Recent Work

2162 items

15 Companies Report Tax Savings of $6.2 Billion in First Three Months of 2018

April 26, 2018 • By Matthew Gardner

In reports released over the past week, covering the first three months of 2018, a few of the biggest and most profitable Fortune 500 corporations acknowledge receiving billions in tax cuts in the first quarter of 2018 alone. Fifteen of these companies collectively disclosed reducing their effective tax rates by $6.2 billion compared to the rates they faced in the first quarter of last year.

State Rundown 12/31/9999: IRS Glitch and Legislative Impasses Extend Tax Season

April 20, 2018 • By ITEP Staff

This week the IRS website asked some would-be tax filers to return after December 31, 9999. State legislators don't have quite that much time, but are struggling to wrap up their tax debates on schedule as well. Iowa legislators, for example, are ironically still debating tax cuts despite having run out of money to cover their daily expenses for the year. Nebraska's session wrapped up, but its tax debate continues in the form of a call for a special session and the threat of an unfunded tax cut going before voters in November. Mississippi's tax debate has been revived by…

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

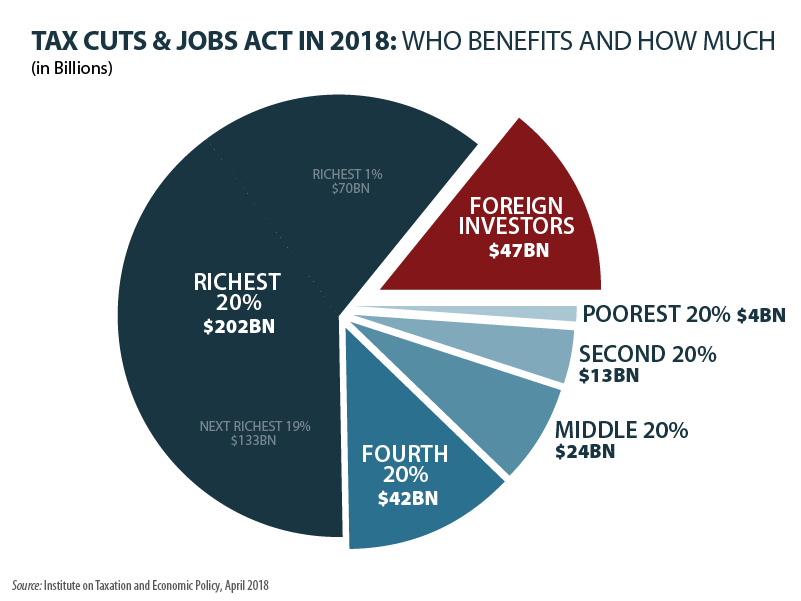

Congressional Budget Office: New Tax Law Helps Foreign Investors Even More than You Thought

April 19, 2018 • By Steve Wamhoff

President Trump and his allies in Congress have made many wild claims about economic growth that would result from the Tax Cuts and Jobs Act. And the Congressional Budget Office just released a report revealing the TCJA will, in fact, create economic growth — for foreign investors.

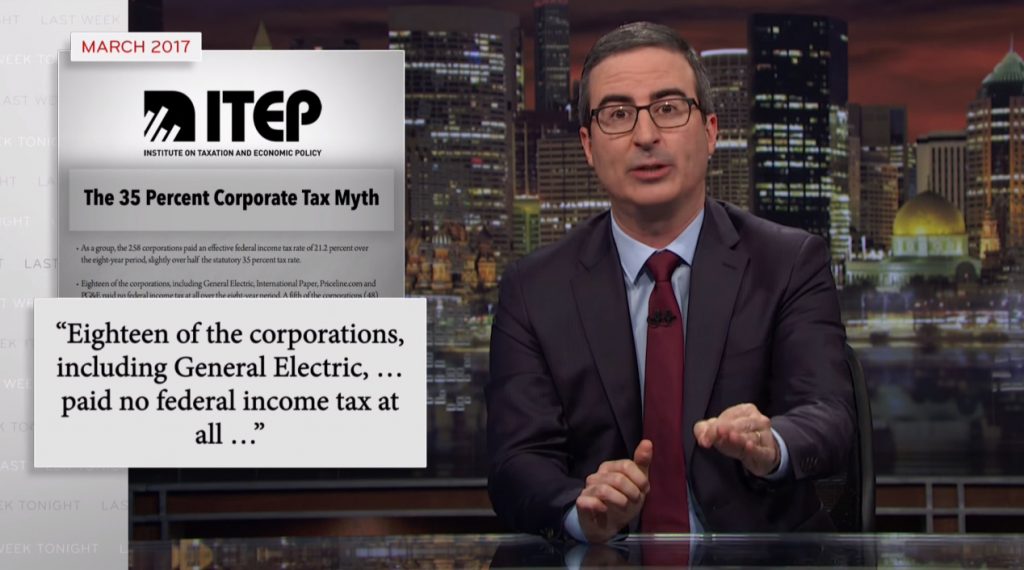

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

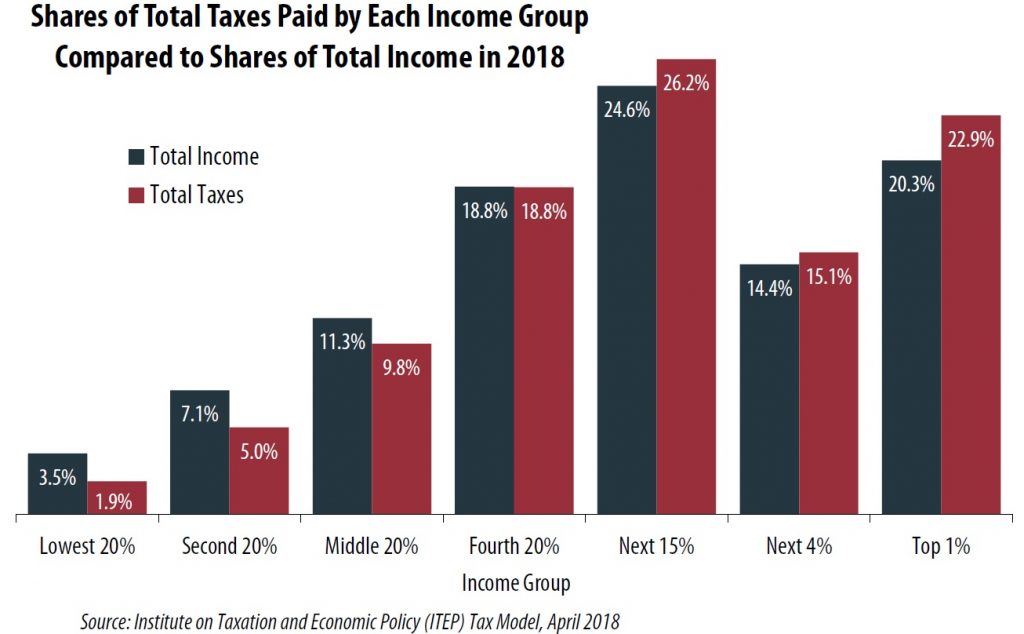

Everyone pays taxes, including those who earn the least. Our collective federal, state, and local tax system includes income taxes, payroll taxes (Social Security, Medicare), property taxes, sales and other excise taxes. The total share of taxes (federal, state, and local) that Americans across the economic spectrum will pay in 2018 is roughly equal to their total share of income.

Many Large Corporations Reporting Tax Cut-Inspired Employee Bonuses Were Paying Low Tax Rates to Begin With

April 12, 2018 • By Matthew Gardner

Since the corporate tax cut took effect at the beginning of 2018, a number of large corporations have announced plans to give bonuses or pay raises to some of their employees. Some of these companies have explicitly said that the new tax law, which sharply reduced the federal corporate income tax rate from 35 to 21 percent, made these moves possible. But an examination of the tax-paying habits of these corporations found that many of them used various tax breaks and accounting maneuvers to reduce their tax rates to below 21 percent year after year before the new tax law…

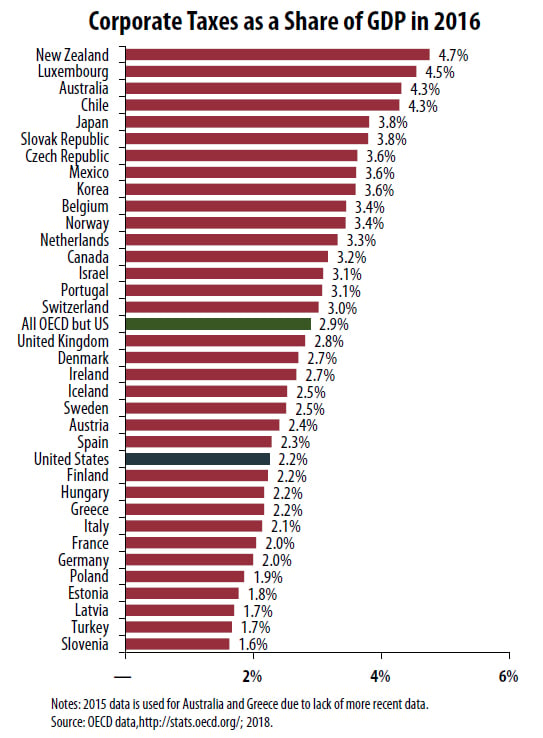

Trump Tax Cuts Likely Make U.S. Corporate Tax Level Lowest Among Developed Countries

April 11, 2018 • By Richard Phillips

U.S. corporate tax collection was equal to 2.2 percent of the nation’s gross domestic product (GDP) in 2016, significantly less than the average 2.9 percent collected by the other 34 other OECD countries for which data were available.

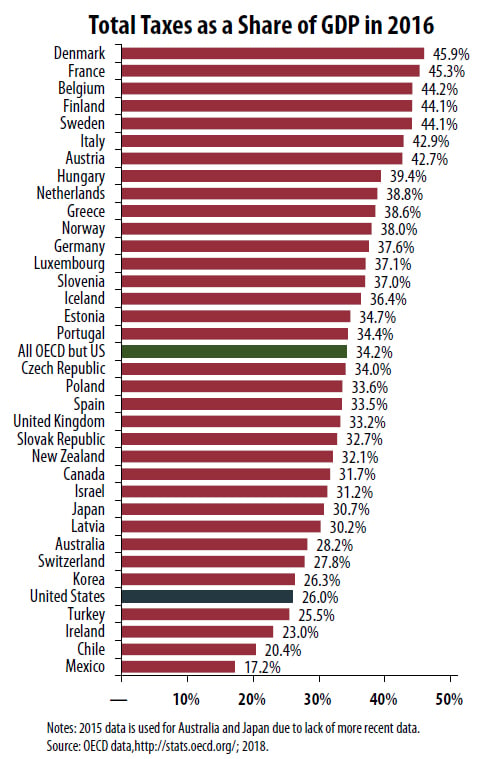

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed of the developed nations.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

What to Expect if the Supreme Court Allows for Online Sales Tax Collection

April 11, 2018 • By Carl Davis

Online shopping is hardly a new phenomenon. And yet states and localities still lack the authority to require many Internet retailers to collect the sales taxes that their locally based, brick and mortar competitors have been collecting for decades.

A Paul Ryan Retrospective: A Decade of Regressive Budget and Tax Plans

April 11, 2018 • By ITEP Staff

As Speaker of the House, Rep. Paul Ryan pushed through the Tax Cuts and Jobs Act that will cost at least $1.5 trillion and provide around half of its benefits to the richest five percent of households. He then announced that Congress needs to cut entitlements to get the budget deficit under control. Before becoming Speaker, Ryan spent several years running the Budget Committee and the Ways and Means Committee, where he issued budget and tax plans each year to carry out his goals (lower taxes for the rich and cuts in entitlement spending), which are described in the reports…

Fifteen (of Many) Reasons We Need Real Corporate Tax Reform

April 11, 2018 • By Matthew Gardner

This ITEP report examines a diverse group of 15 corporations’ federal income tax disclosures for tax year 2017, the last year before the recently enacted tax law took effect, to shed light on the widespread nature of corporate tax avoidance. As a group, these companies paid no federal income tax on $24 billion in profits in 2017, and they paid almost no federal income tax on $120 billion in profits over the past five years. All but one received federal tax rebates in 2017, and almost all paid exceedingly low rates over five years.

America’s tax system overall is marginally progressive. The share of all taxes paid by the richest Americans slightly exceeds their share of the nation’s income. Conversely, the share of all taxes paid by the poorest Americans is slightly smaller than the share of the nation’s income going to that group.