District of Columbia

The Rockefeller Foundation: The Untold Benefits of State EITCs on Child Welfare

June 16, 2021

With the passing of the American Rescue Plan in March, more than 5 million children are projected to be lifted out of poverty this year, cutting child poverty by more than half, through Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) expansions. But what about state tax codes? What can states do to […]

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

“Tax Day” was earlier this week but the debates, research, and advocacy that determine our taxes and how they are used take place every day of the year...

Nearly 20 Million Will Benefit if Congress Makes the EITC Enhancement Permanent

May 13, 2021 • By Aidan Davis

Overall, the EITC enhancement would provide a $12.4 billion boost in 2022 if made permanent, benefiting 19.5 million workers. It would have a particularly meaningful impact on the bottom 20 percent of eligible households who would receive more than three-fourths of the total benefit. Forty-one percent of households in the bottom 20 percent of earners would benefit, receiving an average income boost of 6.3 percent, or $740 dollars.

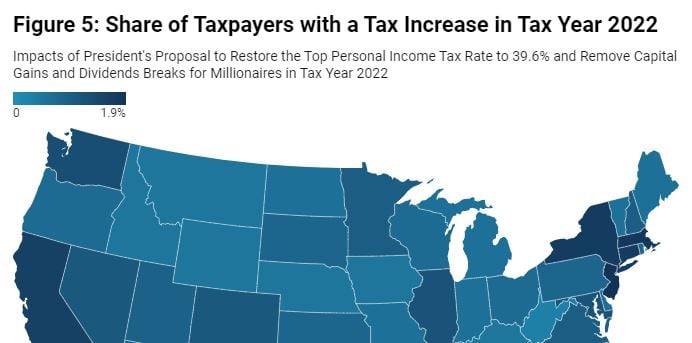

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

Gentrification and the Property Tax: How Circuit Breakers Can Help

April 27, 2021 • By David Crawford

Property tax circuit breakers are effective because they provide property tax relief to families whose property taxes surpass a certain percentage of their income. If a family in a gentrifying area sees their property tax bill (or their rent) surge to an unaffordable level, a circuit breaker credit kicks in to offer relief. This targeted approach assists low- and middle-income families without significantly reducing overall tax revenue.

What to Expect from Biden and Congressional Democrats on Tax Increases for Individuals

April 8, 2021 • By Steve Wamhoff

The Biden administration has already provided details on its corporate tax proposals and in the next couple of weeks is expected to propose tax changes for individuals. Meanwhile, congressional Democrats have some ideas of their own. What should we expect?

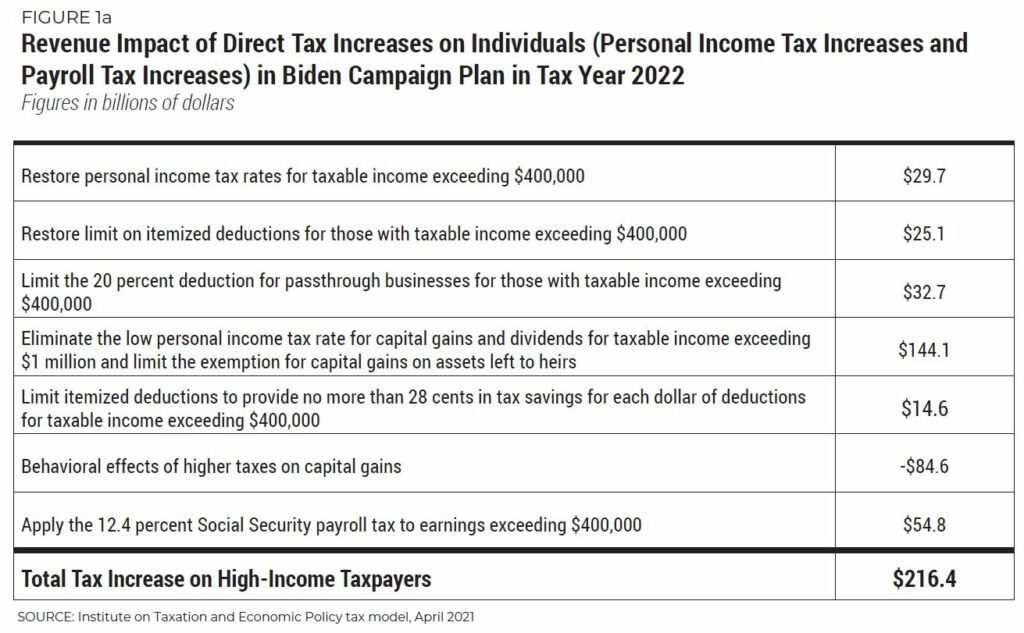

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

A Proposal to Simplify President Biden’s Campaign Plan for Personal Income Taxes and Replace the Cap on SALT Deductions

April 8, 2021 • By Steve Wamhoff

In this paper, we describe a tax policy idea that would simplify the proposals President Biden presented during his campaign to raise personal income taxes for those with annual incomes greater than $400,000. Our proposal would replace the cap on state and local tax (SALT) deductions with a broader limit on tax breaks for the rich that would raise more revenue than the personal income tax hikes that Biden proposed during his campaign. Our proposal would also achieve Biden’s goals of setting the top rate at 39.6 percent and raising taxes only on those with income exceeding $400,000.

State Rundown 4/1: Most States Resisting Foolish Tax Cut Games That Tear Revenues Apart

April 1, 2021 • By ITEP Staff

Supporters of tax fairness and adequate funding for public needs are hoping West Virginia’s income tax elimination effort turns out to be a prank, but most states are not fooling around with such harmful policies this year. For example...

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

The Street: Cannabis Stocks Rise as New York Moves Closer to Legalization

March 30, 2021

New York would be the 16th state, plus the District of Columbia, to fully legalize marijuana after decades of imprisoning people who participated in the cannabis black market. About one in three Americans live in a state with legal sales of recreational cannabis, according to the Institute on Taxation and Economic Policy. Read more

MinnPost: Is Minnesota’s Tax System Unfair?

March 15, 2021

The Institute on Taxation and Economic Policy’s regular assessment of state taxes concludes that just five states and the District of Columbia have positive scores on progressivity: California, Delaware, New Jersey, Vermont and Minnesota. The progressive systems rely less on consumption taxes and more on income taxes, with rates that increase with wealth. They also […]

DC Fiscal Policy Institute: Tax Injustice: DC’s Richest Residents Pay Lower Taxes than Everyone Else

March 5, 2021

A tax system that adequately advances racial and economic justice must be progressive, requiring the richest people to pay a much higher share of their income in taxes than lower-income families who have little or no wiggle room in their family budget. Yet new findings from the Institute on Taxation and Economic Policy (ITEP), a […]

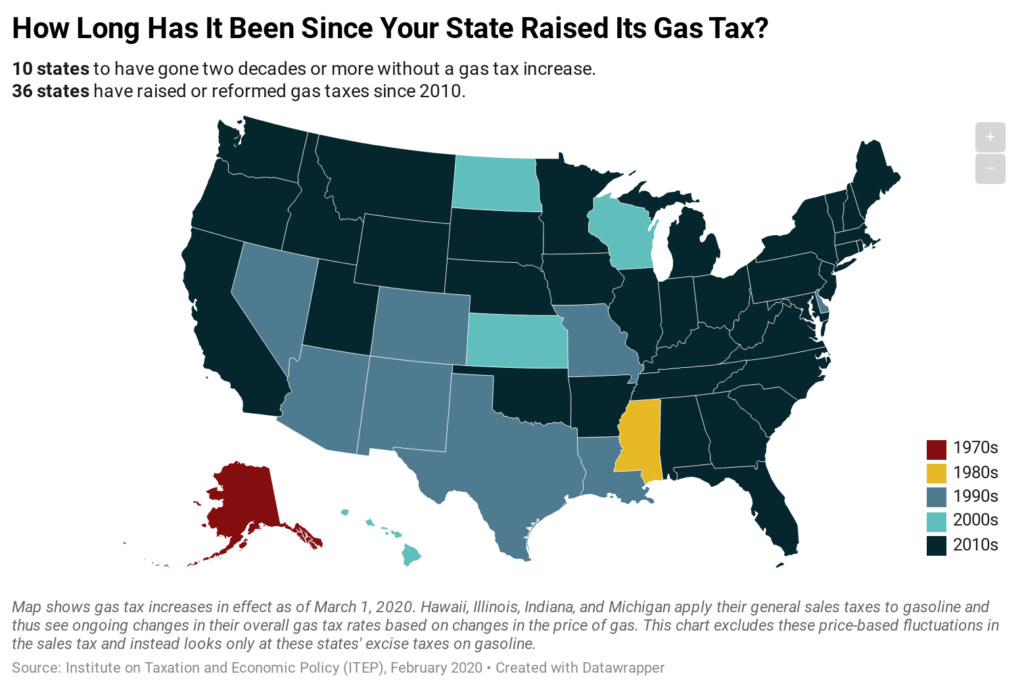

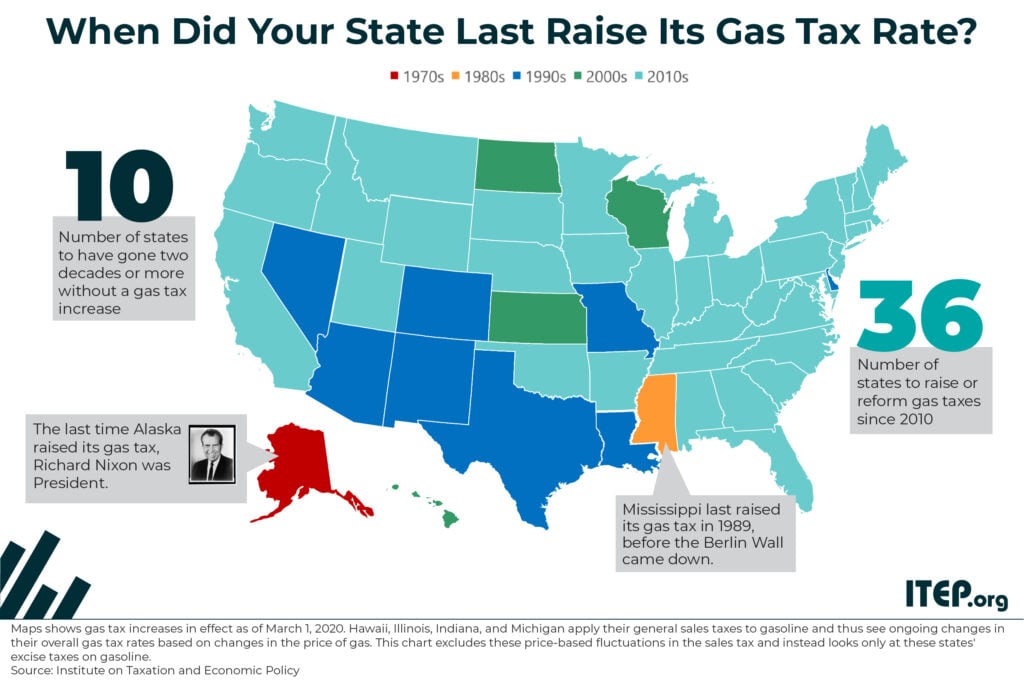

10 states to have gone two decades or more without a gas tax increase.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Although lawmakers in some states continue to push for expensive and regressive tax cuts that would primarily benefit wealthy households, worsen economic and racial injustices, and undermine funding for key public services, this week’s state fiscal news is dominated by efforts to do the opposite. Leaders in the District of Columbia, Maine, Nebraska, New York, Washington, and Wyoming made recent headlines by advocating for policies that improve on upside-down tax codes and generate needed funding for shared priorities like schools and health care.

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

Ever since it was enacted as part of the Trump-GOP tax law, some Democrats in Congress have been pushing to repeal the cap on federal tax deductions for state and local taxes (SALT). Recently several Democratic members have suggested that repeal of the cap should be part of COVID relief legislation. While the cap on SALT deductions is problematic, repealing it without making other reforms would result in larger tax breaks for the rich. Instead, lawmakers should consider ITEP’s proposal to replace the SALT cap with a broader limit on tax breaks for the rich that would accomplish Biden’s goal…

These EITC Reforms Would Help Struggling Families Now and Address Systemic Challenges

December 4, 2020 • By Aidan Davis

The tepid economic recovery is leaving millions behind. The nation still has nearly 10 million jobs less than it did in February, according to the latest jobs report. The number of people living in or near poverty is rising. Twelve million workers are about to lose their unemployment insurance, roughly four in 10 people report experiencing food insecurity for the first time, and conditions are likely to deteriorate further in the weeks ahead as we brace for another deadly surge in COVID cases and new or tightened restrictions on business and personal activity.

After the Dust Has Settled: How Progressive Tax Policy Fared in the General Election

November 30, 2020 • By Marco Guzman

While the results of the 2020 presidential election are all but set in stone—and a sign of life for progressive policy—the results of state tax ballot initiatives are more of a mixed bag. However, the overall fight for tax equity and raising more revenue to invest in people and communities is trending in the right direction.

Voters Have the Chance in 2020 to Increase Tax Equity in Arizona, Illinois, and California, And They Should

October 22, 2020 • By Marco Guzman

There’s a lot at stake in this election cycle: the nation and our economy are reeling from the effects brought on by the coronavirus pandemic and states remain in limbo as they weigh deep budget cuts and rush to address projected revenue shortfalls.

Supreme Court Would Provide Massive Tax Cut for the Rich if It Strikes Down Affordable Care Act

October 13, 2020 • By Steve Wamhoff

If the Supreme Court strikes down the Affordable Care Act (ACA), as argued for by the Trump administration and the president’s nominee to the court, Amy Coney Barrett, one under-appreciated result will be a tax break of roughly $40 billion annually for about 3 percent of Americans, who all have incomes of more than $200,000.