Blog

29 posts

Pennsylvania Just Gave Low-Income Workers a Tax Credit Boost. Now It’s Philadelphia’s Turn.

December 30, 2025 • By Kamolika Das

In the same way states are building upon federal tax credits, localities should consider building on state tax credits.

States Can Create or Expand Refundable Credits by Taxing Wealth, Addressing Federal Conformity

December 19, 2025 • By Zachary Sarver

Many states already recognize the potential of these credits to boost low- and moderate-income households. Other states should follow suit.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

The no tax on tips idea isn't a new one, but it's always been abandoned because it's practically impossible to do without creating new avenues for tax avoidance. Despite its embrace by the candidates from both major parties, this policy idea would do little to help the roughly 4 million people who work in tipped occupations while creating a host of problems.

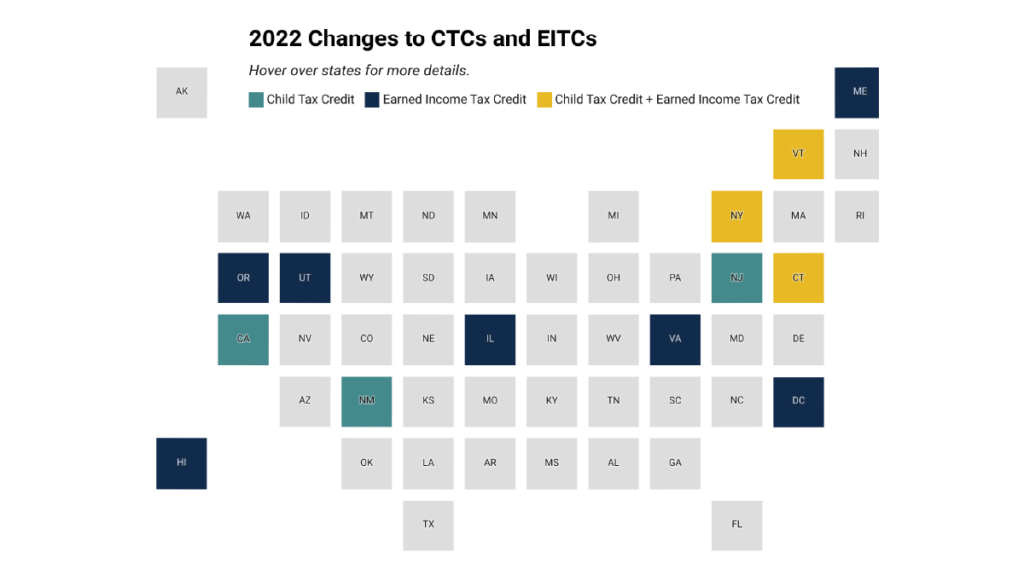

Four states expanded or boosted refundable tax credits for children and families, and the District of Columbia is poised to create a new Child Tax Credit. These actions — in Colorado, Illinois, New York, Utah, and D.C. — continue the recent trend of improving the well-being of children and families with refundable tax credits.

These Three Local EITCs Are Boosting Family Incomes at Tax Time

April 10, 2024 • By Andrew Boardman

This tax season more than 800,000 households in New York City, Maryland's Montgomery County, and San Francisco are set to receive a boost through local refundable EITCs. These credits put dollars directly into the pockets of low-income households, equipping families with resources to better make ends meet and invest in their futures. In turn, they can help build stronger, fairer, and more resilient communities.

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

Three Localities are Boosting Communities with Refundable EITCs; Others Should Follow Suit

October 30, 2023 • By Kamolika Das

Most states already offer their own Earned Income Tax Credits, typically matching a certain percentage of residents’ federal EITC, but this is still a rarity among localities.

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

Why is My Refund So Much Smaller This Year? Only the Good (Tax Credits) Die Young.

April 18, 2023 • By Joe Hughes

This year millions of American families are finding that their refunds are much smaller than last year—or that they even owe taxes back to the government—because of the expiration of the expanded Child Tax Credit and Earned Income Tax Credit that were in effect in 2021. The lapse of the expanded credits affects a majority of the middle class, but lower-income households are particularly likely to feel the sting.

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

Momentum Behind State Tax Credits for Workers and Families Continues in 2023

January 18, 2023 • By Miles Trinidad

Refundable tax credits are an important tool for improving family economic security and advancing racial equity, and there is incredible momentum heading into 2023 to boost two key state credits: the Child Tax Credit and the Earned Income Tax Credit.

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

Women’s History Month is a Reminder that Sensible Tax Policy is Central to Women’s Economic Security

March 24, 2022 • By Brakeyshia Samms

Women’s History Month is a chance to remember what happens for women when tax policy becomes more progressive, boosts income, and helps make raising a family more affordable.

What We Can Learn Today from the American Rescue Plan – and Sen. Rick Scott’s Proposed Tax Increases

March 11, 2022 • By Steve Wamhoff

The success of the American Rescue Plan Act is worth revisiting today. Instead of pursuing Sen. Rick Scott’s agenda of making life more difficult for those already working the hardest, Congress should extend or make permanent some of the beneficial policies in ARPA.

More Than One in Three Young Workers Would Benefit from EITC Reforms in Build Back Better Plan

February 8, 2022 • By Aidan Davis

Although the EITC expansion did not receive as much attention as the expanded Child Tax Credit, a new ITEP report shows the positive impact of allowing young workers without children in the home to maintain access to one of the nation’s most significant and effective anti-poverty programs.

Pandemic Policies Demonstrate Government Can Address Widening Economic Inequality If Policymakers So Choose

December 17, 2021 • By ITEP Staff, Jenice Robinson, Joe Hughes

We are surrounded by evidence that economic inequality is spinning out of control, yet we also see straightforward examples of how government can stop the downward spiral should it choose to do so. The Build Back Better Act, which invests in communities and ensures the wealthy and corporations pay their fair share, is one such example. Congress should pass it.

ITEP Data on Child Tax Credit and Earned Income Tax Credit Provisions Before Congress

December 14, 2021 • By Steve Wamhoff

Congress expanded the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) for 2021 as part of the American Rescue Plan Act (ARP). The additional benefits that millions of families and workers received under that law will end this month if Congress does not act soon. The CTC expansion boosted the annual tax credit […]

Tax Credit Reforms in Build Back Better Would Benefit a Diverse Group of Families

November 18, 2021 • By Aidan Davis

The CTC and EITC provisions would have a particularly profound effect on the poorest 20 percent of Americans, who all will have incomes of less than $22,000 in 2022. Taken together, the EITC and CTC changes would lift the average income of these households by more than 10 percent.

New Census Data Highlight Need for Permanent Child Tax Credit Expansion

September 14, 2021 • By Neva Butkus

The status quo was a choice, but the Census data released today shows that different policy choices can create drastically different outcomes for children and families. It is time for our state and federal legislators to put people first when it comes to recovery.

Extending Federal EITC Enhancements Would Bolster the Effects of State-Level Credits

September 13, 2021 • By Aidan Davis

The EITC expansion targets workers without children in the home. In 2022 it would provide a $12.4 billion boost, benefiting 19.5 million workers who on average would receive an income boost of $730 dollars.

A growing group of state lawmakers are recognizing the extent to which low- and middle-income Americans are struggling and the ways in which their state and local tax systems can do more to ensure the economic security of their residents over the long run. To that end, lawmakers across the country have made strides in enacting, increasing, or expanding tax credits that benefit low- and middle-income families. Here is a summary of those changes and a celebration of those successes.