Recent Work by ITEP

The Illusion of Race-Neutral Tax Policy

February 14, 2019 • By Alan Essig, Carl Davis, Jenice Robinson, Meg Wiehe, Misha Hill, Steve Wamhoff

It is well known that the bulk of the federal tax cuts flowed to the highest-earning households, who received the largest tax cut both in terms of real dollars and also as a share of income. But as our analysis with Prosperity Now reveals, solely examining the tax law in the context of class misses a bigger-picture story about how the nation’s public policies not only perpetuate widening income and wealth inequality, they also preserve historic and current injustices that continue to allow white communities to build wealth while denying the same level of opportunity (and often suppressing it) to…

The Tax Cuts and Jobs Act (TCJA), enacted by President Trump and Congressional Republicans at the end of 2017, has caused quite a bit of confusion, and a recent “Fact Checker” column by the Washington Post’s Glenn Kessler does not help. TCJA created real problems that can't be resolved without real tax reform. To begin that process fact checkers, lawmakers, and everyone else need to be clear about what TCJA did, and did not, do to our tax system.

Fear, Not Facts: Netflix Misleads Media Reporting on Corporate Tax Avoidance

February 13, 2019 • By Matthew Gardner

In an age when even the most incontrovertible facts are routinely dismissed as “fake news,” reporting on corporate taxes can be a daunting challenge for members of the media. ITEP’s recent analysis of the income tax disclosures made by Netflix in its annual financial report last week provide an excellent reminder of this.

On Monday a group of Senators and Representatives from the Northeast announced their latest proposal to repeal the cap on deductions for state and local taxes (SALT), this time offsetting the costs by restoring the top personal income tax rate to 39.6 percent. This is an improvement over previous proposals to repeal the cap on SALT deductions without offsetting the costs at all. But the new approach does not improve our tax system overall. Instead, it trades one tax cut for the rich (a lower top income tax rate) for another (repeal of the cap on SALT deductions).

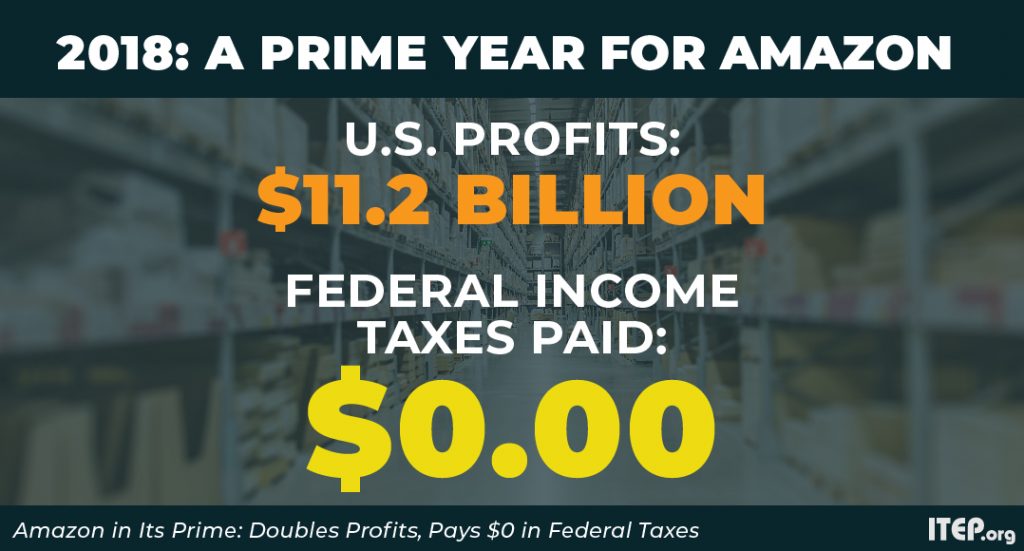

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

February 13, 2019 • By Matthew Gardner

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.

A Tale of Two States: How State Tax Systems Perpetuate Income Inequality

February 11, 2019 • By ITEP Staff

To explain how state tax systems make income inequality worse, we compared tax systems in New Jersey and Texas which, before taxes, have similar levels of income inequality. This comparison provides an example of how policymakers’ decisions affect the economic wellbeing of their constituents.

This year is full of opportunity for state policymakers and advocates seeking to improve upside-down tax systems and generate needed funding for shared priorities. In a series of blog posts, ITEP staff summarize key trends we are watching in statehouses this year, with special attention to the many efforts underway to reduce racial and economic inequities and better prepare state budgets for the next recession and reduced federal investments. Along the way, we’ll also draw attention to some of the more destructive policy ideas to watch for in 2019.

Trends We’re Watching in 2019: Attempting to Double Down on Failed Trickle-Down Regressive Tax Cuts

February 7, 2019 • By Lisa Christensen Gee

It’s always troubling for those concerned with adequate and fair public finance systems when states prioritize tax cuts at the cost of divesting in important public priorities and exacerbating underlying tax inequalities. But it’s even more nerve-racking when it happens on the eve of what many consider to be an inevitable economic downturn.

Trends We’re Watching in 2019: Cannabis Tax Implementation and Reform

February 7, 2019 • By Carl Davis

Few areas of state tax policy have evolved as rapidly as cannabis taxation over the last few years. The first legal, taxable sale of recreational cannabis in modern U.S. history did not occur until 2014. Now, just five years later, a new ITEP report estimates that recreational cannabis is generating more than $1 billion annually in excise tax revenues and $300 million more in general sales tax dollars.

Trends We’re Watching in 2019: Consumption Taxes: the Good, Bad and the Ugly

February 7, 2019 • By ITEP Staff

Consumption taxes are a significant source of state and local revenue, and we expect that lawmakers will continue to adjust state consumption tax levies to adapt to budget needs and a changing economy.