Blog

1298 posts

The Walmart Smiley Face Is Lying: Corporate Tax Cuts Are Not Causing Pay Raises and Bonuses

January 12, 2018 • By Steve Wamhoff

Last night, Yahoo reported that 81 corporations had announced pay raises and bonuses that they claim result from the Trump-GOP tax law’s reduction in the official corporate tax rate from 35 percent to 21 percent. Of these 81 corporations, 13 were included in ITEP’s most recent corporate tax study, which focuses on the Fortune 500 companies that were profitable every year from 2008 through 2015. These 13 companies had a combined effective tax rate of just 19.1 percent, which undermines the idea that the federal corporate tax rate was holding back their ability to pay workers.

State Rundown 1/12: Tax Cut Tunnel Vision Threatens to Bore State Budget Holes Even Deeper

January 12, 2018 • By ITEP Staff

As states continue to sift through wreckage of the federal tax cut bill to try to determine how they will be affected, two things should be clear to everyone: the richest people in every state just got a massive federal tax cut, and federal funding for shared priorities like education and health care is certain to continue to decline. State leaders who care about those priorities should consider asking those wealthy beneficiaries of the federal cuts to pay more to the state in order to minimize the damage of the looming federal funding cuts, but so far policymakers in Idaho,…

Walmart’s Minimum Wage Hike: Did the Tax System Make Them Do It?

January 12, 2018 • By Matthew Gardner

The Walmart corporation announced this week that it will increase its minimum wage to $11 an hour, in a move that the company attributed to the major corporate tax cut signed into law by President Trump last month. The $300 million the company will spend on the wage boost is just a fraction of the more than $2 billion a year ITEP estimates Walmart could net from the corporate tax rate cuts that took effect January 1—but even so, the company felt the need to make the wage boost more affordable by simultaneously closing 63 Sam’s Club stores and laying…

Using Private Debt Collectors as a Substitute for the IRS Is a Bad Deal

January 11, 2018 • By Matthew Gardner

If President Trump is indeed a deal maker, then he should dismantle Congress’s decision to rely on private debt collectors as a substitute for the Internal Revenue Service. This decision, championed for years by Sens. Charles Grassley, R-Iowa, and Chuck Schumer, D-New York, is a lousy deal for everyone--American taxpayers, the federal government--except private debt collectors.

New Tax Breaks for Craft Beer Are a Drop in the Barrel: 76 percent of Tax Bill’s Beer Tax Cut Goes to a Handful of the Biggest Producers

January 10, 2018 • By Matthew Gardner

The $1.5 trillion tax cut that took effect on Jan.1 was never really going to be about small businesses, despite President Trump’s transparently false claims to the contrary. However, one economic sector still appears happy, for now, to hoist a mug to Congress’s successful sleight of hand: craft breweries.

New Tax Law Allows Affluent Taxpayers to Write off K-12 Private School Tuition

January 9, 2018 • By Matthew Gardner

Taxpayers are still learning about the intended and unintended consequences of the major tax overhaul that Republican leaders ramrodded through late last year. One little-noted provision subverts state laws that prohibit the use of public dollars for private schools by allowing taxpayers to use 529 plans to pay for K-12 tuition. Until last year, the […]

State Rundown 1/4: Will States Show Resolve in a Challenging Year?

January 4, 2018 • By ITEP Staff

This week marks the beginning of what is bound to be a wild year for state tax and budget debates. Essentially every state is already working to sort through the complicated ramifications of the federal tax cuts passed in December, including Kansas, Michigan, Montana, and New Jersey highlighted below. These and other states will have important decisions to make about how to incorporate, reject, or mitigate various aspects of the new federal law, and will need considerable resolve to improve state tax policy to be more fair and more adequate – even as federal taxes become less so.

Corporate America, You Just Got a $650 Billion Tax Cut! What Are You Going to Do Next?

December 22, 2017 • By Matthew Gardner

While many Fortune 500 CEO’s likely had to restrain themselves from preemptively shouting “we’re going to Disneyland” in an homage to the Disney Corporation’s trademark ad spot involving the winner of each year’s Super Bowl, it’s pretty understandable that several of them—including known tax avoiders AT&T, Boeing, Comcast and Wells Fargo—would preemptively make grandiose promises that they will reserve part of their tax cuts for the little people who made it all possible.

These have been dark days for those who care about tax justice and public investments, but with the Winter Solstice this week and many states diving into their legislative sessions in January, longer days (and long work days) are soon to come! Governors and legislators are already proposing or hinting at their 2018 tax and budget plans in Alaska, California, Iowa, Maryland, and Washington. And transportation investments are getting strong support in Missouri, Oregon, and Virginia.

Final Tax Bill Hits Parents of College Students Harder than Other Taxpayers

December 19, 2017 • By Steve Wamhoff

While many provisions targeting higher education in previous versions of the tax plan were eventually dropped, little thought has been given to how the bill still raises taxes on parents at the time they are trying to pay for college tuition.

The Trump-GOP’s Big Giveaway to Multinational Corporations

December 19, 2017 • By Richard Phillips

The tax bill just approved by Congress was a golden opportunity to solve these problems for good—but turned out to be a colossal missed opportunity. Instead of addressing the hundreds of billions in lost federal tax revenue due to offshore tax avoidance schemes, the Trump-GOP tax bill would forgive most of the taxes owed on the profits held offshore right now and open the floodgates to even more offshore profit-shifting in the future.

Corker Claims Provisions Benefiting Him Could Not Have Changed His Vote Because He Never Read the Bill

December 18, 2017 • By Matthew Gardner

Many Republicans who had previously claimed to be deficit hawks have been cheerfully supportive of major tax-cutting legislation as it has moved forward this fall. But one Republican Senator, Bob Corker of Tennessee, has taken a defiant stance on the issue, insisting that “passing off increased debt to future generations” would be a deal-breaker for him. When the Senate passed its version of the tax plan last week, Corker was the only Republican to vote No.

Final GOP-Trump Bill Still Forces California and New York to Shoulder a Larger Share of Federal Taxes Under Final GOP-Trump Tax Bill; Texas, Florida, and Other States Will Pay Less

December 17, 2017 • By Meg Wiehe

Residents of California and New York pay a large amount of the nation’s federal personal income taxes relative to their share of the population. As illustrated by the table below, the final GOP-Trump tax bill expected to be approved this week would substantially increase the share of total federal personal income taxes (PIT) paid by both states. Connecticut, Maryland, Massachusetts, and New Jersey would also see their share of federal PIT increase.

Final Tax Bill Reported to Provide Senator Rubio With Much Smaller Improvement for Children than He Demanded

December 15, 2017 • By Steve Wamhoff

The latest news on the GOP tax bill is that, in order to secure the vote of Senator Marco Rubio, Republican leaders have agreed to expand the child tax credit — but only by a fraction of the amount that Rubio initially demanded.

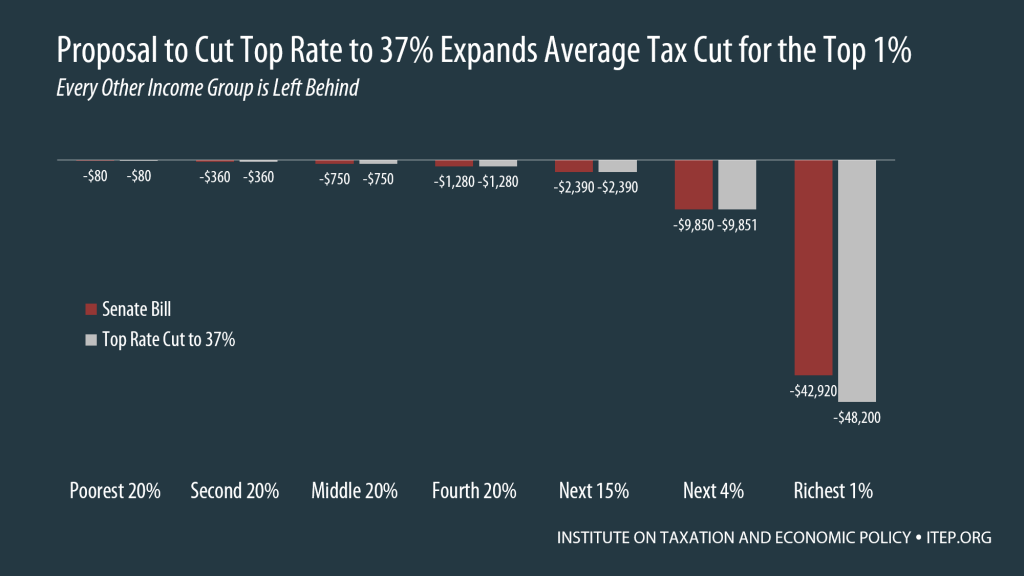

GOP Leaders Scrounge Up Money to Lower Top Tax Rate for the Rich But Not to Help Low-Income Working Families with Children

December 15, 2017 • By Meg Wiehe

Republican leaders who rejected a proposal to have corporations pay a single percentage point higher tax rate to benefit families with children have tapped the exact same source of savings to provide more breaks for the richest 1 percent of taxpayers. The table below compares the number and share of households nationally and in all 50-states who would benefit from the proposal to reduce taxes for working families with children versus the ”compromise” to cut the top individual tax rate -- below either the House or Senate version – to 37 percent for couples with incomes above $1 million.

ITEP researchers have produced new reports and analyses that look at various pieces of the tax bill, including: the share of tax cuts that will go to foreign investors; how the plans would affect the number of taxpayers that take the mortgage interest deduction or write off charitable contributions, and remaining problems with the bill in spite of proposed compromises on state and local tax deductions.

Private Schools Donors Likely to Win Big from Expanded Loophole in Tax Bill

December 14, 2017 • By Carl Davis

For years, private schools around the country have been making an unusual pitch to prospective donors: give us your money, and you’ll get so many state and federal tax breaks in return that you may end up turning a profit. Under tax legislation being considered in Congress right now, that pitch is about to become even more persuasive.

State Rundown 12/13: Supermajority Laws Considered in Some States Even as They Confound Others

December 13, 2017 • By ITEP Staff

Supermajority requirements for tax increases are proving a major obstacle to responsible budgeting in Oklahoma, while ballot initiatives are being filed to alter or abolish Oregon‘s similar requirement, but a similar requirement is slowly advancing toward the ballot in Florida nonetheless. Displeasure with agricultural property taxes are spawning both a ballot initiative drive and a […]

Latest “Compromise” for Tax Plan Is Even Worse than Previous Proposals, Would Reduce the Plans’ “Losers” by Less than 17,000 Taxpayers

December 13, 2017 • By Meg Wiehe, Steve Wamhoff

Earlier this week, ITEP explained that two possible “compromises” to improve the Senate tax bill would accomplish very little other than make the plan more expensive. Incredibly, Republican leaders are now discussing a third possible “compromise” that is even worse — a further reduction in the top personal income tax rate to 37%. This would […]

Parents of College Students: The Tax Plans’ Losers that No One Is Talking About

December 13, 2017 • By Steve Wamhoff

Parents of college students or kids in their last years of high school are more likely to face a tax hike than others under the tax legislation moving through Congress. Higher education has entered the tax debate because the House bill (but not the Senate bill) would repeal several provisions that make college and graduate education more accessible. But little thought has been given to how the tax bills would affect the parents of college students in more direct ways and make it difficult for them to finance college for their kids. If tax legislation were allowed a reasonable number…

As 2017 draws to close, Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. Instead of honoring the work authorizations and protection from deportation that currently shields more than 685,000 young people, President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation…

Who Is “America First” Under the Tax Plan? The Rich First, Foreign Investors Second, Then the Rest of Us.

December 12, 2017 • By Steve Wamhoff

In his inaugural speech, President Trump told the world that Washington would be driven by a principle of “America First.” But the tax plans moving through Congress only put the richest Americans first. Everyone else comes after foreign investors.

Treasury’s 1-Page Memo Reasserts False Claims that Tax Cuts Largely Pay for Themselves — But Only When Accompanied by Spending Cuts

December 12, 2017 • By Steve Wamhoff

Treasury Secretary Steven Mnuchin claimed for weeks that his department would release a study showing that the $1.5 trillion tax cut moving through Congress would “pay for itself.” On Monday he released a one-page memo that asserts, without evidence, that economic growth resulting from President Trump’s policies would raise enough revenue to more than offset the costs of the tax cuts.

“Compromises” Under Discussion for the State and Local Tax Deduction Do Not Fix Flawed Tax Bills

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

Republicans in Congress are reported to be considering two versions of a change they claim would “improve” the current bills by making them more generous to residents of higher-taxed states. As illustrated by these estimates, the reality is that these proposals would make little difference on those states and taxpayers hit hardest.

Even with Potential SALT Compromises, Senate Bill Forces California and New York to Shoulder a Larger Share of Federal Taxes While Texas, Florida, and Other States Will Pay Less

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

The Senate tax bill, with or without either of the compromises that could be added to it, would shift personal income taxes away from Florida and Texas to states like California and New York, which are already paying a high share relative to their populations.