Blog - Corporate Taxes

151 posts

Last week, President Trump destroyed everyone’s coronavirus press conference bingo card by announcing that a conversation he had with celebrity chef Wolfgang Puck inspired him to propose restoring a corporate tax deduction for business entertainment expenses. Trump’s own signature tax plan repealed this break two years ago.

Boeing “CARES” A Lot About its Shareholders—But What about the Rest of Us?

April 1, 2020 • By Matthew Gardner

The gigantic Coronavirus-related tax and spending bill enacted last week, the so-called “CARES Act,” sets aside $17 billion in loans for “businesses critical to maintaining national security.” It’s generally understood that the bill’s authors want much, if not all, of this $17 billion to go to a single company: Boeing. So it behooves us to ask whether Boeing benefits America and its economy in ways that merit this largesse.

Congress “CARES” for Wealthy with COVID-19 Tax Policy Provisions

March 31, 2020 • By Matthew Gardner

At a time when record numbers of Americans are facing unemployment, state and local governments are facing a perfect storm of growing public investment needs and vanishing tax revenues, and small business owners are struggling to avoid even more layoffs, lavishing tax breaks on the top 1 percent in this way shouldn’t be in anyone’s top 20 list of needed tax changes.

COVID-19 Is No Excuse for Airline Industry or Any Other Corporate Tax Cut

March 10, 2020 • By Matthew Gardner

Trump administration officials have reportedly floated the idea of including tax breaks for the airline industry in its package of COVID-19-related stimulus proposals, which would allow airline companies to defer income taxes into the future. This is an odd policy choice since most of the biggest airlines are already using deferral to zero out most or all of their federal income taxes on billions of dollars in profits.

GOP Legacy on IRS Administration: Auditing Mississippi, not Microsoft

January 24, 2020 • By Matthew Gardner

Money doesn’t buy happiness—but it can buy immunity from the reach of Uncle Sam. The IRS is outgunned in cases against corporate giants because that’s how Republican leaders want it to be. They have systematically assaulted the agency’s enforcement capacity through decades of funding cuts. Instead of saving money, these cuts have cost billions: each dollar spent on the IRS results in several dollars of tax revenue collected.

Guilty, Not GILTI: Unclear Whether Corps Continue to Lower Their Tax Bills Via Tax Haven Abuse

January 7, 2020 • By Matthew Gardner

President Trump and GOP lawmakers often cited corporations’ abuse of tax havens, e.g. shifting profits offshore to avoid taxes, as justification for dramatically lowering the federal corporate tax rate under the 2017 Tax Cuts and Jobs Act. By 2016, corporations’ offshore cash haul had grown to $2.6 trillion, representing hundreds of billions in lost federal tax […]

Corporate Tax Avoidance Is Mostly Legal—and That’s the Problem

December 19, 2019 • By Steve Wamhoff

As usual, corporate spokespersons and their allies are trying to push back against ITEP’s latest study showing that many corporations pay little or nothing in federal income taxes. One way they respond is by stating that everything they do is perfectly legal. This is an attempt by the corporate world to change the subject. The entire point of ITEP’s study is that Congress has allowed corporations to avoid paying taxes, and that this must change.

More of the Same: Corporate Tax Avoidance Hasn’t Changed Much Under Trump-GOP Tax Law

December 16, 2019 • By Matthew Gardner

A new report from ITEP released today shows that, based on the first year of financial reports released by companies operating under the new tax law, tax avoidance appears to be every bit as much of a problem under the new tax system as it was before the Trump tax law took effect.

Several Democratic candidates have proposed raising the statutory corporate tax rate from its current level of 21 percent to fund their spending proposals. Political reporters and observers may read a great deal into the different corporate rates proposed by candidates, but the truth is that rates mean very little on their own.

Business Roundtable’s Newfound Devotion to Corporate Responsibility Doesn’t Include Paying Taxes

August 20, 2019 • By Matthew Gardner

If you squint really hard, the Business Roundtable’s newly declared fondness for “supporting the communities in which we work” could be read as an acknowledgment of the need for a tax system that can pay for needed services. But it’s not.

If a future Congress and president enact a real tax reform, one that requires corporations to pay their fair share and ends TCJA’s various corporate breaks for offshore profits, then companies will use inversions and other tactics to dodge taxes once again—if lawmakers let them. That’s why any real tax reform will include something like the Stop Corporate Inversions Act, introduced last week by Sens. Dick Durbin and Jack Reed to block inversions.

$4.3 Billion in Rebates, Zero-Tax Bill for 60 Profitable Corps Directly Related to Loopholes

April 12, 2019 • By Matthew Gardner

Meet the new corporate tax system, same as the old corporate tax system. That’s the inescapable conclusion of a new ITEP report assessing the taxpaying behavior of America’s most profitable corporations. The report, Corporate Tax Avoidance Remains Rampant Under New Law, released earlier this week, finds that 60 Fortune 500 corporations disclose paying zero in federal income taxes in 2018 despite enjoying large profits.

Data released Friday by the U.S. Treasury Department should give great pause to all who care about the federal government’s ability to raise revenue in a fair, sustainable way. In the wake of the 2017 corporate tax overhaul, corporate tax collections have fallen at a rate never seen during a period of economic growth.

Rep. Doggett and Sen. Whitehouse Reintroduce Bill to End Offshore Tax Avoidance

March 15, 2019 • By Lorena Roque

On Thursday, Representative Lloyd Doggett and Senator Sheldon Whitehouse announced that they are reintroducing the “No Tax Breaks for Outsourcing Act.” Our international corporate tax rules have been a mess for a long time, and Tax Cuts and Jobs Act (TCJA) failed to resolve the problems. The old rules and the new rules under TCJA both tax offshore corporate profits more lightly than domestic corporate profits, but in different ways. The No Tax Breaks for Outsourcing Act would create rules that tax domestic profits and foreign profits in the same way.

Fear, Not Facts: Netflix Misleads Media Reporting on Corporate Tax Avoidance

February 13, 2019 • By Matthew Gardner

In an age when even the most incontrovertible facts are routinely dismissed as “fake news,” reporting on corporate taxes can be a daunting challenge for members of the media. ITEP’s recent analysis of the income tax disclosures made by Netflix in its annual financial report last week provide an excellent reminder of this.

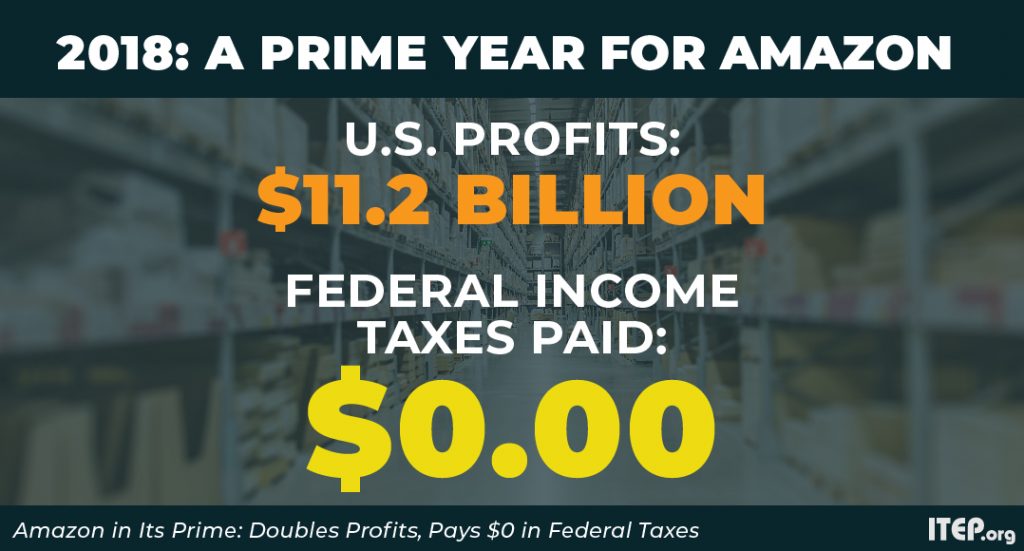

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

February 13, 2019 • By Matthew Gardner

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.

New Legislation Aims to Change Tax Law Provisions That Incentivize Outsourcing

November 29, 2018 • By Richard Phillips

Sen. Amy Klobuchar (D-MN) and several Senate co-sponsors this week introduced the Removing Incentives for Outsourcing Act, which curbs harmful new incentives created by the Tax Cuts and Jobs Act (TCJA) that encourage companies like GM to move their profits and operations offshore.

GM Announcement Confirms Tax Cuts Don’t Prevent, May Encourage Layoffs

November 27, 2018 • By Matthew Gardner

GM’s most recent quarterly financial report reveals the company has saved more than $150 million so far this year due to last year’s corporate tax cuts. So the layoffs announcement may seem especially jarring to anyone who believed President Trump’s claim that his tax cuts would spur job creation—including the Ohio residents Trump told directly “don’t sell your homes” because lost auto-making jobs “are all coming back.”

New ITEP Report on Depreciation Breaks: The Most Important Tax Giveaway that People Don’t Know About

November 19, 2018 • By Steve Wamhoff

Many Americans sense that the tax code is riddled with unnecessary and costly breaks for big business, but if asked to name one, few would reply “accelerated depreciation.” While they may seem arcane, tax breaks like “full expensing” and other types of accelerated depreciation are among the central problems in our tax code. A new report from ITEP makes the case that any serious tax reform would repeal or sharply curb these provisions.

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

15 Companies Report an Average 10.4 Percentage Point Drop in Effective Tax Rates Since 2017

November 13, 2018 • By ITEP Staff

Comparing the year’s first three quarterly filings of 2018 with those of 2017, we find that 15 of the largest Fortune 500 companies reported worldwide effective income tax rates declining by an average of 10.4 percentage points and by as much as 16 percentage points. In total these companies owed $22.3 billion less in taxes than they would have under their 2017 effective rates, saving an average of $1.5 billion each.

New Report Finds Tax Transparency Is Not Just Ethical: It Has a Real Fiscal Impact

November 5, 2018 • By Monica Miller

A new report by Hubertus Wolff and Michael Overesch finds that public country-by-country reporting (CBCR) can have a significant fiscal impact. In fact, the report shows that new CBCR rules applied to European banks appear to have substantially increased the tax rates paid by banks that engage in tax-haven activities. This means that CBCR may not just improve the integrity of the tax system and provide critical information so investors can gauge investment risks, but may also have a much more immediate impact on curbing tax avoidance.

Post-TCJA, International Corporate Tax System Still Leaking Hundreds of Billions in Profits

November 5, 2018 • By Richard Phillips

A recently released working paper from Kimberley Clausing of Reed College finds that U.S. corporations will avoid taxes on nearly $300 billion in offshore profits every year for the foreseeable future. The paper provides an informative new look into the level of offshore tax avoidance before and after the Tax Cuts and Jobs Act (TCJA). While advocates of the TCJA claimed the tax law would end tax haven abuse through lowering the statutory rate and other measures, Clausing’s analysis shows that the TCJA will still allow the vast majority of offshore tax avoidance to remain intact.

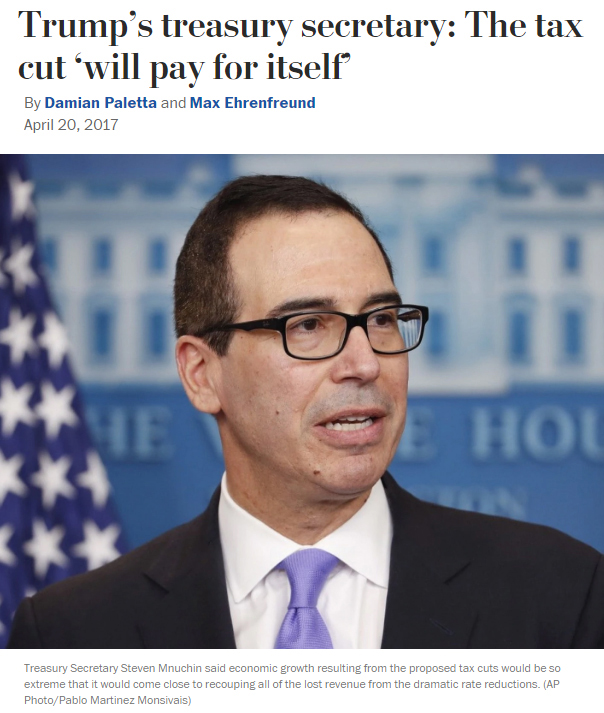

Lawmakers Want Working People to Foot the Bill for Top-Heavy Tax Cuts

October 18, 2018 • By ITEP Staff

Earlier this week, the Treasury Department reported that the federal deficit this fiscal year climbed by 17 percent to $779 billion, and next year is expected to be at least $1 trillion. The increased deficit comes after Congress last December passed an unpopular tax cut (The Tax Cuts and Jobs Act) that will cost nearly $2 trillion over a decade. GOP leaders repeatedly claimed the measure would pay for itself and not increase annual deficits, in spite of multiple economic predictions to the contrary.

‘Financial Exposure’ Showcases Tax Misconduct by Powerful Individuals and Corporations

October 10, 2018 • By Peter Della-Rocca

Elise J. Bean’s Financial Exposure reiterates the point that tax avoidance and tax evasion were endemic to our financial system long before allegations against a sitting president brought them to the forefront of the public consciousness.