Blog

1292 posts

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

The federal minimum wage is almost comically low. At $7.25 an hour, it is 29 percent below its inflation-adjusted peak in the 1960s. Raising the minimum wage to $15 an hour would lift 900,000 Americans out of poverty. A solid 61 percent of voters support the idea. A majority of lawmakers in both the House and Senate support at least some version of a minimum wage hike. The popular $1.9 trillion American Rescue Plan includes a measure that would raise the minimum wage over the next few years to $15. So, what is the problem? And why are lawmakers now…

An Unequal Recession Will Breed Unequal Recovery Without Bold Investments

February 26, 2021 • By Stephanie Clegg

Without bold investments now, experts predict a longer, more unequal recovery. President Biden's American Rescue Plan, the framework for legislation expected to pass this week in the House, would boost economic well-being for those whose livelihoods were most affected by the pandemic-induced economic crisis.

State Rundown 2/24: State Tax Debates Quickly Thaw Out with Warmer Weather

February 24, 2021 • By ITEP Staff

Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas…

Alaska is notoriously reliant on tax and royalty revenue from oil to fund vital public services and institutions, but declining oil prices and production levels have rendered those revenues inadequate to meet the state’s needs. ITEP analysis of potential state income tax options in Alaska shows the potential to raise between $526 million and $696 million per year yet are quite modest compared to personal income tax structures in other states. When measured relative to state residents’ incomes, any of these options would rank among the bottom five lowest state income taxes in the nation.

While lawmakers disagree sharply over what our tax law should look like, there should be no argument that we must enforce tax laws currently on the books. Yet, Republican Congresses systematically weakened the IRS’s ability to enforce tax laws by defunding the agency, resulting in hundreds of billions in lost tax revenue every year. Two bills introduced in the U.S. House would address this by increasing tax audits of big corporations and high-income individuals and by providing more resources to the IRS.

Should lawmakers enact laws that they believe are sensible and constitutional, or should they shape their legislative agenda around what they believe ideological Supreme Court justices will allow? This is a dilemma facing Americans who support a federal wealth tax.

State Rundown 2/17: Friction Over Tax Policy Still Generating Heat in Some Statehouses

February 17, 2021 • By ITEP Staff

Cold-hearted regressive tax proposals were pushed this week to cut income taxes on high-income households in states including Idaho, Montana, and West Virginia, while advocates for fair taxes and well-funded services continue to turn up the heat on taxing the richest residents in states like Connecticut and Pennsylvania.

While the federal EITC provides a great deal of support for families with children, its impact is limited for those without children or who are not raising children in their homes. Childless workers under 25 and over 64 have for far too long received no benefit from the federal credit. And workers aged 25 to 64 have received very little value from the existing credit (the maximum credit is much smaller and the income limits more restrictive). The federal EITC’s meager benefits for just some childless adults lead to an inequitable outcome: the federal income tax system—which is ostensibly based…

CARES Act Helps Create $4.6 Billion Tax Cut for Health Care Companies Paying Opioid Settlements

February 12, 2021 • By Matthew Gardner

Talk about a one-two punch. A new report from the Washington Post reveals that the U.S. public is set to pay for the opioid crisis again. Already, communities across the country have paid a heavy price via the devastating public health toll. Now, it appears taxpayers will be on the hook for billions in corporate tax breaks as four pharmaceutical companies exploit a loophole in the Trump-GOP tax law and a CARES Act tax provision meant for companies facing pandemic-related profit losses.

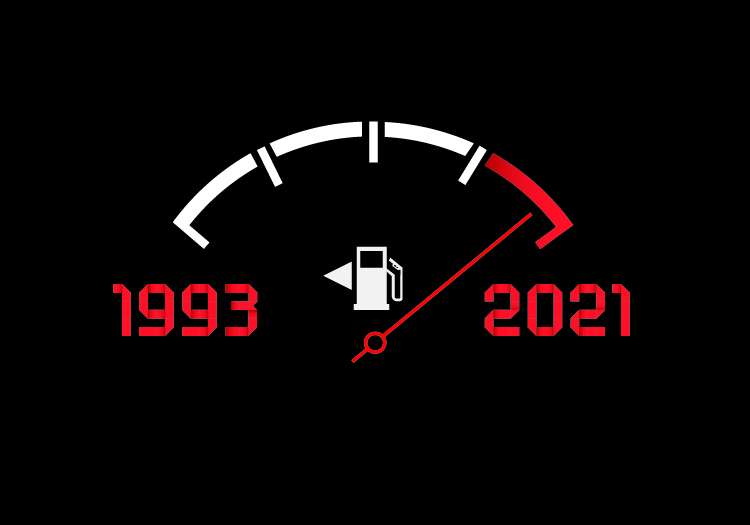

It’s Been 10,000 Days Since the Federal Government Raised the Gas Tax

February 12, 2021 • By Carl Davis

10,000 days. More than 27 years. By next Tuesday that’s how long it will have been since the federal government last raised the gas tax. Over that time, vehicle fuel efficiency has improved by 25 percent and construction costs have grown 185 percent. And yet the federal gas tax has remained frozen at 18.3 cents per gallon, with its purchasing power shrinking by the day. The federal government has never gone this long without updating the nation’s gas tax rate.

State Rundown 2/11: Legalizing and Taxing Cannabis Becoming Increasingly Mainstream

February 11, 2021 • By ITEP Staff

This week, the governors of New Hampshire and West Virginia proposed to eliminate their states’ most progressive revenue sources and shift taxes even more heavily onto the middle- and low-income families who already pay the highest rates in both states. It was also a big week for proponents of legalizing recreational cannabis, as that movement made progress in Hawaii, Virginia, and Wisconsin.

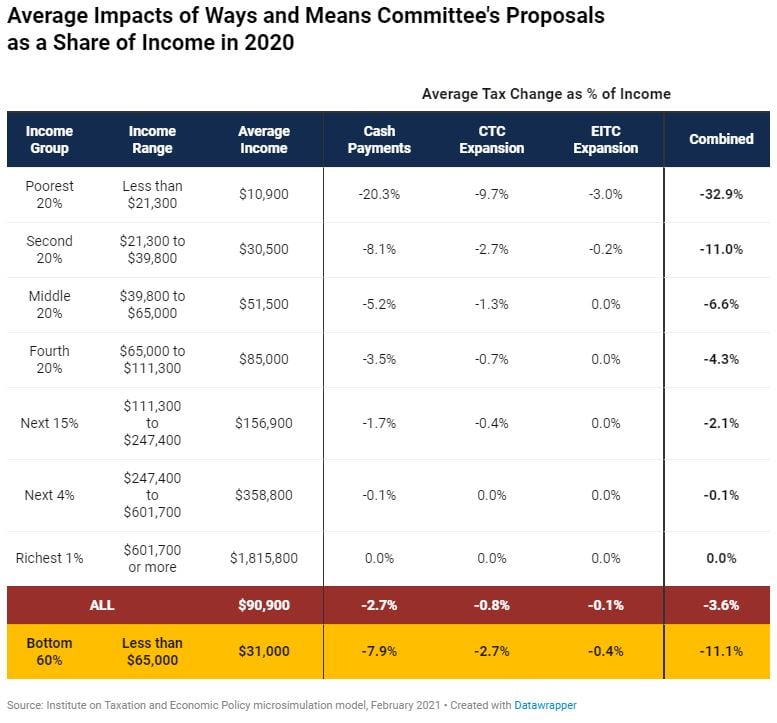

Details of House Democrats’ Cash Payments and Tax Credit Expansions

February 9, 2021 • By Steve Wamhoff

The House Ways and Means Committee published its proposal for the cash payments, tax provisions and other changes that would make up part of the $1.9 trillion COVID relief legislation that President Joe Biden called for a few weeks ago.

Does New York’s Cannabis Tax Idea Offer a Glimpse of the Future?

February 9, 2021 • By Carl Davis

Taxing cannabis won’t end New York’s budget difficulties, but a potency tax could bring New York a more sustainable stream of cannabis tax revenue than we see in most states. It could also have significant benefits for cannabis consumers.

Faulty Fact Check on Tax Breaks for the Rich and Corporations

February 5, 2021 • By Amy Hanauer

When it comes to tax policy, the details are complicated, but the story is often simple. For example, President Trump’s so-called Tax Cuts and Jobs Act (TCJA) disproportionately benefits the rich. This is not controversial. Yet some opinion makers with large megaphones get lost in the details and come to conclusions that only create more confusion.

State Rundown 2/4: Some Lawmakers, Governors Rising to Occasion with Progressive Tax Proposals

February 4, 2021 • By ITEP Staff

States face shifting landscapes as they attempt to deal with both emergent and longstanding issues in their tax codes and budget structures. This is particularly evident in Oklahoma, where lawmakers must adjust to a U.S. Supreme Court decision that literally redraws state boundaries by recognizing the rights of indigenous communities, but is true in every state, and lawmakers in many of them are rising to the challenge. Read below and see our blog posted today for more on bold proposals that increase tax fairness and solidify bottom lines with needed revenue in states including Connecticut, Minnesota, New York, Pennsylvania, Vermont,…

States Are Finally Going Bold with Progressive Tax Efforts

February 4, 2021 • By Dylan Grundman O'Neill

Advocates, lawmakers, study commissions, and even governors in some states are proposing bold tax policy reforms that look beyond pandemic-induced budget shortfalls and the “K-shaped recovery” to address underlying inequities and underfunding that gave rise to them. These efforts include proposals to: end or reverse regressive tax policies like the preferential treatment of income derived from wealth over income earned through work; restore or strengthen estate and inheritance taxes to slow the concentration of wealth in ever-fewer hands; raise revenue and slow inequality with progressive income taxes; and many other ideas to right upside-down tax codes while raising the revenue…

The public and the Biden administration say corporations should contribute to the public infrastructure that lets them earn so much. We agree. It’s the least we can ask, in a pandemic and at all other times too.

Amazon Has Record-Breaking Profits in 2020, Avoids $2.3 Billion in Federal Income Taxes

February 3, 2021 • By Matthew Gardner

Amazon’s winning streak in its battle against the U.S. tax system remains intact. This week the retail giant announced record-breaking sales and income for 2020, and an effective federal income tax rate of just 9.4 percent, less than half the statutory corporate tax of 21 percent. If Amazon had paid 21 percent of its profits in federal income tax, that would have come to $4.1 billion. The company’s reported current tax of $1.8 billion was less than half that, meaning last year Amazon avoided $2.3 billion in taxes.

President Biden’s Child Tax Credit Proposal Could Right a Historical Wrong

February 2, 2021 • By ITEP Staff, Jenice Robinson, Meg Wiehe

Many 1990s policies were grounded in harmful, erroneous ideas such as financial struggles are due to personal shortcomings and less government is better. Lawmakers didn’t apply these ideas consistently, however. For example, there was no drive to reduce corporate welfare even as policymakers slashed the safety net and disinvested in lower-income communities. So, it’s not surprising that a bipartisan group of lawmakers concluded during that era that the CTC was an appropriate vehicle to give higher-income households a tax break while leaving out poor children.

Immediate Action State Lawmakers Can Take to Support Families and Children

February 2, 2021 • By Aidan Davis

If Congress does act and enact President Biden’s CTC expansion, states could simply couple to that federal change. The changes, while temporary, could become the foundation of a permanent state-level credit over the long-term. But state lawmakers need not wait for legislative action in DC. They can take immediate steps to ensure that their state’s most vulnerable children are positioned to succeed.

Ever since it was enacted as part of the Trump-GOP tax law, some Democrats in Congress have been pushing to repeal the cap on federal tax deductions for state and local taxes (SALT). Recently several Democratic members have suggested that repeal of the cap should be part of COVID relief legislation. While the cap on SALT deductions is problematic, repealing it without making other reforms would result in larger tax breaks for the rich. Instead, lawmakers should consider ITEP’s proposal to replace the SALT cap with a broader limit on tax breaks for the rich that would accomplish Biden’s goal…

Pandemic Profits: Netflix Made Record Profits in 2020, Paid a Tax Rate of Less than 1 Percent

February 1, 2021 • By Matthew Gardner

Netflix’s “current” federal income tax for 2020 was $24 million, which equals just 0.9 percent of the company’s pretax income for the year. This is another way of saying Netflix paid an effective federal income tax rate of just 0.9 percent in 2020. If the company paid the statutory rate, its tax bill would be $572 million.

State Rundown 1/28: EITC Efforts a Welcome Contrast to State Tax Tug-of-War

January 28, 2021 • By ITEP Staff

Efforts to deliver and improve targeted tax credits to support low- and middle-income families proved to be unifying in Washington and Oregon, welcome developments in an otherwise divisive week in state tax debates. For example, Mississippi advocates hoping to end the state’s regressive grocery tax are up against a governor and many lawmakers pulling in the opposite direction by trying to eliminate its income tax. After Arizona residents approved an income tax increase to improve education funding, policymakers there are seeking to reverse course by slashing taxes instead. And North Dakota lawmakers are considering converting their graduated income tax into…

Disaggregating Data Illuminates a Path to Equitable Policy

January 27, 2021 • By Jessica Schieder

The Biden administration’s move last week to establish an interagency working group to examine how well data is broken down, or disaggregated, within public sector data sources is welcome news. The executive order specifically names the limited availability of datasets disaggregated “by race, ethnicity, gender, disability, income, veteran status, [and] other key demographic variables.”