Georgia

State Rundown 2/28: February a Long Month for State Tax Debates

February 28, 2018 • By ITEP Staff

February may be the shortest month but it has been a long one for state lawmakers. This week saw Arizona, Idaho, Oregon, and Utah seemingly approaching final decisions on how to respond to the federal tax-cut bill, while a bill that appeared cleared for take-off in Georgia hit some unexpected turbulence. Other states are still studying what the federal bill means for them, and many more continue to debate tax and budget proposals independently of the federal changes. And be sure to check our "What We're Reading" section for news on corporate tax credits from multiple states.

This week, major tax packages relating to the federal tax-cut bill made news in Georgia, Iowa, and Louisiana, as Minnesota and Oregon lawmakers also continue to work out how their states will be affected. New Mexico's legislative session has finished without significant tax changes, while Idaho and Illinois's sessions are beginning to heat up, and Vermont's school funding system is under the microscope.

Georgia Budget and Policy Institute: Lawmakers Might Come to Regret Georgia’s Risky Tax Plan

February 22, 2018

Bill Analysis: House Bill 918 Substitute (LC 34 5383-ECS); Feb. 22, 2018 Georgia leaders are now rushing a massive tax package through the state’s General Assembly with limited debate and without a clear tally of the plan’s true cost. Gov. Nathan Deal and legislative leaders introduced a revised tax package Feb. 20, 2018, designed to […]

New York Times: When Calling an Uber Can Pay off for Cities and States

February 20, 2018

The new fees and taxes are often part of broader regulatory measures as states and localities scramble to update tax codes and laws that have not kept up with the proliferation of app-based ride services. For instance, a Georgia state tax applies to rides in taxis but not ride-hailing cars even though they essentially do […]

Concord Monitor: NH School Choice Bill Could Create a Tax Shelter for the Rich

February 18, 2018

Carl Davis, the research director at the Washington-based Institute on Taxation and Economic Policy, has written extensively about ETCs as tax shelters. Nationwide, about $1 billion in potential tax dollars is diverted each year into these scholarship organizations, according to a 2016 ITEP report by Davis. What kinds of tax credits states allow under ETC […]

Georgia Budget and Policy Institute: Governor’s Tax Plan Carries $1 Billion Price

February 16, 2018

Gov. Nathan Deal’s administration introduced a multifaceted tax package on Feb. 13, 2018 designed to reduce state revenues by about $1 billion a year over the next decade. House Bill 918 comes in response to recent news that the federal tax changes signed into law by President Donald Trump in December could generate a so-called […]

The Augusta Chronicle: Georgia Governor Nathan Deal wants to slash state tax windfall

February 15, 2018

It is difficult to quantify how much the average taxpayer would be affected under current law. A middle income family in Georgia — making between $40,000 and $62,000 annually — could see its federal tax burden decrease by about $600 annually, according to an analysis from the left-leaning Institute on Taxation and Economic Policy in […]

This Valentine's week finds California, Georgia, Missouri, New York, Oregon, and other states flirting with the idea of coupling to various components of the federal tax-cut bill. Meanwhile, lawmakers seeking revenue solutions to budget shortfalls in Alaska, Oklahoma, and Wyoming saw their advances spurned, and anti-tax advocates in many states have been getting mixed responses to their tax-cut proposals. And be sure to check out our "what we're reading" section to see how states are getting no love in recent federal budget developments.

State Rundown 2/8: State Responses to Federal Bill Gaining Steam

February 8, 2018 • By ITEP Staff

Several states this week are looking at ways to revamp their tax codes in response to the federal tax cut bill, with Georgia, Idaho, Maryland, Nebraska, and Vermont all actively considering proposals. Meanwhile, Connecticut, Louisiana, and Pennsylvania are working on resolving their budget shortfalls. And transportation funding is getting needed attention in Mississippi, Utah, and Wisconsin.

Georgia Budget and Policy Institute: Immigrants Make Georgia Stronger and Better Every Day

February 1, 2018

Immigrant taxpayers contribute to Georgia’s bottom line. As immigrants start businesses, buy homes, earn wages and spend disposable income at local businesses, they generate considerable state and local tax revenue regardless of citizenship status. Undocumented Georgians contributed an estimated $352 million in state and local taxes in 2014, according to the Institute on Taxation and […]

Georgia Budget & Policy Institute: People-Powered Prosperity

February 1, 2018

People-Powered Prosperity details a new vision for how state lawmakers can pursue strategies to help all Georgians thrive, as well as how the state can responsibly pay for it.

What the Tax Cuts and Jobs Act Means for States – A Guide to Impacts and Options

January 26, 2018 • By ITEP Staff

The recently enacted Tax Cuts and Jobs Act (TCJA) has major implications for budgets and taxes in every state, ranging from immediate to long-term, from automatic to optional, from straightforward to indirect, from certain to unknown, and from revenue positive to negative. And every state can expect reduced federal investments in shared public priorities like health care, education, public safety, and basic infrastructure, as well as a reduced federal commitment to reducing economic inequality and slowing the concentration of wealth. This report provides detail that state residents and lawmakers can use to better understand the implications of the TCJA for…

Charleston Post-Courier: An Abuse of Charitable Giving?

January 14, 2018

Under the new law, some wealthy South Carolinians may actually make a 37 percent profit, risk-free, by making charitable contributions to Exceptional SC, a nonprofit fund created by the state Legislature to administer scholarships to students with disabilities attending private schools. That’s according to a recent report by the nonpartisan Institute on Taxation and Economic Policy. South Carolina has […]

NPR: This Tax Loophole for Wealthy Donors Just Got Bigger

December 29, 2017

One of the changes, according to the Institute on Taxation & Economic Policy, which advocates for a “fair and sustainable” tax system, allows far more wealthy donors in 10 states to turn a profit through “donations” to private school scholarships. Yes, you read that right. If your income is high enough, you can actually make […]

How the Final GOP-Trump Tax Bill Would Affect Georgia Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

Private Schools Donors Likely to Win Big from Expanded Loophole in Tax Bill

December 14, 2017 • By Carl Davis

For years, private schools around the country have been making an unusual pitch to prospective donors: give us your money, and you’ll get so many state and federal tax breaks in return that you may end up turning a profit. Under tax legislation being considered in Congress right now, that pitch is about to become even more persuasive.

Tax Bill Would Increase Abuse of Charitable Giving Deduction, with Private K-12 Schools as the Biggest Winners

December 14, 2017 • By Carl Davis

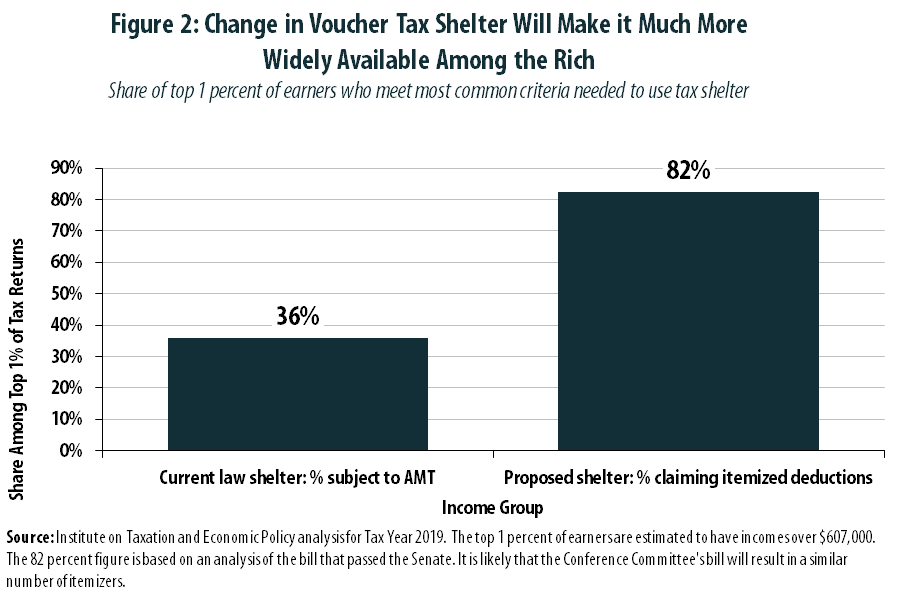

In its rush to pass a major rewrite of the tax code before year’s end, Congress appears likely to enact a “tax reform” that creates, or expands, a significant number of tax loopholes.[1] One such loophole would reward some of the nation’s wealthiest individuals with a strategy for padding their own bank accounts by “donating” to support private K-12 schools. While a similar loophole exists under current law, its size and scope would be dramatically expanded by the legislation working its way through Congress.[2]

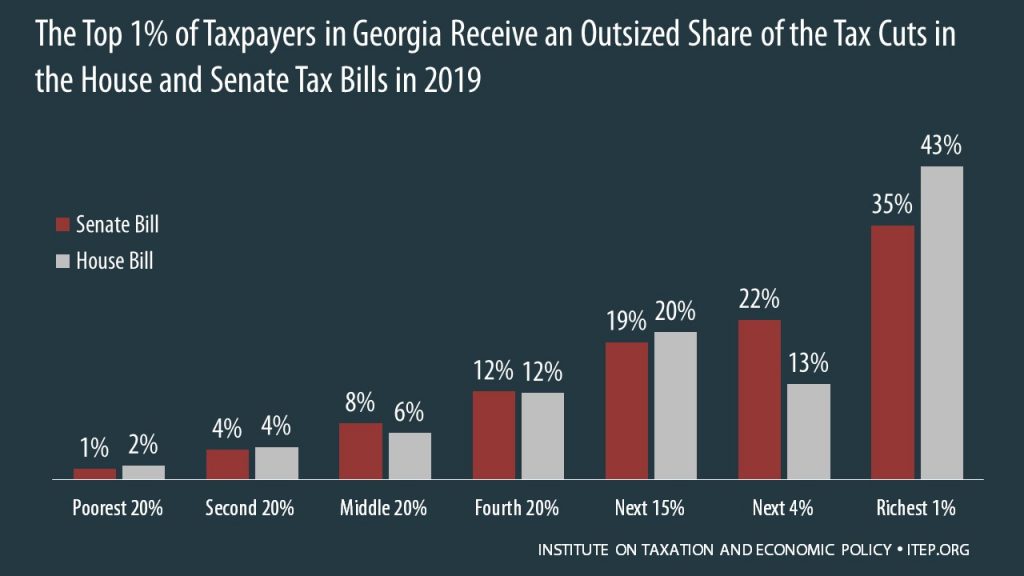

How the House and Senate Tax Bills Would Affect Georgia Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Georgia residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

ITEP has analyzed each of the tax proposals advanced by the House and Senate in recent weeks. While some details have changed, the bottom line is the same: The plans would disproportionately benefit corporations and the wealthy. The Senate tax plan ITEP’s latest analysis examined the proposal that passed the Senate Finance Committee on Nov. […]

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

How the Revised Senate Tax Bill Would Affect Georgia Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Georgia, 60 percent of the federal tax cuts would go to the richest 5 percent of residents, and 19 percent of households would face a tax increase, once the bill is fully implemented.

Senate Tax Plan Reserves Greatest Benefit for Richest Americans, Millions Face an Increase

November 13, 2017 • By ITEP Staff

A 50-state analysis of the Senate tax proposal finds that not only would greatest share of benefits go to the richest Americans, but also more than one in 10 taxpayers would face a tax hike, with a large number of those taxpayers residing in states where residents pay higher state and local taxes.

House Tax Bill Would Put Property Tax Deduction Out of Reach for Most Households

November 13, 2017 • By ITEP Staff

The House of Representatives is expected to vote this week on a bill that would reduce federal revenues by roughly $1.5 trillion over the next decade. Despite the bill’s high price tag, many households would pay more in federal tax if the bill is enacted, in large part because it slashes the deduction for state […]