Recent Work

2162 items

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

Most state legislatures have adjourned for 2023, and that means it’s a perfect time to look at the tax policy trends that have formed thus far...

We can make modest reforms to better tax those who are taking a larger share of our wealth and income in order to reinforce a major pillar of our promise to Americans.

‘Fair Share Act’ Would Strengthen Medicare and Social Security Taxes

July 11, 2023 • By Joe Hughes, Steve Wamhoff

The Medicare and Social Security Fair Share Act would reform the taxes that Americans pay to finance these two important programs so that the richest 2 percent of Americans pay these taxes on most of their income the way that middle-class taxpayers already do.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

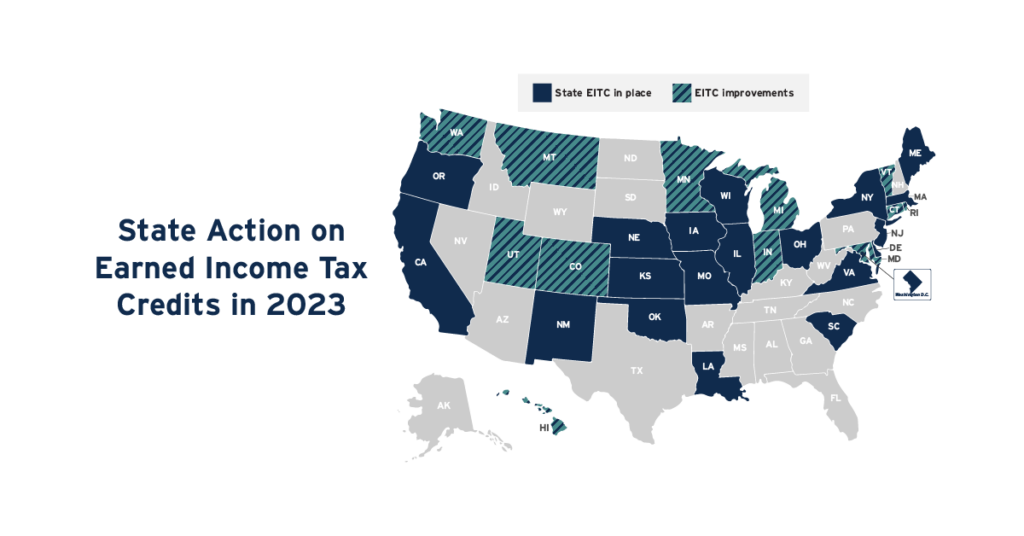

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

Minnesota’s Tax Battle of 2023 Signals a Turning of the Tide Against Corporate Tax Avoidance

July 7, 2023 • By Matthew Gardner

The qualified success of Minnesota’s GILTI conformity—to say nothing of the state’s serious dalliance with the game-changing worldwide combined reporting--sends a clear signal that the days may be coming to an end when big multinationals can scare state lawmakers into allowing them to game the tax system.

State Rundown 7/6: Tax Policy Keeping Governors Busy from Coast to Coast

July 6, 2023 • By ITEP Staff

From coast to coast, state governors have been busy inking their signature on a growing list of consequential budget and tax bills...

Corporations Reap Billions in Tax Breaks Under ‘Bonus Depreciation’

June 29, 2023 • By Matthew Gardner, Steve Wamhoff

Since TCJA expanded tax breaks for “accelerated depreciation” starting in 2018, it has reduced taxes by nearly $67 billion for the 25 profitable corporations that benefited the most. Congress is now looking at extending this policy.

State Rundown 6/28: Movement on Refundable Credits Remains Hot Topic in 2023

June 28, 2023 • By ITEP Staff

The trend of state lawmakers taking big steps on important tax credits like the Child Tax Credit and Earned Income Tax Credit is coming out in full force this week...

State Action on Child Tax Credits and Earned Income Tax Credits in 2023

June 28, 2023 • By ITEP Staff

In 2023 so far, 17 states have either adopted or expanded a Child Tax Credit or Earned Income Tax Credit. Both these policies can help bolster the economic security of low- and middle-income families and position the next generation for success.

Congressional Republicans Distort a New Report on the Global Minimum Tax

June 22, 2023 • By Steve Wamhoff

The notion that we are better off allowing our corporations to pretend their profits are earned in the Cayman Islands or Ireland simply defies logic and the facts. There is no scenario in which the U.S. would be better by ditching the international agreement that the government already negotiated.

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

As the sweet days of summer pass, the scent of jasmine isn't the only thing blowing through the minds of state lawmakers, as tax policy discussions remain at the forefront...

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids, Especially Those in Families with Low Incomes

June 13, 2023 • By Joe Hughes

Restoring the federal Child Tax Credit to 2021 levels would benefit nearly 60 million children. Three-quarters of the benefit would go to families in the bottom three quintiles, consisting of households with less than $86,600 in income.