Michigan

Spring is around the corner and like those pesky allergies that come along with it, equally pesky tax proposals continue to pop up in states across the U.S....

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

Bridge Michigan: Michigan GOP tax cut plan helps wealthy at expense of equity

March 11, 2022

Following is an excerpt from an opEd co-authored by ITEP policy analyst Neva Butkus in Bridge Michigan: At the beginning of 2022, the national Institute on Taxation and Economic Policy (ITEP) forecasted the “tax cut fever” that has been sweeping through state legislatures across the nation — including here in Michigan, with the Legislature’s passage […]

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

ITEP is happy to announce the launch of our new State Tax Watch page, where you can find out about the most up-to-date tax proposals and permanent legislative changes happening across the country...

The Guardian: ‘A really bad deal’: Michigan awards GM $1bn in incentives for new electric cars

February 25, 2022

Meanwhile, GM has recorded $70bn in profits since 2010 while taking $8bn in subsidies in recent decades – more than all but one company nationwide. The idea that it needed incentives to invest in Michigan “is absurd”, said Matt Gardner, a senior fellow at the progressive-leaning Institute on Taxation and Economic Policy (ITEP). Businesses report that tax subsidies infrequently […]

State Rundown 2/16: Spending Priorities Emerge as the Votes Are Counted

February 16, 2022 • By ITEP Staff

State lawmakers have been busy working out deals and negotiating how best to use excess revenues, and as the votes are beginning to come in, spending priorities are becoming clearer...

While record state revenue surpluses have led to big pushes in red states to make unnecessary permanent income and corporate tax cuts, Democrats are also getting in on the tax-cut mania...

One-time payments have become a common theme around the country, as Idaho is one of roughly eleven states with plans to provide tax relief in a similar fashion...

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

State Rundown 11/10: It’s Beginning to Look a Lot Like…Election Season?!

November 10, 2021 • By ITEP Staff

If the leaves are turning colors and you find yourself walking out of the office into pitch-black darkness, it only means that time of the year is upon us—and no, I'm not talking about the holiday season. Before that, it’s the equally important election season...

The end of Spooky Season is near but that hasn’t stopped state lawmakers from adding their frightening plans into the bubbling cauldron of bad tax policy ideas...

The release of the ‘Pandora Papers’ showed once again that states and their tax systems play an important role in wealth inequality, and in this case, worsening it...

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

Labor Day is around the corner and in the spirit of celebrating the achievements of workers around the country, we here at ITEP want to call attention to the states (and territories) that are using tax policy to support workers and residents alike...

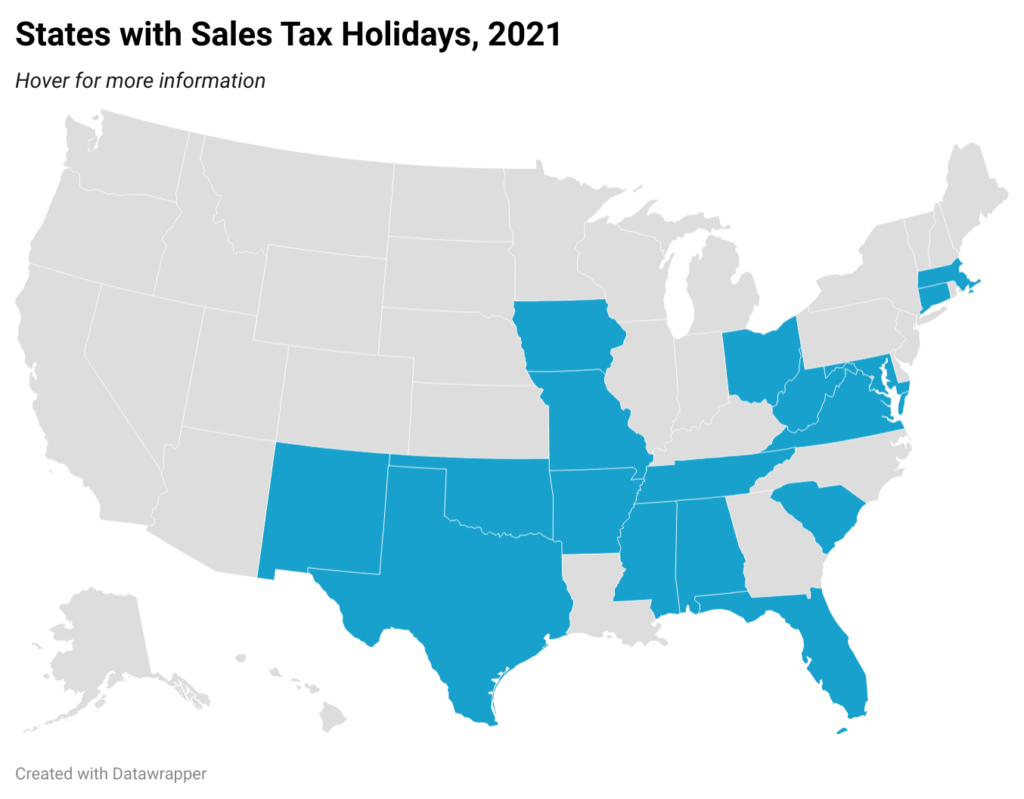

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 7/21: States Go for Tax Policy Gold This Olympics Season

July 21, 2021 • By ITEP Staff

It’s Olympics season! As countries around the globe battle for first place in a plethora of sports and contests it’s as good a time as any to look around America to see which states deserve a gold medal in the ‘Equitable Tax Policy’ event...

Gentrification and the Property Tax: How Circuit Breakers Can Help

April 27, 2021 • By David Crawford

Property tax circuit breakers are effective because they provide property tax relief to families whose property taxes surpass a certain percentage of their income. If a family in a gentrifying area sees their property tax bill (or their rent) surge to an unaffordable level, a circuit breaker credit kicks in to offer relief. This targeted approach assists low- and middle-income families without significantly reducing overall tax revenue.

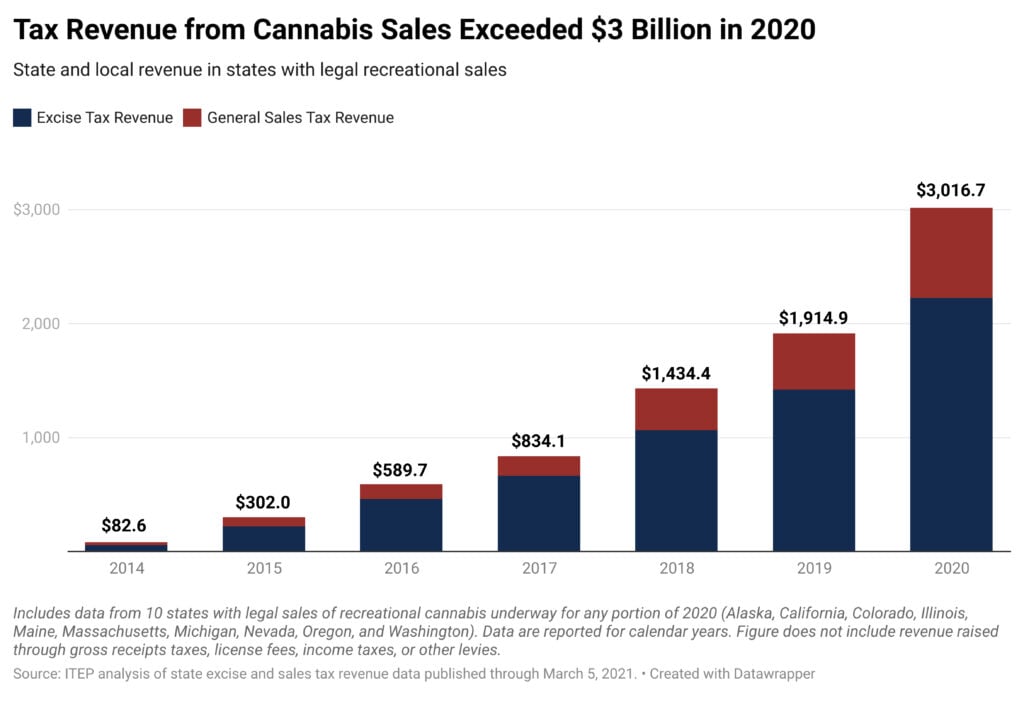

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

State Rundown 1/22: Somewhere Between a Flurry and a Blizzard of State Tax Activity So Far

January 22, 2021 • By ITEP Staff

You won’t find any images of Bernie Sanders and his mittens photoshopped into this week’s Rundown, but you will find the latest news on state fiscal debates, including proposals to generate needed funding by raising taxes on high-income households and profiting businesses in California, Delaware, Hawaii, Maryland, and Washington, as well as misguided efforts to slash taxes in Arizona, Iowa, South Carolina, Utah, and West Virginia. Also in the news are thoughtful improvements to targeted tax credits for families in need in Connecticut and Maryland, harmful obstacles to revenue generation proposed in Nebraska and Wyoming, and renewed hope on the…

It’s Time to Change the Tax Laws to Make Donald Trump and Corporate Giants Pay Up

September 29, 2020 • By Amy Hanauer

It’s time for a new approach. Trump’s egregious tax avoidance further exposes a system that preserves an enormous and growing economic divide. Congress has gutted IRS funding so that we don’t have the resources to audit wealthy tax avoiders. And lobbyists continue to secure giveaways for corporate clients that do nothing for our communities.