Blog

1298 posts

Why Proponents of the Trump-GOP Tax Law Can’t Get their Story Straight

May 16, 2018 • By Steve Wamhoff

If you listened closely to today’s House Ways and Means Committee hearing on the Tax Cuts and Jobs Act (TCJA), you could sense that the witnesses speaking in favor of the new tax law were not 100 percent on the same page. This has been apparent ever since the law was enacted at the end of last year. The economists who speak in favor of the law (including Douglas Holtz-Eakin at today’s hearing) tend to focus on other indicators of its success. They know that the talk of bonuses and raises is nothing more than a desperate corporate PR campaign…

There Is No Evidence That the New Tax Law Is Growing Our Economy or Creating Jobs

May 15, 2018 • By Steve Wamhoff

The House Ways and Means Committee will hold a hearing on the Tax Cuts and Jobs Act (TCJA) Wednesday. Proponents of the law likely will use the occasion to tout its alleged economic benefits and argue that its temporary provisions should be made permanent. The title of the hearing is “Growing Our Economy and Creating Jobs,” but there is little evidence that the law does either of these things.

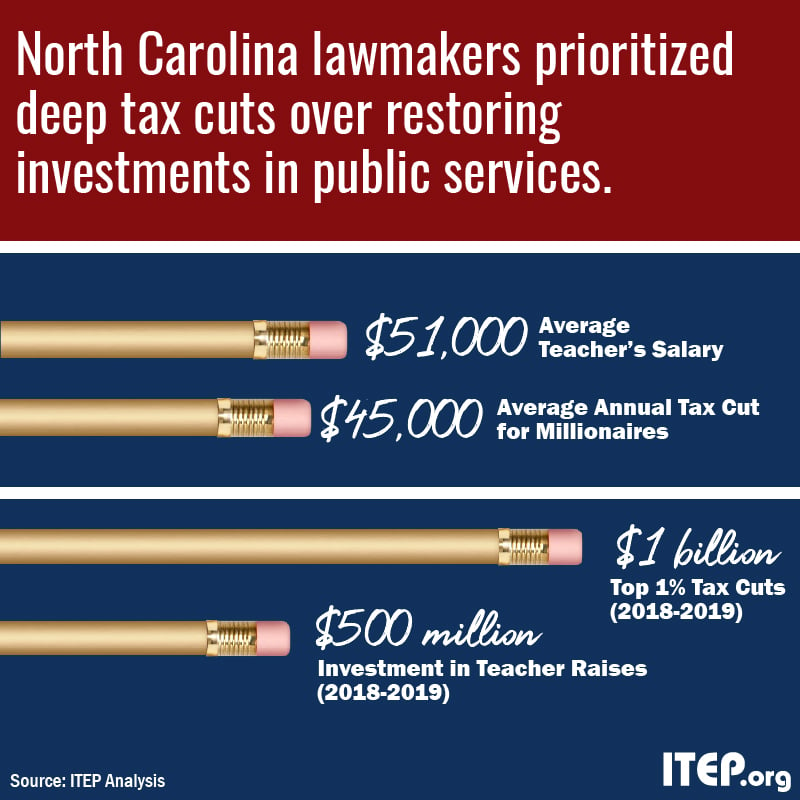

NC Teachers’ March on Raleigh and the Tax Cuts that Led Them There

May 15, 2018 • By Aidan Davis

Once again, public school teachers are taking a stand for education and against irresponsible, top-heavy tax cuts that deprive states of the revenue they need to sufficiently fund public services, including education.

No Work Requirements for the Richest 1 Percent — Most of Their Tax Cuts Are for Unearned Income

May 10, 2018 • By Steve Wamhoff

The Trump Administration is pushing to add or strengthen work requirements for programs that benefit low- and middle-income people but holds a different view when it comes to the wealthy. Most tax cuts enjoyed by the richest 1 percent of households under the recently enacted Tax Cuts and Job Act (TCJA) are tax cuts for unearned income.

State Rundown 5/9: Iowa Digs a New Hole as Other States Try to Avoid or Climb Out of Theirs

May 9, 2018 • By ITEP Staff

This week we have news of a destructive tax cut plan finally approved in Iowa just as one was narrowly avoided in Kansas. Tax debates in Minnesota and Missouri will go down to the wire. And residents of Arizona and Colorado are considering progressive revenue solutions to their states' education funding crises.

New Tax Subsidy for Private K-12 Tuition in Massachusetts Creates a Host of Problems

May 9, 2018 • By Carl Davis

Last year’s federal tax cut bill changed 529 college savings accounts in a major way, expanding them so that they can be used as tax shelters by higher-income families who choose to send their children to private K-12 schools. This controversial change was added in the Senate by the slimmest of margins—requiring a tie-breaking vote […]

In the Face of the Trump Administration’s Anti-Immigrant Agenda, We Must Rely on Evidence to Highlight the Contributions of and Dispel Myths About Dreamers

May 4, 2018 • By Misha Hill

Immigrants face tremendous uncertainty and little hope under the Trump Administration. The administration’s actions—banning travel from residents of primarily Muslim countries, the deportation of Christian Iraqi asylum seekers, and the rescission of DACA, the program that provides temporary reprieve to young immigrants; public statements on the value of immigrants from countries like Norway; and leaked […]

Tax Wars: 3 Lessons about Tax Policy from the Star Wars Universe

May 4, 2018 • By Richard Phillips

Even in the universe of Jedi, Death Stars and Ewoks, tax policy plays a surprisingly important role in driving the events of the day. In celebration of Star Wars Day, we just wanted to share some of the little-known tax policy lessons from the Star Wars universe.

Under Pressure, Trump Organization Abandons Risky Sales Tax Avoidance Strategy in New York. Will It Face Penalties for Taxes it Did Not Collect?

May 3, 2018 • By Carl Davis

While President Trump was busy publicly shaming Amazon for failing to collect some state and local sales taxes, his own business’s online store was not only failing to collect the same taxes, but was arguably more aggressive than Amazon in refusing to do so. As of last month, TrumpStore.com was not even collecting sales tax in New York State despite having a “flagship retail store” inside Trump Tower, in Manhattan. As ITEP pointed out at that time: “It seems likely that the presence of a New York location should be enough to put TrumpStore.com within reach of New York’s sales…

State Rundown 5/3: Progressive Revenue Solutions to Fiscal Woes Gaining Traction

May 3, 2018 • By ITEP Staff

This week, Arizona teachers continued to strike over pay issues and advocates unveiled a progressive revenue solution they hope to put before voters, while a progressive income tax also gained support as part of a resolution to Illinois's budget troubles. Iowa and Missouri legislators continued to try to push through unsustainable tax cuts before their sessions end. And Minnesota and South Carolina focused on responding to the federal tax-cut bill.

New UK Law May Shut Down the Biggest Tax Havens — Aside from the U.S.

May 2, 2018 • By Steve Wamhoff

The United Kingdom’s parliament has enacted a new law requiring its overseas territories — which include notorious tax havens like Bermuda, the Cayman Islands, and the British Virgin Islands — to start disclosing by 2020 the owners of corporations they register. This could shut down a huge amount of offshore tax evasion and other financial crimes because individuals from anywhere in the world, including the United States. have long been able to set up secret corporations in these tax havens to stash their money.

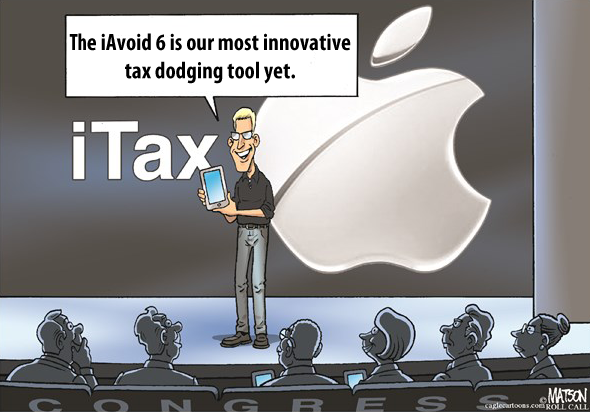

Apple’s Three-Month Tax Savings under President Trump’s New Tax Law: $1.68 Billion

May 2, 2018 • By Matthew Gardner

By now, it should come as no shock that profitable Fortune 500 corporations are reaping huge benefits from the corporate tax cuts enacted last December. But as first quarter earnings reports are released, we’re learning just how big.

Newly Unveiled Ballot Initiative Aims to Tax Arizona’s Top 1 Percent to Fund Education

May 1, 2018 • By Aidan Davis

Today marks Day 4 of the Arizona teachers’ walkout. After decades of tax cuts and underfunding of public education, education advocates are now driving the debate and urging lawmakers to act. Their newest proposal would raise taxes on incomes above half a million dollars for married couples, or above $250,000 for single taxpayers—that is, the same wealthy taxpayers that just received a generous tax cuts under last year’s federal tax overhaul.

No Need for the MythBusters, the Millionaire Tax Flight Myth is Busted Again

May 1, 2018 • By Dacey Anechiarico

One of the most repeated myths in state tax policy is called “millionaire tax flight,” where millionaires are allegedly fleeing states with high income tax rates for states with lower rates. This myth has been used as an argument in state tax debates for years but Cristobal Young argues in his book, “The Myth of the Millionaire Tax Flight,” that both Democrats and Republicans are “searching for a crisis that does not really exist,” and that there is no evidence to support this myth.

State Rundown 4/27: Arbor Day Brings Some Fruitful Tax Developments, Some Shady Proposals

April 27, 2018 • By ITEP Staff

This Arbor Day week, the seeds of discontent with underfunded school systems and underpaid teachers continued to spread, with walkouts occurring in both Arizona and Colorado. And recognizing the need to see the forest as well as the trees, the Arizona teachers have presented revenue solutions to get to the true root of the problem. In the plains states, tax cut proposals continue to pop up like weeds in Kansas and threaten to spread to Iowa and Missouri, where lawmakers are running out of time but are still hoping their efforts to pass destructive tax cuts will bear fruit.

Trump Administration’s Spending Priorities Echo Tax Cut Priorities: Punish the Poor and Lavish the Rich

April 27, 2018 • By ITEP Staff, Jenice Robinson, Misha Hill

In 2017, the Trump Administration released a budget proposal filled with loaded language about “welfare reform” and moving able-bodied people from welfare to work. This narrative is designed to perpetuate the pernicious idea that poor people have personal shortcomings and are taking something that rightly belongs to others.

15 Companies Report Tax Savings of $6.2 Billion in First Three Months of 2018

April 26, 2018 • By Matthew Gardner

In reports released over the past week, covering the first three months of 2018, a few of the biggest and most profitable Fortune 500 corporations acknowledge receiving billions in tax cuts in the first quarter of 2018 alone. Fifteen of these companies collectively disclosed reducing their effective tax rates by $6.2 billion compared to the rates they faced in the first quarter of last year.

State Rundown 12/31/9999: IRS Glitch and Legislative Impasses Extend Tax Season

April 20, 2018 • By ITEP Staff

This week the IRS website asked some would-be tax filers to return after December 31, 9999. State legislators don't have quite that much time, but are struggling to wrap up their tax debates on schedule as well. Iowa legislators, for example, are ironically still debating tax cuts despite having run out of money to cover their daily expenses for the year. Nebraska's session wrapped up, but its tax debate continues in the form of a call for a special session and the threat of an unfunded tax cut going before voters in November. Mississippi's tax debate has been revived by…

Trends We’re Watching in 2018, Part 5: 21st Century Consumption Taxes

April 20, 2018 • By Misha Hill

We're highlighting the progress of a few newer trends in consumption taxation. This includes using the tax code to discourage consumption of everything from plastic bags to carbon and collecting revenue from emerging industries like ride sharing services and legalized cannabis sales.

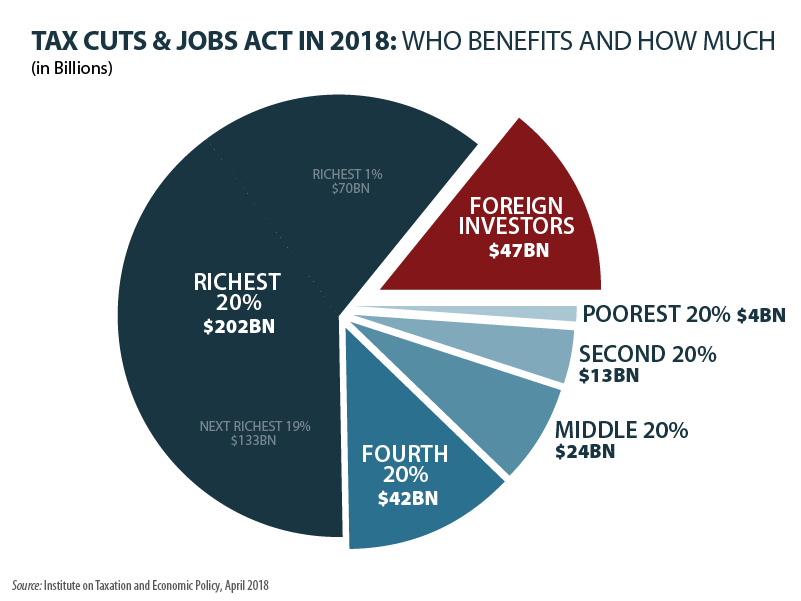

Congressional Budget Office: New Tax Law Helps Foreign Investors Even More than You Thought

April 19, 2018 • By Steve Wamhoff

President Trump and his allies in Congress have made many wild claims about economic growth that would result from the Tax Cuts and Jobs Act. And the Congressional Budget Office just released a report revealing the TCJA will, in fact, create economic growth — for foreign investors.

Key Takeaways from John Oliver’s Segment on Corporate Tax Avoidance

April 16, 2018 • By Richard Phillips

The HBO television show Last Week Tonight with John Oliver has become known for its longer segments that examine important issues facing the country. In its latest segment on Sunday, the show took a deep dive into corporate taxes and how many companies manage to avoid paying their fair share. Between its hilarious interludes, the segment painted a striking portrait of problems in our corporate tax code and how the Tax Cuts and Jobs Act (TCJA) failed to address them.

State Rundown 4/13: Teacher Strikes, Special Sessions, Federal Cuts Haunting States

April 13, 2018 • By ITEP Staff

This Friday the 13th is a spooky one for many state lawmakers, as past bad fiscal decisions have been coming back to haunt them in the form of teacher strikes and walk-outs in Arizona, Kentucky, and Oklahoma. Meanwhile, policymakers in Maryland, Nebraska, New Jersey, Oregon, and Utah all attempted to exorcise negative consequences of the federal tax-cut bill from their tax codes. And our What We're Reading section includes yet another stake to the heart of the millionaire tax-flight myth and other good reads.

The U.S. Supreme Court is scheduled to consider a case next week (South Dakota v. Wayfair, Inc.) that has the potential to significantly improve states and localities’ ability to enforce their sales tax laws on Internet purchases.

What to Expect if the Supreme Court Allows for Online Sales Tax Collection

April 11, 2018 • By Carl Davis

Online shopping is hardly a new phenomenon. And yet states and localities still lack the authority to require many Internet retailers to collect the sales taxes that their locally based, brick and mortar competitors have been collecting for decades.

A Paul Ryan Retrospective: A Decade of Regressive Budget and Tax Plans

April 11, 2018 • By ITEP Staff

As Speaker of the House, Rep. Paul Ryan pushed through the Tax Cuts and Jobs Act that will cost at least $1.5 trillion and provide around half of its benefits to the richest five percent of households. He then announced that Congress needs to cut entitlements to get the budget deficit under control. Before becoming Speaker, Ryan spent several years running the Budget Committee and the Ways and Means Committee, where he issued budget and tax plans each year to carry out his goals (lower taxes for the rich and cuts in entitlement spending), which are described in the reports…