SALT

SALT in the Wound: New Tax Law’s Limit on State Tax Deductions Exempts Some of the Very Wealthiest

August 21, 2025 • By ITEP Staff

The new tax law enacted last month found a temporary compromise on the level of the cap, boosting it to $40,000 through 2029, but failed to fix a loophole that allows some rich taxpayers with good accountants to completely avoid the cap

States Should Move Quickly to Chart Their Own Course on SALT Deductions

July 17, 2025 • By Dylan Grundman O'Neill, Nick Johnson

While a federal SALT cap is hotly debated, capping deductibility at $10,000 was an unambiguously good idea at the state level. States would be smart to stick with the current cap or, better yet, go even farther and repeal SALT deductions outright. Going along with a higher federal SALT cap would double down on a regressive tax cut that will mostly benefit a small number of relatively wealthy state residents and cost states significant revenue.

The endlessly debated cap on deductions for state and local taxes (SALT) has emerged in the GOP megabill largely unscathed—despite the efforts of Republican lawmakers from “blue” states. Those lawmakers are correct that the cap reduces the bill’s tax cuts for their wealthy constituents more than for those in other states. The megabill, however, is so loaded up with other provisions that result in a dramatic tax cut for the richest 1 percent in every state.

Sweeping Federal Tax and Spending Changes Threaten Local Governments

June 3, 2025 • By Kamolika Das

Given this environment, local leaders must do what they can to preserve and strengthen progressive revenue tools, advocate for expanded local taxing authorities and flexibility, and push their state leaders to decouple from harmful federal tax changes.

Five Issues for States to Watch in the Federal Tax Debate

June 3, 2025 • By Dylan Grundman O'Neill, Kamolika Das, Marco Guzman, Miles Trinidad, Neva Butkus

This post covers five particularly notable provisions for states: increasing deductions for state and local taxes (SALT) paid, allowing more generous tax write-offs for businesses, offering new avenues for capital gains tax avoidance to people contributing to private school voucher funds, carving tips and overtime out of the tax base, and re-upping Opportunity Zone tax breaks for wealthy investors.

Different Approaches to the Trump Tax Law’s Cap on Deductions for State and Local Taxes (SALT)

January 17, 2025 • By Steve Wamhoff

President Trump and the Republican majorities in the House and Senate may not extend the $10,000 cap on federal income tax deductions for state and local taxes (SALT), the one part of the 2017 law that significantly limits tax breaks for the rich. And, depending on which proposal they settle on, leaving out the existing cap on SALT deductions could add between $10 billion and over $100 billion each year to the total cost of their tax plan.

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

House SALT Proposal is Expensive, Unneeded, and Poorly Designed

February 2, 2024 • By Joe Hughes

The SALT Marriage Penalty Elimination Act passed by the House Rules Committee on February 1 is costly, decreasing tax revenue by about $8 billion in 2023. It also mostly only helps taxpayers who are already well off.

Weakening the SALT Cap Would Make House Tax Package More Expensive and More Tilted in Favor of the Wealthiest

August 7, 2023 • By Steve Wamhoff

The three tax bills that cleared the House Ways and Means Committee in June are reportedly stalled due to some House Republicans’ demands that the package include provisions weakening the $10,000 cap on deductions for state and local taxes (SALT). Modifying the House tax package in this way would make it much more expensive while benefiting the richest fifth of taxpayers almost exclusively.

Latest Proposal from Senate Democrats Would Bar the Rich from SALT Cap Relief

December 7, 2021 • By Steve Wamhoff

Richest taxpayers would receive $0 benefit under new compromise compared with 51 percent of the benefit of House-passed SALT provision DOWNLOAD NATIONAL AND STATE-BY-STATE ESTIMATES In the latest chapter of the saga over SALT, some Senate Democrats are discussing a new compromise that would amend the House-passed provision providing relief from the SALT cap to […]

Senators Menendez and Sanders Show the Way Forward on the SALT Cap

November 3, 2021 • By Steve Wamhoff

Amending the Build Back Better bill to fully repeal the SALT cap would mean that the richest 1 percent could pay less in personal income taxes than they do now, which goes against everything President Biden has said for the past year as he promoted this legislation.

Repealing the SALT Cap Would Wipe Out Revenue Raised by the House Ways and Means Bill’s Income Tax Provisions

September 23, 2021 • By Steve Wamhoff

There are several ways that the House leadership could avoid this problem. One approach is for lawmakers to replace the SALT cap with a different kind of limit on tax breaks for the rich that actually raises revenue and avoids disfavoring some states compared to others as the SALT cap does. ITEP has suggested a way to do this.

Frequently Asked Questions about Proposals to Repeal the Cap on Federal Tax Deductions for State and Local Taxes (SALT)

September 3, 2021 • By Carl Davis, ITEP Staff, Steve Wamhoff

Even though Democrats in Congress uniformly opposed the TCJA because its benefits went predominately to the rich, many Democratic lawmakers now want to give a tax cut to the rich by repealing the cap on SALT deductions.

We asked New York state resident Morris Pearl, former Blackrock executive and current chair of the Patriotic Millionaires, a few questions to hear straight from the mouth of a millionaire how the SALT cap and its proposed repeal would affect his life.

New Report from ITEP Describes Options for Changing the SALT Cap without Repealing It

August 26, 2021 • By Steve Wamhoff

A new report from ITEP provides policy recommendations to modify the $10,000 cap on federal tax deductions for state and local taxes (SALT), which was signed into law by President Trump as part of the Tax Cuts and Jobs Act. Because the SALT cap mostly restricts tax deductions for the richest 5 percent of Americans, the best options are to leave the cap as is or replace […]

A new ITEP analysis provides critical data for the debate over whether to repeal the $10,000 cap on state and local tax (SALT) deductions. The report finds that repeal of the SALT cap without other reforms would worsen economic disparities and exacerbate racial inequities baked into the federal tax system.

SALT Cap Repeal Would Worsen Racial Income and Wealth Divides

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A bipartisan group of 32 House lawmakers banded together to form the “SALT Caucus,” demanding elimination of the SALT cap. None of their arguments in favor of repeal change the fact that it would primarily benefit the rich and, according to new research, exacerbate racial income and wealth disparities.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

What to Expect from Biden and Congressional Democrats on Tax Increases for Individuals

April 8, 2021 • By Steve Wamhoff

The Biden administration has already provided details on its corporate tax proposals and in the next couple of weeks is expected to propose tax changes for individuals. Meanwhile, congressional Democrats have some ideas of their own. What should we expect?

A Proposal to Simplify President Biden’s Campaign Plan for Personal Income Taxes and Replace the Cap on SALT Deductions

April 8, 2021 • By Steve Wamhoff

In this paper, we describe a tax policy idea that would simplify the proposals President Biden presented during his campaign to raise personal income taxes for those with annual incomes greater than $400,000. Our proposal would replace the cap on state and local tax (SALT) deductions with a broader limit on tax breaks for the rich that would raise more revenue than the personal income tax hikes that Biden proposed during his campaign. Our proposal would also achieve Biden’s goals of setting the top rate at 39.6 percent and raising taxes only on those with income exceeding $400,000.

Ever since it was enacted as part of the Trump-GOP tax law, some Democrats in Congress have been pushing to repeal the cap on federal tax deductions for state and local taxes (SALT). Recently several Democratic members have suggested that repeal of the cap should be part of COVID relief legislation. While the cap on SALT deductions is problematic, repealing it without making other reforms would result in larger tax breaks for the rich. Instead, lawmakers should consider ITEP’s proposal to replace the SALT cap with a broader limit on tax breaks for the rich that would accomplish Biden’s goal…

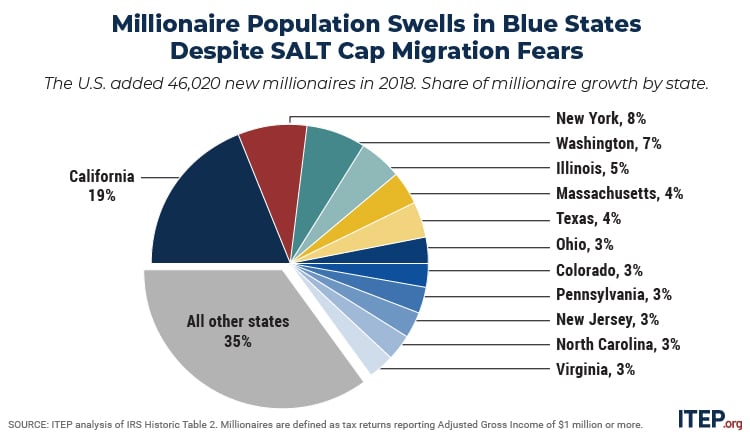

Millionaire Population Swells in Blue States Despite Migration Fearmongering

September 3, 2020 • By Carl Davis

Although the 2017 Tax Cuts and Jobs Act has created a slew of problems, it is now clear that a mass migration of top earners out of higher-tax blue states is not one of them.

IRS Rule Leaves the Door Open for Private/Religious School Voucher Donation Schemes, Broader SALT Cap Workarounds

August 12, 2020 • By Carl Davis

An IRS regulation released last Friday sanctions a widely derided tax dodge that allows profitable businesses to avoid taxes by sending money to private and religious school voucher funds. It also leaves the door open to a brand of state and local tax (SALT) cap workaround that previously appeared to be on its way out.

Addressing the COVID-19 Economic Crisis: Advice for the Next Round

April 7, 2020 • By Steve Wamhoff

Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?

House Democrats’ Suggestion of Retroactively Repealing SALT Cap is a Poor Emergency Relief Measure

March 31, 2020 • By Steve Wamhoff

The House Democrats have plenty of ideas to help workers and families and boost the economy, but Speaker Nancy Pelosi’s recent idea to repeal the cap on deductions for state and local taxes (SALT) is not one of them. The 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats have long made it clear that they want to start by repealing the $10,000 cap on SALT deductions, which is one of the law's few provisions that restrict tax breaks for the rich.