Income Taxes

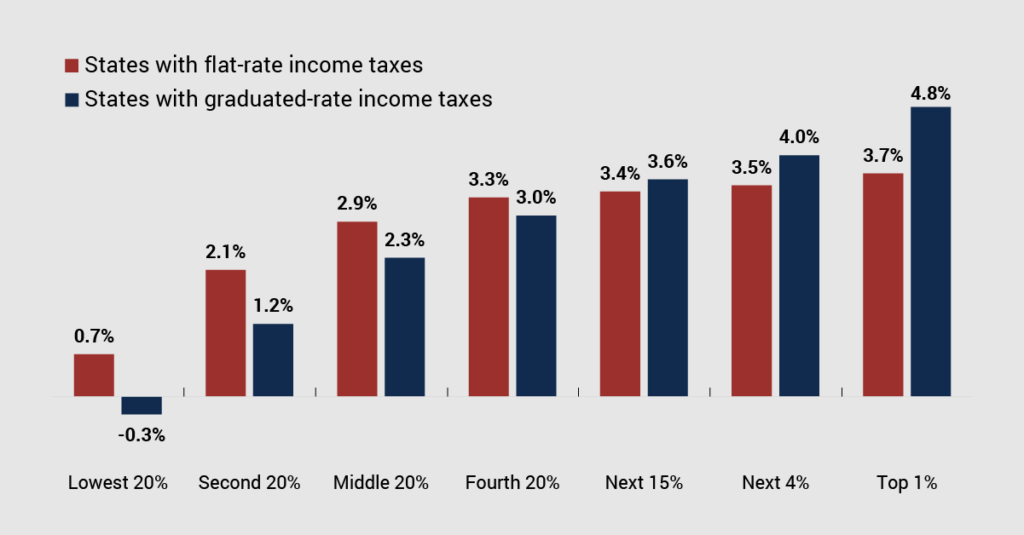

America's tax system is just barely progressive, and not nearly as progressive as many suggest or as progressive as it could be. There is plenty of room for lawmakers to improve the progressivity of the tax code to combat economic, wealth, and racial inequality.

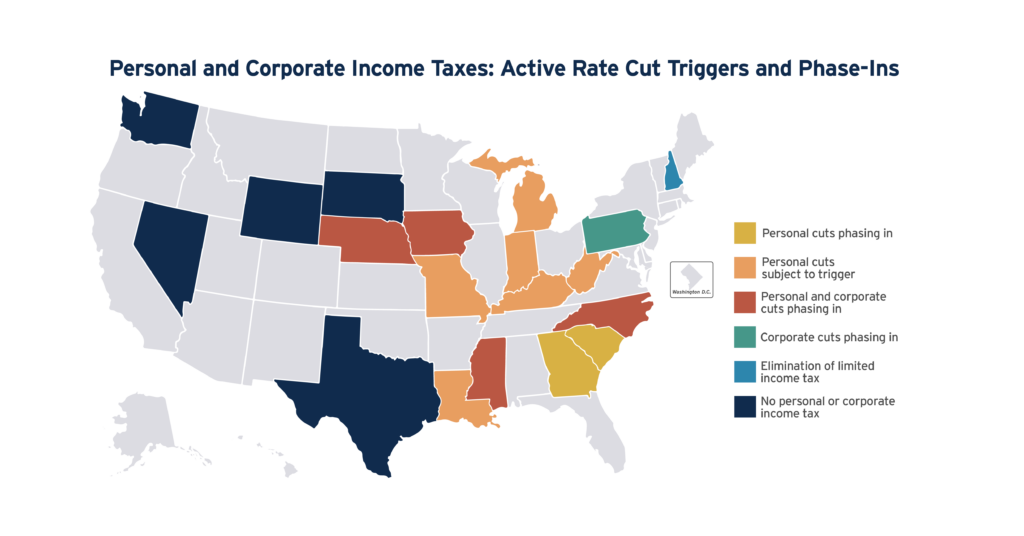

Governors and legislative leaders in a dozen states have made calls to fully eliminate their taxes on personal or corporate income, after many states already deeply slashed them over the past few years. The public deserves to know the true impact of these plans, which would inevitably result in an outsized windfall to states’ richest taxpayers, more power in the hands of wealthy households and corporations, extreme cuts to basic public services, and more deeply inequitable state tax codes.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2025 Budget Plan

March 12, 2024 • By Steve Wamhoff

President Biden’s most recent budget plan includes proposals that would raise more than $5 trillion from high-income individuals and corporations over a decade. Like the budget plan he submitted to Congress last year, it would partly reverse the Trump tax cuts for corporations and high-income individuals, clamp down on corporate tax avoidance, and require the wealthiest individuals to pay taxes on their capital gains income just as they are required to for other types of income, among other reforms.

Some states have improved tax equity by raising new revenue from the well-off and creating or expanding refundable tax credits for low- and moderate-income families in recent years. Others, however, have gone the opposite direction, pushing through deep and damaging tax cuts that disproportionately help the rich. Many of these negative developments are quantified in […]

Tax Cuts Fail Again in Kansas and Wisconsin; Lawmakers Should Pivot to Proven Investments

March 6, 2024 • By Neva Butkus

The governors of both Kansas and Wisconsin recently stood up to legislators who tried to push through costly tax cuts that would overwhelmingly benefit the most well-off. Lawmakers in those states and others should shift their focus from expensive, top-heavy tax cuts to tried and true policies that help middle-class and low-income families.

IRS Commissioner, New GAO Report Highlight Importance of Proper IRS Funding

February 16, 2024 • By Joe Hughes

A new GAO report and Commissioner Werfel’s testimony highlight the value and necessity of a well-funded and functioning IRS. Most families and businesses do their best to pay taxes accurately and on time. The nation benefits from a modern revenue agency that can make this process as easy and simple as possible and identify complex tax schemes that deprive the country of revenues.

House SALT Proposal is Expensive, Unneeded, and Poorly Designed

February 2, 2024 • By Joe Hughes

The SALT Marriage Penalty Elimination Act passed by the House Rules Committee on February 1 is costly, decreasing tax revenue by about $8 billion in 2023. It also mostly only helps taxpayers who are already well off.

It doesn’t matter if someone with a family income of $800,000 per year thinks they aren’t rich because they can’t quit their jobs and retire to a luxury home on the beach in Malibu. They can call themselves what they want. The point is that they are richer than 99 percent of the population and can afford to pay more.

Latest Kansas Tax Plan Would Provide an Estimated $875,000 Tax Cut to Charles Koch

January 22, 2024 • By Carl Davis, Neva Butkus

Last week, both houses of the Kansas legislature approved a significant tax cut centered around replacing the state’s graduated rate income tax structure with a flat tax instead. The bulk of this would flow to upper-income families, mostly through lowering the state’s top income tax rate from 5.7 to 5.25 percent. This tax cut would […]

Three states allow an unusual income tax deduction for federal income taxes paid. Missouri and Oregon limit these deductions by capping and/or phasing out the deduction, while Alabama, offers what amounts to an unlimited deduction. These deductions are detrimental to state income tax systems on many fronts, as they offer large benefits to high-income earners […]

Eliminating Indiana’s Income Tax Would Jeopardize Public Services & Create a Windfall for the Well-Off

October 19, 2023 • By Neva Butkus

Meaningful investments in Indiana’s future require a smart, and fair, tax code that recognizes current economic realities and can raise a sustainable stream of funding from those most able to pay.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

Congress Should Raise Taxes on the Rich, But That’s a Totally Separate Issue from the Debt Ceiling

May 9, 2023 • By Steve Wamhoff

Congress absolutely should raise taxes on the rich and on corporations to generate revenue and improve the fairness of our tax code. President Biden has several proposals to do exactly that. But this is an entirely separate question from whether we should raise the debt ceiling to honor the debts the nation has already incurred and avoid an economic apocalypse.

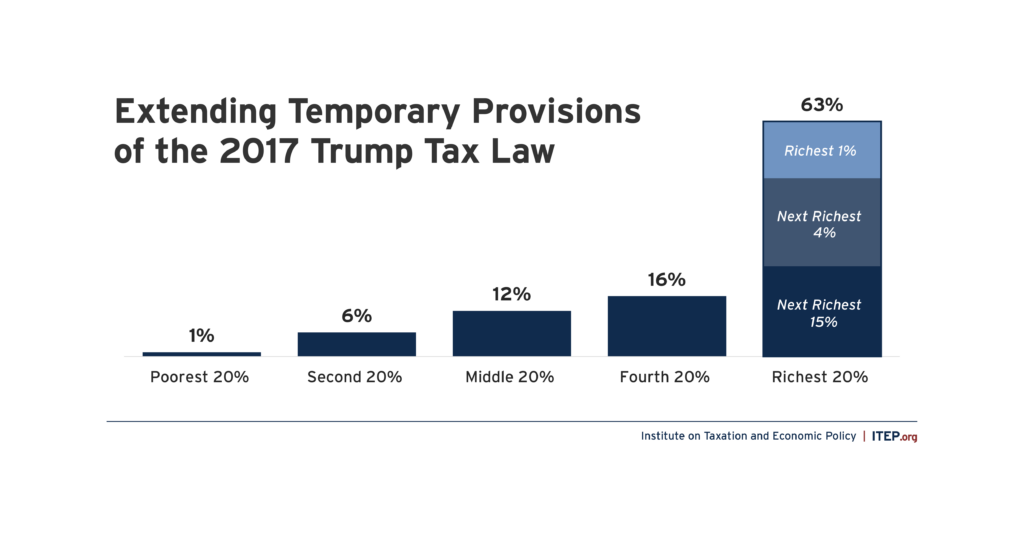

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Kansas Avoids Flat Tax Proposal: Narrow Victory a Cautionary Tale for Other States

April 27, 2023 • By Brakeyshia Samms

Kansas lawmakers failed to override Gov. Laura Kelly’s veto of a damaging flat tax package. In doing so, the state narrowly avoided traveling again down the same disastrous yet well-worn path of deep income tax cuts. States across the country can learn from Kansas’s experience by rethinking tax policy decisions and broader statewide priorities.

Everything! Taxing wealthy people and corporations and using the revenue for paid leave, child care, education, health care and college would transform America for girls and women of every race and family type, in every corner of this country.

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

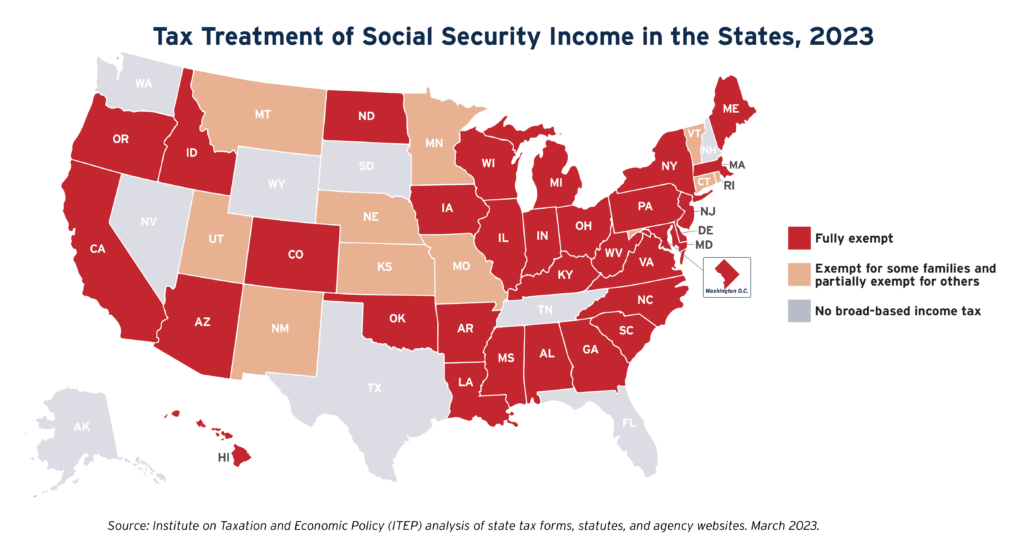

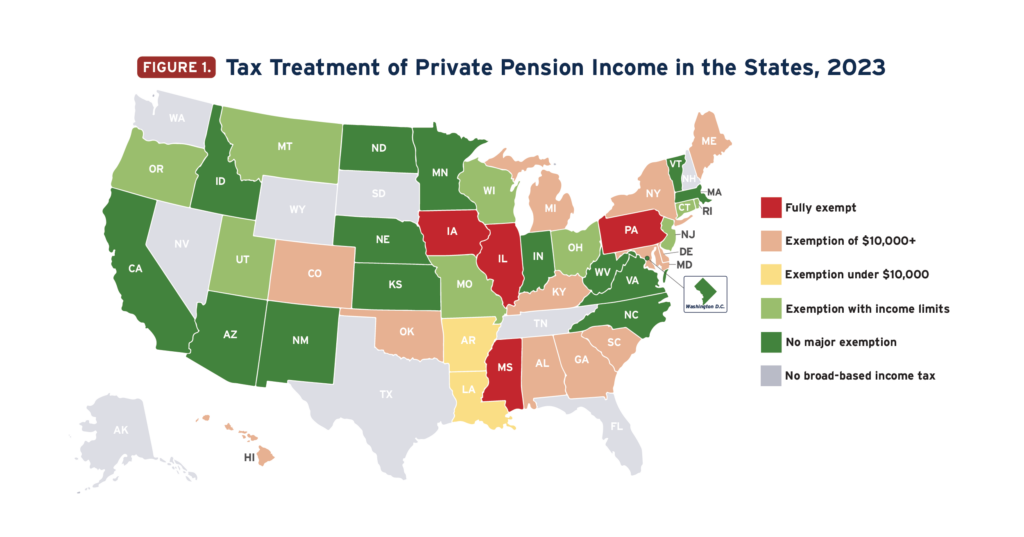

Every state with a personal income tax offers tax subsidies for seniors that are unavailable to younger taxpayers. The best academic research suggests that the median state asks senior citizens to pay about one-third less in personal income tax than younger families with similar incomes. The majority of these subsidies are costly and poorly targeted. […]

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2024 Budget Plan

March 10, 2023 • By Steve Wamhoff

President Biden’s latest budget proposal includes trillions of dollars of new revenue that would be paid by the richest Americans, both directly through increases in personal income, Medicare and estate taxes, and indirectly through increases in corporate income taxes.

Politifalse: A Fact-Checker Does Biden an Injustice on Taxes Paid by Billionaires

March 9, 2023 • By Michael Ettlinger

Most Americans pay more in Social Security and Medicare payroll taxes than they pay in federal personal income tax. So just looking at the personal income tax for comparison misses most of the taxes middle-income Americans pay. That is not true for billionaires because a much, much smaller proportion of their income is subject to the federal payroll taxes.

In recent years, lawmakers have been quick to push for phased-in tax cuts or cuts attached to trigger mechanisms. These policy tools push the implementation of tax cuts outside of the current budget window with a predetermined phase-in schedule or a mathematical formula tied to state revenue trends.

Two-thirds of states with broad-based personal income tax structures have a graduated rate, while one-third have flat taxes.