Tennessee

State Rundown 6/8: Tax Policy Features Prominently During Budget and Primary Season

June 8, 2022 • By ITEP Staff

As voters head to the polls to weigh in on their state’s primary elections and legislators convene to hash out budget deals, tax policy remains atop the agenda...

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...

While tax discussions among federal lawmakers continue in fits and starts, major tax news continues to make waves across the nation...

Some Lawmakers Continue to Mythologize Income Tax Elimination Despite Widespread Opposition

April 19, 2022 • By Kamolika Das

One of the most surprising trends this legislative session is that conservative leaders and the business community joined with progressive advocates to oppose income tax repeal plans. There is a general consensus that income tax repeal is a step too far.

State Rundown 4/13: Recent State Budgets Prove Not All Tax Cuts are the Same

April 13, 2022 • By ITEP Staff

Two prominent blue states made headlines this past week when they passed budget agreements that include relief for taxpayers, and fortunately, the budget plans don’t include costly tax cuts that primarily benefit the wealthy...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

Several states have dropped a few late-session surprises, and from the looks of it, they’re not the good kind...

State Rundown 3/16: The Scramble to Curb Rising Gas Prices is On

March 16, 2022 • By ITEP Staff

Rising gas prices have lawmakers around the country searching for ways to ease the pressure on consumers and almost half the states are considering reducing or temporarily repealing their gas tax, but another idea is taking hold...

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

State Rundown 1/26: States Offering Preview of Tax Themes and Trends for 2022

January 26, 2022 • By ITEP Staff

Governors and legislators are beginning to settle on and advance tax bills that could drastically shape the future of their states and several trends and themes are beginning to emerge...

The new year often brings with it a reinvigorated commitment to new goals and a fresh perspective on how to accomplish them, but it seems like lawmakers in states around the country are giving up already...

State Rundown 11/10: It’s Beginning to Look a Lot Like…Election Season?!

November 10, 2021 • By ITEP Staff

If the leaves are turning colors and you find yourself walking out of the office into pitch-black darkness, it only means that time of the year is upon us—and no, I'm not talking about the holiday season. Before that, it’s the equally important election season...

The end of Spooky Season is near but that hasn’t stopped state lawmakers from adding their frightening plans into the bubbling cauldron of bad tax policy ideas...

The release of the ‘Pandora Papers’ showed once again that states and their tax systems play an important role in wealth inequality, and in this case, worsening it...

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

One of the few industries to excel during the economic downturn brought on by the pandemic has been the marijuana business, and lawmakers around the country are taking notice as they try to ensure that sales in their state are both legal and subject to tax...

Joe Hughes

August 27, 2021 • By ITEP Staff

Joe supports ITEP in monitoring federal tax policies. His research focuses on progressive tax priorities to ensure corporations and the ultra wealthy pay their fair share. Prior to joining ITEP in 2021, Joe worked at the Congressional Research Service and the Bureau of Labor Statistics. He completed a master’s in applied economics at George Washington University and undergraduate studies at the University of Tennessee.

Eliminating the State Income Tax Would Wreak Havoc on Mississippi

August 25, 2021 • By Kamolika Das

History has repeatedly shown that such policies harm state economies, dismantle basic public services, and exacerbate tax inequities.

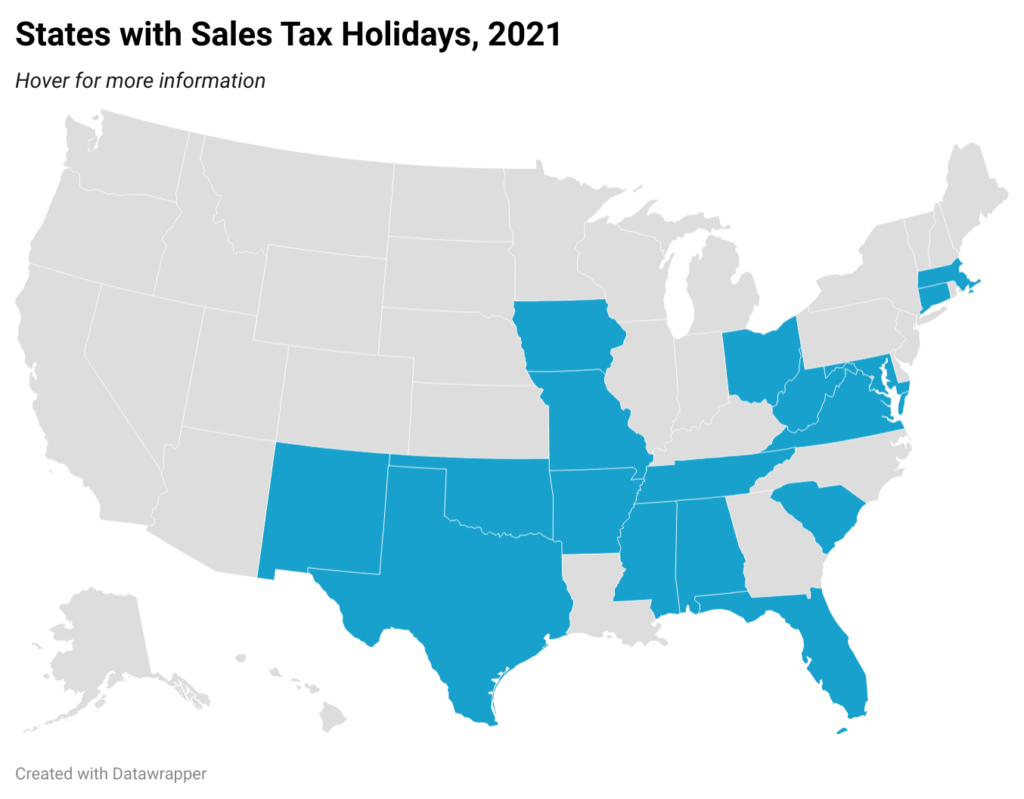

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

Taxing rich households and large corporations to fund vital investments in education and other shared priorities has long been a winner in the eyes of the American public, and more recently has also enjoyed a string of victories in state legislatures and at the ballot box. That win streak continued this week as Arizona’s voter-approved tax surcharge on the rich and Seattle, Washington’s payroll tax on high-profit, high-salary businesses both survived court challenges, and Massachusetts leaders approved a millionaires tax to go before voters next year.

State Rundown 6/7: Remaining State Legislative Sessions Are Heating up as Budget Deadlines Loom

June 7, 2021 • By ITEP Staff

Just as an early summer heatwave brought soaring temperatures this past weekend through much of the lower 48 states, several state legislative sessions are heating up as legislators scramble to make tough budget decisions. Massachusetts lawmakers are voting on a fiery new "millionaires' tax" that would support transportation and education revenue needs, and Connecticut will likely restore its state Earned Income Tax Credit (EITC) back to 30 percent. Illinois’s decision to cut back corporate tax breaks also provided a breath of fresh air. Unfortunately, we'd give other state tax proposals a more lukewarm reception: New Hampshire, North Carolina, and Ohio…

Take a minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.

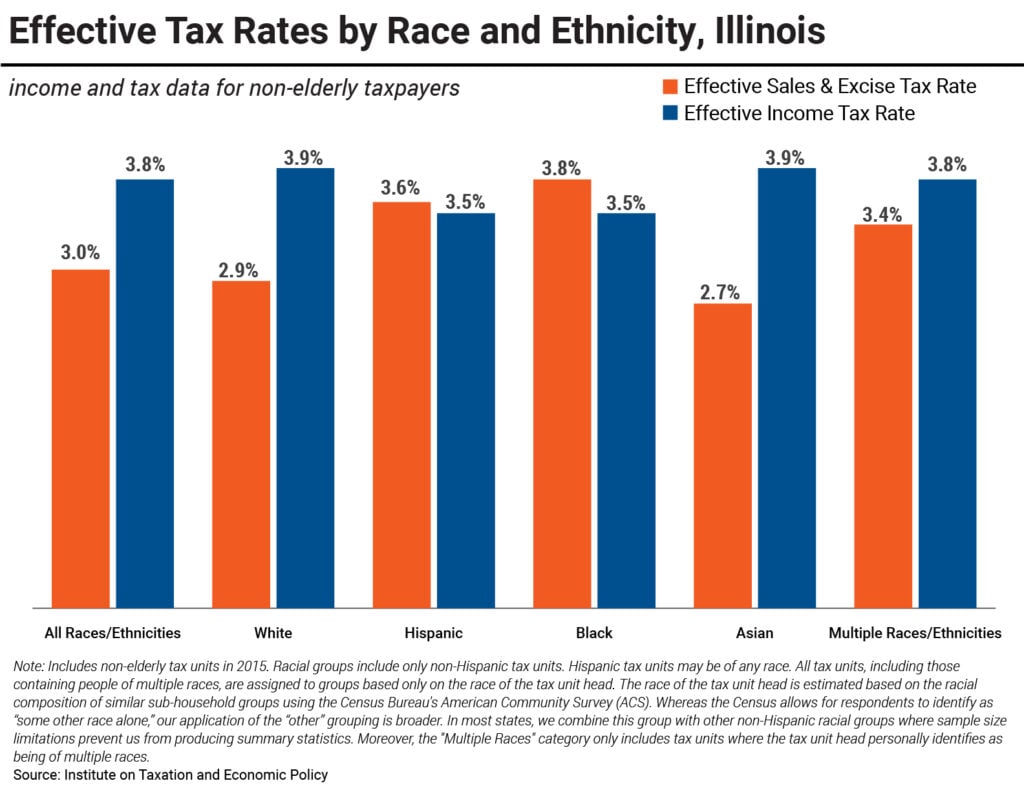

State Tax Codes & Racial Inequities: An Illinois Case Study

May 14, 2021 • By Lisa Christensen Gee

Earlier this year, ITEP released a report providing an overview of the impacts of state and local tax policies on race equity. Against a backdrop of vast racial disparities in income and wealth resulting from historical and current injustices both in public policy and in broader society, the report highlights that how states raise revenue to invest in disparity-reducing investments like education, health, and childcare has important implications for race equity.