ITEP's Research Priorities

COVID-19 and the Case for Race-Forward Economic Policy Prescriptions

March 24, 2020 • By Jenice Robinson

Unconscious bias runs deep. Legislative proposals to assuage the exploding economic crisis are advancing and changing quickly, but initial GOP proposals are consistent with the nation’s long history of ostensibly race-neutral policies that are discriminatory in their outcomes.

NEW ANALYSIS: House Democratic Stimulus Bill Explained

March 24, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

Breaking ITEP analysis explains how a newly-introduced House Democrats' proposal—far more comprehensive and better targeted than the recently failed GOP Senate bill—combines overdue expansion of the Earned Income Tax Credit and Child Tax Credit with direct rebates to reach workers and families across all income groups.

New Analysis: Revised GOP Stimulus Proposals Still Fails to Meet Critical Needs

March 23, 2020 • By ITEP Staff

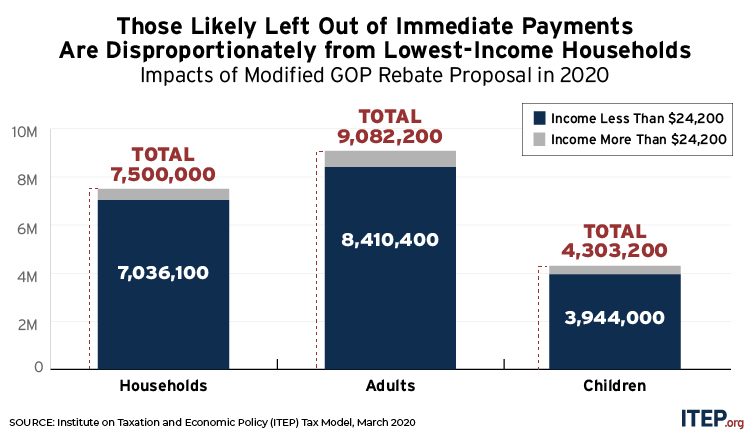

Media Contact The revised GOP stimulus proposal still fails to do enough for struggling families while providing a no-strings-attached bailout to corporations, the Institute on Taxation and Economic Policy said today. ITEP today released an analysis of the revised plan. Among its key findings: The revised proposal could leave 7.5 million households without access to […]

New State-by-State Estimates: Modified Senate GOP Stimulus Bill Still Falls Short

March 23, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

The GOP Senate stimulus bill voted down yesterday is a slight improvement over the first GOP proposal released Thursday, but it still fails to prioritize workers and families or provide fast relief to those who need it most.

Why the GOP Senate Bill Fails to Address the Crisis, and Why a Democratic Bill Looks More Promising

March 20, 2020 • By ITEP Staff, Meg Wiehe, Steve Wamhoff

National and state-by-state data available for download By Steve Wamhoff and Meg Wiehe On Thursday night, Senate Majority Leader Mitch McConnell released a bill that reportedly cost more than $1 trillion, most of which would go toward breaks for corporations and other businesses. A provision in the bill to provide payments to families would cost […]

New Analysis Compares Republican- and Democratic-Sponsored Proposals to Help Families and Individuals

March 20, 2020 • By ITEP Staff

Media Contact The economic stimulus bill released by Senate Majority Leader Mitch McConnell Thursday night would leave behind millions of adults and children and do little to help struggling families weather this current public health and economic crisis, the Institute on Taxation and Economic Policy (ITEP) said today. ITEP has released a new analysis that […]

Senate Bill Addresses Unprecedented Health and Economic Crisis with Wrong-Headed Corporate Tax Cuts

March 19, 2020 • By Amy Hanauer

Following is a statement by Amy Hanauer, ITEP’s executive director, regarding the GOP aid plan introduced today by the Senate:

CNBC: A tale of two coronavirus relief efforts: One for the rich, one for the poor

March 19, 2020

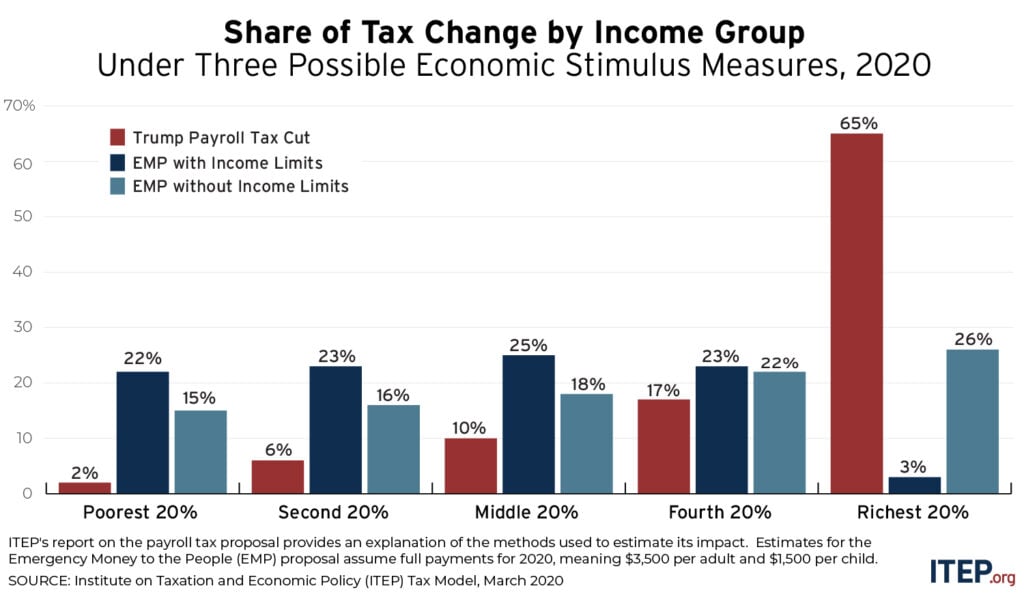

Two financial-relief measures the Trump administration is weighing to fight the economic scourge of the coronavirus would have drastically different impacts on the rich and poor, according to a new analysis. A payroll tax cut would overwhelmingly benefit the richest Americans, and would do little to prop up the economy, according to the Institute on […]

State Rundown 3/19: Spring Is Here but States Brace for Long Winter

March 19, 2020 • By ITEP Staff

As the COVID-19 pandemic continues to disrupt more and more aspects of life and cause greater and greater harms to public health and the economy, information is changing by the hour. State policymakers, if they are even able to convene, are wholly focused on how to respond to the crisis. The pandemic is certain to pose a series of fiscal challenges for states and their economies, and this week’s Rundown focuses on the most helpful resources and the latest state-by-state updates available.

It’s Time for Some State Fiscal Policy Triage

March 18, 2020 • By Carl Davis, Dylan Grundman O'Neill, ITEP Staff

The COVID-19 novel coronavirus’s effects on public health and economies at all scales are creating a daunting situation for state budgets as well. Lawmakers can choose and prioritize their responses through a straightforward approach similar to that taken by health professionals: marshal and reinforce available resources, triage response options to prioritize the most vital services and most vulnerable people, and enact or strengthen the policies that will help address longer-term issues as well as immediate emergencies.

Foreign Policy: Trump’s Big Turnaround: Cash Payments Instead of a Payroll Tax Cut

March 17, 2020

First, a payroll tax cut only offers benefits to those with a job, and, as the Institute on Taxation and Economic Policy has extensively documented, it heavily favors higher-income workers—not the unemployed or the retired. So a payroll tax cut would do little or nothing for people who would be among the most vulnerable during […]

Talking Points Memo: Why The Checks-For-Everyone Idea To Ward Off A Recession Is Gaining Steam

March 17, 2020

An analysis by the Institute on Taxation and Economic Policy found that the top 20 percent of income earners would reap two-third of the benefit of a payroll tax cut, while the bottom fifth of income earners would receive only 2 percent of the benefit. A direct cash transfer, particularly one phased out at higher […]

A payroll tax cut would help those lucky enough to keep their job and would provide a bigger break to those with more earnings. Sending checks to every household would be a far more effective economic stimulus because it would immediately put money in the hands of everyone who would likely spend it right away, pumping it back into the economy.

New ITEP Report on President’s Misguided Payroll Tax Proposal

March 13, 2020 • By Steve Wamhoff

Earlier this week, ITEP analyzed what would happen if Congress and the President repeated the 2 percentage-point cut in the Social Security payroll tax that was enacted for two years during the last recession. Little did we know that President Trump was about to propose something far more radical: eliminating all Social Security and Medicare […]

President Trump has proposed to eliminate payroll taxes that fund Social Security and Medicare through the end of the year. ITEP estimates that this would cost $843 billion and 65 percent of the benefits would go to the richest 20 percent of taxpayers, as illustrated in the table below.

An Overload of Pie Graphs and Metaphors for Pi Day

March 13, 2020 • By ITEP Staff, Jenice Robinson, Stephanie Clegg

For Pi Day, we’re doubling down on the pie metaphor to reiterate the compelling case for progressive tax policies to ensure more of us have an opportunity to share a slice of this nation’s economic pie.

Bloomberg Tax: Virus Panic Prompts Trump Call for Tax Relief

March 12, 2020

A payroll tax cut, something the administration has floated, would be an ineffective stimulus measure to combat the virus’s economic fallout, according to the Institute on Taxation and Economic Policy. Cutting the payroll tax—a levy imposed on employees, employers, and self-employed individuals to fund Social Security—would primarily benefit higher earners, according to an analysis from […]

New York Times: Trump’s Payroll Tax Cut Would Dwarf the 2008 Bank Bailout

March 12, 2020

The largest gains in dollar figures would go to households earning more than $123,000 a year, according to an analysis by the Institute on Taxation and Economic Policy in Washington. Read more

Washington Examiner: In cutting payroll taxes to spur the economy, Trump would be following in Obama’s footsteps

March 12, 2020

The Institute on Taxation and Economic Policy, a left-of-center nonpartisan tax policy organization, found that Obama’s payroll tax cut didn’t benefit the lower and middle class very well. The study showed that the portion of the payroll tax cut that went to the richest 20% of households was 47% in 2011 and 46% in 2012. […]

The Sacramento Bee: Trump has big plans for California highway repair, but no plan to pay for it

March 12, 2020

While there’s no way to know how much states increases would be curbed if federal taxes were higher, if at all, Carl Davis, research director at Washington, D.C., Institute on Taxation and Economic Policy, saw two reasons for the state increases. One is that the cost of asphalt, concrete, machine and labor has gone up. […]

State Rundown 3/11: Georgia Bucks Trend of Cautious Policymaking Amid Crises

March 11, 2020 • By ITEP Staff

With all eyes on the potential effects of the oil price war and COVID-19 coronavirus on lives, communities, and economies, Georgia House lawmakers this week crammed through a regressive and costly tax cut for the rich with essentially no debate, information, or transparency. Most states are proceeding much more responsibly, assessing the ramifications for their service provision needs and revenues to fund those needs.

Politico: That’s a lot of tax relief

March 11, 2020

Just looking at sales and excise taxes, the eight states where recreational pot was legal in 2019 raised close to $2 billion in revenue, according to Carl Davis of the liberal Institute on Taxation and Economic Policy. That adds up to an increase of around a third, or nearly a half-billion dollars. Why the big […]

ITEP Testimony on the Illinois Earned Income Credit

March 11, 2020 • By Lisa Christensen Gee

Read as PDF Testimony of Lisa Christensen Gee, Director of Special Initiatives, Institute on Taxation and Economic Policy Submitted to: Illinois House Revenue Committee Chairman Zalewski, committee members—thank you for holding this subject matter hearing this morning on the Earned Income Credit (EIC) and its importance for hard working Illinoisans and their families. My name […]

The Trump administration is floating a cut in the Social Security payroll tax as a measure to counteract a potential economic downturn related to the COVID-19 virus. It should go without saying that a public health crisis requires government interventions that have nothing to do with taxes. But even if policymakers want to find ways to stimulate the economy beyond solving the health crisis, the payroll tax cut is not likely to be very effective.