu of deductions available or the extent to which those deductions are allowed. This report summarizes the key details of each state’s itemized deduction policies and discusses various options for reforming those deductions with a focus on lessening their regressive impact and reducing their cost to state budgets.

If President Trump puts forth another tax proposal this year, as he is hinting, it will be his third. The second round, already costing the U.S. Treasury billions, was implemented largely out of the public’s view.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

New York Times: As States Add Money to Fix Roads, U.S. Is Urged to Ante Up

January 25, 2020

According to the Institute on Taxation and Economic Policy, most states have raised their gasoline taxes over the last several years. Along with the ballot initiatives passed to support highway projects, states could take a bigger role in their own infrastructure destinies. Ironically, more state-level control and funding is one of the tent poles of […]

State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug […]

State Rundown 1/8: States Need Clear Tax and Budget Policy Vision in 2020

January 8, 2020 • By ITEP Staff

Happy New Year readers! The Rundown is back to our usual weekly schedule as state legislative sessions and governors’ budgets and State of the State Addresses begin in earnest. Here’s to clear-eyed 20-20 vision guiding state tax and budget decisions in 2020! So far this year, the harm of Colorado’s TABOR policy and Alaska’s lack of an income tax are coming into focus in big ways. Utah advocates are hoping the benefit of hindsight will help convince voters to overturn a recently enacted tax overhaul. Lawmakers in states including Iowa, Maryland, and Virginia can clearly see a need for revenues,…

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

State Rundown 12/18: Utah’s Tax Fight Wraps Up As Other States’ Ramp Up

December 18, 2019 • By ITEP Staff

With the new year and many state legislative sessions just around the corner, most state tax and budget debates are just getting started. Arkansas will be among the states working to improve their roads and other infrastructure. Massachusetts will have to deal with revenue losses due to a misguided tax-cut trigger put in place in prior years. Maryland and South Dakota will be two of many states facing teacher pay shortages and other education funding needs. And debates over the legalization and taxation of cannabis will likely continue in California, Kentucky, New Jersey, and beyond. Utah lawmakers, on the other…

For the Holiday Wishlist: Child Tax Credit Improvements That Would Lift Millions Out of Poverty

December 18, 2019 • By Aidan Davis

A recent New York Times article serves as a stark reminder that child poverty remains a persistent problem in this country and that the policies we have in place to help this vulnerable population need immediate attention and improvement.

Corporate Tax Avoidance in the First Year of the Trump Tax Law

December 16, 2019 • By ITEP Staff, Lorena Roque, Matthew Gardner, Steve Wamhoff

Profitable Fortune 500 companies avoided $73.9 billion in taxes under the first year of the Trump-GOP tax law. The study includes financial filings by 379 Fortune 500 companies that were profitable in 2018; it excludes companies that reported a loss.

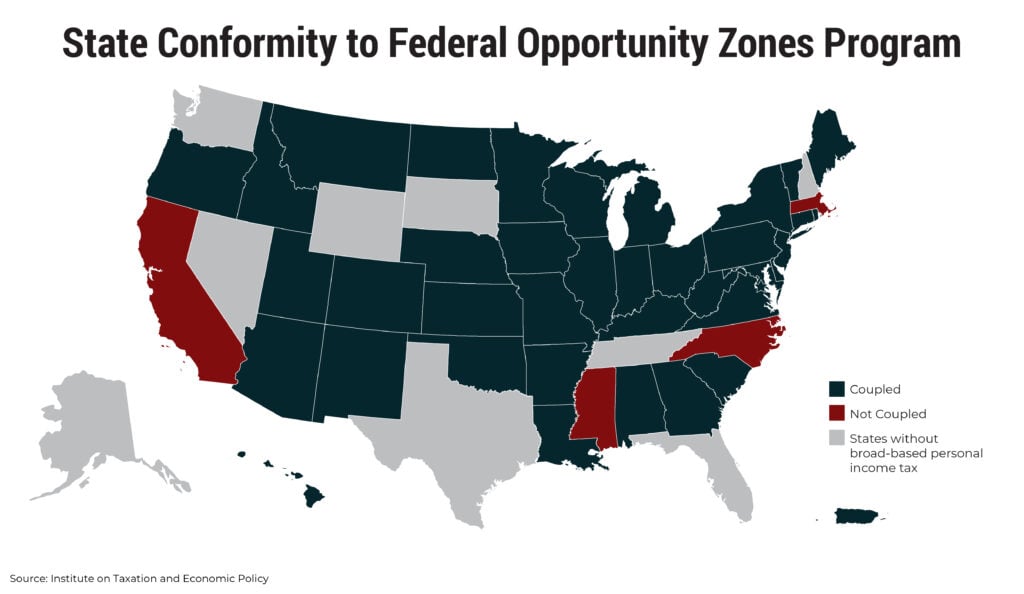

States Should Decouple from Costly Federal Opportunity Zones and Reject Look-Alike Programs

December 12, 2019 • By ITEP Staff

Post enactment of TCJA, lawmakers in most states needed to decide how to respond to the creation of this new program. Given the shortcomings of the federal Opportunity Zones program and its added potential costs to states, the most prudent course of action is three-pronged: States should move quickly to decouple; states should reject look-alike programs; and lawmakers should make investments directly into economically distressed areas.

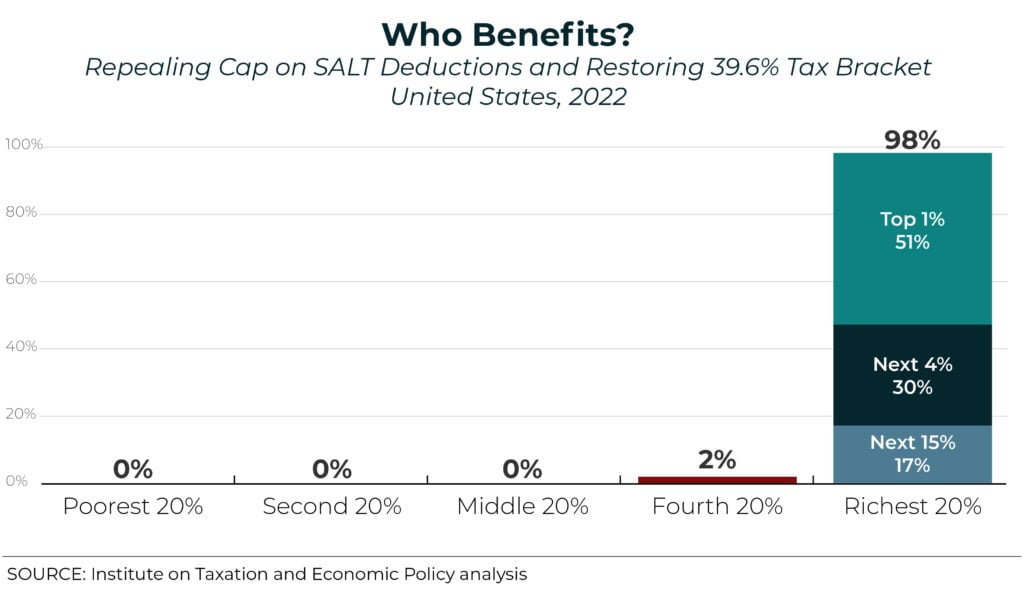

House Democrats’ Latest Bill on SALT Deductions Would Mean Bigger Tax Cuts for the Rich

December 11, 2019 • By Steve Wamhoff

ITEP estimates show that if the House Democrats' proposal was in effect in 2022, it would have a net cost of $81 billion in that year alone. The estimates also show that 51 percent of the benefits would go to the richest 1 percent of taxpayers in the U.S. Clearly, lawmakers concerned about the SALT cap need to go back to the drawing board.

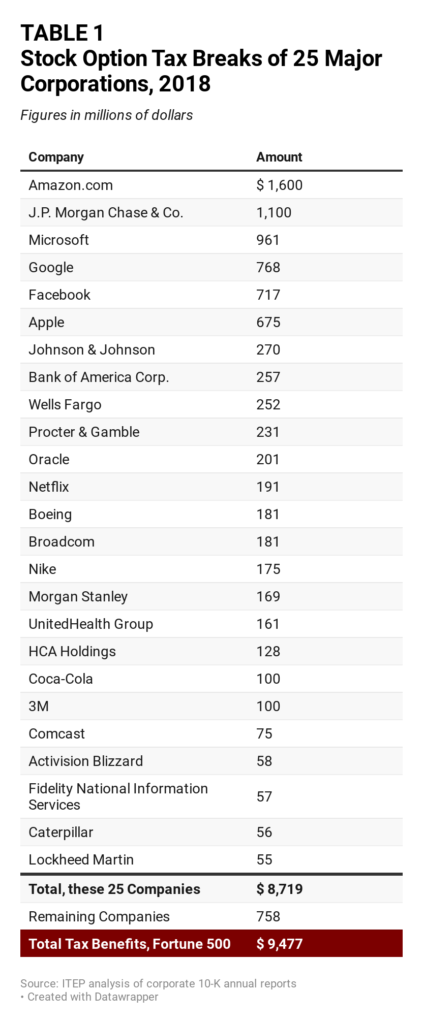

How Congress Can Stop Corporations from Using Stock Options to Dodge Taxes

December 10, 2019 • By ITEP Staff

The stock option rules in effect today create a problem because they allow corporations to report a much larger expense for this compensation to the IRS than they report to investors. The result is that corporations can report larger profits to investors but smaller profits to the IRS, undermining the fundamental fairness of the tax system.

In the last few weeks, Florida Gov. Ron DeSantis has served up his budget proposal, which advocates are eager to dig into and hoping to contribute to with a delectable Earned Income Tax Credit proposal of their own. Utah lawmakers have been cooking up tax ideas as well, but haven’t yet decided when to come to the table to debate them. And Maryland leaders finalized their menu of needed education reforms, now moving on to assigning responsibilities for funding them. With respect to dividing up the pie, our “What We’re Reading” section below includes reporting on evidence that corporate tax…