Recent Work

2162 items

Trump-GOP Tax Law Encourages Companies to Move Jobs Offshore–and New Tax Cuts Won’t Change That

June 2, 2020 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

New tax cuts to incentivize bringing jobs back to the United States will fail. No new tax provisions can be more generous than the zero percent rate the 2017 law provides for many offshore profits or the loopholes that allow corporations to shift profits to countries with minimal or no corporate income taxes.

Trump Administration Stops Pretending to Care About the Economy with Its Capital Gains Tax Proposal

May 28, 2020 • By Steve Wamhoff

Proponents of capital gains tax breaks have always offered a weak argument that they encourage investment and thereby grow the economy. But the Trump administration is now floating a temporary capital gains tax break, which is supported by no argument at all. It would only reward investments made in the past while doing nothing to encourage new investment.

State Rundown 5/27: Some States Finally Talking Revenue Solutions to Revenue Crisis

May 27, 2020 • By ITEP Staff

This week the immense scale and uneven distribution of economic and health damage from the COVID-19 pandemic continued to come into focus, hand in hand with greater clarity around pandemic-related revenue losses threatening state and local revenues and the priorities—such as health care, education, and public safety—they fund. Officials in many states, including Ohio and Tennessee, nonetheless rushed to declare their unwillingness to be part of any solution that includes raising the tax contributions of their highest-income residents. On the brighter side, some leaders are willing to do just that, for example through progressive tax increases proposed in New York…

What Biden Means By No Tax Increases on Anyone “Making Under $400,000”

May 22, 2020 • By Steve Wamhoff

Presidential candidate Joe Biden said on Friday that under his proposals, no one with income below $400,000 would pay higher taxes than they do now. Does this make sense? It is true that Congress and the next president have many options to raise trillions of dollars from people who have incomes even higher than that. […]

State Rundown 5/20: State Revenue Crisis Getting Clearer…and Scarier

May 20, 2020 • By ITEP Staff

State policymakers are navigating incredibly uncertain waters these days as they attempt to get a firmer grasp on the scale of their revenue crises, identify painful budget cuts they may have to make in response, and look for ways to raise tax revenues coming from the households and corporations still bringing in large incomes and profits amid the pandemic—all while hoping that additional federal aid and greater flexibility in how they can use federal CARES Act funds will help relieve some of these difficult decisions.

The Health Economic Recovery and Omnibus Emergency Solutions (HEROES) Act includes important changes to business tax provisions in the CARES Act, the most recent COVID-19 legislation enacted by Congress and the president. The House-passed plan would undo CARES Act changes that make it easy for businesses to claim losses to reduce or avoid all taxes. […]

JPMorgan Chase CEO Jamie Dimon, in a May 19 memo to employees, outlines steps the company is taking to help its customers, small businesses and communities stay afloat. The part of the public relations memo that has received the most attention, however, is Dimon’s call for “rebuilding a more inclusive economy.” “It is my fervent […]

Major Cash Payment and Tax Provisions in the HEROES Act

May 15, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

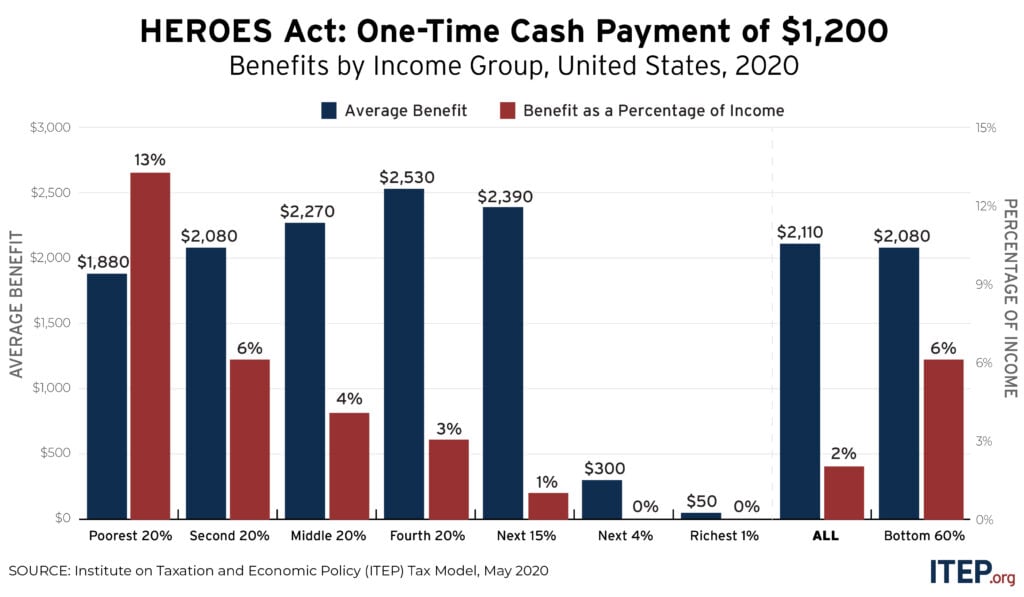

The major provisions for cash payments and tax changes in the House Democrats’ Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act would provide nearly $600 billion to individuals and households and average benefits of more than $3,000 to families in all but the highest income levels.

The HEROES Act, filed by the House Democrats this week, includes a new one-time payment of $1,200 per adult and child and extends the payment to ITIN filers and their families. The bill also includes a retroactive change to the CARES Act ensuring ITIN filers will also receive the initial payment under the CARES Act. ITEP estimates more than 4.3 million adults and 3.5 million children would benefit from this change.

Fiscal Policy Institute: Unemployment Insurance Taxes Paid for Undocumented Workers in NYS

May 14, 2020 • By ITEP Staff

In the midst of a pandemic, there has been a growing call for undocumented immigrants, who make up five percent of the New York State labor force, to be covered by some form of unemployment insurance. What is often overlooked in discussions of unemployment insurance is the extent to which undocumented immigrants are already part […]

House Democrats today introduced a proposal that responds to our staggering economic crisis with the right policies at the necessary scale. It’s a refreshing change from some of the misdirected ideas that have passed or been floated in these alarming economic times.

Which Workers Wouldn’t Be Helped by a Payroll Tax Cut?

May 8, 2020 • By Jessica Schieder, Lorena Roque

New data released today estimates 20.5 million jobs were lost in the month of April alone. Workers not currently receiving paychecks would be left out of any benefits provided by a payroll tax cut.

Harris-Sanders-Markey Cash Payment Proposal Would Dwarf Checks Sent Under the CARES Act

May 8, 2020 • By Steve Wamhoff

Sens. Kamala Harris, Bernie Sanders and Edward Markey released a proposal to provide a monthly payment of $2,000 for each member of a household (including up to three dependents), with benefits phased out at income levels starting at $200,000 for married couples. The proposal is partly a response to concerns that one-time cash payments under the CARES Act, which amount to $1,200 ($2,400 for married couples) and $500 for each child under age 17, are not sufficient to help families make ends meet or boost the economy.

State Rundown 5/7: State Fiscal Responses to Pandemic Starting to Get Real

May 7, 2020 • By ITEP Staff

State lawmakers are starting to use fiscal policy levers to address the COVID-19 pandemic, but the actions vary greatly and are just a start. Mississippi, for example, is one state still clarifying who has authority to determine how federal aid dollars are spent. Colorado, Georgia, Missouri, and Ohio are among the many states identifying painful funding cuts they will likely make to shared priorities like health care. The Louisiana House and the Minnesota Senate each advanced tax cuts and credits that could dig their budget holes even deeper. Connecticut leaders are looking at one of the more comprehensive packages, which…

Trump’s Latest Tax Break Proposals Include Everything—Except Helping Regular People

May 6, 2020 • By Steve Wamhoff

None of the tax proposals considered by the administration would provide help to those who need it or do much, if anything, to boost investment.