Wyoming

In Wyoming 57.3 Percent of Trump’s Proposed Tax Cuts Go to People Making More than $1 Million

August 17, 2017 • By ITEP Staff

A tiny fraction of the Wyoming population (0.5 percent) earns more than $1 million annually. But this elite group would receive 57.3 percent of the tax cuts that go to Wyoming residents under the tax proposals from the Trump administration. A much larger group, 39.4 percent of the state, earns less than $45,000, but would receive just 2.6 percent of the tax cuts.

2017 marked a sea change in state tax policy and a stark departure from the current federal tax debate as dubious supply-side economic theories began to lose their grip on statehouses. Compared to the predominant trend in recent years of emphasizing top-heavy income tax cuts and shifting to more regressive consumption taxes in the hopes […]

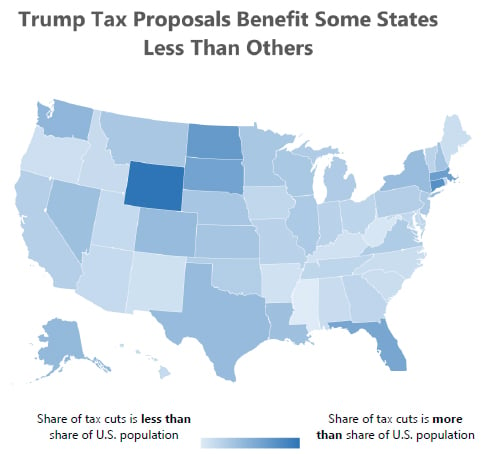

50-State Analysis of Trump’s Tax Outline: Poorer Taxpayers and Poorer States are Disadvantaged

July 20, 2017 • By Alan Essig

Not only would President Trump’s proposed tax plan fail to deliver on its promise of largely helping middle-class taxpayers, it also would shower a disproportionate share of the total tax cut on taxpayers in some of the richest states while southern and a few other states would receive a smaller share of the tax cut […]

Trump Tax Proposals Would Provide Richest One Percent in Wyoming with 64 Percent of the State’s Tax Cuts

July 20, 2017 • By ITEP Staff

Earlier this year, the Trump administration released some broadly outlined proposals to overhaul the federal tax code. Households in Wyoming would not benefit equally from these proposals. The richest one percent of the state’s taxpayers are projected to make an average income of $3,008,400 in 2018.

Trump’s $4.8 Trillion Tax Proposals Would Not Benefit All States or Taxpayers Equally

July 20, 2017 • By Matthew Gardner, Steve Wamhoff

The broadly outlined tax proposals released by the Trump administration would not benefit all taxpayers equally and they would not benefit all states equally either. Several states would receive a share of the total resulting tax cuts that is less than their share of the U.S. population. Of the dozen states receiving the least by this measure, seven are in the South. The others are New Mexico, Oregon, Maine, Idaho and Hawaii.

State Rundown 6/14: Some States Wrapping Up Tax Debates, Others Looking Ahead to Next Round

June 14, 2017 • By ITEP Staff

This week lawmakers in California and Nevada resolved significant tax debates, while budget and tax wrangling continued in West Virginia, and structural revenue shortfalls were revealed in Iowa and Pennsylvania. Airbnb increased the number of states in which it collects state-level taxes to 21. We also share interesting reads on state fiscal uncertainty, the tax experiences of Alaska and Wyoming, the future of taxing robots, and more!

A Better Wyoming: Guess Which Sparsely Populated Mineral Rich State is Getting an Income Tax…

June 8, 2017

Alaska stopped collecting income taxes 35 years ago, and Wyoming has never remotely considered implementing one in the 82 years since it decided instead to charge state and local sales taxes. The Institute on Taxation and Economic Policy (ITEP) discovered recently that nearly 82 percent of Alaskans could expect to pay less under a progressive income tax than they would under a sales tax designed to generate an identical level of revenue.

A Better Wyoming: Everything You Know About Wyoming Taxes is Wrong

June 6, 2017

Wrong. According to the Institute on Taxation and Economic Policy (ITEP), a D.C. think tank that studies state tax policy, Wyoming’s wealthiest residents pay the lowest tax rate in the country. Meanwhile, people at the bottom 20 percent of Wyoming’s shaky economic ladder pay taxes at seven-times the rate that the top one percent of earners do. That’s the largest tax rate discrepancy between rich and poor in the United States.

State Rundown 5/31: Budget Woes Spurring Special Legislative Sessions

May 31, 2017 • By ITEP Staff

This week, special legislative sessions featuring tax and budget debates are underway or in the works in Kentucky, Minnesota, New Mexico, and West Virginia, as lawmakers are also running up against regular session deadlines in Illinois, Kansas, and Oklahoma. Meanwhile, a legislative study in Wyoming and an independent analysis in New Jersey are both calling for tax increases to overcome budget shortfalls.

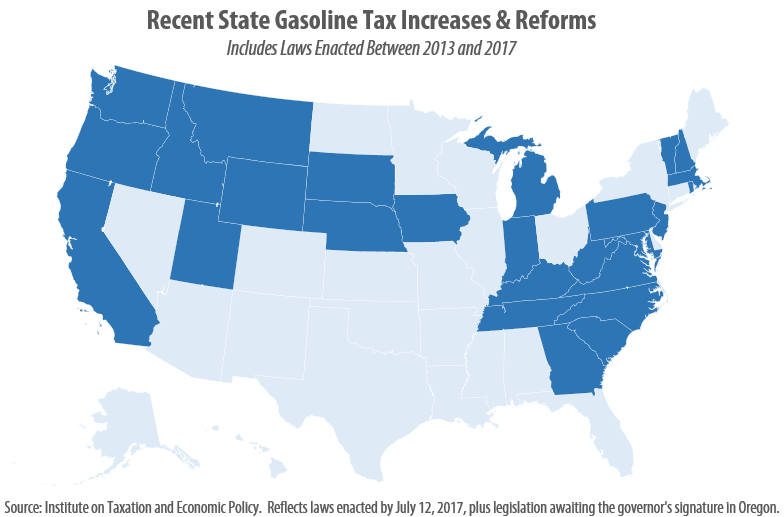

This post was updated July 12, 2017 to reflect recent gas tax increases in Oregon and West Virginia. As expected, 2017 has brought a flurry of action relating to state gasoline taxes. As of this writing, eight states (California, Indiana, Montana, Oregon, South Carolina, Tennessee, Utah, and West Virginia) have enacted gas tax increases this year, bringing the total number of states that have raised or reformed their gas taxes to 26 since 2013.

State Rundown 5/3: Lawmakers See Value in State EITCs, Danger in Tax Cut Triggers

May 3, 2017 • By ITEP Staff

This week, Kansas lawmakers found that they’ll have to roll back Gov. Brownback’s tax cuts and then some to adequately fund state needs. Nebraska legislators took notice of their southern neighbors’ predicament and rejected a major tax cut. Both Hawaii and Montana‘s legislatures sent new state EITCs to their governors, and West Virginia began an […]

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

Charleston Gazette-Mail: Cutting WV Income Tax Likely to Backfire

April 11, 2017

There are nine states with no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, New Hampshire and Tennessee. Only Texas has seen job growth — as a result of being the center of the oil industry. The others have not; job growth has trailed population growth in the other eight. This is based […]

Testimony before the Alaska House Labor & Commerce Committee On House Bill 36

April 4, 2017 • By Matthew Gardner

Thank you for the opportunity to testify on the changes House Bill 36 would make to Alaska's tax treatment of pass-through income. The taxation of pass-through business entities has been a focal point of state and federal tax reform debates for over a quarter century, with a dual focus on minimizing the role of tax laws in determining the choice of business entity and on ensuring that the income of all business entities is subject to at least a minimal tax. My testimony makes two main points: 1. Alaska is one of a small number of states that do not…

A growing number of Americans are getting rides or booking short-term accommodations through online platforms such as Uber and Airbnb. This is nothing new in concept; brokers have operated for hundreds of years as go-betweens for producers and consumers. The ease with which this can be done through the Internet, however, has led to millions of people using these services, and to some of the nation's fastest-growing, high-profile businesses. The rise of this on-demand sector, sometimes referred to as the "gig economy" or, by its promoters, the "sharing economy," has raised a host of questions. For state and local governments,…

Planet Jackson Hole: American Dreams, Undocumented Fears

February 22, 2017

A report published by the Institute on Taxation and Economic Policy (ITEP) in 2016 found that undocumented immigrants contribute around $11.6 billion to the economy annually. Undocumented immigrants in Wyoming contributed $12.7 million in state in federal taxes last year, according to a report from the New American Economy (NAE). And a University of Wyoming […]

What to Watch in the States: Modernizing Sales Taxes for a 21st Century Economy

February 15, 2017 • By Misha Hill

This is the fourth installment of our six-part series on 2017 state tax trends. The introduction to this series is available here. State lawmakers often find themselves looking for ways to raise revenue to fund vital public services, fill budget gaps, or pay for the elimination or weakening of progressive taxes. Lately, that search has […]

This week we are following a number of significant proposals being debated or introduced including reinstating the income tax in Alaska and eliminating the tax in West Virginia, establishing a regressive tax-cut trigger in Nebraska, restructuring the Illinois sales tax, moving New Mexico to a flat income tax and broader gross receipts tax, and updating […]

State Rundown 2/8: Lessons of Kansas Tax-Cut Disaster Taking Hold in Kansas, Still Lost on Some in Other States

February 8, 2017 • By ITEP Staff

This week we bring news of Kansas lawmakers attempting to fix ill-advised tax cuts that have wreaked havoc on the state’s budget and schools, while their counterparts in Nebraska and Idaho debate bills that would create similar problems for their own states, as well as tax cuts in Arkansas that were proven unaffordable within one […]

Below is a list of notable resources for information on state taxes and revenues: Alabama Alabama Department of Revenue Alabama Department of Finance – Executive Budget Office Alabama Department of Revenue – Tax Incentives for Industry Alabama Legislative Fiscal Office Alaska Alaska Department of Revenue – Tax Division Alaska Office of Management & Budget Alaska […]

And Then There Were Six: Amazon Expands Its Sales Tax Collection

January 30, 2017 • By Carl Davis

UPDATE: After this post was published, Amazon announced that it will begin collecting sales tax in Oklahoma on March 1. This post has been updated to reflect this development. The nation’s largest Internet retailer has made an about-face on its sales tax policy, making consumers’ ability to evade sales tax on online purchases a little […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

January 26, 2017 • By Carl Davis, Meg Wiehe

When states shy away from personal income taxes in favor of higher sales and excise taxes, high-income taxpayers benefit at the expense of low- and moderate-income families who often face above-average tax rates to pick up the slack. This chart book demonstrates this basic reality by examining the distribution of taxes in states that have pursued these types of policies. Given the detrimental impact that regressive tax policies have on economic opportunity, income inequality, revenue adequacy, and long-run revenue sustainability, tax reform proponents should look to the least regressive, rather than most regressive, states in crafting their proposals.

This week brings more news of states facing budget crunches, a new state looking to eliminate income taxes, and plans to raise gas taxes to fund transportation projects. Be sure to check out the What We’re Reading section for a look at how repealing federal health reform could add to those crunches and a review […]

State Rundown 1/18: Revenue Woes Piling Up Faster Than Solutions

January 18, 2017 • By ITEP Staff

This week we continue to track revenue shortfalls, governors’ budget proposals, and other tax news around the country, finding most proposals to be focused on slashing taxes and reducing public investments despite public opinion and economic research showing the benefits of well-funded state services and progressive tax policies. — Meg Wiehe, ITEP State Policy Director, […]

State Rundown 1/11: State Legislative Sessions Kick Off Amid Uncertainty

January 11, 2017 • By ITEP Staff

This week brings still more states looking for solutions to revenue shortfalls, multiple governors’ State of The State addresses, important reading on counter-transparency and local-preemption efforts, and more. — Meg Wiehe, ITEP State Policy Director, @megwiehe A Nebraska legislator this week diagnosed the state’s $900 million revenue shortfall in plain terms, describing it as “self-inflicted […]