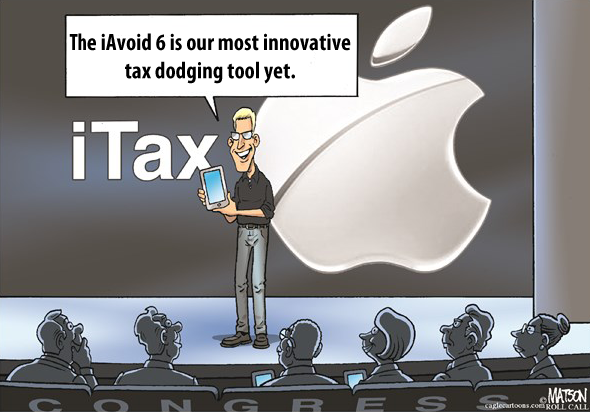

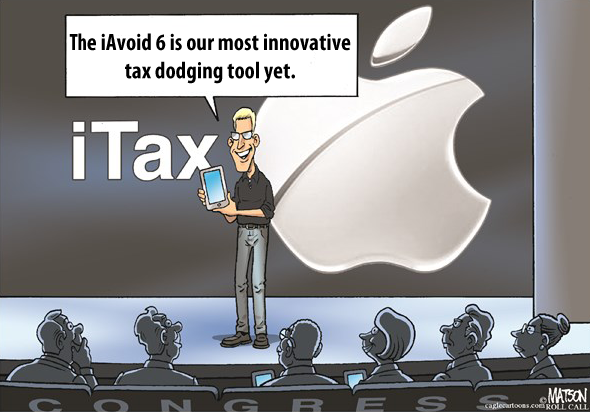

Offshore Tax Avoidance

The Senate Tax Plan’s Big Giveaway to Multinational Corporations

November 21, 2017 • By Richard Phillips

Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Senate tax bill would forgive most of the taxes owed on these profits and open the floodgates to even more offshore profit-shifting in the future.

Shopping for a Tax Haven: How Nike and Apple Accelerated Their Tax Avoidance Strategies, according to the Paradise Papers

November 14, 2017 • By Steve Diese

A year and a half after the release of the Panama Papers, a new set of data leaks, the Paradise Papersreleased by the International Consortium of Investigative Journalists (ICIJ) provides important new information on the tax dodging of wealthy individuals as well as multinational corporations.

House Tax Plan Would Make Offshore Tax Avoidance Substantially Worse

November 8, 2017 • By Richard Phillips

The Sunday release of the Paradise Papers has once again brought the issue of offshore tax avoidance to the forefront of public discussion. The papers expose the complex structures that companies such as Apple and Nike have pursued in recent years to pay little to nothing in taxes on their offshore earnings. Yet even as these revelations make headlines, House Republicans are moving forward with major tax legislation, the Tax Cuts and Jobs Act, that would reward the worst tax avoiders and make it even easier for multinational companies to avoid taxes.

American Corporations Tell IRS that 61 Percent of Their Offshore Profits Are in 10 Tax Havens

November 5, 2017 • By Richard Phillips

Recent revelations that a Bermuda law firm helped facilitate offshore tax avoidance has heightened awareness of the vast amount of income and wealth flowing into tax and secrecy havens worldwide. The countries through which this firm helped funnel global elites’ assets also act as tax havens for multinational corporations. Recently released data from the Internal Revenue Service show that U.S. corporations claim that 61 percent of their foreign subsidiaries’ pretax worldwide income is being earned in 10 tiny tax haven countries.

Fact Sheet: The Consequences of Adopting a Territorial Tax System

September 18, 2017 • By Steve Wamhoff

President Trump and Republican leaders in Congress have proposed a “territorial” tax system, which would allow American corporations to pay no U.S. taxes on most profits they book offshore. This would worsen the already substantial problem of corporate tax avoidance and result in more jobs and investment leaving the U.S. Lawmakers should know some key facts about the territorial approach.

New ITEP Report: Trump’s Proposed Territorial Tax System Would Increase Corporate Tax Dodging

September 6, 2017 • By Steve Wamhoff

While promoting his ideas for overhauling our tax code today in North Dakota, President Trump said that Congress should adopt a territorial tax system which, he argued, would result in more investment in the United States. You’re not alone if you’re not sure what “territorial” means in this context. It’s a euphemism used by some politicians to describe a proposal that will be wildly unpopular once voters understand what it really means.

Turning Loopholes into Black Holes: Trump’s Territorial Tax Proposal Would Increase Corporate Tax Avoidance

September 6, 2017 • By Matthew Gardner, Steve Wamhoff

The problem of offshore tax avoidance by American corporations could grow much worse under President Donald Trump’s proposal to adopt a “territorial” tax system, which would exempt the offshore profits of American corporations from U.S. taxes. This change would increase the already substantial benefits American corporations obtain when they use accounting gimmicks to make their profits appear to be earned in a foreign country that has no corporate income tax or has one that is extremely low or easy to avoid.

Apple: A Case Study in Why a Tax Holiday for Offshore Cash is Indefensible

May 4, 2017 • By Matthew Gardner

The Apple corporation made waves earlier this week with its disclosure that its worldwide cash now exceeds $250 billion. Less noticed was a separate disclosure on Wednesday that the company’s offshore cash now exceeds $239 billion, meaning that more than 93 percent of the company’s cash is now held—at least on paper—abroad. This represents an […]

The Trump Administration Should Not Reopen Offshore Loopholes Closed by Recent Regulations

April 21, 2017 • By Richard Phillips

A new executive order signed by President Donald Trump on Friday asks that Treasury Secretary Steven Mnuchin review significant tax regulations issued in 2016. The broader context of the order is that President Trump is seeking to roll back regulations across the government – many of which he claims are overly burdensome – and could […]

How to Shut Down Offshore Corporate Tax Avoidance, Full Stop

April 7, 2017 • By Richard Phillips

A new bill introduced this week by Rep. Mark Pocan (D-WI), the Tax Fairness and Transparency Act, would rip out the offshore corporate tax avoidance system by its roots. This legislation combines into a single, comprehensive bill elements of three pieces of legislation that Rep. Pocan has proposed in previous years. While many drivers of […]

Two New Bills Would Plug Major Loopholes in Our Offshore Corporate Tax System

April 6, 2017 • By Richard Phillips

A new pair of bills introduced by Representative Lloyd Doggett (D-TX) this week would crack down on loopholes that allow corporations and individuals to avoid paying their fair share in taxes. Rep. Doggett’s Stop Tax Haven Abuse Act, which was sponsored by Senator Sheldon Whitehouse (D-RI) in the Senate, would close a number of the […]

With the failure of legislation to repeal the Affordable Care Act, the Trump administration and Republicans lawmakers are moving on to corporate tax reform. At the heart of this debate is the problem of corporations shifting their profits to foreign tax havens to avoid U.S. income taxes. A new report by the Institute on Taxation […]

Fortune 500 Companies Hold a Record $2.6 Trillion Offshore

March 28, 2017 • By Matthew Gardner

All told, Fortune 500 corporations are avoiding up to $767 billion in U.S. federal income taxes by holding more than $2.6 trillion of "permanently reinvested" profits offshore. In their latest annual financial reports, 29 of these corporations reveal that they have paid an income tax rate of 10 percent or less in countries where these profits are officially held, indicating that most of these profits are likely in offshore tax havens.

Trump Plan to Give Billions in Tax Breaks to Multinational Corporations May Have Bipartisan Support

January 18, 2017 • By Richard Phillips

There are a lot of troubling components of the tax reform packages being proposed by President-Elect Donald Trump and the House GOP, but one that especially stands out is the push to give companies a tax break on the earnings they are holding offshore. Unfortunately, proposals rewarding the nation’s most egregious tax dodging multinational corporations […]

Multinational Corporations Would Receive Half a Trillion in Tax Breaks from Trump’s Repatriation Tax Proposal

January 18, 2017 • By Richard Phillips

One of the central questions for lawmakers looking to reform the federal tax code this year is how to address the $2.5 trillion in earnings that U.S. companies are holding offshore to avoid taxes. Lawmakers on both sides of the aisle have supported proposals that would either require or allow companies to repatriate these earnings to the United States at a discounted tax rate. These proposals have ranged from letting companies repatriate their earnings tax-free to requiring them to immediately pay a discounted rate of 20 percent. All of the proposals would give corporations a substantial tax discount and forego…

Corporations falsely claim that they have to engage in offshore tax avoidance maneuvers because the U.S. corporate tax rate is too high, an argument which has unfortunately found an audience in lawmakers on both sides of the aisle. In 2017, Congress likely will evaluate a number of approaches to taxing the trillions of dollars corporations currently hold offshore. This report explains and evaluates these proposals, including a so-called repatriation holiday and deemed repatriation. Further, it explains why ending deferral of taxes on U.S. multinational corporations' foreign earnings could halt the widespread corporate practice of funneling money to subsidiaries for the…

Fact Sheet: What You Need to Know About Repatriation Proposals

November 28, 2016 • By Richard Phillips

Fortune 500 corporations collectively have stashed $2.5 trillion in profits offshore, on which they have avoided up to $718 billion in taxes. It's no wonder that policymakers on both sides of the aisle are weighing legislative options to either tax these profits or create an incentive for corporations to "repatriate" or bring these profits to the United States so that they are subject to taxation. Lawmakers have introduced several "repatriation" proposals that would glean tax revenue from these offshore profits. But the only solution that will ensure corporations pay taxes on their offshore profits AND shut down the practice of…

This study explores how in 2015 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country's wealthiest corporations benefit the most from this tax avoidance scheme.

News Release: U.S. Should Take a Page from European Commission’s Book And Crack Down on Corporate Tax Avoidance

August 30, 2016 • By ITEP Staff

Following is a statement by Matt Gardner of the Institute on Taxation and Economic Policy regarding the European Commission’s ruling today that the Apple Corporation must pay as much as €13 billion ($14.5 billion) in back taxes due to an illegal tax break granted by the Irish government. “The European Commission action is a chastening […]

Tim Cook’s Disingenuous Argument to Justify Apple’s $215 Billion Offshore Cash Hoard

August 9, 2016 • By Jenice Robinson

Tim Cook is a persuasive CEO. In a wide-ranging interview published earlier this week in the Washington Post, he discussed his vision for the company, thoughts about leadership succession, and humbly admitted he has made mistakes. So it would be very easy to view as reasonable his declaration that Apple will not repatriate its offshore […]